The Compute Investor

@ComputeInvestor

Where capital meets compute. 🧠⚡ The trusted voice in AI infrastructure investing. Tracking the trillion-dollar build-out behind AI data centers.

Pinning this. Important.

$MSFT's Satya is saying that compute is not the bottleneck, but energy and data center space is. In fact the problem he has is that he has a surplus of GPUs right now sitting which he can't use (glut?). He is also saying he doesn't want to over buy one generation of $NVDA GPUs.…

$MARA | 𝐌𝐀𝐑𝐀 𝐇𝐨𝐥𝐝𝐢𝐧𝐠𝐬: Compass Point upgrades to Buy, sets 𝐏𝐓 𝐚𝐭 $𝟑𝟎 Analyst sees deep undervaluation vs. bitcoin assets, with AI ventures and global energy footprint offering major upside.

Amit is in. $NBIS

yeah…hard to see after $NVDA earnings how $NBIS stays at these levels over the long term unless their debt load becomes completely egregious to the market (which right now looks reasonable), they should be fine over the next few years and only continue to expand these…

Goldman: "We expect another Fed cut in December, followed by two more moves in March and June 2026 that take the funds rate to 3-3.25%."

$NBIS growth for the slow people on X: Last quarter: ~$500M ARR ✅ They will DOUBLE ARR to ~$1B this quarter / by end of 2025 📈 In the first quarter of 2026, they will DOUBLE again to ~$2B ARR 📈 During 2026 they will then DOUBLE again to ~$4B ARR 📈 And guess what…

$GOOGL is an absolutely MONSTER. Haven’t changed any of my annotations from last week, Google was setting up perfectly for breakout and Berkshire Hathaway just gave it that extra boost over $300. $GOOG has been one of the only stocks holding up in this market over the last few…

BIG moves from $GOOGL - on Friday - Berkshire Hathaway disclosed a stake in Google. It’s possible this stake wasn’t purchased by Warren Buffett, as he’s now stepped down from Berkshire, but one of his top employees. Either way, it shows the change in Berkshire’s approach, now…

Rolex Oyster Perpetual 39 'Grape' Dial Ref. 114300 🍇

Trading isn’t a GAME Trading isn’t a SPORT Trading isn’t a HOBBY Trading isn’t a GAMBLE Trading isn’t a CONTEST Trading isn’t a SIDESHOW Trading isn’t a COMPETITION Trading is a BUSINESS

Top 20 Stocks that can be big winner in coming months- 1. $IREN - is a data-centre and AI infrastructure operator that has pivoted from crypto mining to supplying high-performance compute capacity. 2. $IONQ - is a pure-play quantum computing company developing…

When Cyberprince was making millions of dollars on RKLB, he was talking shit to people with less money than him. Calling them poor, blocking them, calling them peasants Now, anything he buys like XPEV, AVAX, LINK absolutely tanks immediately after he buys. It is Karma.

And we saw how karna works. Like when you talked mad shit about small to mid sized accounts. now you’re closer to us than ever before. $TSLA $NBIS $RKLB $NVDA

No matter how bad it gets with Bitcoin, you can bet it gets infinitely worse with Ethereum. There’s simply no buyer demand for Ethereum. The DATs bought over 10% of the supply and it couldn’t even make an ATH. It’s gonna be a wild unwind. Since most of these are highly leveraged.

Whenever theres a big sell off like today, you see some traders come out with their little strategies on how they “predicted” price was going to dump because it formed this magical “pattern”… If you believe that, then you’re an idiot. Moves like this dont come from cute little…

$META about to go nuts tomorrow.

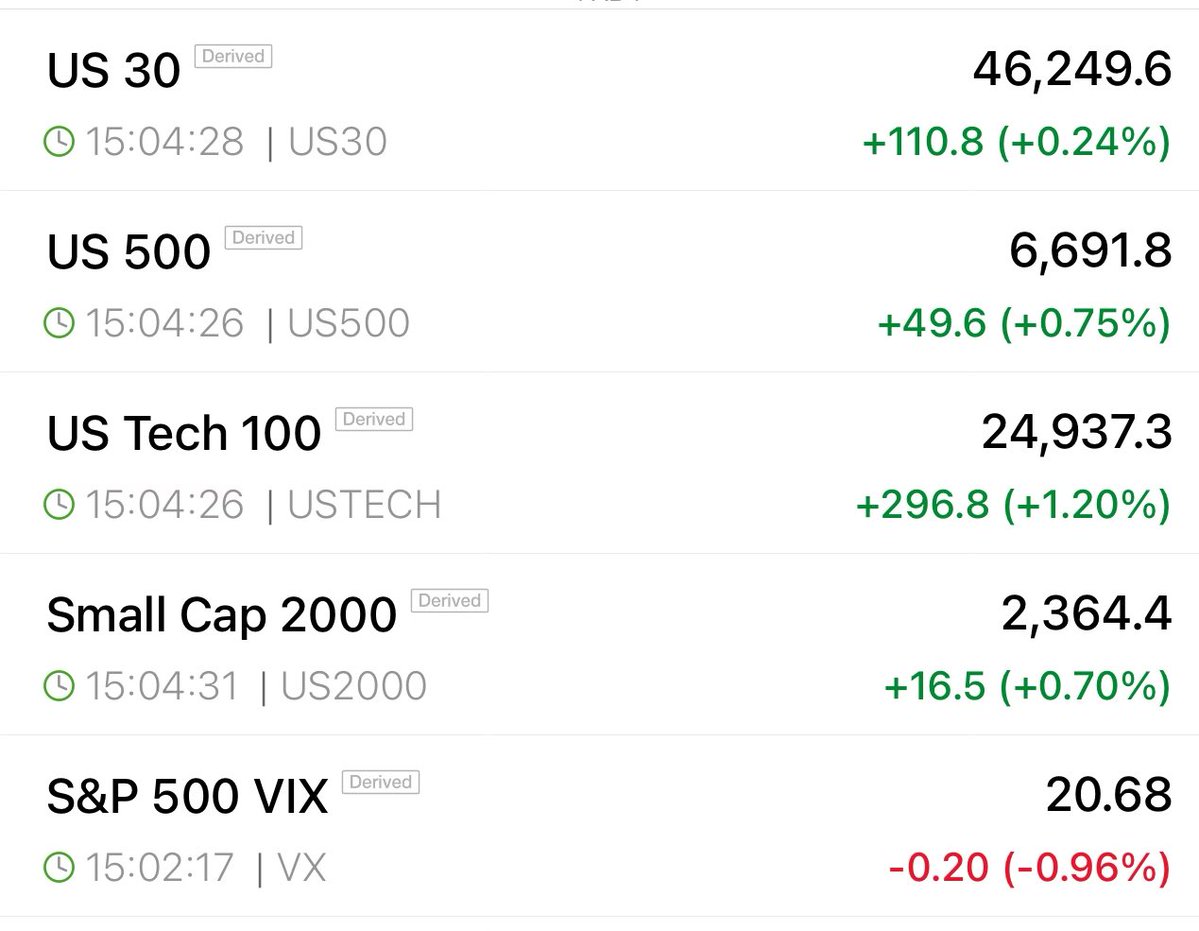

Futes: Thanks Daddy Jensen.

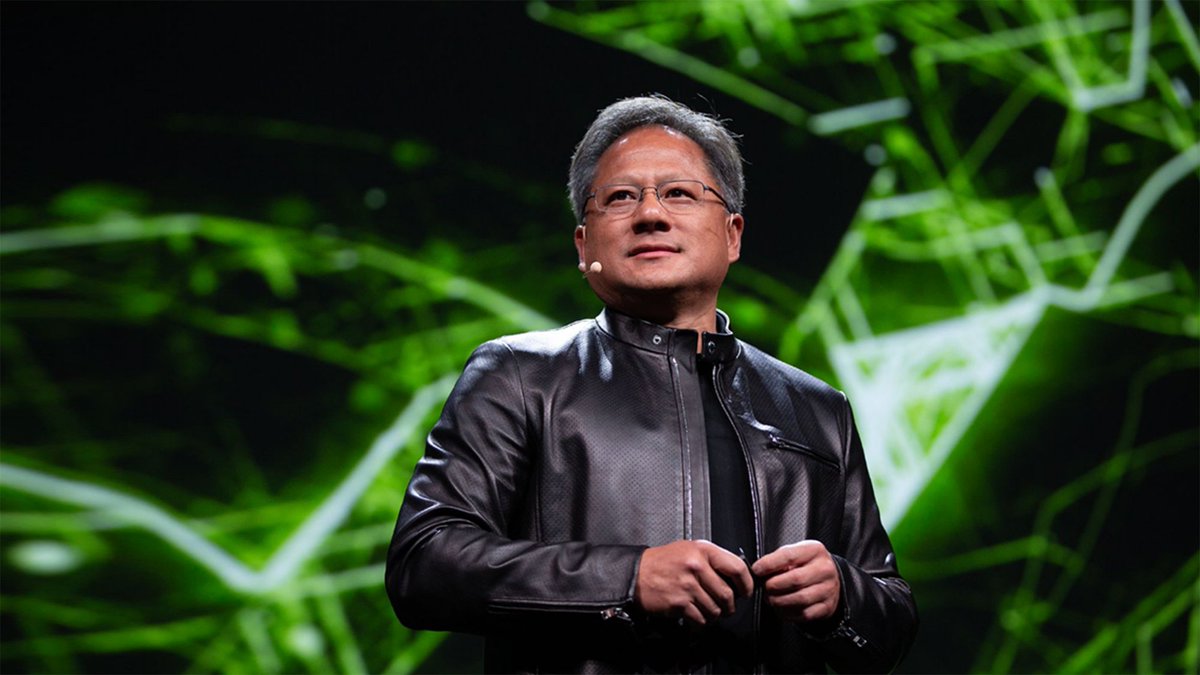

woah first thing Jensen says on the call: “There’s been a lot of talk about the AI bubble, here’s what we are seeing at Nvidia.” completely addresses the bubble concerns head first and then proceeds to challenge the narrative by explaining Nvidia’s growth

Much less stressful watch after today.

Jensen Huang, $NVDA CEO : "Cloud GPUs are sold out"

I don't care if you're a bull or bear...watching one of the most impactful companies to EVER exist repeatedly (and massively) outperform, you can't help but get goosebumps. This is American dynamism, $NVDA.

$NVDA delivered 😏 • Sales $57B vs Est. $55B • EPS $1.30 vs Est. $1.26 • Data Center Sales $51.2B vs Est. $48.6B • Gross Margins 74% vs. Est. 74% Q4 Guidance • Sales $65B vs Est. $62B

United States Trends

- 1. Everton 113K posts

- 2. Comey 152K posts

- 3. GeForce Season 2,754 posts

- 4. Amorim 43.1K posts

- 5. Seton Hall 1,822 posts

- 6. Manchester United 68.7K posts

- 7. Pickford 8,071 posts

- 8. Mark Kelly 99.6K posts

- 9. #MUNEVE 13.8K posts

- 10. Dorgu 16.7K posts

- 11. #MUFC 21K posts

- 12. Opus 4.5 6,965 posts

- 13. Zirkzee 20.5K posts

- 14. Gueye 26.7K posts

- 15. Amad 11.2K posts

- 16. Keane 16.8K posts

- 17. Hegseth 36.8K posts

- 18. Maui 4,375 posts

- 19. Man U 20.4K posts

- 20. UCMJ 14.9K posts

Something went wrong.

Something went wrong.