Decoded Market

@Decoded_Market

I analyze markets through price, fundamentals & institutional flow. Focused on asymmetric risk/reward ⬇️ Free research

$PINS (again) because it’s underrated how different planning behavior is from passive scrolling. Intent is harder to fake — and harder to replace.

$W is one of those names that mirrors macro sentiment almost in real time. Housing, rates, consumer confidence — it all flows through e-commerce home goods.

$MDB keeps earning attention from developers who value flexibility over rigid structure. When tools adapt to builders — not the other way around — adoption usually follows.

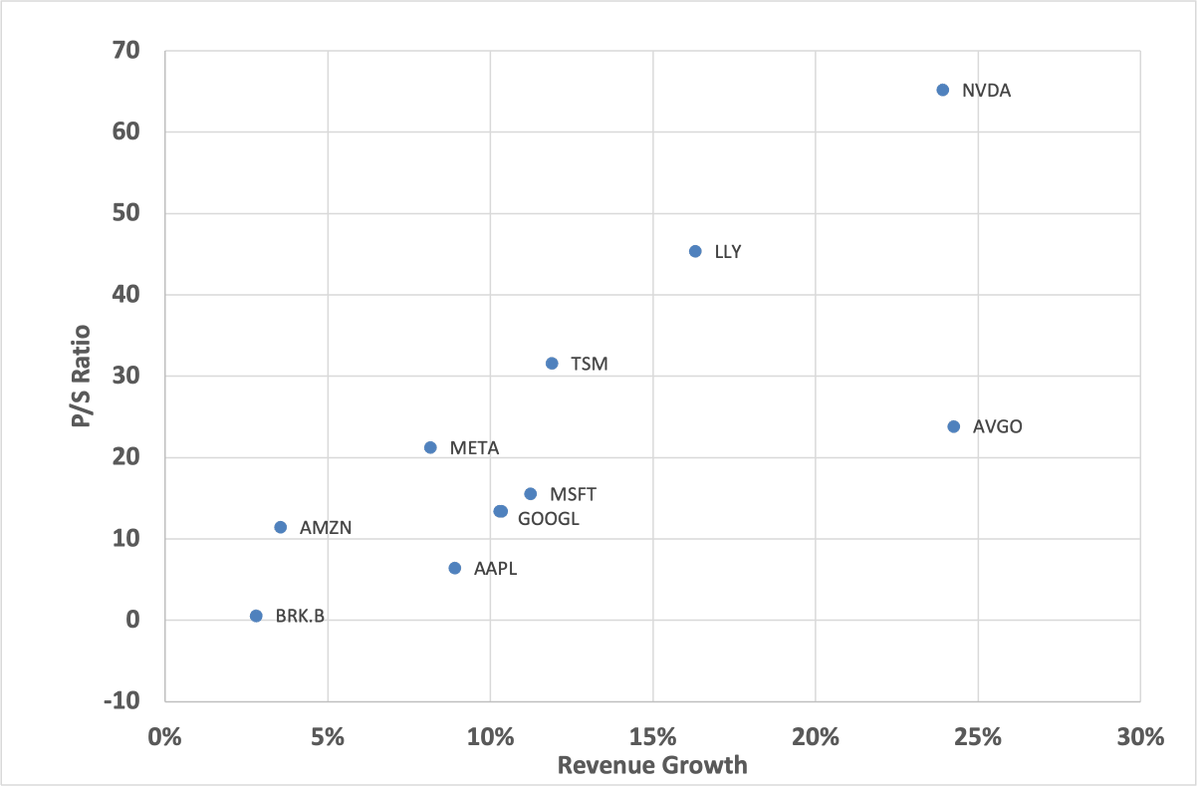

Mega-caps mapped by revenue growth vs P/S ratio. Which one are you buying now?

Not every biotech is trading at hype-level valuations. Some have massive valuation reset potential: $OGN: P/E 4.8 (mkt cap. $2.4B) $CRMD: P/E 3.7 (mkt cap. $592M) $ABEO: P/E 4.5 (mkt cap. $287M) Low multiples can often be found in small caps.

If there is an AI bubble, $ADBE and $TEAM are the exact opposite: $ADBE at ~12x P/FCF, $TEAM at ~23x P/FCF This is despite solid growth and extremely sticky businesses with high switching costs. “Be fearful when others are greedy, and greedy when others are fearful.”

$DDOG feels embedded in how modern software teams operate. Observability isn’t optional anymore — it’s how developers sleep at night when systems scale.

Some think tech companies lead in revenue per employee. In reality, capital-intensive businesses with tiny teams often rank far higher. $TOPS - $87.87M/employee: Oil & chemical tanker shipping $ABVE - $42.69M/employee: Food ingredients & agricultural assets $CMCT -…

While everyone is watching the large AI names like $NVDA, $AMD, or $AVGO in the age of AI, mid-cap semiconductors are also showing tremendous growth. Here are three I’m watching closely: $SITM – Timing solutions critical for data centers, 5G, automotive, and AI infrastructure.…

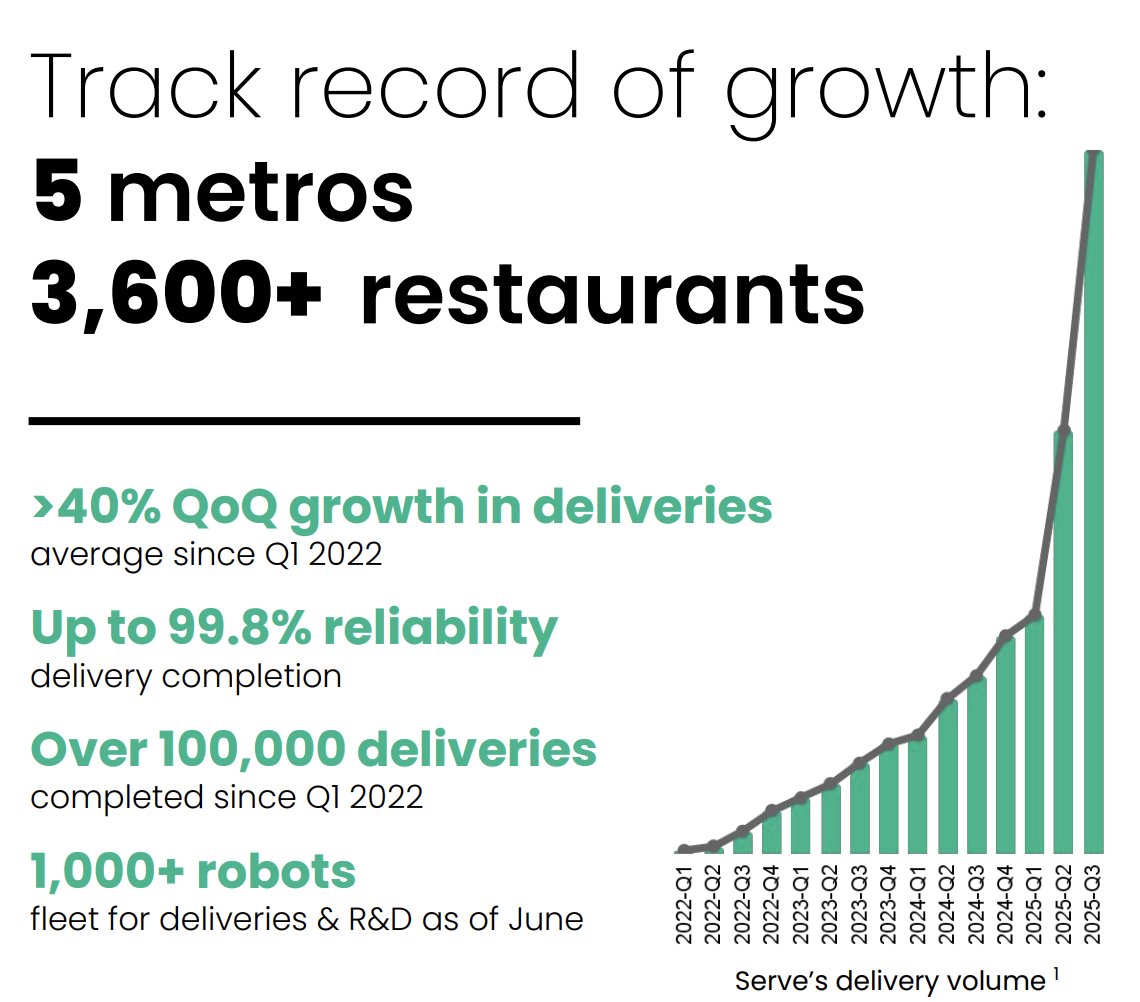

As Jensen Huang from $NVDA said, the next wave of AI is physical AI - robots operating in the real world. Here, I believe $SERV will be a primary beneficiary of that shift. • >$450 billion untapped market • Physical AI moving from data centers to streets • Autonomous…

$NCLH reflects how quickly travel sentiment can change. Bookings, seasonality, and macro all show up here faster than most people expect.

I am buying pharma small-caps to take advantage of the biotech megatrend as the world’s population ages rapidly. $NTLA – CRISPR-based gene editing focused on one-time, potentially curative therapies (+51% revenue growth quarter-over-quarter) $ZYME – Antibody engineering…

High-growth small-caps I’m buying for potential multibaggers 🚀 AI, Robotics & Automation: $SERV – Serve Robotics Autonomous delivery moving from pilots to real-world deployment (QoQ revenue growth: +209.5%) $DGNX – Digital assets & ESG data platform seeing rapid customer…

As an investor, I focus not just on revenue growth - but profitable growth: $APP – Mobile ad & app-monetization platform with massive operating leverage. As ad budgets recover, earnings scale fast. (TTM EPS growth: +144%) $PLTR – Mission-critical AI software embedded in…

Companies with over 100% YoY EPS growth: $PLTR – AI software platform for government & enterprises (+117%) $LLY – Pharma leader driven by obesity & diabetes blockbusters (+121%) $APP – Mobile ad-tech & app monetization with surging margins (+140%) $MU – Memory chip maker…

$TEAM and $ADBE are trading at the cheapest levels in their history on long-term estimates. • $TEAM: ~12× P/E on 2030 earnings • $ADBE: ~9× P/E on 2030 earnings Category-defining software businesses. Durable moats. Long runways. The market is pricing them like growth never…

United States Tendenze

- 1. Seahawks N/A

- 2. Seahawks N/A

- 3. Stafford N/A

- 4. Vikings N/A

- 5. Woolen N/A

- 6. McVay N/A

- 7. Pats N/A

- 8. Puka N/A

- 9. #RHOP N/A

- 10. Drake Maye N/A

- 11. #NFCChampionship N/A

- 12. Mike Macdonald N/A

- 13. Xavier Smith N/A

- 14. Kupp N/A

- 15. #LARvsSEA N/A

- 16. Tom Brady N/A

- 17. Broncos N/A

- 18. #mcrperu N/A

- 19. Demarcus Lawrence N/A

- 20. gerard N/A

Something went wrong.

Something went wrong.