Edwin

@EdDesan

Stay Hungry, stay foolish. Full time stock trader and Laker fan

You might like

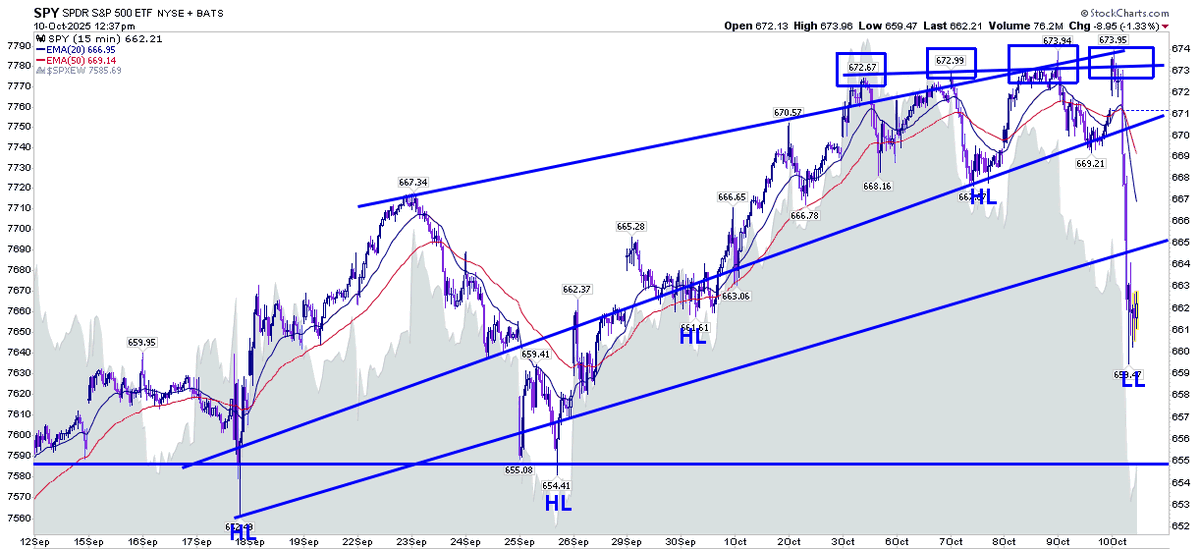

673 level for $SPY was rejected multiple times (usually means insiders knew about the news coming out). No appetite for higher prices, must come down to create demand

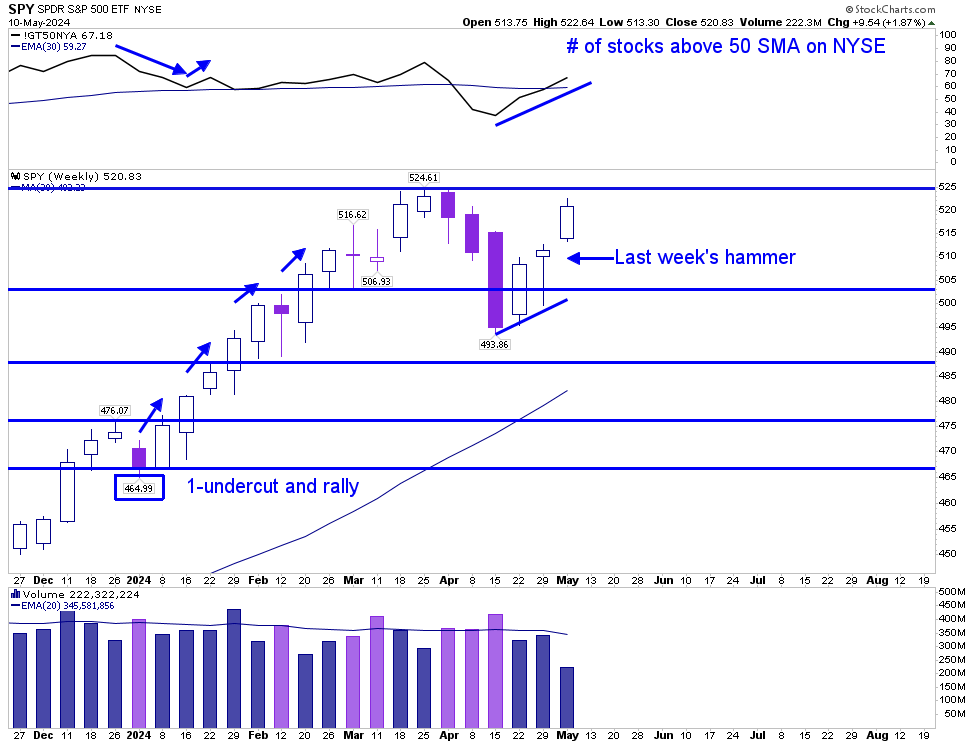

Not the best close to the market for Friday (5/10). Both weekly Calls and Puts were heavy (520-521). Market makers try to smoke both sides of option holders by holding her steady. $SPY managed to close above last week's hammer though.

So far $PI, $ATI $CARR having stellar earnings reactions this season. Adding those to my watchlist

Newer IPO $ALAB looking good. The first entry though was the undercut &rally/shakeout with add on at the pivot. Watching to see if they retest that $75 area

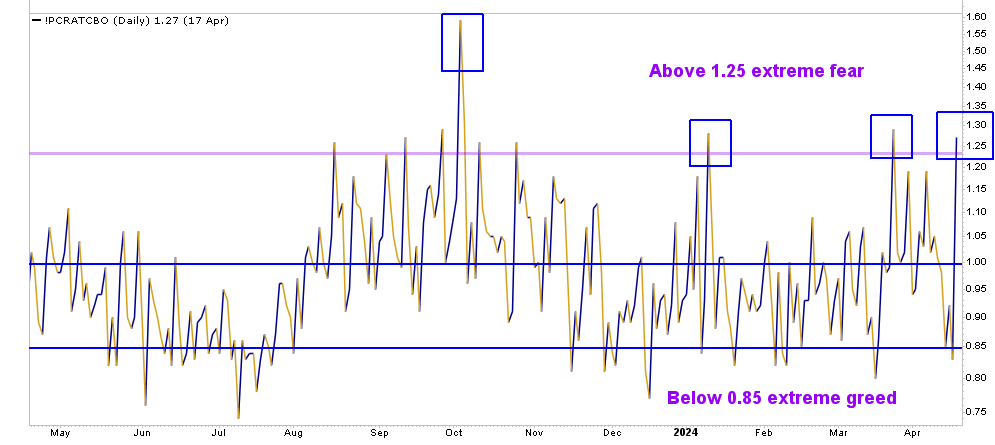

Sentiment & positioning play a vital role for reversals. I like to use the Put/Call ratio to determine positioning and sentiment. Yesterday we hit 1.27 Puts vs calls, showing extreme fear. We don't know if this bounce will hold; however, it makes for a good snapback rally.

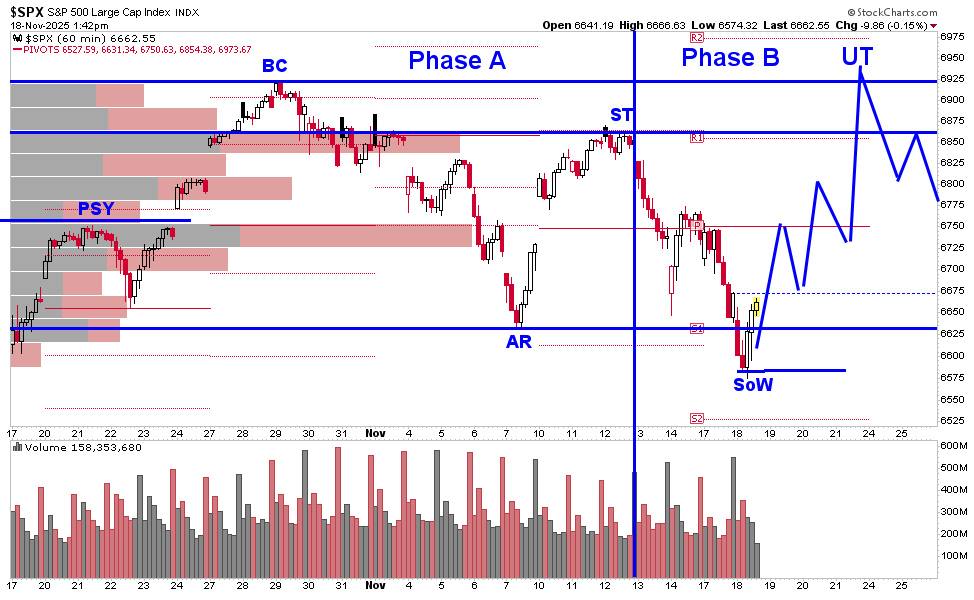

Rate cuts? No rate cuts? It's all a narrative the Fed and Wall street play in order to build hype and lead the market higher or shake people out. Eventually when the narrative runs its course, trust me you will know with either a climactic melt up or a distribution structure

Always know how stock market leaders are acting. Referred as leaders for a reason, since they lead the market. As indices chop around, leaders are already off to the races. Spot what is green on your screen on red days, those tend to be leaders $SMCI $CAVA $NVDA $AVGO $TOST $APP

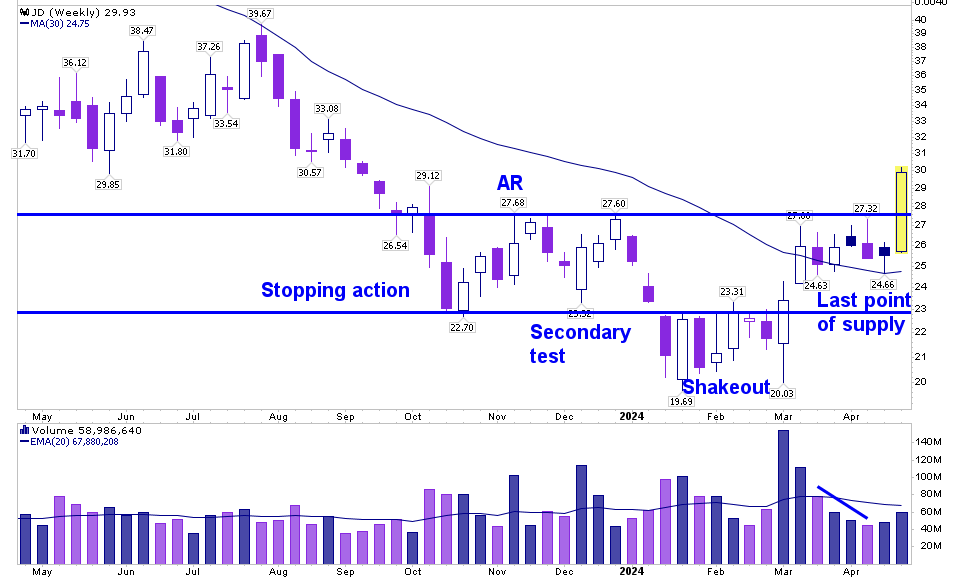

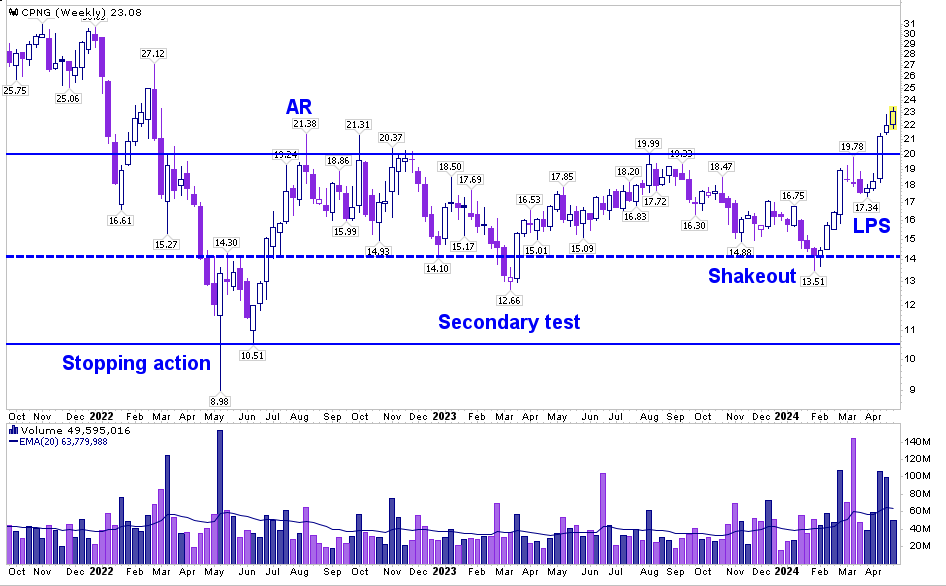

People need to stay away from stock market bear porn and just learn to trade by taking low-risk setups. $CAVA $NVDA were easy to spot this week as they undercut and rallied above their respective 10 week moving average

Interesting stock market. They punish chasers by hitting all their stops, only to have them all come back and chase the next day.

It would be epic for @Qullamaggie to stream again once we reach the top. Preferably a climax top.

Am I the only one that notices politicians wait to fix whatever they got elected to fix when election season is getting closer? In San Diego, we complain about potholes and they wait 2 years to fix them, then send out pamphlet asking to vote for them again. Bro! You had 2 years.

United States Trends

- 1. #911onABC N/A

- 2. Abigail N/A

- 3. eddie N/A

- 4. Warsh N/A

- 5. #TNAiMPACT N/A

- 6. Patrick Kane N/A

- 7. Ian Cunningham N/A

- 8. Yam Yam N/A

- 9. CHRISTOPHER N/A

- 10. #LetsGoPens N/A

- 11. #BridgertonS4 N/A

- 12. Iron Lung N/A

- 13. Cooper Flagg N/A

- 14. #911Nashville N/A

- 15. whitaker N/A

- 16. Chim N/A

- 17. SpaceX N/A

- 18. Sean Mannion N/A

- 19. tim minear N/A

- 20. Goldberg N/A

Something went wrong.

Something went wrong.