Cotality

@CoreLogicInc

Formerly CoreLogic. Unrivaled Intelligence. Unprecedented Performance.

You might like

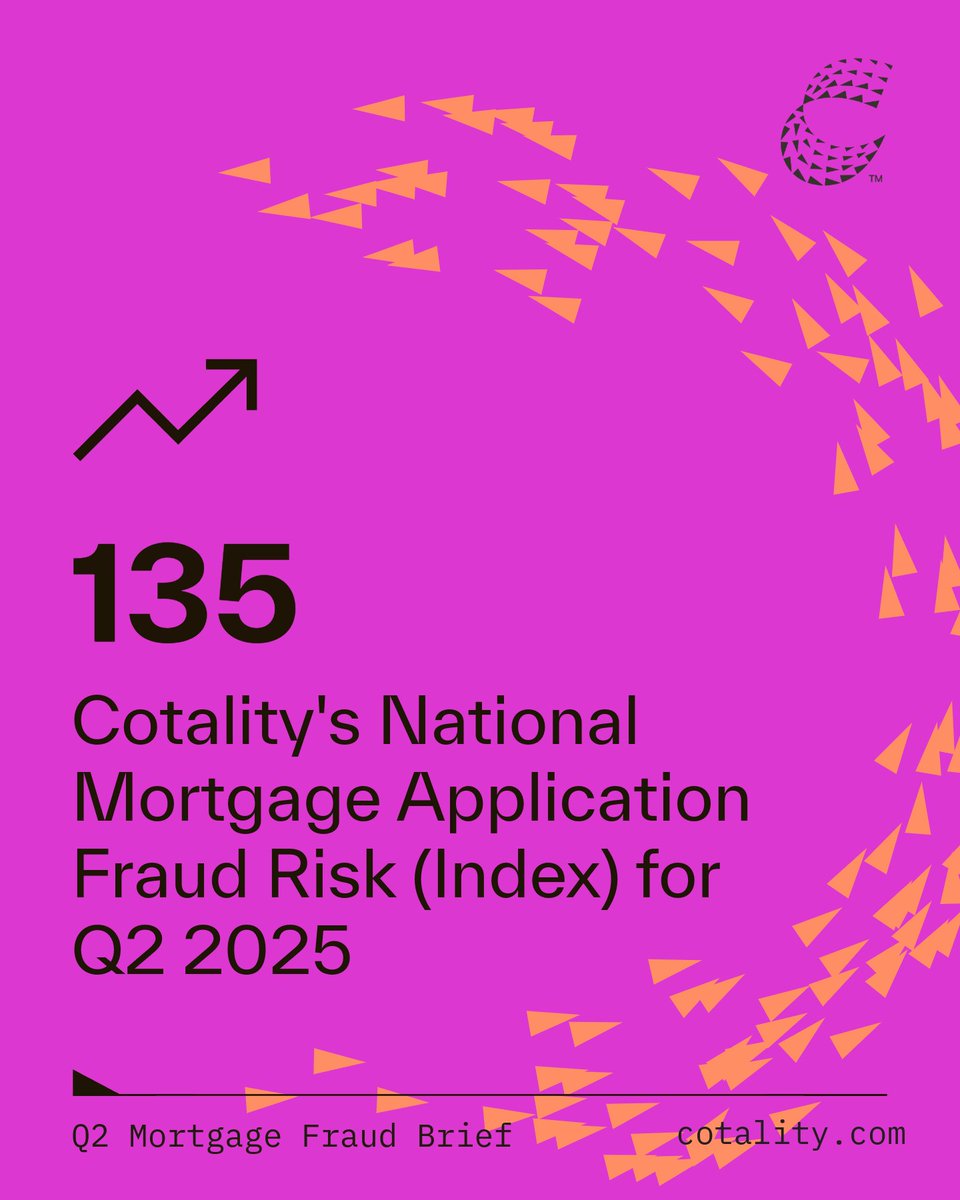

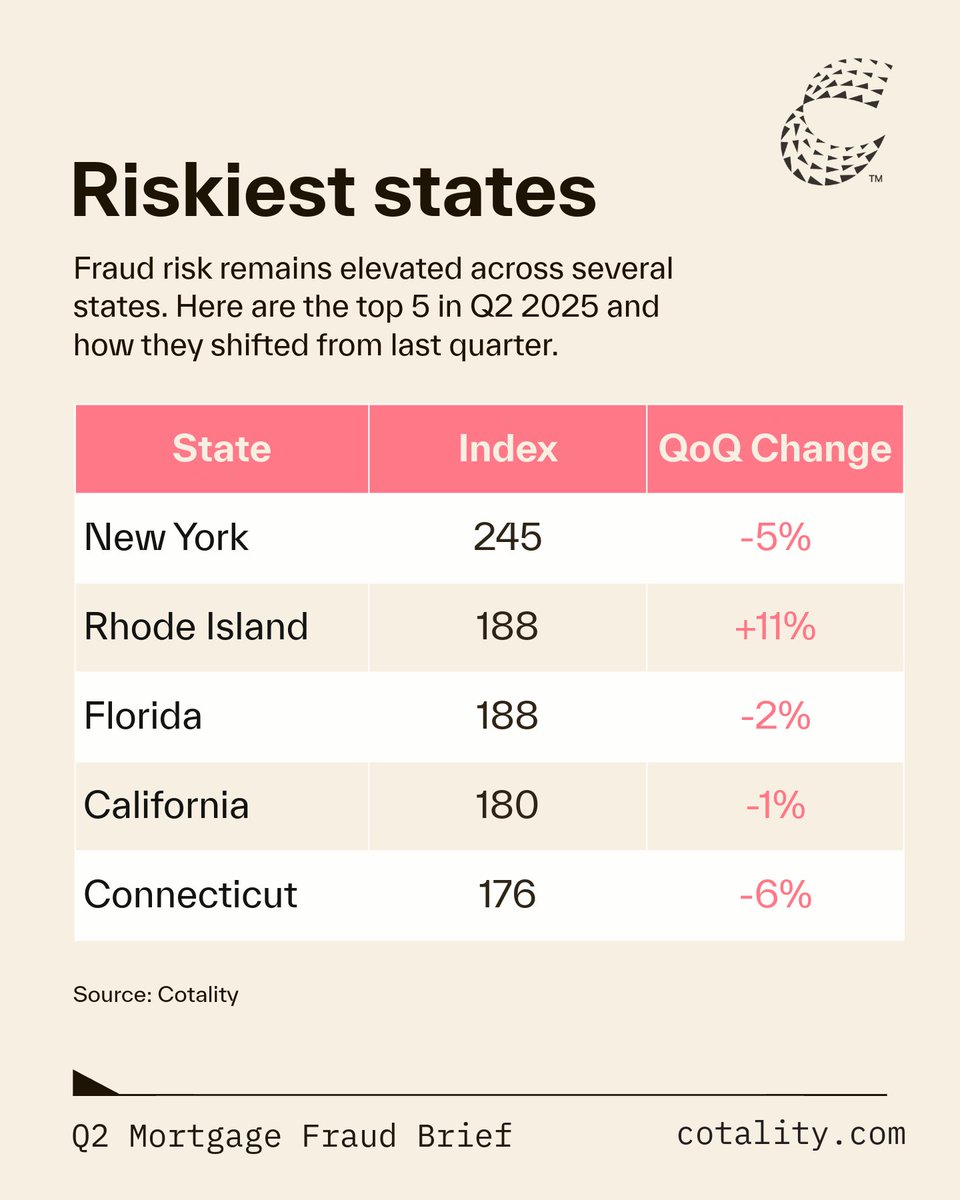

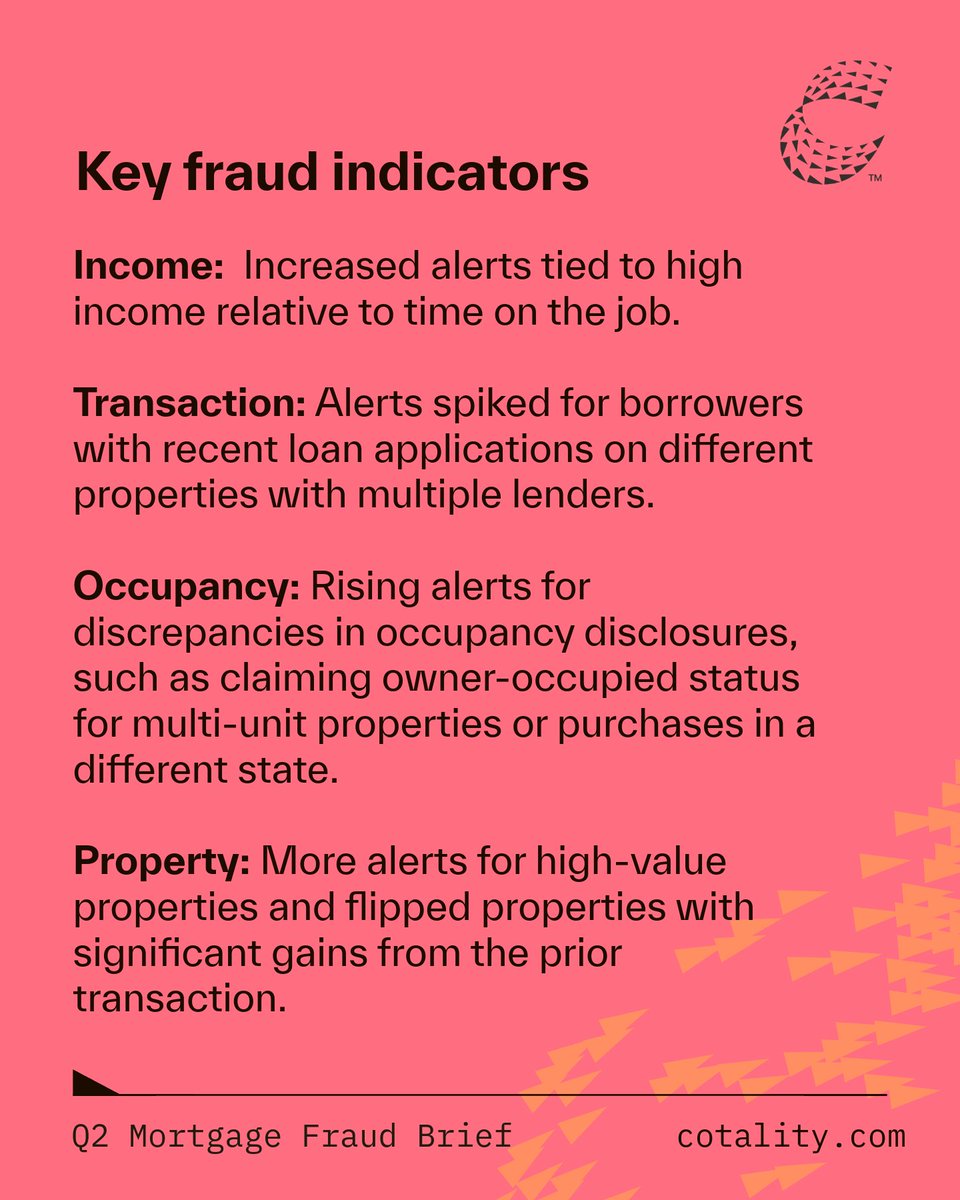

Mortgage fraud risk is climbing: 📝 About 1 in 116 applications show signs of fraud 📊 Undisclosed real estate debt up 12% 🏠 Transaction fraud up 6.2% Read our full report → ctlty.co/4mGPL1M

Nearly 60% of Millennial and Gen Z buyers feel overwhelmed by the mortgage process. Shared equity, co-buying, and freelance income are reshaping the path to homeownership. See Article 3 of Who (really) owns the homebuyer? and read the full report: ctlty.co/45M4DEP

Wildfires are rewriting the rules of property insurance. Cotality’s 2025 Wildfire Risk Report shows how total-loss events, underinsurance, and soaring rebuild costs are reshaping who can recover and who gets priced out. 🔗: ctlty.co/4mIPAT8

Is the housing market finally shifting? 📉 Price growth under 2% in June 🏡 Nearly 1 in 5 metros saw declines — the most since 2012 💰 Median home price: $403K Stay up to date on market trends: ctlty.co/45qOGoA

Home prices grew just 1.7% in June—slower than inflation and the weakest June gain since 2008. Could this cooling trend open the door for more buyers? Find out in our August US home price insights report: ctlty.co/4mopntl

Who (really) owns the homebuyer? 🏡 New Cotality research shows how trust, tech & affordability are reshaping the journey to homeownership—with insights from the US, UK & Australia. Read the report here: ctlty.co/4m5dfNW

What’s dimming the glow of the Sunshine State? 🌪️ Hurricane risk 📈 Skyrocketing premiums 💰 Out-of-reach prices Florida’s housing market is shifting—fast. Read why in our Hurricane Risk 2025 report: hubs.li/Q03t3tnn0

Insurance costs are the new barrier to homeownership. The storm of affordability is spreading far beyond Florida. Our 2025 Hurricane Risk Report is out now: hubs.li/Q03pJsXQ0

“AI is powerful—but it needs a human in the loop.” Cotality’s John Rogers sat down with KeyCrew Journal to talk AI, climate resilience, and why real estate pros are the real superheroes: bit.ly/44NBfyY

“The hill behind your house is on fire.” Our president of global insurance solutions shares how a personal crisis reshaped his view of the industry—and why the future of insurance depends on collaboration, tech & smart regulation. Read the full story in this @Forbes article.

A potential TikTok ban isn’t just about social media—it’s about access. From tailored home listings to neighborhood insights, the platform has changed how people navigate real estate. With the April 5 deadline looming, what happens next? 🔗: hubs.li/Q03fFhP70

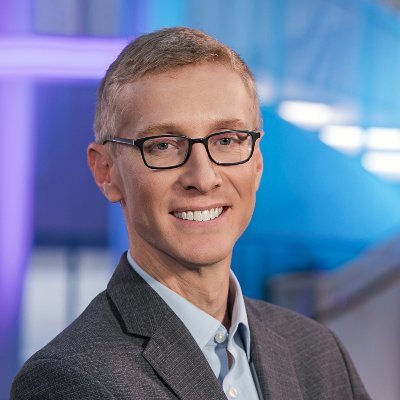

The housing market's insurance shock, as explained by CoreLogic Chief Data & Analytics Officer John Rogers The median annual U.S. home insurance premium rose 33% between 2020 and 2023. Here's why. My latest for @ResidentialClub resiclubanalytics.com/p/the-housing-…

United States Trends

- 1. #WorldSeries 57K posts

- 2. Halo 126K posts

- 3. PlayStation 59.1K posts

- 4. $BIEBER N/A

- 5. Purdue 4,925 posts

- 6. Xbox 72.4K posts

- 7. Jasper Johnson N/A

- 8. Darryn Peterson N/A

- 9. End of 1 13.5K posts

- 10. #HitTheBuds 3,075 posts

- 11. Joe Davis N/A

- 12. End 1Q N/A

- 13. End of the 1st 2,582 posts

- 14. #NBAonPrime N/A

- 15. #BelleCollective N/A

- 16. Go Dodgers 4,384 posts

- 17. North Texas 3,831 posts

- 18. Pharrell 6,843 posts

- 19. Cole Anthony N/A

- 20. Honeycutt N/A

You might like

-

HousingWire

HousingWire

@HousingWire -

National Mortgage News

National Mortgage News

@NatMortgageNews -

Zillow

Zillow

@zillow -

NAR Research

NAR Research

@NAR_Research -

Fannie Mae

Fannie Mae

@FannieMae -

Realtor.com Economics

Realtor.com Economics

@RDC_Economics -

REALTOR® Magazine Media

REALTOR® Magazine Media

@realtormag -

National Association of REALTORS®

National Association of REALTORS®

@nardotrealtor -

RISMedia

RISMedia

@RISMediaUpdates -

Altos

Altos

@AltosResearch -

Realtor.com

Realtor.com

@realtordotcom -

John Burns Research and Consulting

John Burns Research and Consulting

@JBREC -

Mortgage News Daily

Mortgage News Daily

@mortgagenewsmnd -

U.S. Federal Housing (FHFA)

U.S. Federal Housing (FHFA)

@FHFA -

Mortgage Bankers Association

Mortgage Bankers Association

@MBAMortgage

Something went wrong.

Something went wrong.