Patrick Calver

@CalverPatrick

Head of Strategic Communications @EconChange | Previously external affairs @jrf_uk | Even more previously @BankofEngland & @HMTreasury

You might like

A group of the UK’s most distinguished economists have written to the Chancellor, warning her that new cuts to spending or investment at the Spring Statement would be a “profound mistake”: ft.com/content/4b0d4e…

📉These #DisabilityBenefits cuts would be unprecedented - the largest since the OBR was created in 2010. The 'Right to Try' guarantee might help to remove the barriers that prevent people from working, but enormous cuts mean the Government risks undermining any positives. 2/4

Andy Haldane: "It would be deeply counterproductive to both growth & to the fiscal position" to cut "investment & indeed in spending more generally" after the March OBR forecast. He says cuts will lead to a doom loop btwn debt & growth: "that's a situation to avoid at all costs."

Full wide ranging interview at 7pm on tonight’s #PoliticsHub Article here: news.sky.com/story/rachel-r…

New PRS stats out today for Oct 24 show an annual increase of 8.7% in GB and 10.5% in London, equating to £105 more per month on avg in GB and £204 in London, compared to Oct 23. These are big rises, on the back of the decision taken to keep LHA frozen at the Budget. 🧵 1/x

Early analysis shows that the economy (particularly the cost of living) drove Trump's election win. This week, we explore the economic factors behind Trump’s success and the controversial policies he is proposing. neweconomybrief.net/the-digest/in-…

In @thetimes, alongside @Gus_ODonnell & others, we welcome #Budget2024's shift on public investment & fiscal rules. The UK has trailed behind G7 peers in both public & private investment for too long. This isn't just about spending more—it's about designing a fiscal framework…

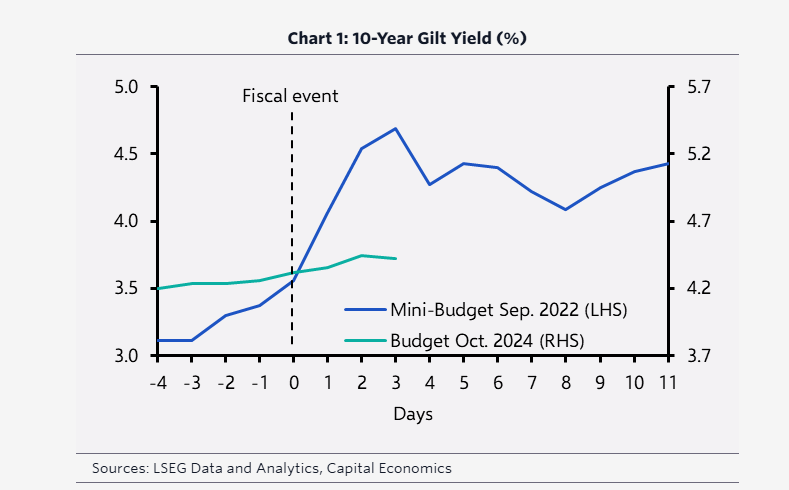

Capital Economics helpfully puts the post #Budget UK government debt market moves in context. There's been a rise in 10 year Gilt yields - a sign of market repricing in response to the extra borrowing - but nothing really comparable to what happened after the Sep 2022 Truss…

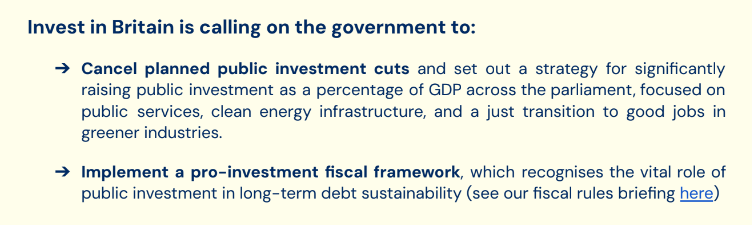

Our response to the Chancellor's first Budget today: investinbritain.org.uk/response-to-th…

It's Budget Day and here is what we are looking for from the Chancellor. Read our pre-Budget briefing on underinvestment in the UK economy, the impact of inherited plans for public investment cuts on growth, and the case for raising public investment: investinbritain.org.uk/resource/pre-b…

Britain faces a pivotal moment. Our infrastructure is creaking, public services are collapsing, and we are falling behind other countries in the race to decarbonise. We can’t afford another lost decade. We need to start investing in the future.

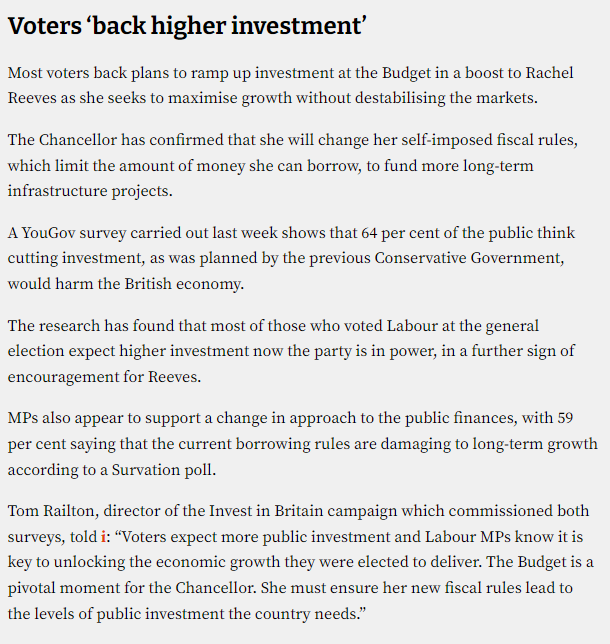

Polling shows voters and MPs support moves to relax borrowing rules in order to fund new long-term investment: inews.co.uk/news/politics/…

There is a lot of nonsense being said about gilts yields reacting to the debate on changing the fiscal rules. This nice chart from @DeutscheBank shows that the communications from @RachelReevesMP and @hmtreasury have NOT impacted on market trends.

Yesterday's splash in the @FT suggested that UK gilts yields are rising on budget speculation around the fiscal rules. My letter in the FT explains why it's a bit more complicated.... "Reeves has to strike right balance on debt policy" (1/n) ft.com/content/57c999… via @ft

There is an inclination to attribute the recent rise in yields on UK government bonds to, quoting today’s Financial Times, “concerns about the Labour government’s Budget, pushing the gap with Germany to the widest in more than a year.” It is more complicated than that. Just note…

🚨Poverty in Scotland 2024 out today. Stark findings about levels of poverty and about how our social security system is failing us. Looking forward to hearing both UK and Scottish governments’ response at the launch of the report this morning.

This week's New Economy Brief covered a variety of reports on the debates about public investment, growth and fiscal space from @TheIFS, @oeufling, @NIESRorg and @UKandEU. Sign up to our weekly newsletter to get our 5 minute digest of key economic news: neweconomybrief.net/sign-up

🛫Will scrapping the non-dom tax break cause the rich to leave the UK? This week’s New Economy Brief looks at the evidence which suggests the fears of capital flight are overblown. In fact, there is a strong economic case for ambitious reform: neweconomybrief.net/the-digest/non…

After 5 brilliant years at @jrf_uk I'm joining @EconChange today as its first Head of Strategic Communications. I'll mainly be working on the ECU's new @Invest_Britain campaign, focusing on the urgent need to increase public investment in the UK. Can't wait to get started!

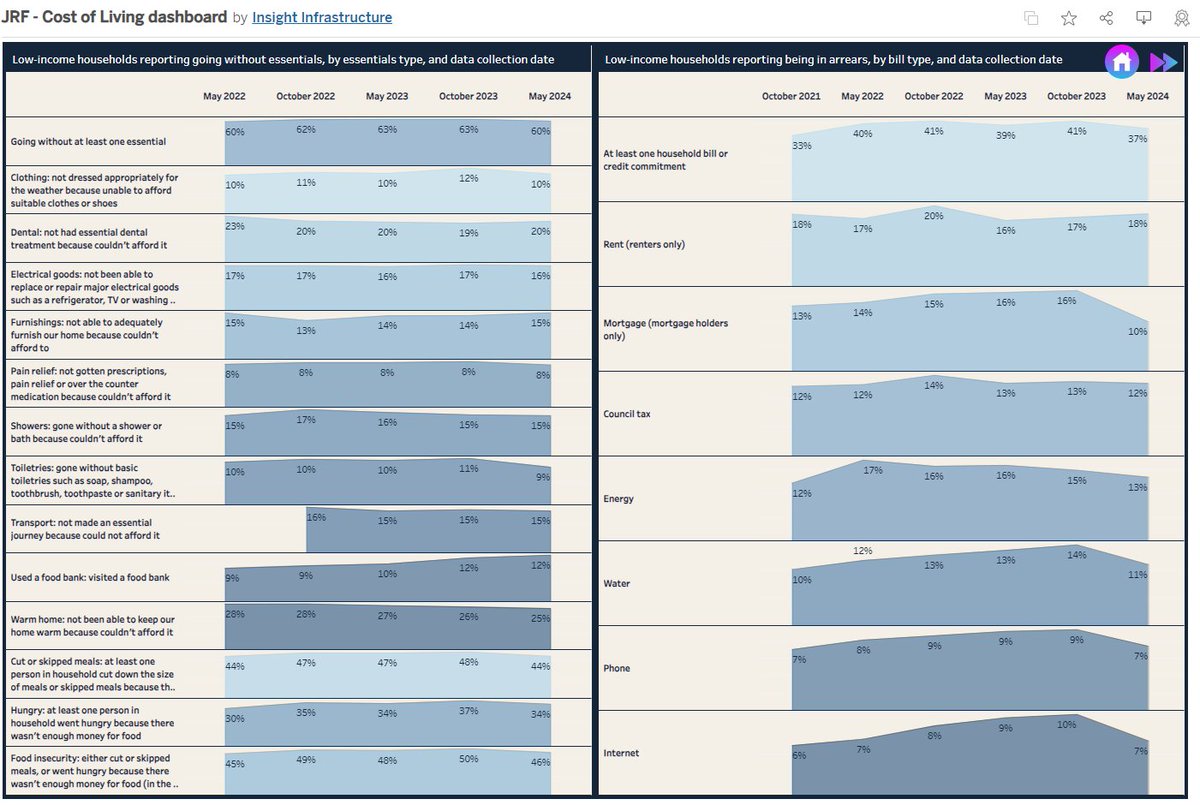

Some BIG data news: @jrf_uk has launched our cost of living dashboard! We've been tracking the financial impact covid and the COL crisis has had for low income households since October 2021, & now you can explore some of the data we have gathered in an interactive way 🧵1/x

🗣️ "A direct result of wider social injustices - poor quality housing, lower incomes, insecure employment. It's not just damaging the health of our nation, it's piling up the pressures on our NHS" @Keir_Starmer lays out the conclusions of Lord Darzi's report into the NHS. 1/4

This is why it's so important the Government: 🏘️Delivers its manifesto commitment to set up a cross-government homelessness strategy as soon as possible 🏘️Brings forward a much stronger Renters' Rights Bill in September

📢 Latest statutory homelessness stats show: 117,450 households were living in temporary accommodation on 31 March 2024, an increase of 12.3% since last year. A total of 151,630 dependent children were living in temporary accommodation on 31 March 2024. (1/3)

United States Trends

- 1. Nobel Peace Prize N/A

- 2. Anthony Black N/A

- 3. Machado N/A

- 4. Kathleen Kennedy N/A

- 5. Lucasfilm N/A

- 6. Dave Filoni N/A

- 7. Leon N/A

- 8. Karoline N/A

- 9. Drew Lock N/A

- 10. Board of Peace N/A

- 11. Insurrection Act N/A

- 12. New World Order N/A

- 13. #ResidentEvilRequiem N/A

- 14. Grizzlies N/A

- 15. Lynwen Brennan N/A

- 16. Lara Croft N/A

- 17. #LoveIslandAllStars N/A

- 18. The GitHub N/A

- 19. The Discord N/A

- 20. Chara N/A

You might like

-

Iain Porter

Iain Porter

@IainKPorter -

Peter Matejic

Peter Matejic

@StatsPeter -

Darren Baxter-Clow

Darren Baxter-Clow

@DarrenBaxter -

Policy in Practice

Policy in Practice

@policy_practice -

Abby Jitendra

Abby Jitendra

@abbyabhaya -

Daisy Sands

Daisy Sands

@sandsdaisy -

Rebecca McDonald

Rebecca McDonald

@R_McDonald_ -

Calum Masters

Calum Masters

@Calum_Masters -

Donald Hirsch

Donald Hirsch

@donaldhirsch -

Sumi Rabindrakumar

Sumi Rabindrakumar

@Sumi_RabindraK -

Sam Tims

Sam Tims

@Sam_Tims -

Christians Against Poverty (CAP) UK

Christians Against Poverty (CAP) UK

@CAPuk

Something went wrong.

Something went wrong.