Chad leone

@CLCrypto

This is my public swing-trade idea journal. My most recent trade setup will usually be pinned on top. I trade W/D/2h setups

You might like

Maybe you'll find this an interesting chart for $BTCUSD. I've plotted the distance of the price to the 142 day EMA and highlighted bearish and bullish reversal areas with red/green dotted lines.

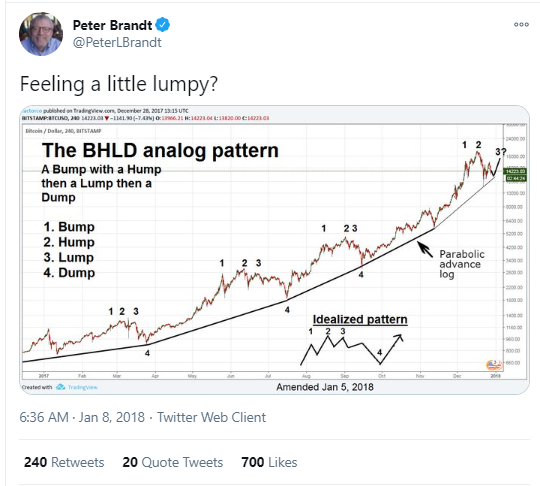

History question for the #Cryptotwitterites of the world Does anyone remember this Jan 8, 2018 Tweet, just before the parabolic advance was broken? A derivative of the BHLD is the Hump..Slump..Pump..Dump. It takes really old traders to come up with chart names such as this.

Last time that happened, $btcusd was dumping and Vitalik fanboys were chanting "flippening". $ethusd

$BAND looks like it's completing it's complex iHS soon, with a price target of $10.

$btc I'm not saying it's gonna happen, but bitfinex traders have a very good track record.

Is $BTC doing a neckline retest of the iHS, or are we going lower? I'm betting on the latter. A retrace to the 61.8% fib of the last dump lines up with the 61.8% retrace of the bigger range and is a logical place for a short entry with a stop above 13.3k. Above that it's up. #TA

I'm really looking forward to the $btc "it's over 9000" memes in 2020 guys.

For those interested in the lesser known or forgotten aspects of technical analysis, in point & figure terms $BTCUSD is on a "high pole".

Looking for $BTC short entries between $11500 and $11650 with a stop above 11800. Above that I don't see any resistance until $12800. $13350 is another technically interesting area at the 61.8% retrace of the bear market.

I'm not convinced of another rally with $BTC hanging out below $8280. A daily close above would do it. I'm looking for shorts until that happens.

The Standard #Ripple $XRP is showing signs of reactivation. Let's see if we can close above .236 fib and go to .382fib this time.

entered #Harmonyprotocol $ONE. With 20% of tokens released, current market cap is 65 million USD. Expect a big fucking pump with all the volume incoming because of the airdrops.

United States Trends

- 1. Armed N/A

- 2. Border Patrol N/A

- 3. Border Patrol N/A

- 4. Another ICE N/A

- 5. Bournemouth N/A

- 6. Collin Chandler N/A

- 7. #BOULIV N/A

- 8. Resisting N/A

- 9. Wink N/A

- 10. Van Dijk N/A

- 11. #ICEOUT N/A

- 12. Jose Ramirez N/A

- 13. Minnesotans N/A

- 14. Gigi N/A

- 15. Thomas Frank N/A

- 16. Travis Perry N/A

- 17. #Caturday N/A

- 18. Burnley N/A

- 19. Murdered N/A

- 20. Romero N/A

You might like

-

arbee

arbee

@arbee101 -

Sumo

Sumo

@TraderSumo1 -

ASTRE CAPITAL

ASTRE CAPITAL

@astre_ts -

Les Fah-Kin Goh

Les Fah-Kin Goh

@RealLesGoh -

Krokz

Krokz

@krokotar -

Matt

Matt

@tradermatt -

Koning

Koning

@koningkarell -

cryptowolff

cryptowolff

@wolff1309 -

turnip

turnip

@bisbrah -

qumatru(dips are for buying)

qumatru(dips are for buying)

@qumatru -

Wagner 🟧

Wagner 🟧

@crypto_wagner -

Worship the Glitch

Worship the Glitch

@hindsightoshi -

w🅰️lkingde🅰️d1970

w🅰️lkingde🅰️d1970

@walkingdead1970

Something went wrong.

Something went wrong.