Cotality

@CoreLogicInc

Formerly CoreLogic. Unrivaled Intelligence. Unprecedented Performance.

Вам может понравиться

AI is changing the housing industry — and we believe it should be built on trust, transparency, and real data. Visit our new AI signal to see how we apply AI across property, read expert insights, and explore responsible innovation: ctlty.co/3L80MLY

Who owns the algorithm when AI shapes property values and risk? Chapter One of our new AI series explores trust, transparency, and clarity in an automated market: ctlty.co/4aTrMcu

Home price growth slowed to 1.1% by October 2025, the lowest rate since 2012. But the real story is regional and mortgage rates remain a wild card for 2026. Read out latest Home Price Insights: ctlty.co/4oSGWCa

AI + trusted data = clarity. In a new Q&A with @digitaljournal, Kevin Greene shares how Cotality is redefining the future of real estate with tools that empower buyers and the professionals who guide them. Read the full article : ctlty.co/3YgwwkS

Insurance is now a bigger share of monthly payments than ever. @FastCompany highlights insights from Cotality's John Rogers on what’s driving premiums higher and how data and risk science can help stabilize the market. 🔗Read the full feature: ctlty.co/4piaVoi

Premiums, cash offers, and fast closings give investors an edge in today’s market. That advantage is reflected in the growing investor share of low-priced homes, which can limit options for first-time buyers. Read our full analysis here: ctlty.co/4pPg5YT

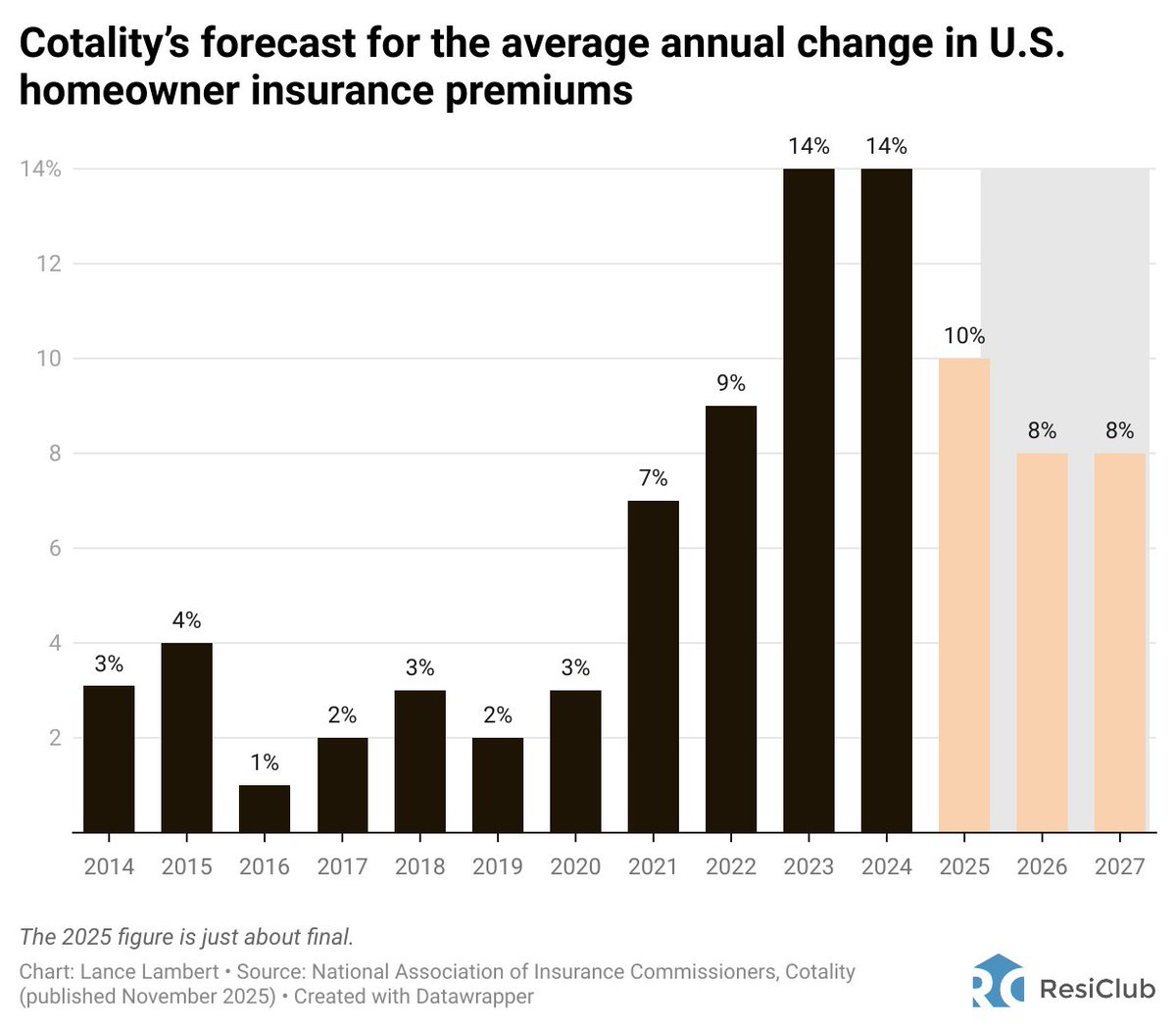

THE HOME INSURANCE SHOCK ISN'T OVER YET Speaking at ResiDay 2025, @cotality chief data & analytics officer John Rogers said they're forecasting another +8% in 2026, followed by +8% increase in 2027 resiclubanalytics.com/p/housing-mark…

🌪️ Could a real tornado send Dorothy’s house to Oz? Our Hazard HQ team used Cotality data to break down tornado intensity, compare it to major modern storms, and explain why understanding your risk matters long before the sky turns green. ctlty.co/3M79Tg1

Climate exposure is influencing where people can safely and sustainably build a life. Here’s how the safest and riskiest counties in the U.S. stack up based on 2025 property-level risk data. 🔗: ctlty.co/4r2Wiq1

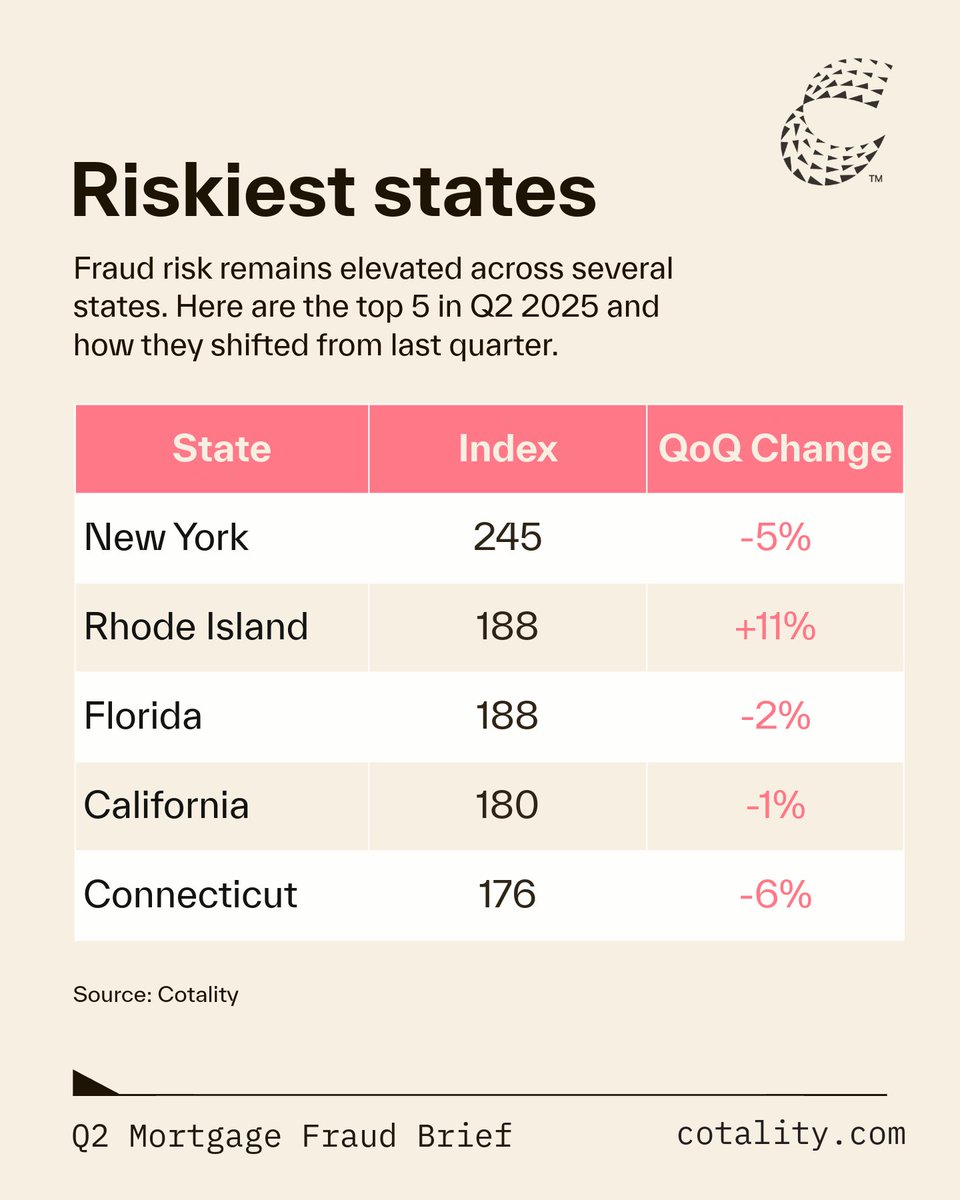

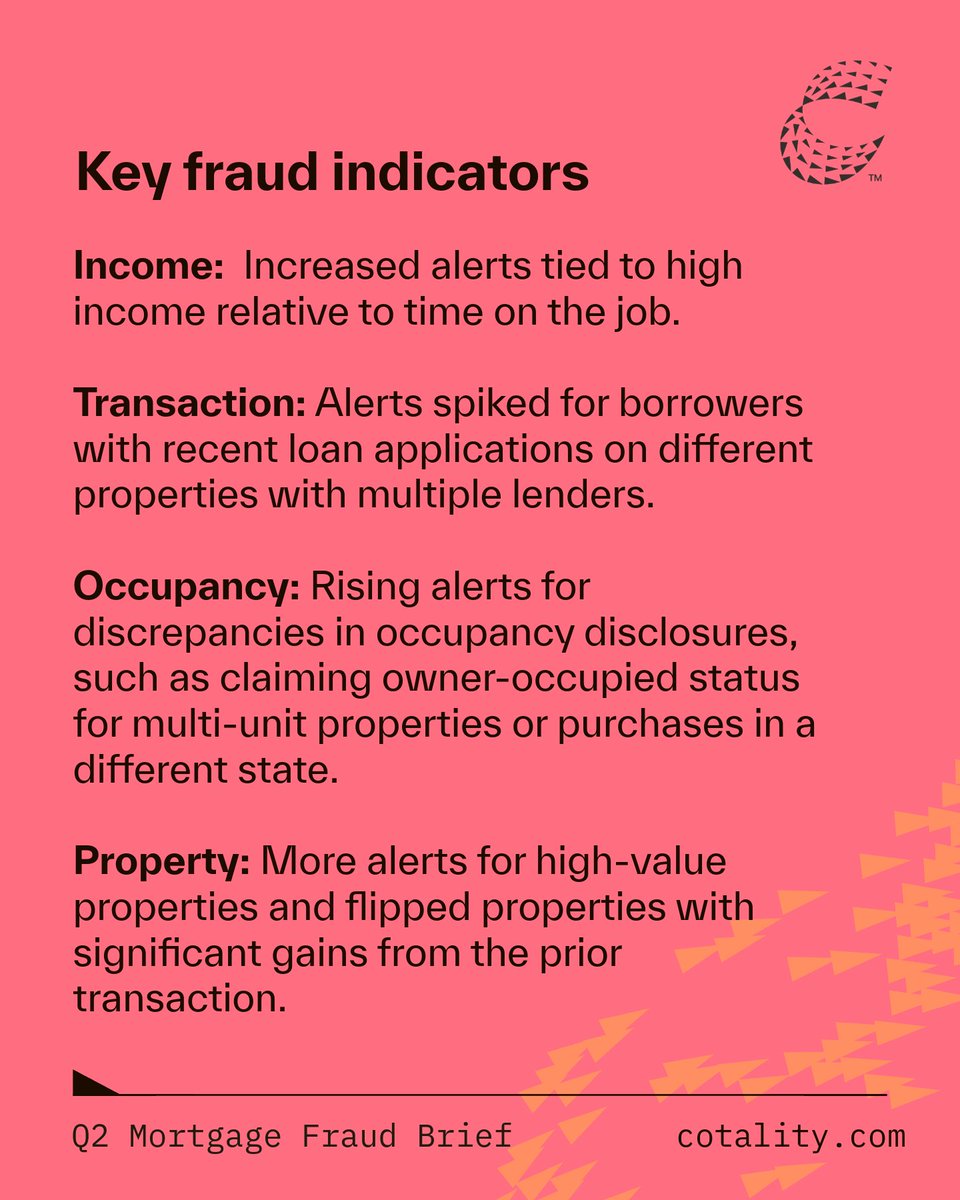

Mortgage fraud risk is climbing: 📝 About 1 in 116 applications show signs of fraud 📊 Undisclosed real estate debt up 12% 🏠 Transaction fraud up 6.2% Read our full report → ctlty.co/4mGPL1M

Nearly 60% of Millennial and Gen Z buyers feel overwhelmed by the mortgage process. Shared equity, co-buying, and freelance income are reshaping the path to homeownership. See Article 3 of Who (really) owns the homebuyer? and read the full report: ctlty.co/45M4DEP

Wildfires are rewriting the rules of property insurance. Cotality’s 2025 Wildfire Risk Report shows how total-loss events, underinsurance, and soaring rebuild costs are reshaping who can recover and who gets priced out. 🔗: ctlty.co/4mIPAT8

Is the housing market finally shifting? 📉 Price growth under 2% in June 🏡 Nearly 1 in 5 metros saw declines — the most since 2012 💰 Median home price: $403K Stay up to date on market trends: ctlty.co/45qOGoA

Home prices grew just 1.7% in June—slower than inflation and the weakest June gain since 2008. Could this cooling trend open the door for more buyers? Find out in our August US home price insights report: ctlty.co/4mopntl

Who (really) owns the homebuyer? 🏡 New Cotality research shows how trust, tech & affordability are reshaping the journey to homeownership—with insights from the US, UK & Australia. Read the report here: ctlty.co/4m5dfNW

What’s dimming the glow of the Sunshine State? 🌪️ Hurricane risk 📈 Skyrocketing premiums 💰 Out-of-reach prices Florida’s housing market is shifting—fast. Read why in our Hurricane Risk 2025 report: hubs.li/Q03t3tnn0

Insurance costs are the new barrier to homeownership. The storm of affordability is spreading far beyond Florida. Our 2025 Hurricane Risk Report is out now: hubs.li/Q03pJsXQ0

“AI is powerful—but it needs a human in the loop.” Cotality’s John Rogers sat down with KeyCrew Journal to talk AI, climate resilience, and why real estate pros are the real superheroes: bit.ly/44NBfyY

“The hill behind your house is on fire.” Our president of global insurance solutions shares how a personal crisis reshaped his view of the industry—and why the future of insurance depends on collaboration, tech & smart regulation. Read the full story in this @Forbes article.

United States Тренды

- 1. Bears 117K posts

- 2. Caleb Williams 29K posts

- 3. Malik Willis 13.7K posts

- 4. Nixon 10.4K posts

- 5. #BearDown 3,594 posts

- 6. Ben Johnson 7,402 posts

- 7. Doubs 8,157 posts

- 8. Oregon 33.9K posts

- 9. Jordan Love 11.5K posts

- 10. #GoPackGo 7,570 posts

- 11. Tulane 31.3K posts

- 12. #GBvsCHI 3,036 posts

- 13. Duke 25.4K posts

- 14. Texas Tech 6,707 posts

- 15. LaFleur 3,676 posts

- 16. #GuerraDeTitanes 15.6K posts

- 17. Cairo Santos 1,268 posts

- 18. Josh Jacobs 4,014 posts

- 19. Jahdae Walker 2,987 posts

- 20. Cher 33.4K posts

Вам может понравиться

-

HousingWire

HousingWire

@HousingWire -

National Mortgage News

National Mortgage News

@NatMortgageNews -

Zillow

Zillow

@zillow -

NAR Research

NAR Research

@NAR_Research -

Fannie Mae

Fannie Mae

@FannieMae -

Realtor.com Economics

Realtor.com Economics

@RDC_Economics -

NAR REALTOR® NEWS

NAR REALTOR® NEWS

@realtormag -

National Association of REALTORS®

National Association of REALTORS®

@nardotrealtor -

RISMedia

RISMedia

@RISMediaUpdates -

Altos

Altos

@AltosResearch -

Realtor.com

Realtor.com

@realtordotcom -

John Burns Research and Consulting

John Burns Research and Consulting

@JBREC -

Mortgage News Daily

Mortgage News Daily

@mortgagenewsmnd -

U.S. Federal Housing (FHFA)

U.S. Federal Housing (FHFA)

@FHFA -

Mortgage Bankers Association

Mortgage Bankers Association

@MBAMortgage

Something went wrong.

Something went wrong.