Element

@Elementcapl

Talvez você curta

2025 perf. Perfect. Close it and annualized it. 👌🏼

🚨 NEW: Finance YouTuber with over 2.3M subscribers has applied to DOGE "to fix the IRS." His IQ is 140. Brian Kim, known as "ClearValue Tax," submitted his resume to President Trump and Elon Musk. I hope he's accepted. 🔥🇺🇸 "I want to help our country by decreasing government…

Volvo posted a 3 min and 46 second ad on Instagram, shot by Hoyte Van Hoytema, the cinematographer of Interstellar and Oppenheimer. It goes against every single rule you can think about as a social lead. Length. Format. Over-produced. Every comment under the ad said it…

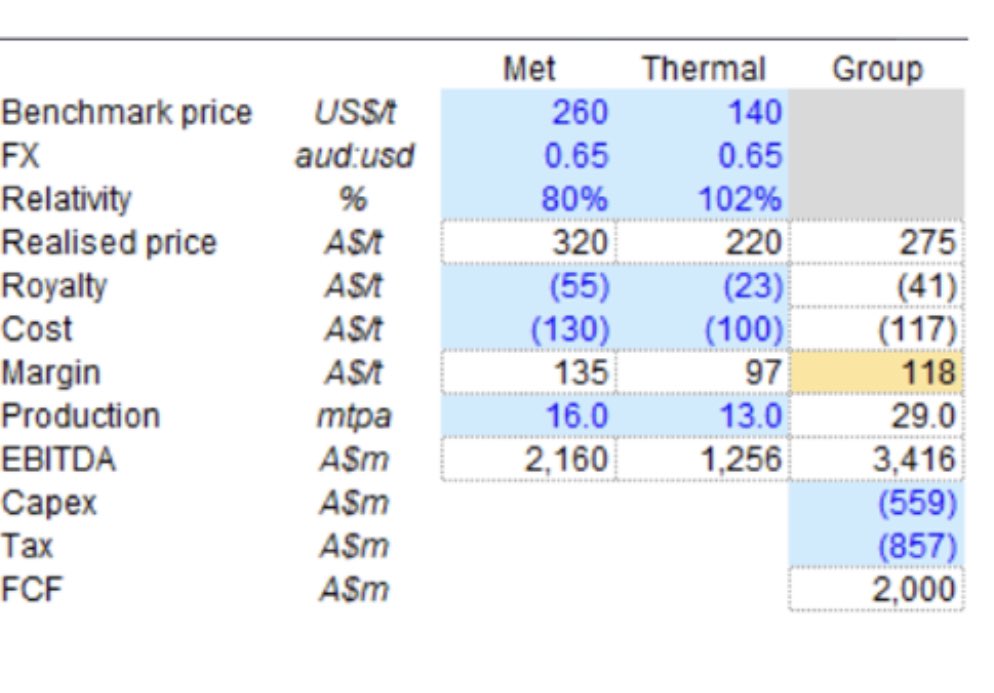

Sure you can gut the benchmark prices down a bit and maybe the relativities down, costs up but where do you land at the end? A$2/sh FCF (A$1.6bn)? Maybe you see none of that for next 18mths as debt/deferred but then after at $2/sh FCF stock is what? $14/sh is 14% FCFy $WHC.AX

Over the summer, the Biden administration reportedly sold off $300 million worth of wall parts for just $2 million. Leading up to the 2020 election, Biden vowed to not build “another foot” of wall, mostly because Trump wanted one. Yesterday, the Biden administration announced…

businesswire.com/news/home/2023… Massively bullish UBS. They’ve now looked at CS, saw it’s not as toxic, nodded to the SNB and thanked the gods for this once in a generation gift. UBS longer dated (2026-27) are a must own 🥹

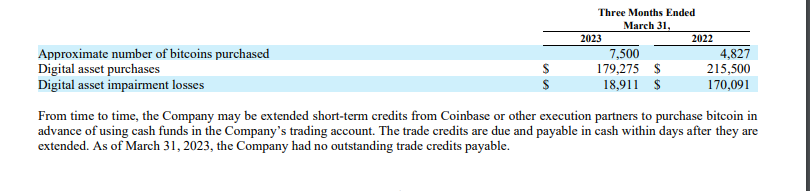

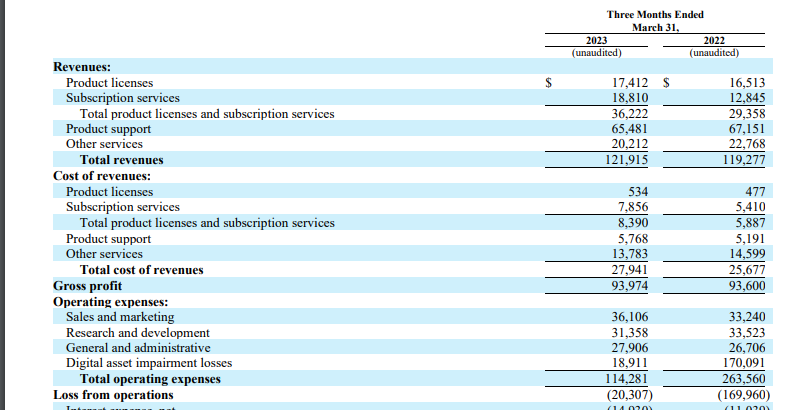

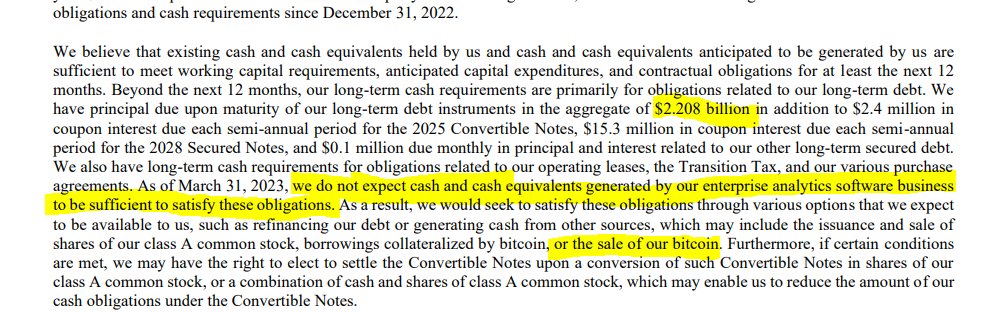

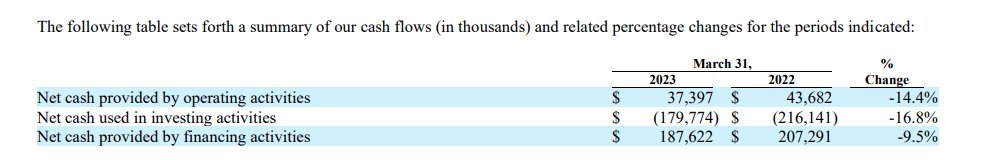

🚨 $MSTR earnings. Few initial💎s 1) Operating loss even backing out impairment charges 2) $COIN is fronting cash for bit Bitcoin buys 3) >$2.2B in long-term debt obligations creeping up. Plan to dump shares & bitcoin to cover it. 4) They're bleeding cash, dumping shares

Blackthorn raising 30bn for a new RE fund … just as BREIT investors still being gated reuters.com/business/finan…

Truly the first synergies in this forced marriage

This has to be a joke😂. The fund with listed players is down 55% YTD. The fund investing in non listed (read early stage / even more unprofitable) is only down 25%YTD. Probably Bain did the valuation 🤡🤡

@kittysquiddy What is happening to crypto players is eerily similar to the GFC. What happened then was over leveraged banks taking on huge risks with the mindset that housing prices always go up. When Lehman failed counterparty risk became the most important thing 1/n

United States Tendências

- 1. #OPLive N/A

- 2. #SmackDown N/A

- 3. Jaylon Tyson N/A

- 4. #DragRace N/A

- 5. Darryn Peterson N/A

- 6. Cavs N/A

- 7. #JustinStrong N/A

- 8. Sixers N/A

- 9. #Dateline N/A

- 10. Embiid N/A

- 11. The Rip N/A

- 12. Chelsea Gray N/A

- 13. Maxey N/A

- 14. Duke N/A

- 15. SAROCHA AT TIANJIN EVENT N/A

- 16. Trick Williams N/A

- 17. Mandy Mango N/A

- 18. Michael Cohen N/A

- 19. Hannity N/A

- 20. DePaul N/A

Something went wrong.

Something went wrong.