Caplight

@CaplightData

Data and deal flow for venture capital investors.

คุณอาจชื่นชอบ

🚀 The $2T pre-IPO market is on the blockchain 🚀 Caplight is thrilled to see @injective launch the world's first perpetual futures on private Unicorn companies, powered by Caplight's secondary market data.

Injective is revolutionizing finance once again. Introducing, onchain Pre-IPO markets. For the first time ever, anyone can trade major private companies like OpenAI on $INJ with leverage. Unlike other Pre-IPO solutions from Robinhood and others, Injective’s Pre-IPO perps are…

Junior VCs: you’re spending 1,000+ hours a year sourcing. 🤯 Most of that time? Noise. Caplight 2.0 (beta) changes that. Our AI sourcing engine and private market data help you qualify companies in minutes, not weeks. Request early access: platform.caplight.com/schedule-demo

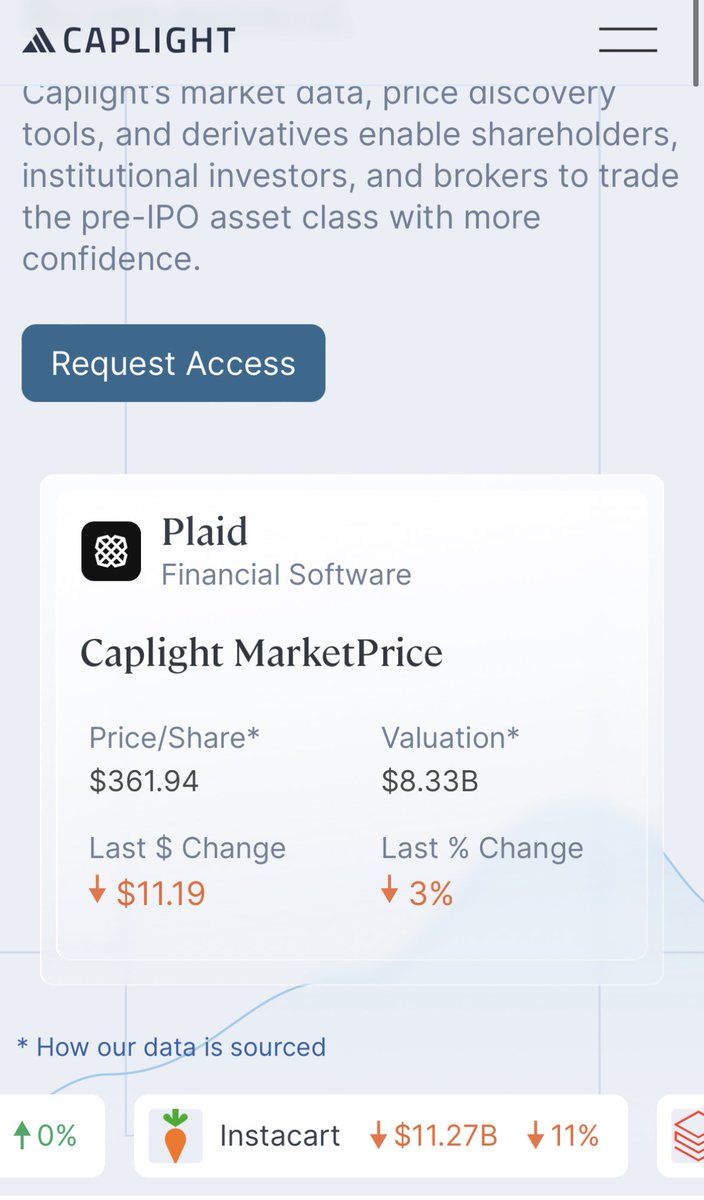

Plaid's ~10x rev. multiple is a slight premium to public comps and the ARK Fintech Innovation ETF, likely due to Plaid's revenue growth (20% YoY vs 7% average for comps). See more public comps benchmarking on Caplight: platform.caplight.com/signup x.com/pitdesi/status…

Plaid is on pace to do ~$370M in revenue this year, with 80% gross margins Burning $50M this year, $140M in the bank, worth ~$3.8B today per @CaplightData Needs to figure out the next act, core business isn’t growing very fast. The article is a good read!

This week for the Builders Series, we highlight @JavierCAvalos, Co-Founder and CEO @CaplightData, the first-ever derivatives marketplace for private markets. From his work at Forge to his current role, Javier has paved the way for markets that are more robust and liquid.…

We've enhance our IPO Tracker with estimated valuations from @CaplightData. See how far private company valuations have fallen from pandemic-era peaks theinformation.com/projects/tech-…

Thank you to @mvpeers for using Caplight Data to analyze @Shopify’s acquisition of a $650M minority interest in @flexport

In tonight's The Briefing by @mvpeers: ✔️ Apple isn't growing, but that's OK (for now) ✔️ Shopify's quick change of heart theinformation.com/articles/apple…

theinformation.com

Apple Isn’t Growing, but That’s OK (for Now)

We got a barrage of March-quarter earnings today and they provide a good summary of who’s up and who’s down in tech and media. (Spoiler alert: Apple did fine, but given how weak the smartphone and PC...

We are excited to announce a partnership with @CaplightData to offer our clients access to historical pricing and data from Caplight's consortium of market participants. investx.com/investx-partne… #privateequity #privatemarkets #datadriven #marketdata #secondarymarkets

Thank you @FortuneMagazine for selecting Caplight as a go-to source of private market data!

Databricks says it’s cut its internal valuation about 10%—some of its investors haven’t been as forgiving. trib.al/QxsXPZc

NEW from @heetermaria @coryweinberg @annie_goldsmith + me: Celeb-backed fitness startup Tonal is looking for a buyer after scrambling to cut costs last yr. It closed several stores after spending major $$ on marketing featuring stars like Serena + Lebron: theinformation.com/articles/home-…

you should check out @CaplightData for unreal insights into private market trading activity 👀

It used to be the case that companies undervalued themselves on a #409A basis, now internal valuations often represent the actual market value. What does this mean for startup employees? Thank you to @heetermaria for featuring Caplight in your latest analysis!

Data Point: Fidelity maintained its valuation on Reddit for much of 2022 while it repeatedly cut its value on Stripe and Instacart. thein.fo/12wg5G1

Will Russian unicorns drive the next era of private market growth? Thank you @techinasia for using Caplight Data in your analysis!

We look at the wave of Russian startups entering the Indonesian market and the relatively stable performance of IPOs in Southeast Asia. techinasia.com/russia-love-fi…

NEW: TikTok owner ByteDance's e-commerce volume (GMV) in China grew 76% to 1.41 trillion yuan ($208B) in 2022. TikTok's GMV in Southeast Asia more than quadrupled to $4.4B. TikTok is planning e-commerce push in U.S., Brazil, Spain, Australia this year. theinformation.com/articles/tikto…

This is incredibly cool. That’s not just because I have a niche geekiness about this from my time in the secondary markets — but that does give me unique appreciation for how hard this is to pull off. Proud to be backing @JavierCAvalos, Justin Moore, and the @CaplightData team!

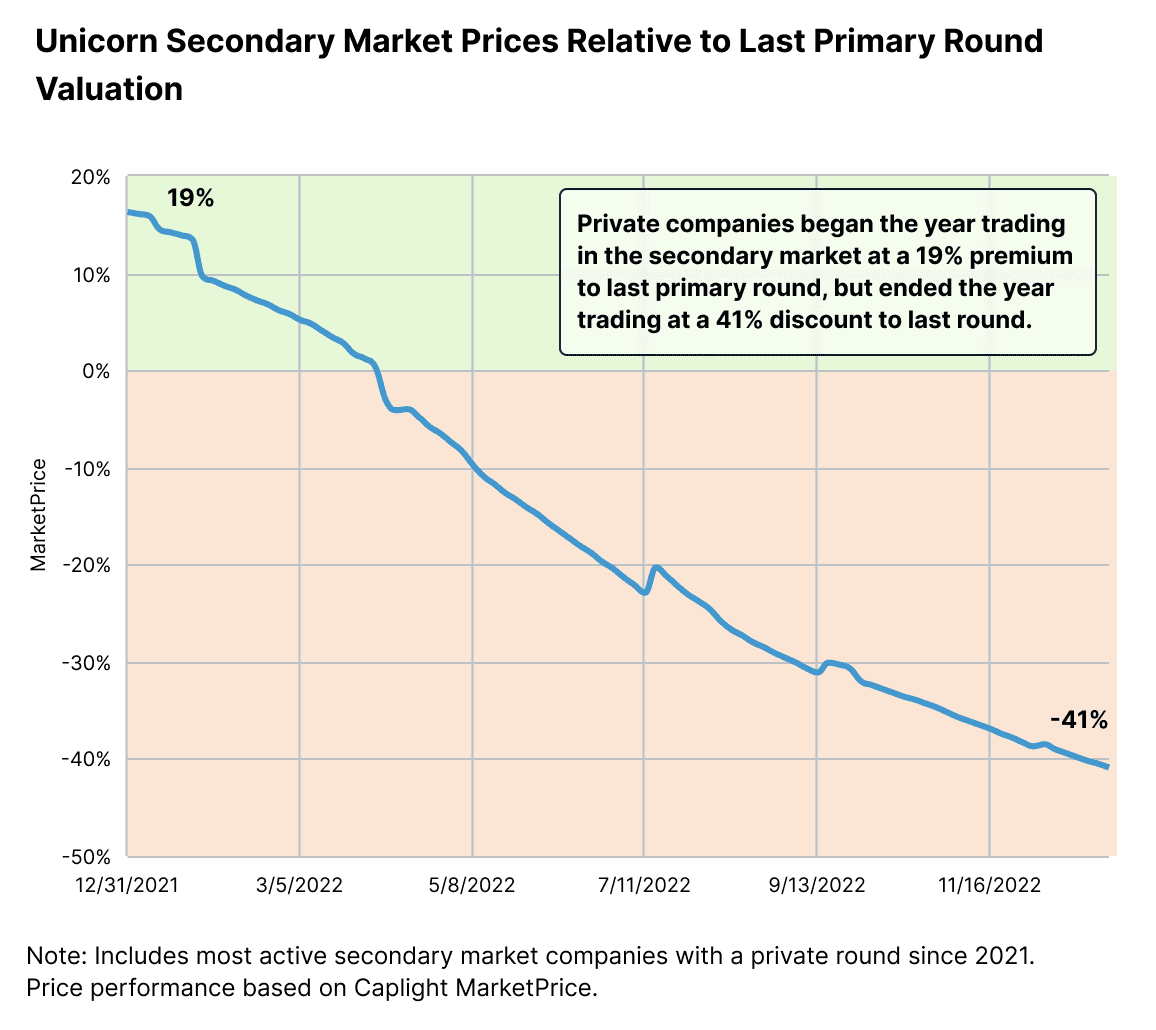

In the secondary markets, unicorns were trading at an avg of 19% above their last round at the beginning of the year. Today they are trading at a 41% discount, which I suspect would be higher but no one wants to sell at the actual clearing price. data from @caplightdata

Thank you @theLinlyShow for featuring Caplight in your analysis!

Hedge funds gave Discord, Stripe, SpaceX and other startups billions. A Bloomberg News analysis shows how valuations have moved trib.al/cq6vCin

Investor interest in SpaceX appears immune to Musk's meddling tcrn.ch/3VhOuzu by @rebecca_szkutak

Thank you @FPratty and @misssaxbys for featuring Caplight in @Siftedeu's analysis of European, VC-backed companies! Transparency benefits everyone in private markets!

New data shows that the prices of some of Europe’s most successful private tech scaleups have fallen as much as half in the last 18 months. sifted.eu/articles/valua…

sifted.eu

Some European tech giants' valuations may be down as much as half

New data shows that the prices of some of Europe’s most successful private tech scaleups have fallen as much as half in the last 18 months.

Fintech valuations are down across the board but some companies are getting hit worse than others. One well-known startup saw its valuation creep up over $200 billion on the secondary market last year before dropping 61%. Find out who below ⬇️🧐

It irks me that Startup Valuation trends are usually self-perpetuating (i.e. investors letting the trend broadly shape future valuations) so glad to see @rebecca_szkutak and @CaplightData shedding light on the exceptions. #StartupValuation #Fundraising

Startup valuations are declining — but not consistently ➡️ techcrunch.com/2022/12/01/sta… "Some started to drop off in 2021, before the public markets tanked, and others are still seeing their valuation creep up." - @rebecca_szkutak #StartupValuation #VC #Fundraising #Startups

United States เทรนด์

- 1. Liverpool 119K posts

- 2. #UFCQatar 17.4K posts

- 3. Slot 92K posts

- 4. Chris Paul 7,641 posts

- 5. Anfield 21.6K posts

- 6. Lamine 31.9K posts

- 7. Isak 22.9K posts

- 8. Forest 106K posts

- 9. #LIVNFO 15.5K posts

- 10. Konate 10.9K posts

- 11. Ferran 12.6K posts

- 12. Klopp 6,061 posts

- 13. Fermin 14.7K posts

- 14. #CollegeGameDay 1,440 posts

- 15. Alex Perez N/A

- 16. Point God 4,476 posts

- 17. Topuria 6,257 posts

- 18. #Caturday 4,217 posts

- 19. Aliev 1,419 posts

- 20. Rutgers 3,619 posts

Something went wrong.

Something went wrong.