Cryptoclear

@CryptoclearM

In search of the best mid-term and long-term investments in Cryptocurrency, commodity and equity markets leveraging research and technical analysis.

You might like

Nice short term target! I think more to come longer term as well, the #Palladium 10 month EMA also crossed over the 20 month EMA. The last two times that happened it led to a 15 month rally before a major pullback. Im hoping for a repeat which would push higher into end of 2026.

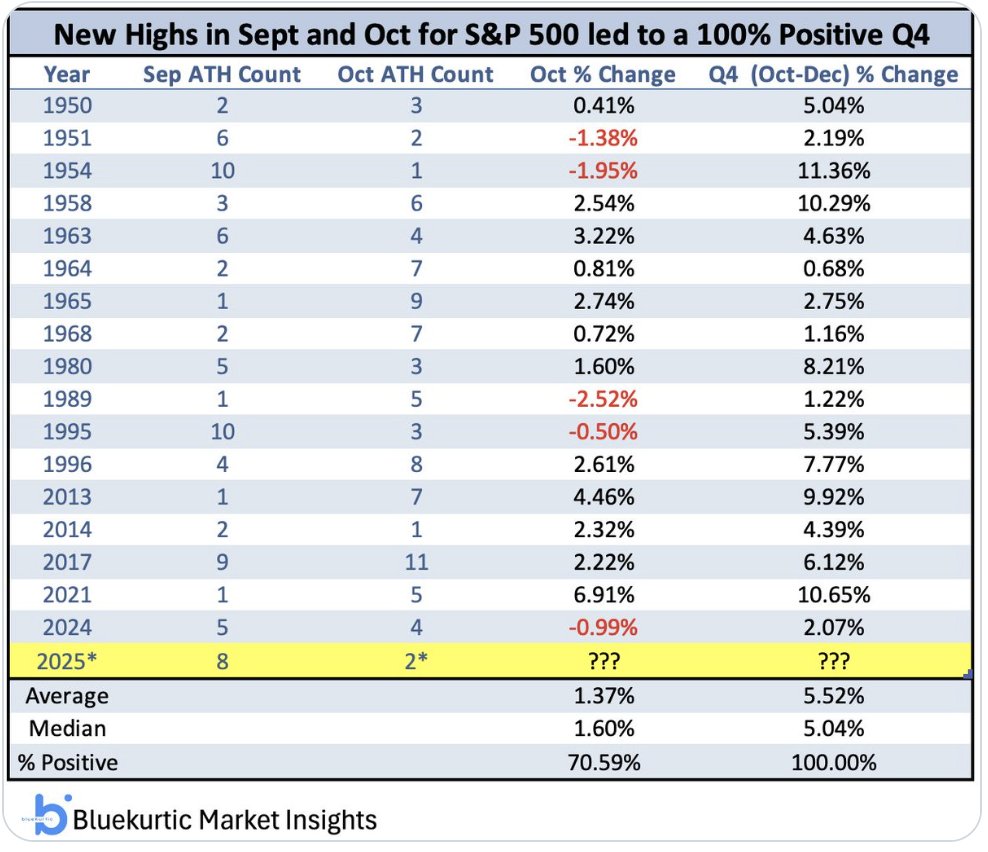

New ATHs in September and October bode well for Q4 EVERY. SINGLE. TIME. higher in Q4 w/median gain +5% ALSO📢 $SPX has never made an ATH in month of October for 3 consecutive calendar years (2024, 2025...? ). Midterm-election 2026, something to consider! January 2026 should be…

The previous two cycles both lasted exactly 1064 days. If that pattern repeats, this #Bitcoin cycle should top around the 27th of October - with room for #Altcoins to keep running into late November. Not saying it has to play out the same - just don't forget to take profits.

That seems reasonable based on my long term analysis also, looking at the weekly chart historically, $SILVER RSI reading of approximatly 88 on the weekly seems to mark the top and we are starting to get close. That would be my sell point. The $54 to $55 seems to be a nice…

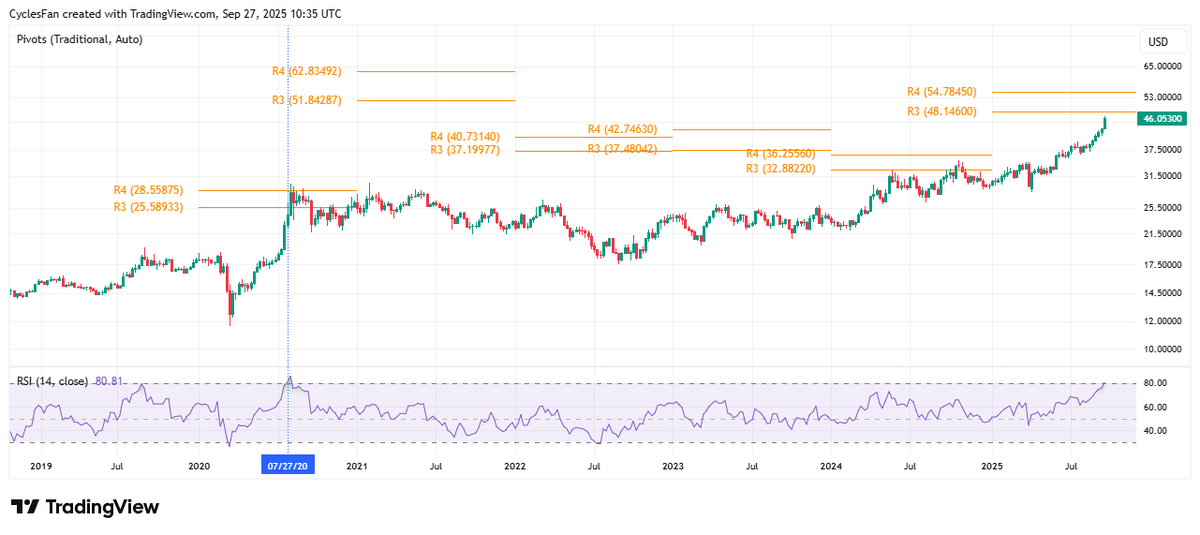

$Silver - The 14 week RSI is at 80.8. That is identical to the level it was at 1 week before the 2020 top. The following week was a 16% up week and silver reached the yearly R4 pivot. If it repeats the same action next week it would make a new ATH and reach the R4 pivot at 54.78.

$Gold - The 1980 top was $873. The 2011 top at $1921 was 120% higher than the 1980 top. The yearly R4 pivot at $4236 is 120% higher than the 2011 top. If gold gets to 4236 in October the bull market would probably end in 2025. If it doesn't, it would probably end in 2026.

Definitley a nice breakout, my thought has been that it will see resistance at 1730 and retest the breakout similar to year 2000 but with the strenght of this breakout I would not be surprised if I am wrong and it goes up further before a significant retrace.

As we head into month end its worth keeping an eye on the Bloomberg Commodity index to see if this breakout holds. It could be signaling a strong rally ahead for commodities probably fueled by expecation of further rate cuts.

$AVAX is looking great here from a longer term perspective also as it looks to be on the verge of a major breakout. New all time highs should come soon after a monthly breakout.

always a big fan of bidding whatever comes back the fastest and strongest after massive liquidation events like yesterday and $avax is ticking all those boxes. huge buyback here after yesterday.

Is 2010/2011 the analog for this run in Silver? $SI_F

I've been waiting for the Brazil ETF (EWZ) to break above 32 for over 10 years, I have a feeling this might finally be the year. It should have a strong move once it does.

Yes Bob, pattern from 2010 is repeating!

That major thrust is in action now. I think we're in a runaway market for Silver.

$SUI SUI is on the cusp of breaking out from this Downtrending Channel (light blue) A breakout would see SUI revisit the old All Time High area #BTC #SUI

SUI and SOL are the two major Crypto alts poised for major moves in Q4. ETF likely for SOL soon and the SUI partnership with Google should be a catalyst. Two of my bigger positions.

Update on Palladium

#palladium I agree bob, still consolidating above the accumulation and looks ready to make a similar move to the run in 2017 with MACD and RSI in similar positions.

Since my post in February #BABA hasnt followed exactly the same path as in 2017 but its catching up now and making strong move that in my opinion should last several more months and reach the first resistance at $190 soon.

#Baba Is still tracking 2017 as predicted back in September, price came back to the 10 month SMA in Q4 and now on its way higher. If the trend continues 2025 should be a great year for Baba and China in general.

The timing for a gold bull market top is not until late 2028, but likely 2029. That's the 8yr Cycle top window.

#GOLD just put in one of it's best ever monthly candles. The 10+ year bear market is now a bull market, yet few have has noticed. I think this will rip faces.

There might be short term resistance but the breakout in the silver ETF #SLV is very similar to the breakout in 2010 when silver went parabolic. If SLV follows the same pattern, then new all-time highs will be likely by early 2026. The gain from the breakout back in 2010 was…

When $IWM (iShares Russell 2000 ETF) breaks out, historical data shows the next bear market typically doesn't start for at least a year, with the longest delay being nearly 1,400 days. Consider this: $IWM hasn't even hit all-time highs yet. This suggests the current bull market…

It's almost time to go to Algoland. Are you ready? We're giving away 5,000 ALGO in total to 5 participants (1,000 each) who do the following: 1. Follow @AlgoFoundation 2. RT & Like 3. Reply with 'ALGOLAND' below Bonus: Add “Algoland” as your location for extra luck!

For Bitcoin I do think time is more important than price, so makes sense to me to assume the top is coming in 55 days. Have to be open to a shift in cycle duration but not my base case.

United States Trends

- 1. Auburn 17.8K posts

- 2. Auburn 17.8K posts

- 3. #UFCRio 37.9K posts

- 4. Penn State 24.9K posts

- 5. Indiana 45.9K posts

- 6. James Franklin 12.7K posts

- 7. Oregon 68.6K posts

- 8. Diane Keaton 204K posts

- 9. Andrew Vaughn 1,147 posts

- 10. Nuss 4,256 posts

- 11. Charles 90.4K posts

- 12. Hugh Freeze N/A

- 13. Do Bronx 5,041 posts

- 14. Mateer 12.7K posts

- 15. King Miller N/A

- 16. #iufb 7,897 posts

- 17. Michigan 53.2K posts

- 18. Makai Lemon 1,185 posts

- 19. #AEWCollision 6,836 posts

- 20. Drew Allar 5,985 posts

You might like

-

Peter Chen

Peter Chen

@peterljchen -

steven 🛸| Suiswap ⚙️

steven 🛸| Suiswap ⚙️

@SMyers_21 -

Jack

Jack

@Divine1z -

Piko MagicSquare $SQR

Piko MagicSquare $SQR

@pikobtc -

Garen M

Garen M

@GarenMeger -

marvin germo

marvin germo

@marvingermo -

Richard Patey

Richard Patey

@RichardPatey -

adam brotman

adam brotman

@adambrotman -

John M. Spallanzani

John M. Spallanzani

@JohnSpall247 -

Quam

Quam

@QuamSQI -

Aaron Johnston

Aaron Johnston

@AaronJo69491508 -

CryptoMagic

CryptoMagic

@bg_mallorc39990 -

Alejandro

Alejandro

@Alejand40789484 -

BullFlow 🧩©️

BullFlow 🧩©️

@cryptobullflow -

Wade Alters

Wade Alters

@WadeAlters

Something went wrong.

Something went wrong.