Doom Log

@DoomLog_

Original account: @DoomLog All tweets are my opinion only, not investment advice.

You might like

Chart is SPX in 2018. Just a reminder of how it CAN go... Yest SPX -9.7% off high (at low). 1st leg down in Oct'18 was ~ 8%. But ultimately -20% by yr-end. Of course, in 2018 Fed was still hiking, and QT amt had ratcheted up to $50b month. Diff backdrop, but still worth…

Hmmm

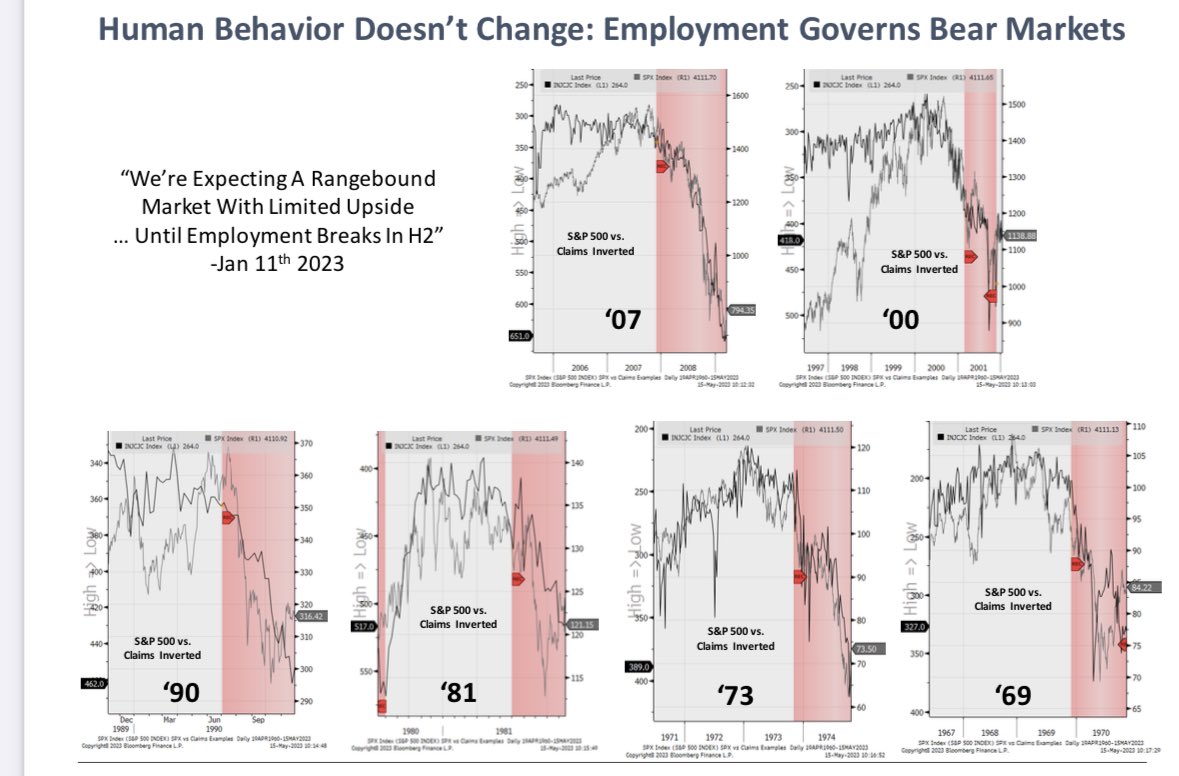

Wonder why the S&P 500 isn’t down more? Because claims aren’t up more. Can’t show the fact that markets aren’t forward looking any clearer than this. Bear markets start when claims rise steadily. #macro #hopE $SPY

Never good for liquidity when traders know in March that their upside for the year is keeping their job.

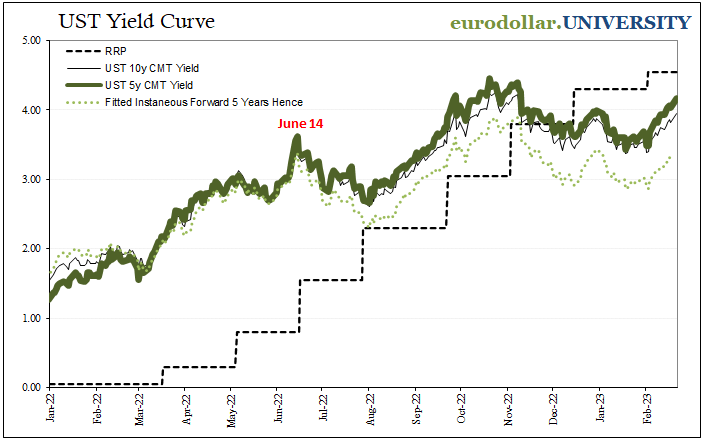

"No landing" goes with Fed rate hike expectations. But even as markets price more rate hikes, they continue to price the same rate cuts as before. As forward rates rise but spreads remain negative, the mkt continues to expect the same thing but from a higher terminal rate level.

day of the bottom

As I see what poIwer structure Xi has wrought, my conclusion is China is now uninvestible for American corporations...and much higher risk for US asset managers

“Long COVID mostly transient with mild symptoms.” — People’s Daily. Monitor propaganda tones, intro of foreign vaccines/drug & vaccination% of senior population for potential changes in COIVD-0. Also appreciate Chinese philosophy of gradualism.

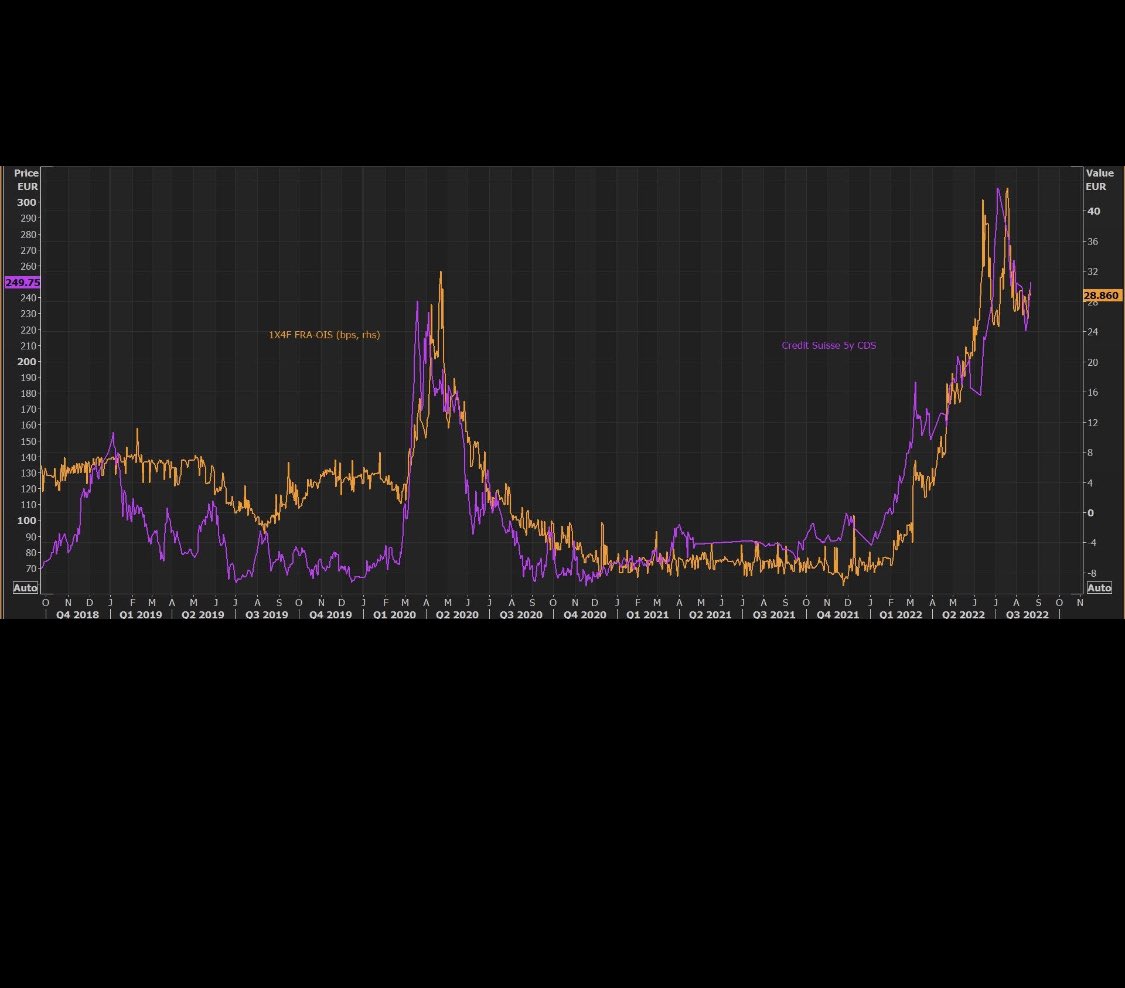

Oh my, this feels like a concerted effort at scaremongering. See my recent tweets. In 2011-2012 Morgan Stanley CDS was twice as wide as Credit Suisse is today. Take a deep breath guys.

Credit Suisse is probably going bankrupt … $CS The collapse in Credit Suisse's share price is of great concern. From $14.90 in Feb 2021, to $3.90 currently. And with P/B=0.22, markets are saying it's insolvent and probably bust. 2008 moment soon ? Systemic risk bank.

Lol

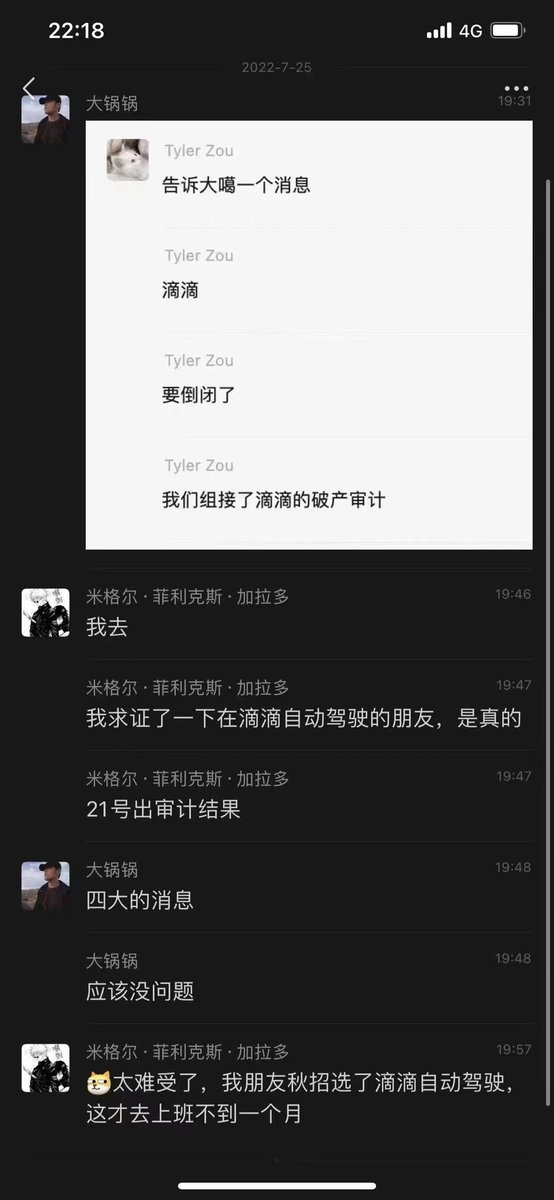

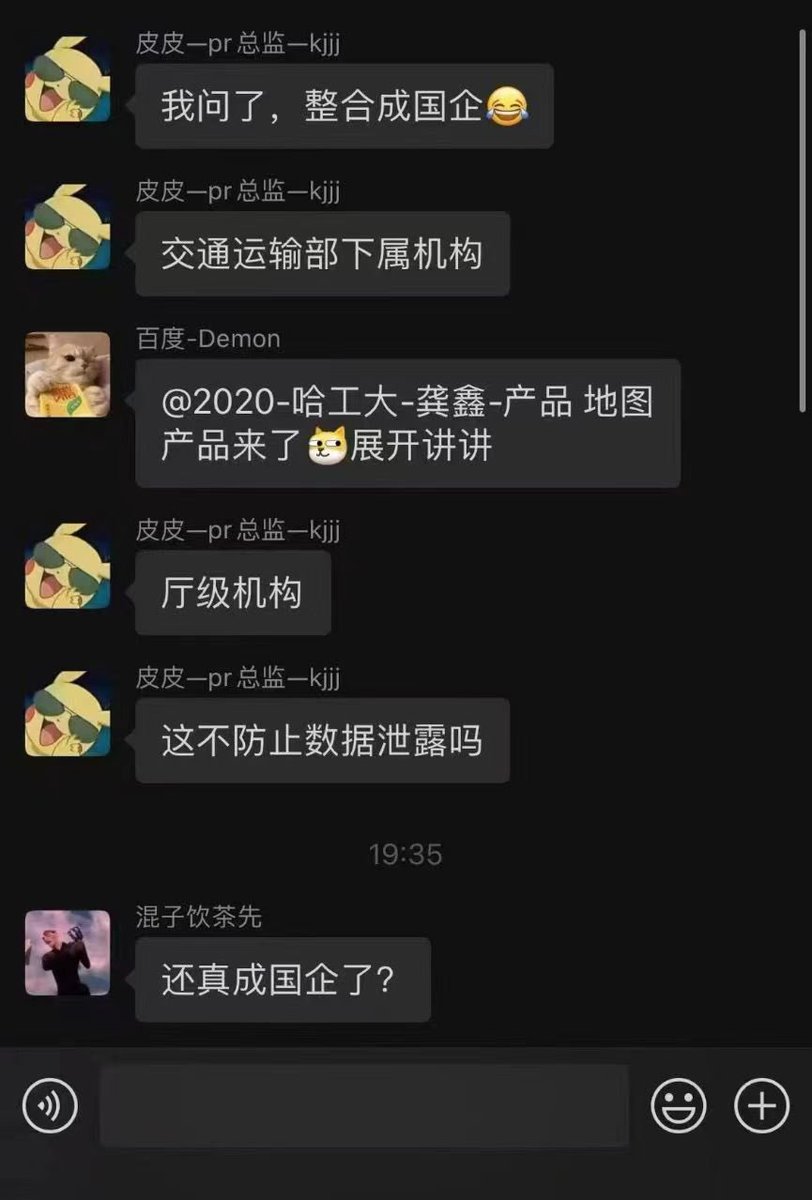

This was the rumor circulating among investors today: DiDi is about to file bankruptcy as one of the Big Four was recruited to do bankruptcy audit. The latest rumor was that Didi will be transformed into a SOE under the Ministry of Transportation. I was not able to confirm it.

if you cant beat them, join them

United States Trends

- 1. Happy Black History Month N/A

- 2. Solanke N/A

- 3. Jordan Hicks N/A

- 4. Azzi N/A

- 5. Sandlin N/A

- 6. UConn N/A

- 7. #GRAMMYs N/A

- 8. Devers N/A

- 9. Mike LaFleur N/A

- 10. White Sox N/A

- 11. Nate Oats N/A

- 12. Rodri N/A

- 13. Tottenham N/A

- 14. Gage Ziehl N/A

- 15. Spurs N/A

- 16. #TOTMCI N/A

- 17. Thomas Frank N/A

- 18. Tennessee N/A

- 19. Man City N/A

- 20. Guehi N/A

Something went wrong.

Something went wrong.