Darde Investor

@CommodityInves2

Here for the next big commodity bull market. Uranium enthusiast. Gold, Copper and Oil, you name it.

You might like

What's going on in the Natural Resources Markets? In this blog, we cover what happened in the Q4 markets to Oil, Natural Gas, Coal, Base Metals, Agricultural, Precious Metals, and Uranium. Find out here: hubs.li/Q01J3lYY0 --- #oil #naturalresources #investing

POS Terminal company listed in Hong Kong, highly recommend checking out. So cheap trading at 6x EPS, should be double, with current growth in 3 years this should triple. #PAXglobal

Pax Global reported strong results, growing its EPS by 18%. Moreover, the company raised +27% the dividend to 0.19 HKD (from 0.15 last year) increasing the payout ratio to 31%. Pax becomes shareholder friendly those last years distributing up to 1bn while 7.6bn market cap

Lighthouse always with great insights about spanish small-caps, this is the place to look for bargains. They really know the spanish small-cap space.

Informe de Resultados 12m 2022 de Nicolás Correa: "Un 2022 excelente (EBITDA: +21%). Rentabilizando su propio ciclo" institutodeanalistas.com/wp-content/upl… Por Lighthouse, el servicio de análisis fundamental e independiente del Instituto Español de Analistas institutodeanalistas.com/lighthouse/

Greta Thunberg and Kevin Bambrough: the crossover we did not see coming

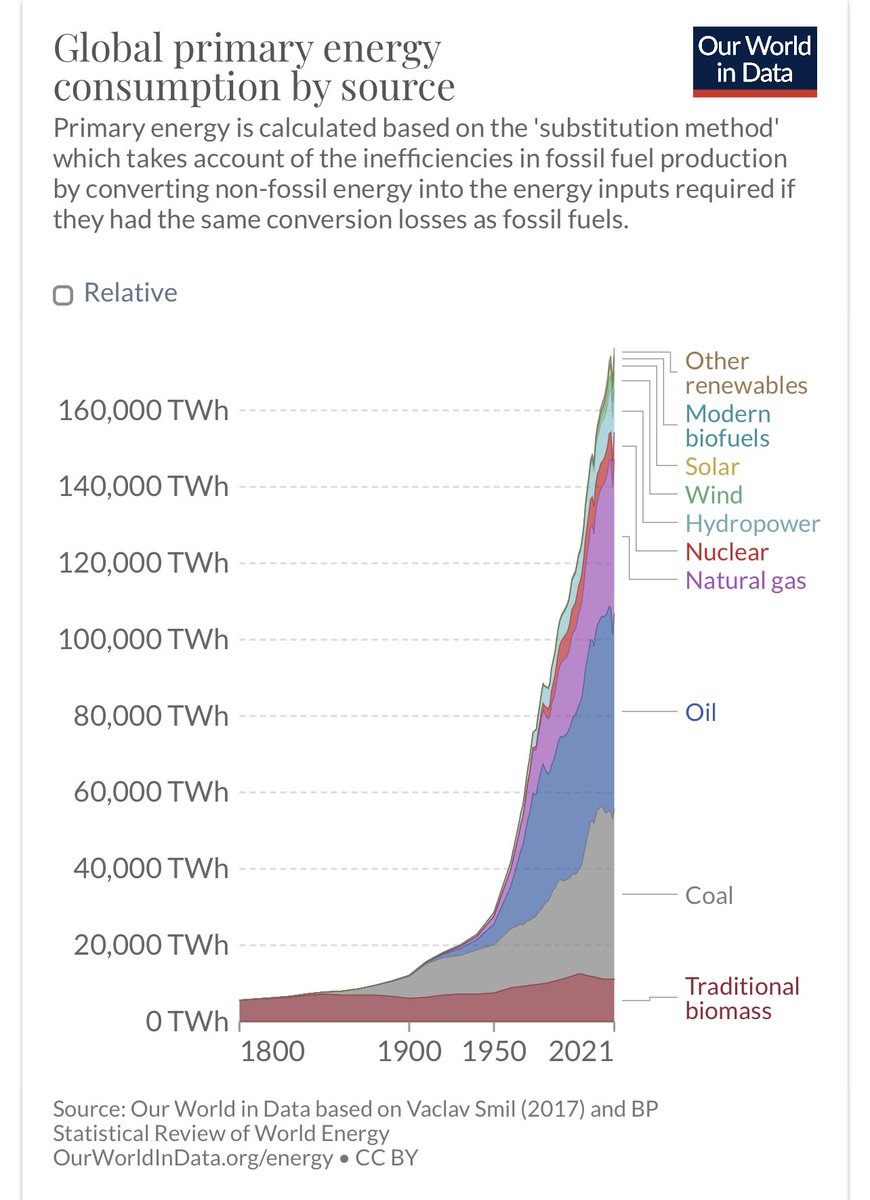

I’d love to have a video call with @GretaThunberg and discuss this chart and the reality that her decision to favour #nuclear over #coal should apply to new builds. Not just shut downs. We are still building new coal plants and as bringing many back online

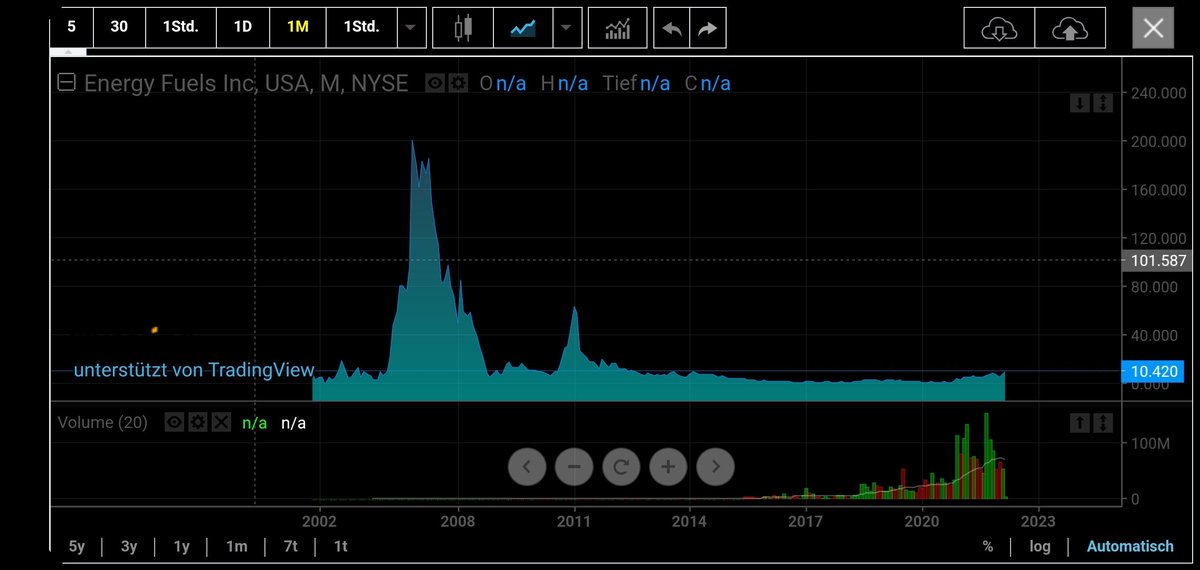

The key lies in here. 55$ is not even close. I think we will see north of 100$. My exposure since a month ago is 100% in physical vehicles. #uranium

WTF man

#Uranium My forecast for Energy Fuels... $20 at the end of April, $60 at the end of the year and $200 at the end of 2023! What do you think? $UUUU $EFR

Putin's fault

In January 2020, there was $4.02 trillion in circulation in the USA. By November 2021, that number had spiked to $20.35 trillion. Since January 2020, the Federal Reserve has printed nearly 80% of all US dollars in existence. 🥲

That's nice. Definitely grateful that we live in a society where Mark Zuckeberg and Google executives determine when we can advocate violence against certain people and when we can't. Seems healthy and democratic.🔪🔪

EXCLUSIVE Facebook and Instagram to temporarily allow calls for violence against Russians reut.rs/3tKVeud

Demential

As we discuss energy and climate change, let's not pretend the war alone has changed everything. The issues predate it. Before Russia invaded Ukraine, oil demand was heading to an all-time high in 2022. Natural gas and coal consumption was already at a record high (yes, coal too)

BOOOOM

Glad I did

Started 100% miners 0% physical in 2019. Today I am looking at 30% miners 70% physical uranium. #uranium

UxC “S/D imbalance is contributing to rapid decline in available mobile inventories. It’s imperative for new production to emerge to avoid a further spike in #uranium prices. This could prove challenging given difficulties financing new projects in the current economic climate”

Here we go!! 🔥🔥🔥

The majority of Kazatomprom supply if not nearly all will be consumed buy China. Panic #uranium buying is coming soon to the western world kazatomprom.kz/en/media/view/…

[communiqué] Pour Greenpeace France, l'annonce par un président en campagne de la construction de nouveaux réacteurs nucléaires en France est totalement irréaliste et anti-démocratique #Macron20h greenpeace.fr/espace-presse/…

greenpeace.fr

Allocution d’E. Macron / Nucléaire : réaction de Greenpeace France

Mardi 9 novembre, Emmanuel Macron a pris la parole lors d’une allocution sur la situation sanitaire. Dans son discours, le Président a également abordé divers thèmes et a notamment annoncé la...

United States Trends

- 1. #SmackDown N/A

- 2. #Olympics2026 N/A

- 3. Obamas N/A

- 4. Mariah Carey N/A

- 5. Giulia N/A

- 6. Braylon Mullins N/A

- 7. #OpeningCeremony N/A

- 8. Lion King N/A

- 9. Kiana James N/A

- 10. Pistons N/A

- 11. Cody Raheem Rhodes N/A

- 12. Tim Scott N/A

- 13. #readytolove N/A

- 14. #MilanoCortinaOlympic2026 N/A

- 15. St. John N/A

- 16. Mikey N/A

- 17. Goldy N/A

- 18. Pizza Hut N/A

- 19. Iyo Sky N/A

- 20. Lee Greenwood N/A

You might like

-

Mr. #Uranium

Mr. #Uranium

@ABongo888 -

Chriso

Chriso

@Chriso26619000 -

Big Mike

Big Mike

@Big_U_Dawg -

SnowyWindows

SnowyWindows

@UraniumTails -

UraniumSam

UraniumSam

@sam37077730 -

long U bull

long U bull

@gdawg54 -

Lukester588

Lukester588

@lukester588 -

UrBull

UrBull

@bull_ur -

DimasUranium

@DimasUranium -

uraniumfilledbatteries

uraniumfilledbatteries

@uraniumfilledb1 -

Jim

Jim

@uraniumNI -

Muril

Muril

@UraniumMuril -

Up to U

Up to U

@nerja2509 -

Griup

Griup

@jgrimold -

uBeliever

uBeliever

@peterzhou15

Something went wrong.

Something went wrong.

![numerco's profile picture. Commodity supply and technology co, specialising in the sourcing and supply chain optimisation of low carbon energy and industrial products.[Feed is 90% Bot]](https://pbs.twimg.com/profile_images/953673054839869440/lrVrWETZ.jpg)