David Gourley, M.Ed

@DavidG_CSLP

$15 million in student loan forgiveness for teachers. Former teacher who now specializes in financial planning and student loan planning for other educators.

You might like

Crazy to think how many advisors are now sending their clients my way for student loan consults. Never would’ve guessed I’d be here a few years ago.

Bringing my student loan fees up to *almost* market value has been one of the best things I've done. Way too long I was giving advice away for free (or close to it). And... consultations haven't slowed down. This is your reminder to charge what you are worth!

If you tell me you bring home $8,000/month and spend $6,000/month... Then I'm going to expect to see your checking/savings grow by $2,000/month. If it only grows by $500/month... That means you are really spending $7,500. Time to get honest with yourself!

I always "arrive" to my virtual meetings at least 5 minutes early to wait for clients. If they are there before me... Then the next time we have a meeting I'll be on 10 minutes early!

Words by another financial "advisor": "Ya ngl I don’t feel comfortable having them pay for a consultation. I’m just curious if I can somehow get licensed to do it for them. I’m bringing these student loan providers hella cases with massive balances. Is there anyway for me to…

Real life Financial Planning win: Client's mortgage was sold in 2024. She itemized, but only gave her CPA one of her 1098s (showing mortgage interest). She's going to get the other one to her CPA and have her return amended. She will get over $3,000 in additional refund.

Got an email this morning that announced I have been chosen as one of "The 10 Most Innovative CEOs Making a Difference in 2025". It would only cost me $3500 for them to cover my story. So yeah... I've basically made "it".

A long-term ramification of the RAP student loan repayment plan is there is no inflation adjustment like the other IDR plans. Currently, repayment amounts are based on the federal poverty guidelines, which get updated each year with inflation. RAP is based only on AGI. This…

Pay $138,000 in taxes today or $1.4 Million over your lifetime. A case study: k-12planning.com/post/case-stud…

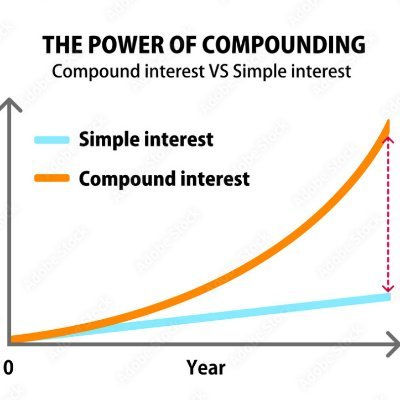

A variable annuity within a teacher's 403(b) plan can easily be costing you 2.2%+ per year. "But my advisor said he doesn't charge any fees" Well... The advisor gets paid through a commission, not a fee. Time to see if you have any other options!

Fees get a lot of attention in financial planning... But what about the hidden fees? • The fee to the IRS if you don't optimize your taxes (think Roth conversions, pre-tax vs post tax, credits/deductions) • The fee to the Department of Education if you don't understand…

United States Trends

- 1. Steelers 52.3K posts

- 2. Rodgers 21.1K posts

- 3. Chargers 37.1K posts

- 4. Tomlin 8,240 posts

- 5. Schumer 223K posts

- 6. Resign 105K posts

- 7. #BoltUp 2,997 posts

- 8. Tim Kaine 19.2K posts

- 9. #TalusLabs N/A

- 10. Keenan Allen 4,910 posts

- 11. #HereWeGo 5,672 posts

- 12. Dick Durbin 12.4K posts

- 13. #RHOP 6,927 posts

- 14. #ITWelcomeToDerry 4,642 posts

- 15. 8 Democrats 9,086 posts

- 16. Gavin Brindley N/A

- 17. Angus King 16.2K posts

- 18. 8 Dems 7,076 posts

- 19. Herbert 11.8K posts

- 20. Shaheen 34.4K posts

You might like

-

Travis Hornsby, CFA, CFP®

Travis Hornsby, CFA, CFP®

@StudentLoanTrav -

New Jersey Department of Education

New Jersey Department of Education

@NewJerseyDOE -

Pursuing Freedom

Pursuing Freedom

@PursuingFreed0m -

Jason Staats⚡

Jason Staats⚡

@jasononfirms -

Money Guy Show

Money Guy Show

@moneyguyshow -

Meredith Whitehouse

Meredith Whitehouse

@WhitehouseM09 -

Chad Aldeman

Chad Aldeman

@ChadAldeman -

CFP Board

CFP Board

@CFPBoard -

Colton Etherton, CFP®

Colton Etherton, CFP®

@slices_design -

The Teacher Salary Project

The Teacher Salary Project

@teachersalary -

NJSBA

NJSBA

@njsba -

Bruce D. Baker

Bruce D. Baker

@SchlFinance101 -

Zach Ashburn

Zach Ashburn

@zachary_ashburn -

かえで.77

かえで.77

@missaka08 -

Colin Overweg, CFP®

Colin Overweg, CFP®

@colinoverweg

Something went wrong.

Something went wrong.