Elephant Capital

@ElephantCapita2

Technical trade setups and occasional macro musings. Posts are my opinion, not financial advice. No telegram.

You might like

One mega cycle - 22 years and counting - with some junctures in-between, as outlined on the qtly log chart of the #NASDAQ100. One steep rally left imho. Stay tuned for levels. $NDX $NQ $QQQ $SPX $SPY $DAX

$SPX update. Follow through below last week's very bearish close brings into play two main targets, the first being 6000-6010. Other potential targets noted on chart. $SPY $ES #US500

$NVDA update. 195.62 tagged - smack bang in the middle of the target zone (194-197), followed by a firm reversal. You're welcome. $NQ $QQQ $NDX $SMH

$NVDA update. Coming along nicely since the last update - ~$194-197 the next inflection point. $NQ $QQQ $NDX

#Bitcoin update. Cracked a new high, and flushed with no follow through. Ominous. Next major target to the downside is ~99400. $BTCUSD $BTS #BTC #crypto

#ASX200 update. A harsh reversal at a double top, along with global markets. Risk that we break down, rather than up, out of the ABCDE consolidation. A break below 8720 could very well confirm a major correction is underway. $XJO #ASX

$QQQ update. Corrects exactly where anticipated. Still a short to 580-587. The question when that zone hits, does it find support for a final rally to complete W3, or has W4 commenced? A break below 577 will tell us. #China news will be digested over the weekend. $NDX $NQ $NDQ

$QQQ update. Inflection point as price for w5 of W3 extends to the exact height of w1 of W3 ($607). There's still a chance of a run to price extensions as marked on chart, to complete w5 of W3. Note targets at 615-617, 630-635 (high confluence), stretch at 641-654. $NQ $NDX

$DAX update. Nailed it. Possibly a bit more downside to 23800s, but as can be seen from prior post and the chart below, the idea has played out perfectly. Interested to see if we get a reversal to the upside soon. Will update accordingly based on the evolving price action.

$DAX update. The bounce was far more like a reversal to the upside - so, I got that wrong. Based on the current structure and price action, I see a move down slightly, before a move higher to 24700s.

$EURUSD daily chart update. Looks like the $DXY is going to rear its head in earnest. Current price 1.157. Targets 1.143, 1.118, 1.106. In my humble opinion, rallies could be opportunities to sell.

$GBPUSD - the Sterling in for a pounding (couldn't help myself). Current price 1.329. Downside targets 1.27 and 1.24. Note, the harsh rejection in the area marked the "sell zone" i.e., the mid-point of two important ranges. #GBP $DXY

$AUDUSD monthly chart. Key range on the monthly chart is 63-70c. It is holding on and so far the market has stepped in whenever 61-63 has been tested. Any follow through below 0.635 is bad news for the $AUD.

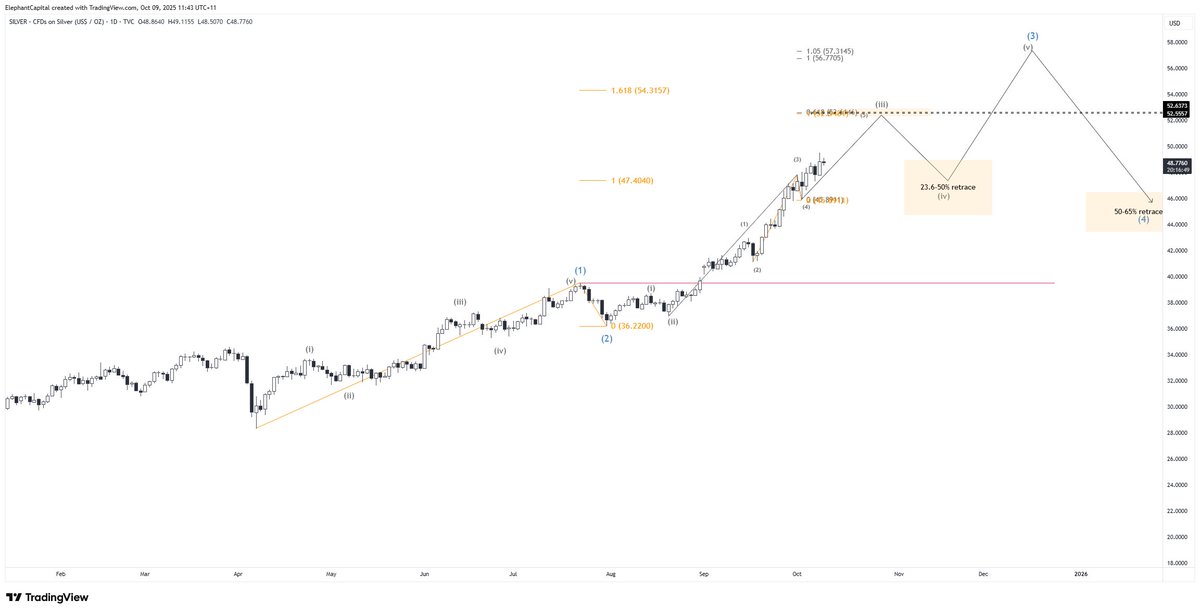

#SILVER update. Recutting the count and this fits a lot better and aligns with the big picture longer-term view. Interim target mid 52s. Count and measures on the chart. $SILVER $SIL $XAGUSD $XAG

#SILVER update. $48s achieved. Minimum correction target 44, wouldn't be surprised to see 41s. Bigger picture view, I have the next upside targets as 52-56 after this correction. $XAGUSD $XAG $SIL

$GOLD update. Well and truly in the zone for a correction now. 4006-4015 could be the spot. First downside target is 3750s, and second downside target is ~3670-3690. #GOLD $XAUUSD $GLD $GDX

$GOLD update. Watch it closely if we get a move between here (3860) and 3950, it could be the final stretch before an elongated wave 4 into Q1-Q2 of 2026 (~3500s) before the wave 5 leg to ~4200+ #GOLD $XAUUSD $XAU $GLD $GDX

#SILVER update. $48s achieved. Minimum correction target 44, wouldn't be surprised to see 41s. Bigger picture view, I have the next upside targets as 52-56 after this correction. $XAGUSD $XAG $SIL

#SILVER update. We surged past the 0.618 inflection point, and that means we have the next target coming up at x1 ext of w1-3 (~$48s). That is another area for a correction down to low $40s before an attempt at the 1.618 ext ($52-56) to complete w5. $SILVER $XAGUSD $XAG $SIL

$GOLD update. Watch it closely between here and wicks up to 4005. We are in the zone. 3500s to 3600s comes after that imo #GOLD $GLD $GDX $XAUUSD

$GOLD update. Watch it closely if we get a move between here (3860) and 3950, it could be the final stretch before an elongated wave 4 into Q1-Q2 of 2026 (~3500s) before the wave 5 leg to ~4200+ #GOLD $XAUUSD $XAU $GLD $GDX

$DAX update. The bounce was far more like a reversal to the upside - so, I got that wrong. Based on the current structure and price action, I see a move down slightly, before a move higher to 24700s.

$NVDA update. Coming along nicely since the last update - ~$194-197 the next inflection point. $NQ $QQQ $NDX

$NVDA - still no follow through and the count suggesting one more push higher to achieve wave 5 that is 0.618 of W1 (~$194). $NQ $QQQ $NDX

The market is bullish - we will get a solid clean out when w5 of W3 prints. That clean out could be as much as ~20% on the $NDX $QQQ $NQ. That will place price at low-mid 500s on $QQQ. We will get a final big rally thereafter to deliver ~50% gains from low-mid 500s (~765-830).

$QQQ update. Inflection point as price for w5 of W3 extends to the exact height of w1 of W3 ($607). There's still a chance of a run to price extensions as marked on chart, to complete w5 of W3. Note targets at 615-617, 630-635 (high confluence), stretch at 641-654. $NQ $NDX

$QQQ update. Inflection point as price for w5 of W3 extends to the exact height of w1 of W3 ($607). There's still a chance of a run to price extensions as marked on chart, to complete w5 of W3. Note targets at 615-617, 630-635 (high confluence), stretch at 641-654. $NQ $NDX

$NDX update. Food for thought - as previously stated, a move higher still in play (measures marked on chart), but expect some end of month vol. Timing wise, end of October into end of November seems significant (fib time zones marked on chart). $NQ $QQQ #US100 #NASDAQ100

United States Trends

- 1. Jets 68.7K posts

- 2. Jets 68.7K posts

- 3. Aaron Glenn 3,263 posts

- 4. Justin Fields 4,911 posts

- 5. Garrett Wilson 1,916 posts

- 6. HAPPY BIRTHDAY JIMIN 75K posts

- 7. #OurMuseJimin 113K posts

- 8. #JetUp 1,489 posts

- 9. Peart 1,644 posts

- 10. Tyrod N/A

- 11. #DENvsNYJ 1,618 posts

- 12. Bo Nix 2,161 posts

- 13. #30YearsofLove 104K posts

- 14. Sherwood 1,165 posts

- 15. Kurt Warner N/A

- 16. Bam Knight N/A

- 17. Hail Mary 2,413 posts

- 18. #AskFFT N/A

- 19. Good Sunday 66.7K posts

- 20. Rich Eisen N/A

You might like

-

norvast

norvast

@ColinSt30481392 -

ancient warrior

ancient warrior

@warrior_0719 -

Prof

Prof

@Prof_heist -

kiddow

kiddow

@kiddowstuff -

Graddhy - Commodities TA+Cycles

Graddhy - Commodities TA+Cycles

@graddhybpc -

Andrew 🇨🇦

Andrew 🇨🇦

@GoldnGuitars -

WonderINK

WonderINK

@WanderingTrad14 -

Patrick Karim

Patrick Karim

@badcharts1 -

RBswingtrader

RBswingtrader

@rbswingtrader -

Northstar

Northstar

@NorthstarCharts -

Surf City

Surf City

@SurfCity_Cycles -

James Choi

James Choi

@JC_Investment -

Burak

Burak

@Tradingchannels -

CyclesFan

CyclesFan

@CyclesFan -

Simon

Simon

@sich8

Something went wrong.

Something went wrong.