Connor

@CPSellsOptions

Husband | Father | Founder of @RollTrackr | Helping You Master Options Trading, One Lesson at a Time | Not Financial Advice

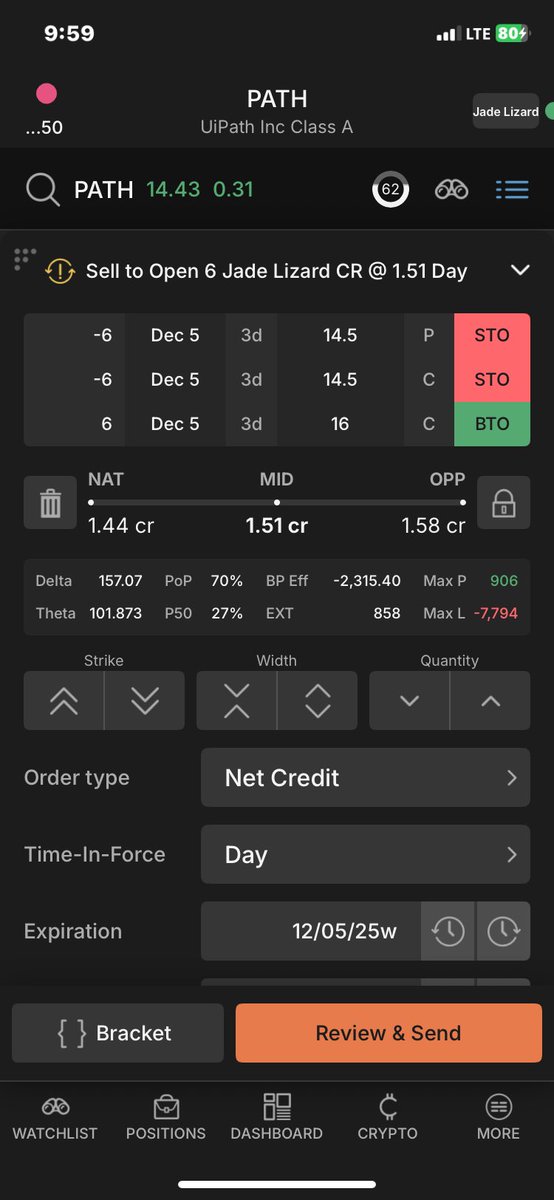

This is my options play for $PATH earnings 👇🏻 Strategy Type: Jade Lizard Setup: • Sell the 14.5 straddle • Buy the 16 call • 3DTE • BPR = $3,515 Plan: Close for 50%+ max profit before expiration Or Take assignment at $14.5, adjusted to $13 factoring in premiums collected

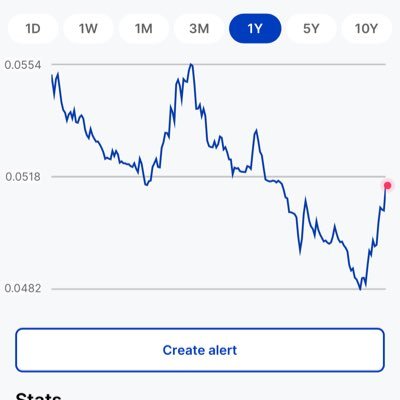

Implied Volatility rank is a cheat code for strategy selection High IVR = Sell Options Low IVR = Buy Options Interested in learning more? Here is the full breakdown 👇🏻🧵

Crush Options Selling With This 1 Metric 🔍📉 Selling options without checking IVR is like sailing without a compass. ❌ It tells you when implied volatility is truly elevated — something you can’t see by just looking at an options chain. Here’s the breakdown 🧵👇

My ideal portfolio: 20% Options (Active Trading) 50% $SPY + covered calls or $VOO without CC's 20% $QQQ + Covered Calls or $QQQM without CC's 10% $IBIT + Covered Calls or $BTC without CC's

I’ve made posts about this and omg people lose their shit It really is a simple concept most don’t understand

Selling ITM puts is better than selling covered calls. Change my mind.

Put ratio spreads are one of my favorite strategies You can make money in all directions, being able to squeeze out even more money of the stock drops It really is a win win type strategy

Turn High IV Into Income with a Put Ratio Spread 💰⚖️ Want to profit if a stock drifts, dips slightly, or even stays flat? Put Ratio Spreads give you credit upfront and multiple paths to win — especially when IV is high. Here’s how it works, using a fresh $ORCL example: 🧵👇

If you actively trade options on $HOOD, you are actively losing money on terrible fills. Trust me, paying $1 in commissions will save you a ton of money over time.

Just bought one of my wife’s Christmas presents, financed via selling 0dte csp’s on $SPY This is what I call a life hack

The Ultimate Guide to Selling Cash-Secured Puts 💰📈 Cash-secured puts = consistent income & a chance to buy stocks at your preferred price—all while managing risk. Here’s EVERYTHING you need to know (with examples): 🧵👇

The best way to reduce risk in a long delta portfolio is to reduce your delta exposure This can be done in a few ways: • Sell stock • Sell calls • Buy puts The rest are combinations like put debit spreads, call credit spreads, collars, etc.

United States Trends

- 1. Mark Pope 1,727 posts

- 2. Derek Dixon 1,074 posts

- 3. Jimmy Butler 1,908 posts

- 4. Brunson 7,147 posts

- 5. Carter Hart 3,244 posts

- 6. Knicks 13.8K posts

- 7. Seth Curry 1,936 posts

- 8. Pat Spencer N/A

- 9. Connor Bedard 1,841 posts

- 10. Kentucky 28.9K posts

- 11. Jaylen Brown 8,008 posts

- 12. Celtics 15.4K posts

- 13. Caleb Wilson 1,037 posts

- 14. Notre Dame 37.6K posts

- 15. Rupp 2,678 posts

- 16. Duke 29.3K posts

- 17. Van Epps 128K posts

- 18. UConn 8,824 posts

- 19. Bama 24.2K posts

- 20. Hubert Davis N/A

Something went wrong.

Something went wrong.