You might like

The Science of Nerdiness scientificamerican.com/article/the-sc… via @sciam There are many paths to investment success but deep curiosity is a prerequisite. For knowledge seekers, dopamine drives discovery:

Bold move by @eldsjal @spotify $SPOT -- taking @joerogan exclusive Spotify is playing to win in podcasting

The ability to hold stocks for the long-term is a superpower, especially if you're a concentrated investor. @CliffordSosin was a Jedi during the pandemic chaos: whalewisdom.com/filer/cas-inve…

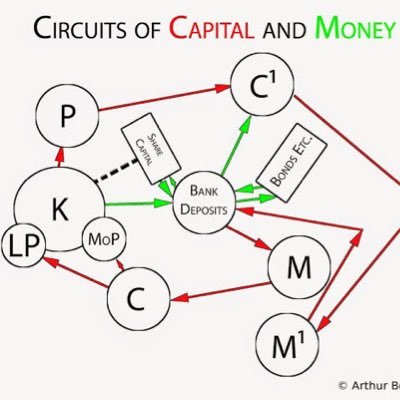

20th century infrastructure was physical, non profit, government owned, & depreciated with usage. 21st century infrastructure is digital, for profit, publicly traded, & appreciates with usage. Today's market captures an enormous, high value opportunity set that 1950 did not.

Lots of commentaries on a new global order post CV with hot takes on which industries will be unduly impacted. It is helpful to think through such scenarios but important to remember humans are a resilient species and possess short-term memories: scmp.com/business/china…

Being rational and objective in a market-selloff does not mean you always have to be a buyer. Muscle memory on “buy the dip” is resulting in a lot of sloppy past is prologue analysis on Coronavirus. Strive for humility and let data be your guide.

PREACH. This is the time to help everyone. I don't give a shit about what's theoretically correct and/or political ideals. We are at war and the lower and lower middle class are sacrificing the most. Don't be an asshole.

I'm not sure how @QuisitiveInvest is doing managing through this crisis but I suspect better than most. People ask me how they can be better investors, do something like this: Your job as a PM is to manage risk. Know thyself and it becomes easier.

Bob Woodward – “Democracy dies in darkness.” China just banished the NYT, WSJ and Washington Post. In a post-fact world, it is more important than ever to seek the light. Tune your media diet accordingly: wsj.com/articles/china…

Bill Miller on framing price discovery in the COVID era - "markets have to price in all the things that can happen. Many more things can happen than will happen, and as those possible outcomes narrow, the market’s accuracy greatly improves." millervalue.com/markets-comple…

There is great wisdom in saying "I don't know."

I will repeat my overarching perspective, which is that I don’t like to take bets on things that I don’t feel I have a big edge on, I don’t like to make any one bet really big, and I’d rather seek how to neutralize myself against big unknowns than how to bet on them.

Area man pretty sure he nailed recent market decline at some point in the last decade: marketwatch.com/story/man-who-…

marketwatch.com

Man who predicted the 2008 financial crisis says coronavirus may mean his bets of stock-market...

It’s times like these that get Peter Schiff’s blood running hot. The polarizing Wall Street prognosticator says that the Federal Reserve’s latest move, an emergency half-a-percentage-point interest...

If you're only listening for investment advice when parsing Charlie Munger, you're doing it wrong: youtube.com/watch?v=HS8neX…

youtube.com

YouTube

Legendary investor Charlie Munger speaks at Daily Journal annual...

Netflix is the biggest beneficiary of the language barrier falling for global content consumption - "thanks to the internet, social media and these streaming services, the entire society is experiencing less of these language barriers” Parasite director Bong Joon-ho

The problem with betting on the end of the world is the world can only end once.

Do yourself a favor and follow one of the most original thinkers in fund management, valuation ninja and all-around nice guy Keith Smith at @Bonhoeffer_KDS.

My 2019 #SpotifyWrapped. Nobody builds community in music like $SPOT. Your Top Songs 2019 open.spotify.com/playlist/37i9d… #NowPlaying

If you want to be depressed about the future I'd start with Super Sad True Love Story. If you want to be depressed about the present, I'd read Lake Success. If you just want to laugh about the present, then Absurdistan. Thanks for reading!

@Shteyngart Dear Gary, I follow you but have yet to read anything by you, I admit. What should I start with? Thanks....

United States Trends

- 1. Lions 72.7K posts

- 2. Lions 72.7K posts

- 3. Goff 17.2K posts

- 4. Dan Campbell 3,566 posts

- 5. #StrangerThings5 20.7K posts

- 6. Snoop 18.7K posts

- 7. Max Brosmer 6,906 posts

- 8. #Skol 3,728 posts

- 9. Spurs 81.1K posts

- 10. Brian Flores 1,402 posts

- 11. #OnePride 3,943 posts

- 12. #NFLonNetflix 15.5K posts

- 13. #DETvsMIN 2,615 posts

- 14. Anthony Davis 3,796 posts

- 15. Gibbs 5,782 posts

- 16. Brad Holmes N/A

- 17. Christmas Day 809K posts

- 18. Niger 9,843 posts

- 19. FaZe 11.7K posts

- 20. Jordan Addison 1,209 posts

You might like

-

Laughing Water Capital

Laughing Water Capital

@LaughingH20Cap -

Steven Wood

Steven Wood

@GWInvestors -

Greenhaven Road

Greenhaven Road

@GreenhavenRoad -

Fred Liu

Fred Liu

@HaydenCapital -

WTCM

WTCM

@WTCM3 -

Implied Expectations

Implied Expectations

@LongHillRoadCap -

scuttleblurb

scuttleblurb

@scuttleblurb -

Adam Wilk

Adam Wilk

@AKWilk -

soonervaluecap

soonervaluecap

@soonervaluecap -

SouthernValue

SouthernValue

@SouthernValue95 -

Redwood capital

Redwood capital

@RedwoodCap -

Global Value Hunter

Global Value Hunter

@stockjock84 -

Elliot Turner

Elliot Turner

@ElliotTurn -

Avram Fisher

Avram Fisher

@longcastadviser -

MoatsLikeKodak

MoatsLikeKodak

@MoatsLikeKodak

Something went wrong.

Something went wrong.