Daniel Sotiroff

@DanielSotiroff

Morningstar ETF analyst. Editor, Morningstar ETF Investor. Morningstar Research Services. Important disclosure information. http://shorturl.at/yCNP3

You might like

Dimensional filed for its first 13 ETF share classes today Looks like mostly core, large-cap, and some small-cap portfolios. Interesting that the micro-cap portfolio is getting ETF'd sec.gov/Archives/edgar…

Morningstar's @DanielSotiroff and @MstarArmour dig into everything investors need to know about ETF share classes here.morningstar.com/funds/etf-shar…

Vanguard will offer three new, active fundamental stock ETFs overseen by managers who run some of the family’s most storied stock mutual funds. @DanielSotiroff shares what investors need to know about the new offerings. morningstar.com/funds/vanguard…

@ConvertBond says the market is showing signs that a 10-20% selloff will hit in the next 4-6 weeks, part of a rotation that he says will favor hard assets. @DanielSotiroff of @Morningstar on @VanguardGroup plans to offer #ETF versions of 3 popular active funds & more. Tune in!

@DanielSotiroff on Vanguard's just-announced plan to launch three new 'Vanguard Wellington' branded active ETF, one with links to Vanguard Dividend Growth Fund, another to Vanguard Global Equity Fund, and a third to Vanguard Windsor Fund. morningstar.com/funds/vanguard…

Vanguard just filed for an ETF share class of its actively managed mutual funds... sec.gov/Archives/edgar…

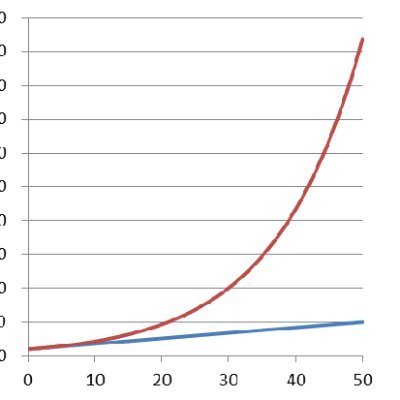

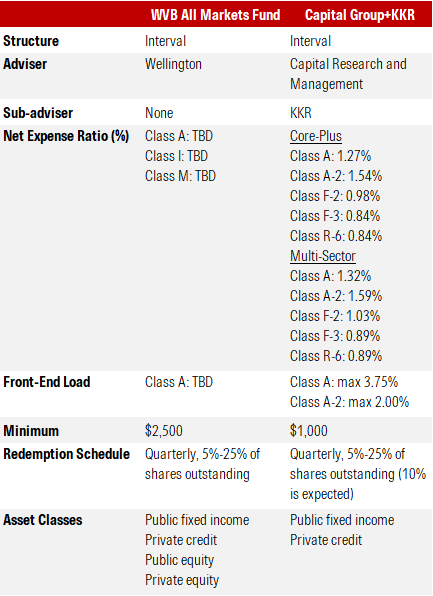

Here's what WVB All Markets looks like compared to Cap Group+KKR collab. Gives you a taste of where fees are at right now on these public+private funds 👍👍 to both for choosing the interval fund structure

The Vanguard/Wellington/Blackstone interval fund filing is here. (h/t @DanielSotiroff) Will feature a mix of public and private assets, largely via investments in a mix of Vanguard and Blackstone funds. $2,500 minimum initial investment. sec.gov/Archives/edgar…

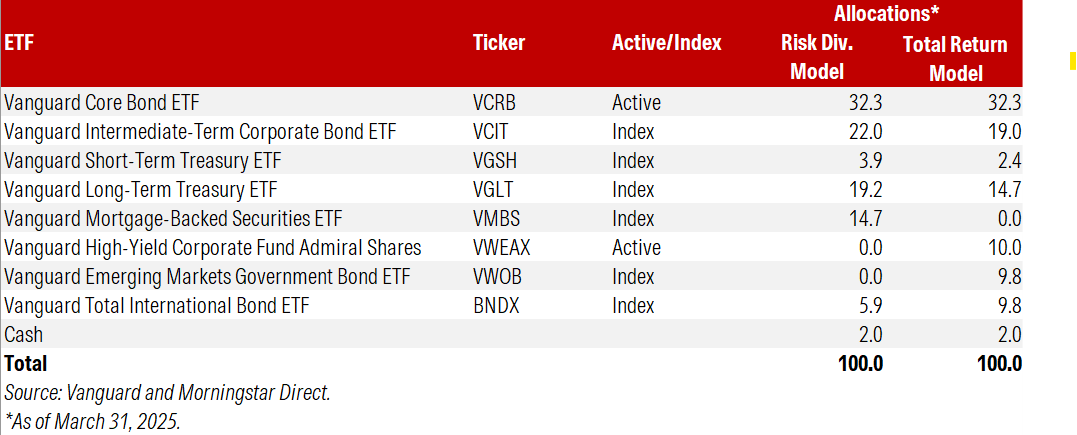

Vanguard's newest models are a little different from its existing models: 1) Fixed income only, and 2) Dynamic. The allocations may shift over time to reflect Vanguard's outlook, which adds a layer of active management to the mix corporate.vanguard.com/content/corpor…

Vanguard officially getting into private assets beyond its partnership with HarbourVest. Teaming up with long-term partner Wellington and Blackstone wellington.com/en/wellington-…

.@DanielSotiroff asks critical questions about ETFs holding private assets and why the asset management industry is enamored with the convergence of public/private investing. Excellent food for thought to start my morning! morningstar.com/funds/how-priv…

morningstar.com

How Private Assets Impede the Benefits of ETFs

ETFs holding private assets may give up some of their tax efficiency, and many look expensive.

Vanguard with another(!) actively managed bond ETF (third this year): Multi-Sector Bond Income ETF Fee is 0.30% same as Vanguard Multi-Sector Income Fund (launched October 2021). Cheaper than approx 98% of share classes in multisector bond category sec.gov/Archives/edgar…

Morningstar's Active/Passive Barometer is live! Of the 3,200 active funds included in our analysis, 42% survived and outperformed their average passive peer in 2024. Article: spr.ly/60150KzYf Paper: spr.ly/60130KzYN

Here's a little context for Vanguard's recent fixed income ETF launches... Vanguard has actually been launching fewer share classes over the past 3-ish years. Launches peaked in the 2000s. A lot of them were bolt-on inst. shares and ETF shares of an open-end fund.

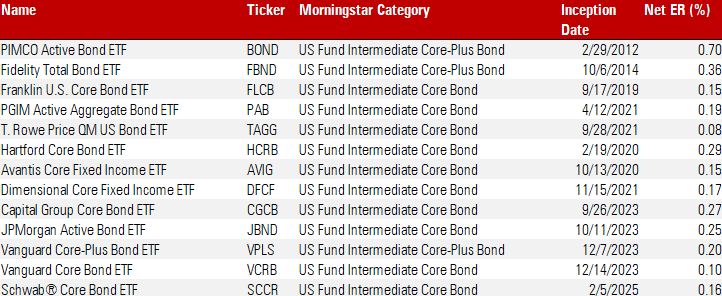

Schwab Core Bond ETF $SCCR launched Feb 5. Net ER is just 0.16%. It's the latest in actively managed core and core-plus bond ETFs. Almost all the big asset managers have one now. The fees across the newer breed are a lot lower than $BOND and $FBND sec.gov/Archives/edgar…

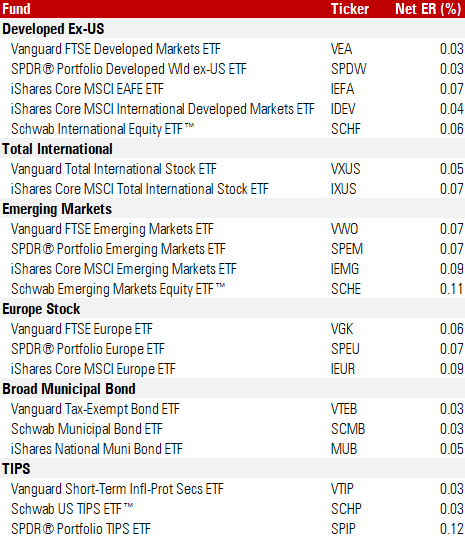

If any fee competition starts because of the Vanguard cuts, it's probably going to show up in the broad low-cost index funds/ETFs--stuff that competes on fees Here's where the gaps are

United States Trends

- 1. Panthers 100 B posts

- 2. Bears 85,9 B posts

- 3. Ben Johnson 7.148 posts

- 4. Stafford 35,4 B posts

- 5. Bryce Young 23,8 B posts

- 6. Dennis Allen 1.897 posts

- 7. #GoPackGo 12,5 B posts

- 8. #KeepPounding 14,4 B posts

- 9. Jordan Love 6.223 posts

- 10. Caleb Williams 6.292 posts

- 11. Bob Weir 13,6 B posts

- 12. #GBvsCHI 1.965 posts

- 13. Dan Campbell 1.263 posts

- 14. #NFLPlayoffs2026 2.025 posts

- 15. Coker 11,2 B posts

- 16. Al Michaels 1.505 posts

- 17. Green Bay 10,1 B posts

- 18. Puka 22 B posts

- 19. Bobby 44,1 B posts

- 20. Jaylon Johnson N/A

You might like

-

Jack Forehand

Jack Forehand

@practicalquant -

Jeremy Schwartz

Jeremy Schwartz

@JeremyDSchwartz -

Jeffrey Ptak

Jeffrey Ptak

@syouth1 -

The ETF Institute®

The ETF Institute®

@ETF_Institute -

Wes Gray 🇺🇸

Wes Gray 🇺🇸

@alphaarchitect -

Ben Johnson, CFA

Ben Johnson, CFA

@MstarBenJohnson -

Lara Crigger

Lara Crigger

@LaraCrigger -

Jack Vogel

Jack Vogel

@jvogs02 -

Elisabetta Basilico, PhD, CFA

Elisabetta Basilico, PhD, CFA

@ebasilico -

𝗕𝗜𝗟𝗟 𝗦𝗪𝗘𝗘𝗧

𝗕𝗜𝗟𝗟 𝗦𝗪𝗘𝗘𝗧

@billsweet -

Philippe Brassard

Philippe Brassard

@pbrassard -

Andrew Miller

Andrew Miller

@millerak42 -

Ryan Patrick Kirlin 👽

Ryan Patrick Kirlin 👽

@RyanPKirlin -

Nathan Faber

Nathan Faber

@theNFaber -

Art Johnson 🇨🇦

Art Johnson 🇨🇦

@ArtEddywealth

Something went wrong.

Something went wrong.