AGM

@ConvexityCap

Mostly bad takes. Investing growth equity in emerging markets.

You might like

Some people seem to happily arbitrage their purchasing power abroad (in SEA, China, LatAm etc.), yet resent expats doing the same where they live. Preach what you practice.

Guardiola, what have you done?

Kompany on the 16 wins in a row: "I always tell my players: 'When there's hype please don't believe it, you're not that good - and when you lose a game or you have a bad performance, don't believe that you're bad, you're not that bad' - that's something I always keep with me. Now…

Sam Altman is a fascinating new type of person -- someone who is transparently a sociopathic liar and grifter and immensely unlikeable to 99% of humanity, but within Silicon Valley tech bro circles is viewed as incredibly charismatic and visionary

TLDR: Private-equity owned insurers are buying ratings for private equity-backed loans from private equity-owned credit rating agencies. 😑 on.ft.com/47sTNV9

Jon Gray being somewhat honest while Blue Owl is begging for 401k money on LinkedIn really tells you everything you need to know

Blackstone’s Jon Gray says that the days of high returns in private credit are over

Nice move, poaching Indonesian talent from GIC. Danantara’s heading in the right direction. businesstimes.com.sg/international/…

It’s ADE week in Amsterdam --> your neighbourhood sandwich shop drops a clinical house set at 7pm. 👑

Great piece from Lazard on sovereign debt restructuring, the case of Ghana, and the perverse incentives of multilateral development banks' guarantees. lazard.com/research-insig…

The scammy real estate guy who grew up negotiating with mobsters & racketeers in Queens & Brooklyn outperforms all the polished Georgetown diplomats. Probably a lesson in there.

The increasing secularization of Indonesian youth is changing the country subtly now, but it will become much more evident in the years to come. It will shape SEA as well.

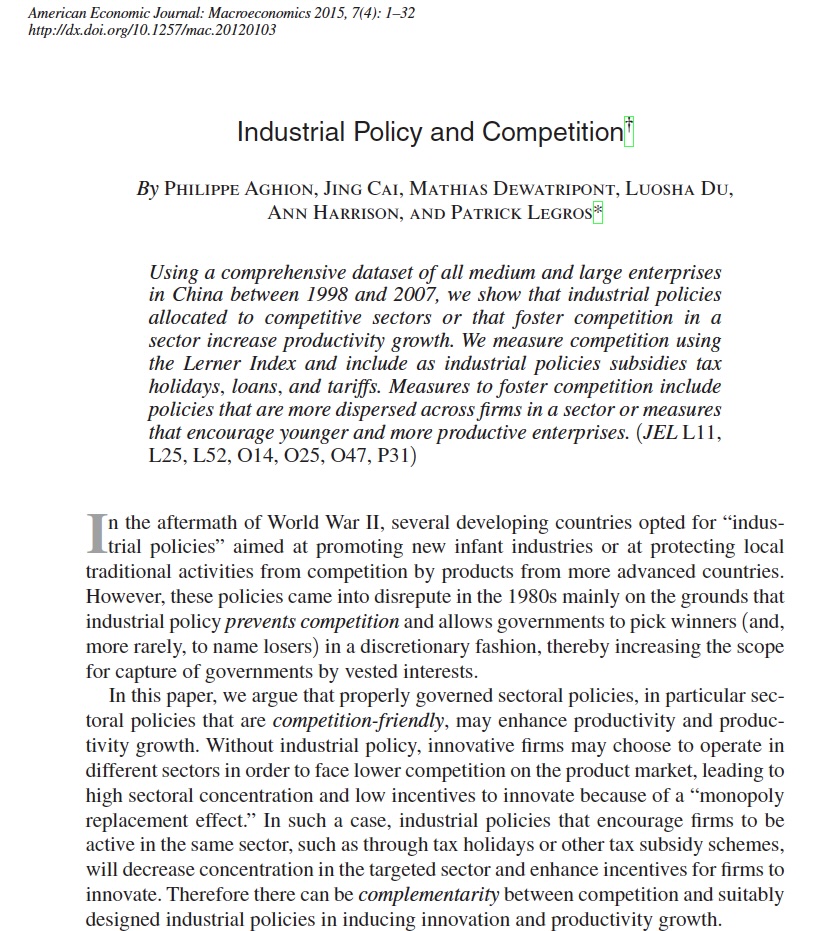

Aghion (with several co-authors) also has a paper on China. They recognised long ago & before many, that the Chinese model departs from the general East Asia model in having Darwinian struggle-to-the-death competition amongst firms behind a wall of protection. It pairs…

Mr. YC dropout discovered (too late) that trust is the currency of private markets.

You know a pretty good solo software business for the next few years would be “Upload your past tax returns, we run them by an LLM and file amended returns if we find any where juice is worth the squeeze, you pay us 30 cents on the refund dollar and nothing until you get paid.”

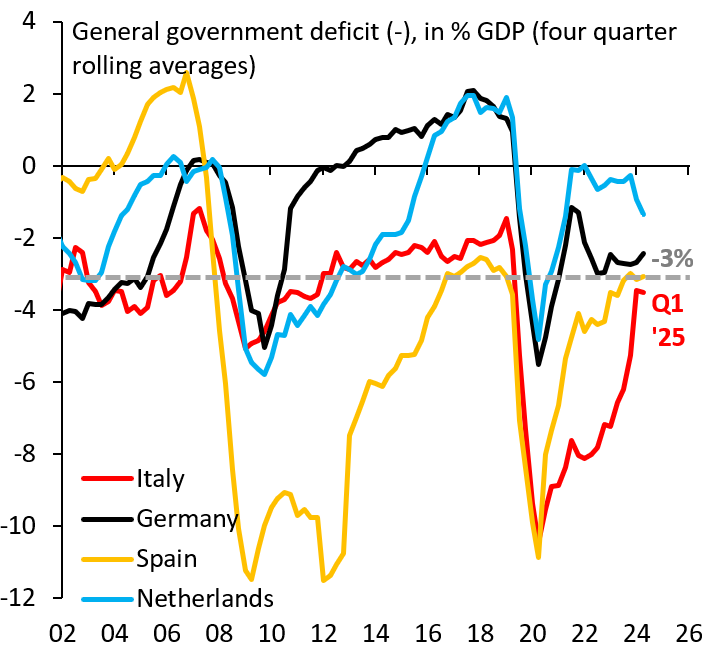

The euro zone is a system where export driven economies like Germany link their currencies to a broader economic block, and thus avoid a shock that would price German auto and machinery exports out of global markets absent massive fx intervention by the Buba!

The Euro zone is a system where fiscally responsible countries subsidize chronically irresponsible ones. This happens via open-ended, no-strings-attached transfers by way of joint EU debt issuance and periodic ECB yield caps. A system that will fail because incentives are broken.

United States Trends

- 1. Louisville 13.1K posts

- 2. Raindotgg 1,523 posts

- 3. Nuss 5,449 posts

- 4. Miller Moss 1,007 posts

- 5. Bama 12.8K posts

- 6. Ty Simpson 3,084 posts

- 7. The ACC 19.5K posts

- 8. #OrtizLubin 2,162 posts

- 9. #AEWCollision 9,231 posts

- 10. Emmett Johnson 1,005 posts

- 11. Brohm N/A

- 12. Lagway 3,406 posts

- 13. Clemson 6,261 posts

- 14. Hawks 16.7K posts

- 15. Kentucky 30.5K posts

- 16. #RollTide 5,054 posts

- 17. Van Buren 1,246 posts

- 18. Stoops 1,894 posts

- 19. #RockHall2025 4,731 posts

- 20. Wake Forest 2,070 posts

You might like

-

Sergi CJ 🇺🇦

Sergi CJ 🇺🇦

@SCristobalJane -

Marc Guerrero

Marc Guerrero

@marc_guerrero -

El Constitucional

El Constitucional

@TribuConsti -

Meritxell Borràs

Meritxell Borràs

@txellborras -

Listo Entertainment

Listo Entertainment

@listocomics -

Guillem Carol

Guillem Carol

@guillemcarol -

marta

marta

@replicanta_ -

Adrià Alsina

Adrià Alsina

@AdriaAlsina -

#AdriEtVolemACasa

#AdriEtVolemACasa

@EtVolemACasa -

Pol

Pol

@lorenzopol1990 -

Jaume Sampériz

Jaume Sampériz

@jsamperiz1 -

Biel Figueras

Biel Figueras

@Rincewindcat -

🍋

🍋

@llim0na -

Jose Rodríguez

Jose Rodríguez

@trinitro -

Mandra Infinita aka The Mandralorian

Mandra Infinita aka The Mandralorian

@Tuit_And_Shout

Something went wrong.

Something went wrong.