Wasteland Capital

@ecommerceshares

Escaped the Vampire Squid, surviving in the wasteland. Investing in bottlecaps, US UK EU & global assets. Also, jokes. Liking is not endorsing. Do your own DD.

You might like

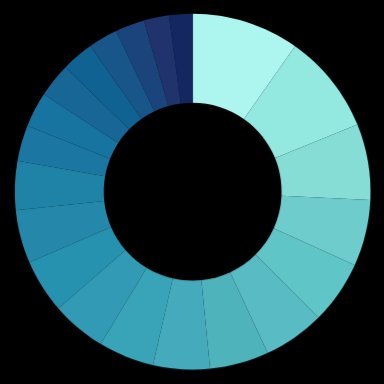

H1 21 came to a close, and the #WastelandCapStash portfolio is now up 179.4% since last summer’s start and 42.2% YTD. The portfolio added 7.2 percentage points in June on a YTD basis. Open positions below. (1/3)

Milestone: I’ve reached the 1-year anniversary of the #WastelandCapStash portfolio! 🥳 It’s up $165.3% in USD since start a year ago. The starting $1m is now $2.65m. It’s +35.0% YTD. You can click through these tweets to see it from the start. Open positions below (1/4)

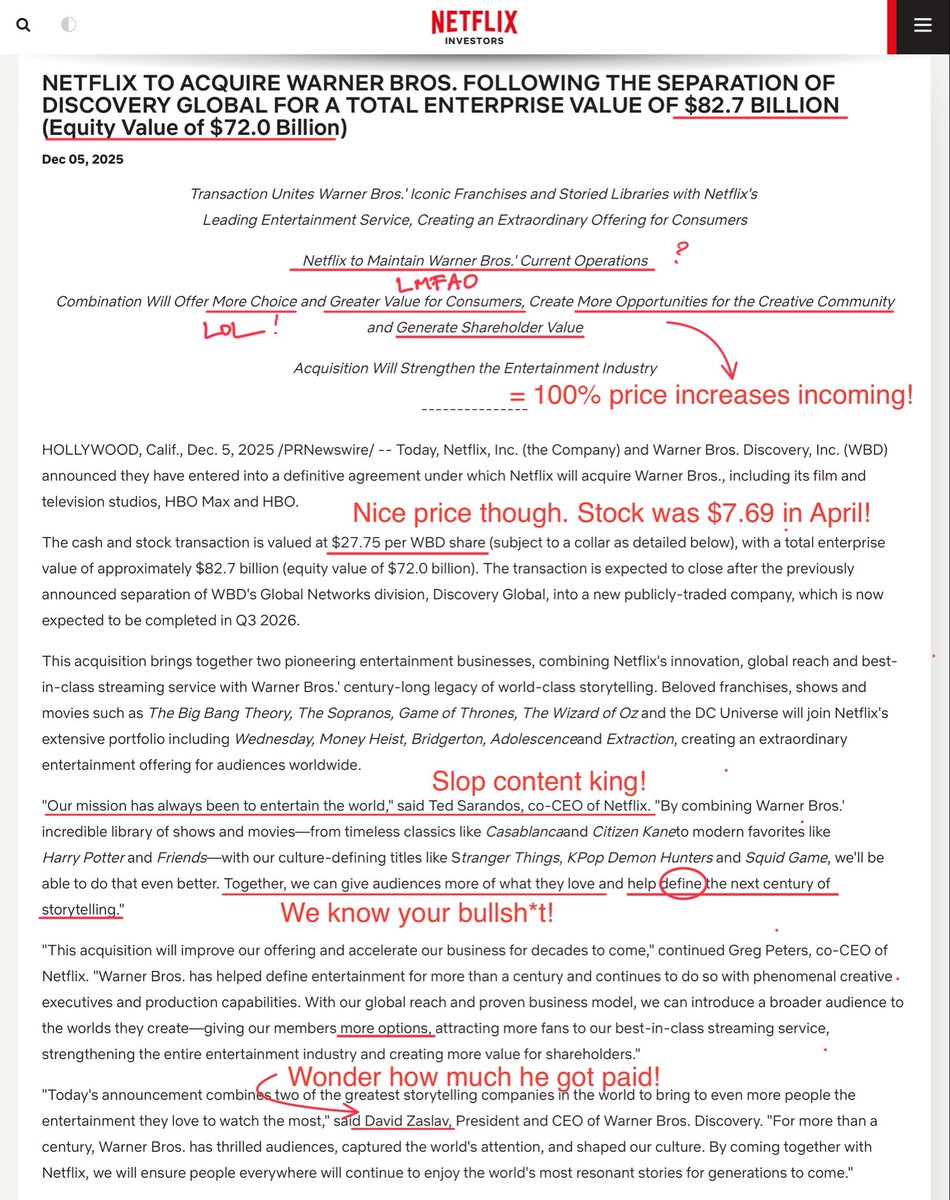

$NFLX announces it won the $WBD auction at $27.75 per share, +260% higher than Warner traded in April. Huge win for shareholders, a loss for everyone else. Subscription price increases of 100%+ incoming! Plus HBO will now be 95% garbage slop. I hope this sh*t gets blocked.

Apart from my earnings reviews, I’ve only tweeted five new cases on here over the last year. They ended up the #1 Mag7 YTD $GOOG, the #1 Semi YTD $MU & #1 China LargeCap YTD $BABA. Plus 2 🚀 smallcaps, $AEO & $LYFT Average return +111% currently. Less is more, as they say.

With Zuckerberg announcing major cost cuts, we now know the pain threshold he’s willing to subject his $META shareholders & employees to before enough people complain & force him to reverse or do something: A -27% or ~$500bn wealth drawdown. At least it’s not -77% like in 2022!

$AEO closed today at +128% since the late July entry. Many quick flipped this at +30-50% on the back of the media attention, instead of trusting the fundamentals. In cases like this, you have to let the fundamental case play out. Let it cook. Compounding always wins.

Sydney Sweeney doing the fall campaign at $AEO. Consensus EPS next year is $1.23 (Feb-27), which implies 8.5x P/E at the $10.50 price. Stock’s beaten down due to poor (-3%) Q1 SSS & tariff-induced margin pressure. I think they can do $1.60 in EPS, which would be $24 @ 15x P/E.

Many widow makers in biotech recently, on both the short and long side. Yikes. Biotech tourists led like lamb to the slaughter.

The key US consumer story this quarter: Restaurant same store sales collapsing. Fashion retail same store sales exploding. The American Eater is on zepbound, hating $30 slop bowls. The American Shopper is spending brokerage gains on looking good, loving $30 jeans & lingerie.

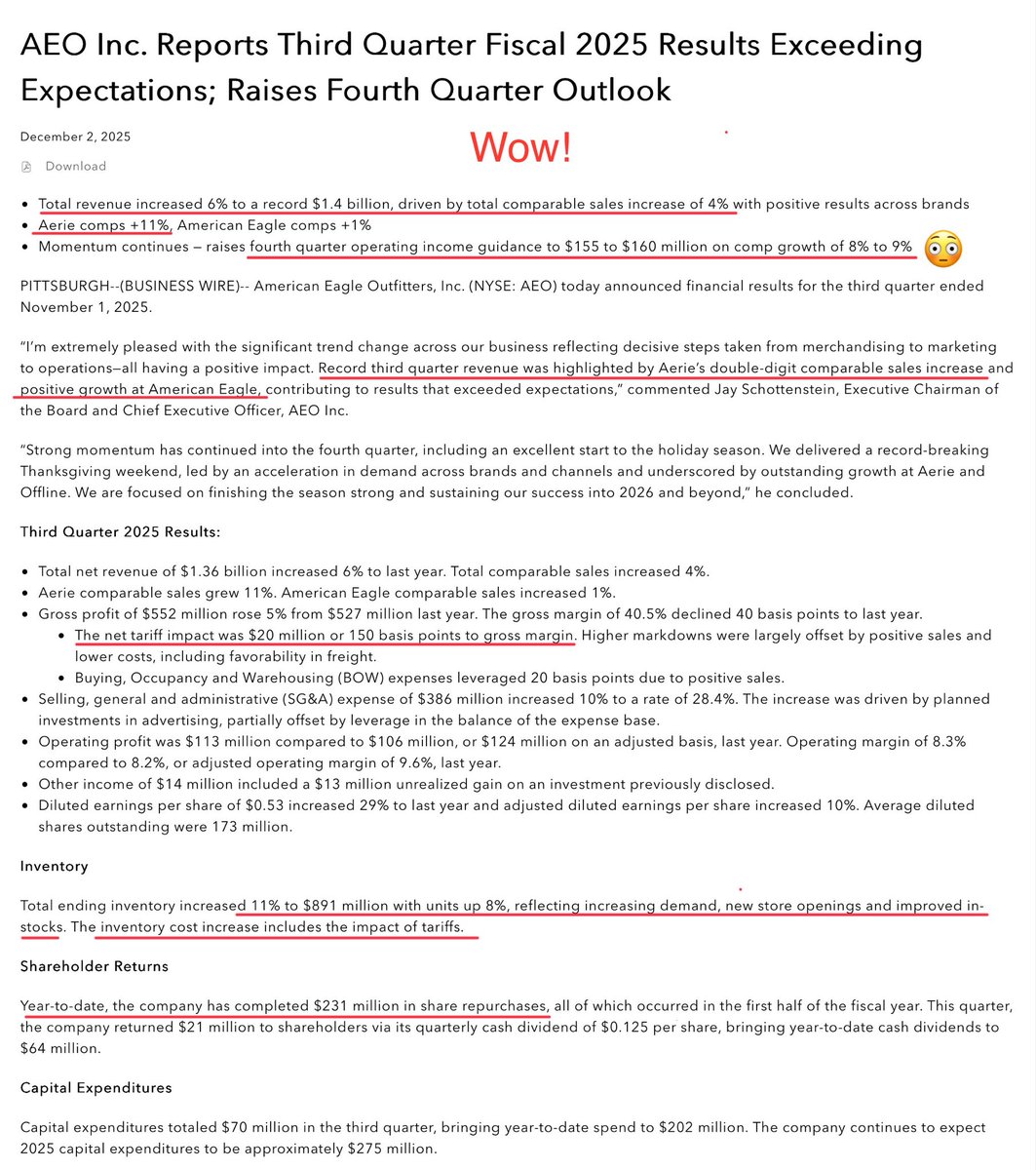

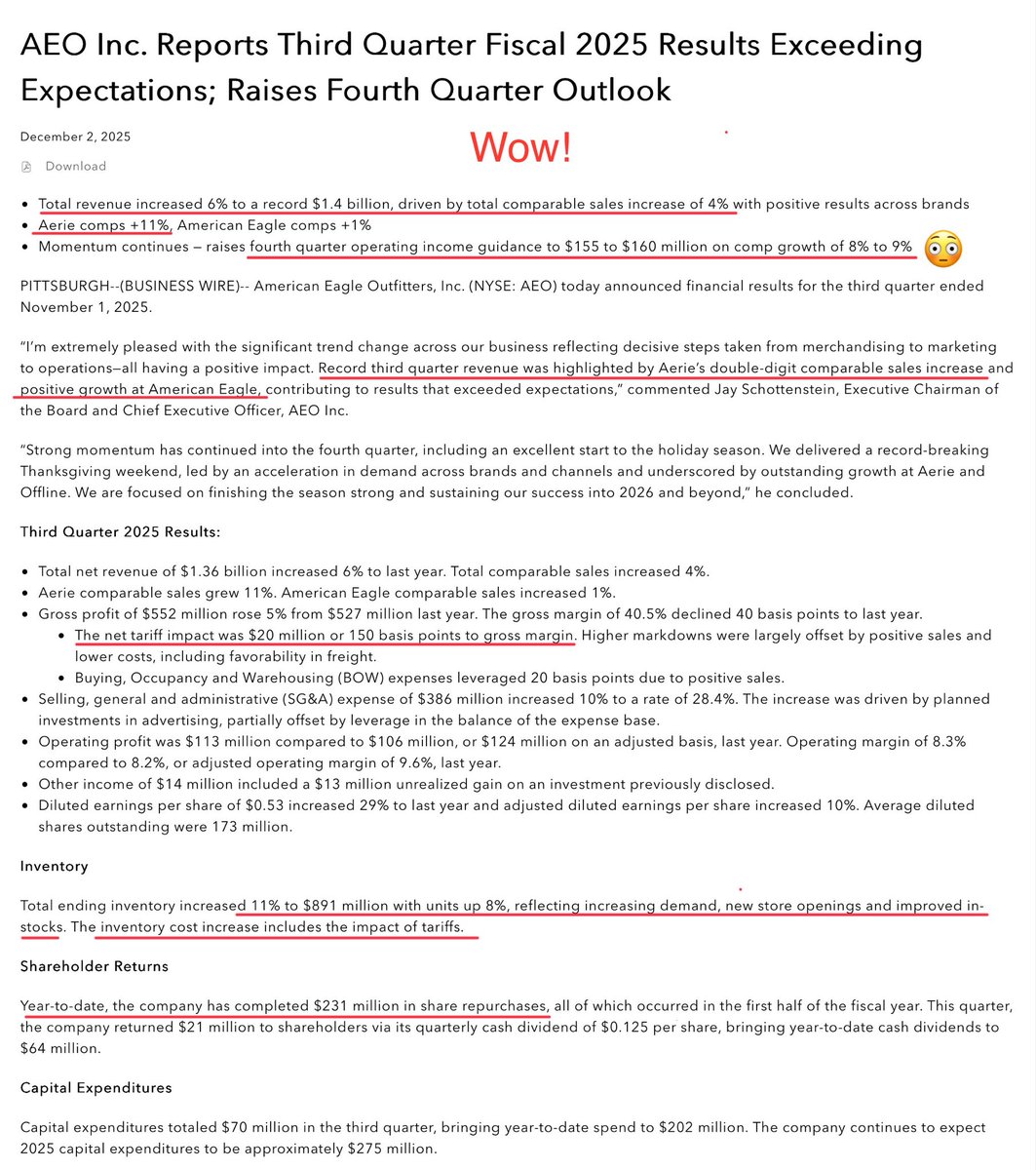

$AEO FUUK YEAH! Massive beat as expected (Aerie SSS accelerated to +11%), but the Q4 guide of +8-9% total SSS and operating income at $155-160m (vs $130m cons) looks absolutely insane. Simply flabbergasted. I’m just undefeated in retail & brand investing. Sydney, call me 🤙

$AEO FUUK YEAH! Massive beat as expected (Aerie SSS accelerated to +11%), but the Q4 guide of +8-9% total SSS and operating income at $155-160m (vs $130m cons) looks absolutely insane. Simply flabbergasted. I’m just undefeated in retail & brand investing. Sydney, call me 🤙

Sydney Sweeney doing the fall campaign at $AEO. Consensus EPS next year is $1.23 (Feb-27), which implies 8.5x P/E at the $10.50 price. Stock’s beaten down due to poor (-3%) Q1 SSS & tariff-induced margin pressure. I think they can do $1.60 in EPS, which would be $24 @ 15x P/E.

$AAPL at new All Time High today. Is it because the Vision Pro has been an huge success? No. Is it because of the incredible power of Apple Intelligence? Also no. No capex, no AI, no problems. Release the same phone every year, just 5% better. Do nothing else. Win. 🤷♂️

I was reading some research today and was blown away by the lack of ability by these analysts to identify what’s important. Endless words and data. Zero insights. Yet insight is all that matters. And any insight can be expressed in a paragraph or two, a chart, or both.

$KLAR trying to pump its dumpster-IPO stock by announcing that they gave loans to literally ANYONE cash-poor who asked for it during Black Friday. Unsecured lending to desperate consumers? Huh, noone’s tried that before. I wish them well. But, this is bullish retailers.

BNPL exploded this holiday season Klarna saw a 45% year-over-year increase in U.S. sales from November 1 through Black Friday. Footwear, tech, beauty, and home goods all performed strongly.

Klarna -47% since IPO day, while S&P500 is at highs. Predatory issuers & VCs keep dumping overvalued sh*t on some of the dumbest American fund managers in existence, while the SEC is asleep. $KLAR literally missed their first Q numbers post IPO. What a dumb IPO syndicate.

What exactly is the conclusion from the @michaeljburry GPU depreciation case? People will need to buy more (or less?) GPUs because they get older faster (or slower?) than current market expectations? What is his trade? I don’t get it.

Altman expected to burn through $500bn in cash until 2030…. Yikes. Good luck bro.

HSBC forecasts that OpenAI is going to have nearly a half trillion in operating losses until 2030 ft.com/content/23e54a…

United States Trends

- 1. Spurs 47.8K posts

- 2. Merry Christmas Eve 43.9K posts

- 3. Rockets 24.6K posts

- 4. #Pluribus 19.4K posts

- 5. Cooper Flagg 12K posts

- 6. UNLV 2,548 posts

- 7. Chet 9,952 posts

- 8. Ime Udoka N/A

- 9. SKOL 1,712 posts

- 10. #PorVida 1,732 posts

- 11. Mavs 6,298 posts

- 12. Randle 2,671 posts

- 13. Kawhi Leonard 1,041 posts

- 14. #VegasBorn N/A

- 15. Rosetta Stone N/A

- 16. #WWENXT 12.1K posts

- 17. connor 153K posts

- 18. Yellow 60.1K posts

- 19. #GoAvsGo N/A

- 20. Keldon Johnson 1,650 posts

You might like

-

Brian Feroldi

Brian Feroldi

@BrianFeroldi -

The Kobeissi Letter

The Kobeissi Letter

@KobeissiLetter -

Christopher Bloomstran

Christopher Bloomstran

@ChrisBloomstran -

Lisa Abramowicz

Lisa Abramowicz

@lisaabramowicz1 -

Long Equity

Long Equity

@long_equity -

Idea Hive

Idea Hive

@ideahive -

Mac10

Mac10

@SuburbanDrone -

Bob Elliott

Bob Elliott

@BobEUnlimited -

Quartr

Quartr

@Quartr_App -

Puru Saxena

Puru Saxena

@saxena_puru -

Markets & Mayhem

Markets & Mayhem

@Mayhem4Markets -

Michael Green

Michael Green

@profplum99 -

Paulo Macro

Paulo Macro

@PauloMacro -

High Yield Harry

High Yield Harry

@HighyieldHarry -

Daniel S. Loeb

Daniel S. Loeb

@DanielSLoeb1

Something went wrong.

Something went wrong.