Barry Dawes

@DawesPoints

Helping investors profit in the resources sector Many years experience commodity and equity research [email protected] #gold #copper #ASX #commodities

Dit vind je misschien leuk

#Mining #Commodities Updating this six years later @DawesPoints Global Boom on track Commodity prices over the next decade need to reflect: 1 3,400m in Asia improving living standards 2 High mine capacity utilisation rates in many resources 3 Low stocks of…

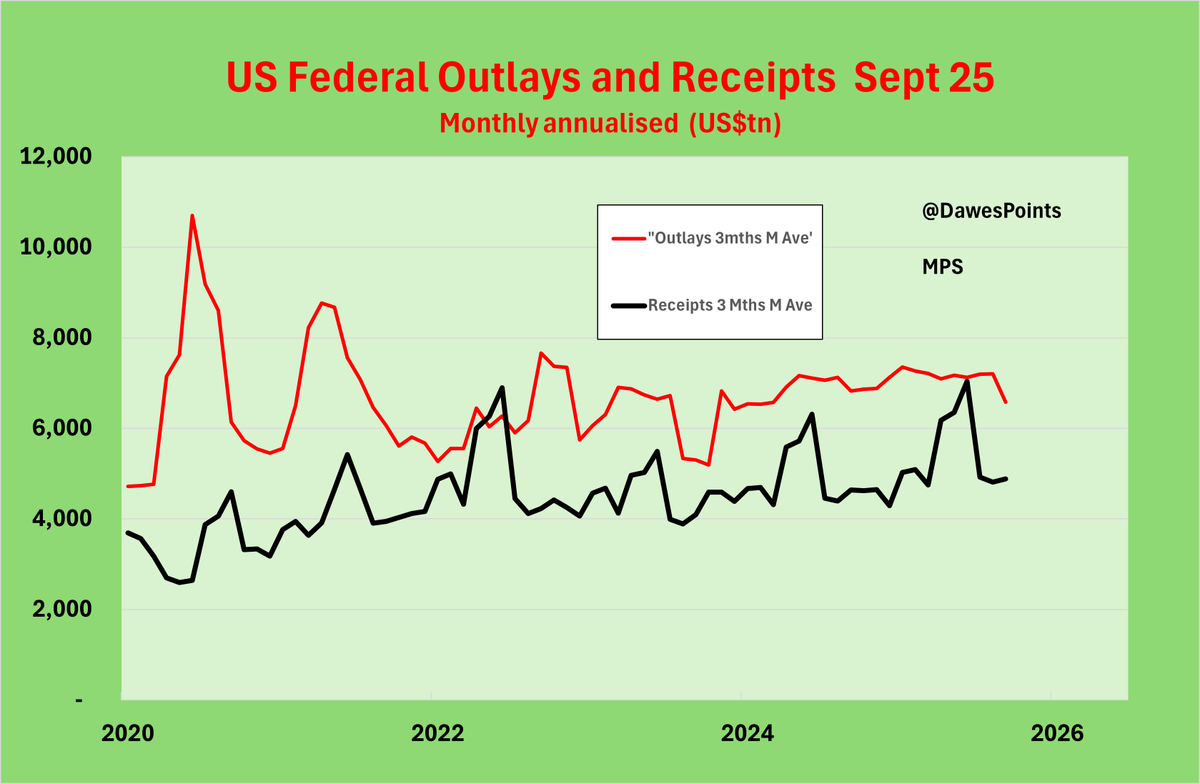

US Treasuries will have ~$11tn maturing in 2026 with ~$15tn maturing by end 2027 with most going into T Bills. T Bills are discounted on issue & don't pay 6mth coupons so mthly cash interest will be <50% in FY26. ST rates are falling -the ave int rate on $30tn fell in Oct.…

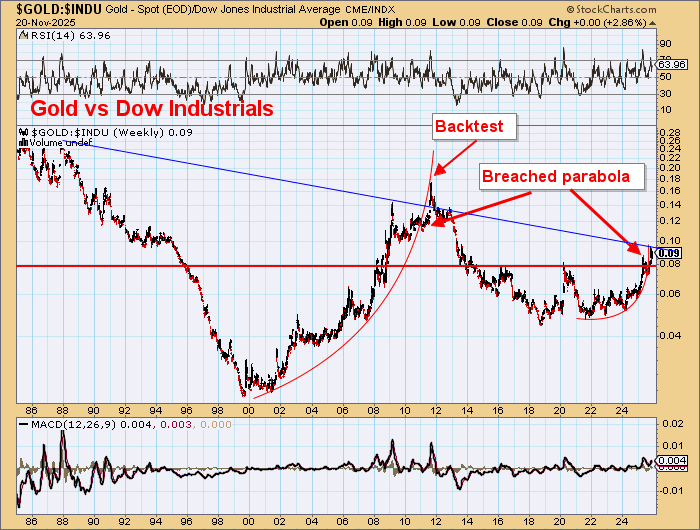

Budget Repair is well underway in the US. Outlays are declining and 12mth mov ave is down 2% YoY(5% real?). Receipts are rising (+5%YoY) The Deficit is shrinking. Ave int rate of Treasuries now falling. 10 year T Bond under 4.0% and dropping. Gold bulls need to be careful.…

I hope you are starting to understand what is really happening. The Great Gold Hoax is now over. The Golden Fleece Sting is well underway. It is all downhill from here for government deficits and inflation and so too for gold. US is leading in Budget Repair and the…

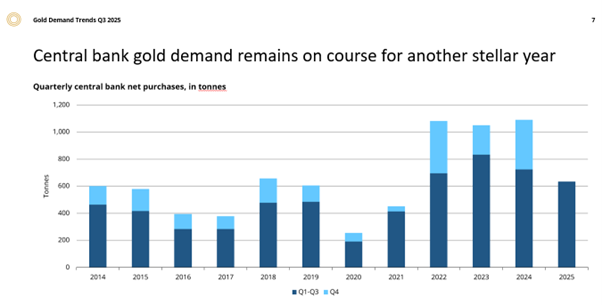

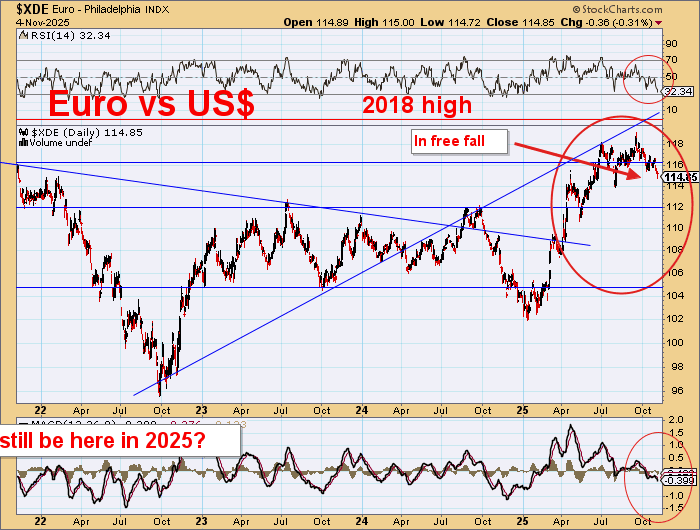

I guess this one didn't work either. So- US$ is in a bull market. US stock market heading higher CB buying fizzled out. US Budget Repair well underway Inflation falling. US T bond yields falling. Record level of foreign holders of US treasuries. De dollarisation is a…

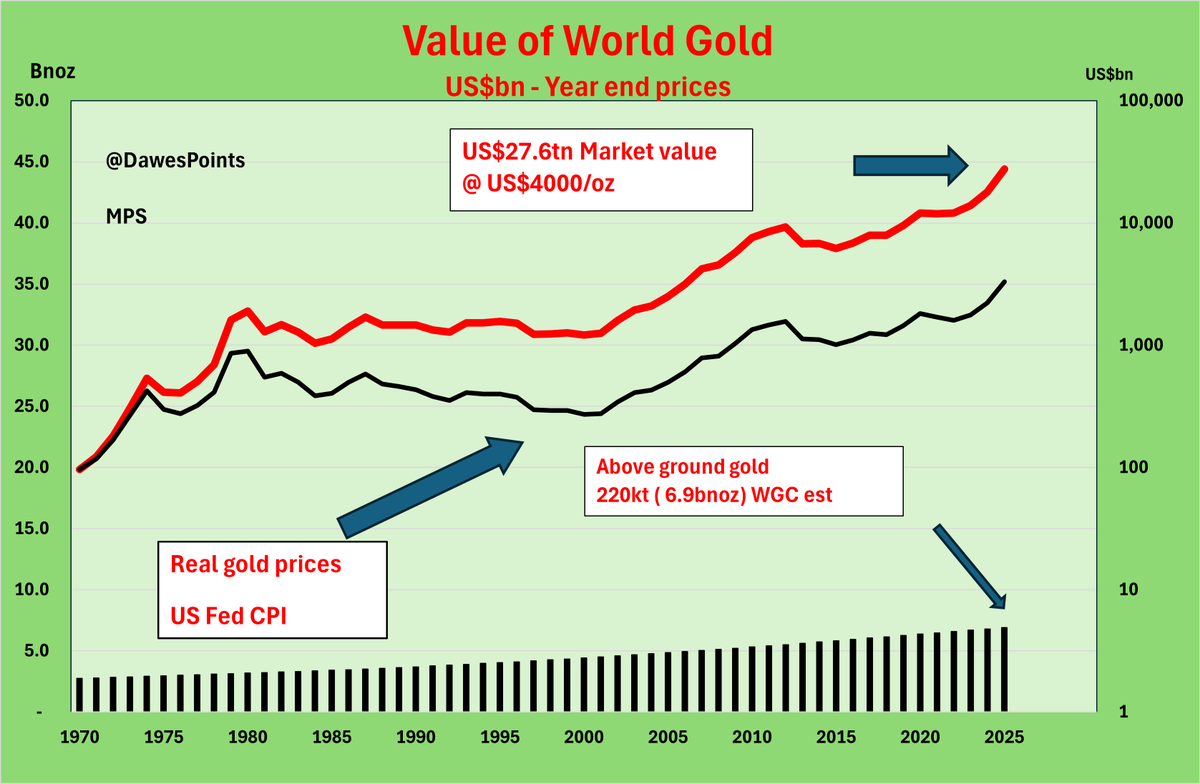

After its parabolic blowoff looks ready to fall back sharply. No support before $3500. Nothing below $3300. 220kt of overhang worth $28tn. Golden Fleece Sting underway. US$⬆️ CBs exhausted after buying at the top. #gold

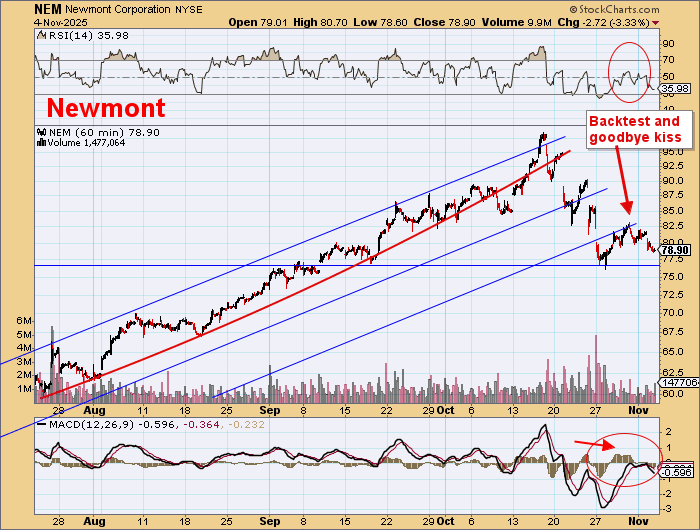

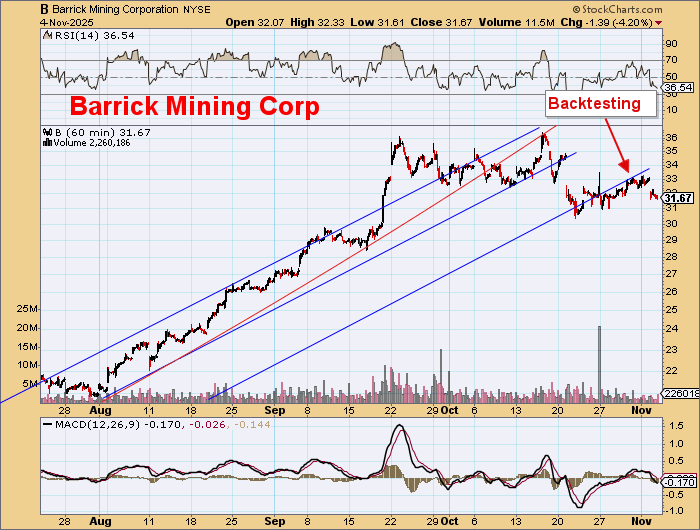

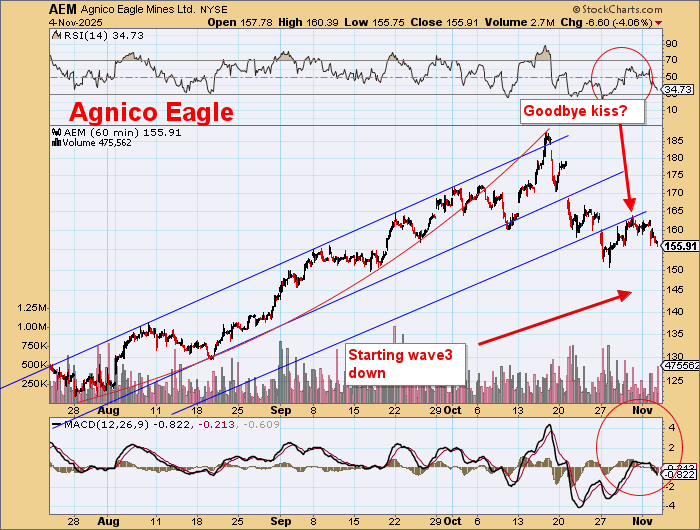

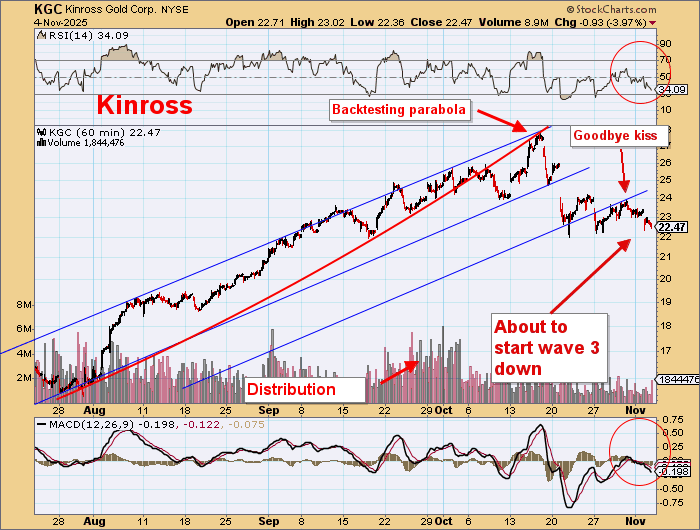

Major Nth Am Gold stocks are looking very vulnerable. Any further weakness will send them much lower. Gold doesn’t seem to be in a bull market any more. $NEM $AEM $B $KGC #gold

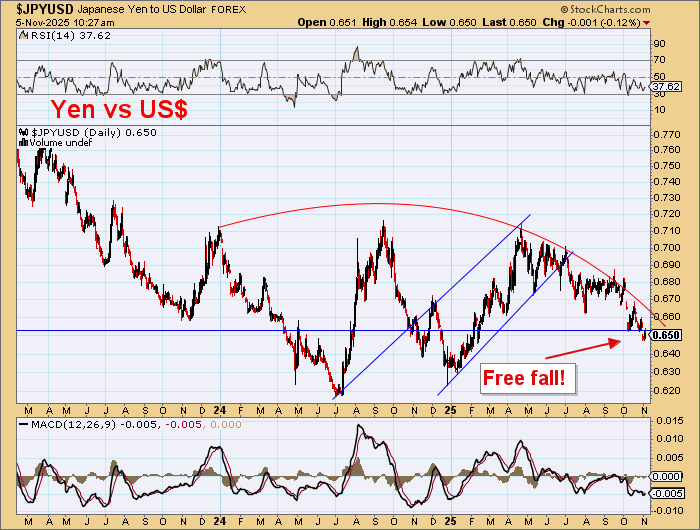

The US$ is in a long term bull market against the major currencies. Yen, GBP and Euro entering the free fall zone with much lower levels coming. Gold will be soon following them much lower. Whatever your time frame these are very bearish. Even the SWF is dropping. #gold.

Gold Is About To Get Ugly ow.ly/z3t850Xt2gi Barry Dawes of Martin Place Securities shares his thoughts on where the gold market is headed and takes a look at a few gold stocks. @DawesPoints

Gold Is About To Get Ugly ow.ly/z3t850Xt2gi Barry Dawes of Martin Place Securities shares his thoughts on where the gold market is headed and takes a look at a few gold stocks. @DawesPoints

There was supposed to be a big bull market in gold stocks around here somewhere. Anyone seen one? You would know it if you saw it. Big, bright and shiny. Very big. These aren't in it, are they? No. It's probably hiding somewhere else. $NEM $AEM $B #gold

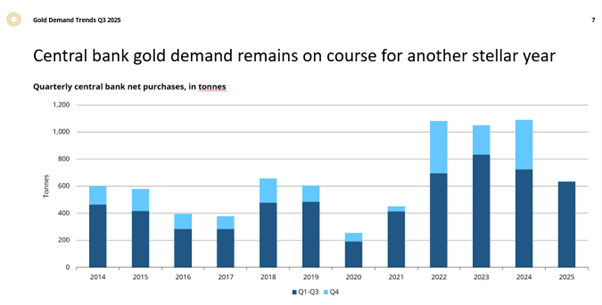

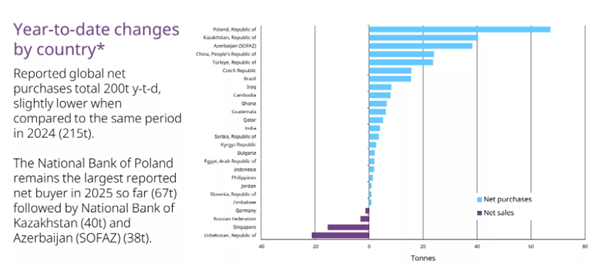

Holes appearing everywhere for the gold bulls. US$ strong Collapsing Euro and Yen CBs bought 22% less gold in 2025 Budget repair underway The $25k gold kids are thinking $170tn is good value for #gold. Gold security biz will be bigger than AI! 🤣 $NEM $AEM $GDX $XAU

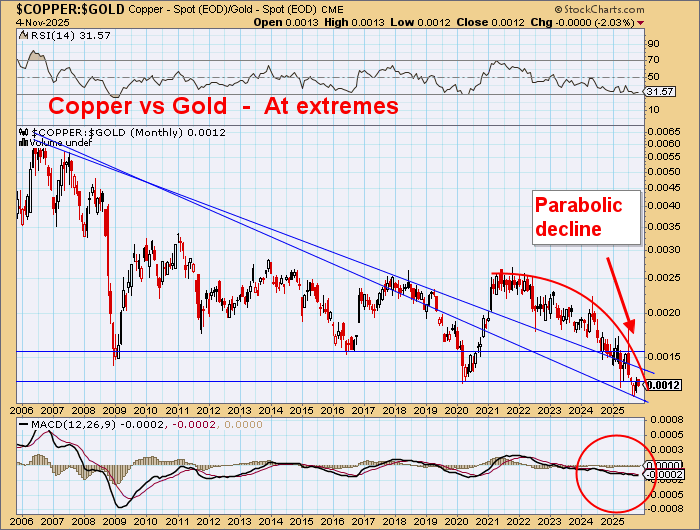

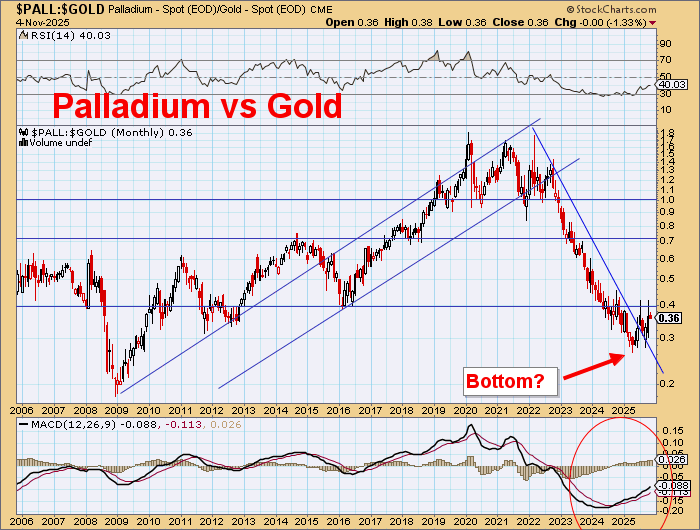

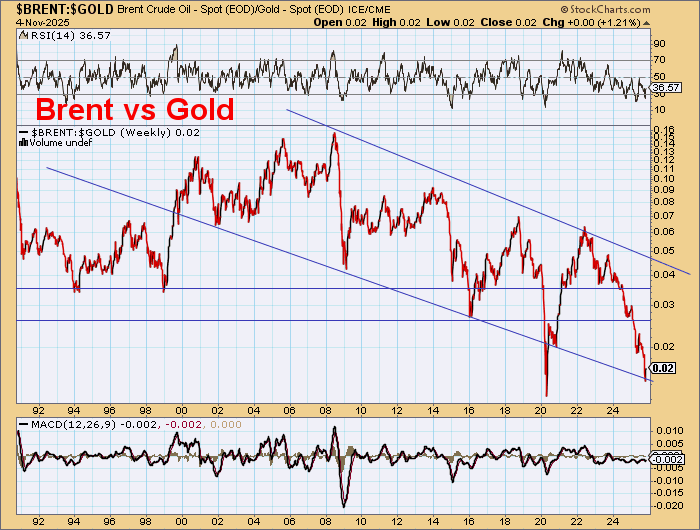

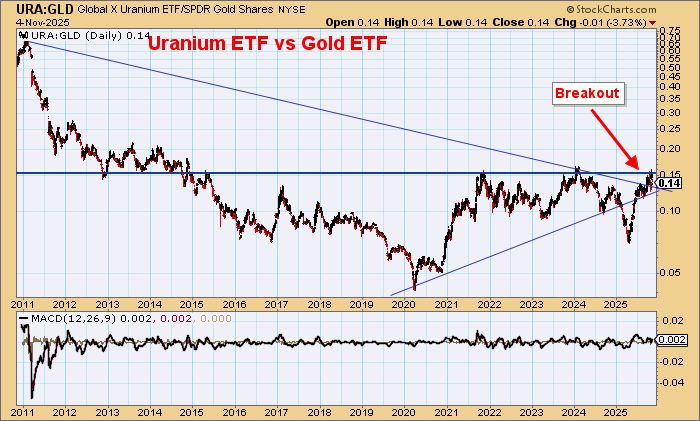

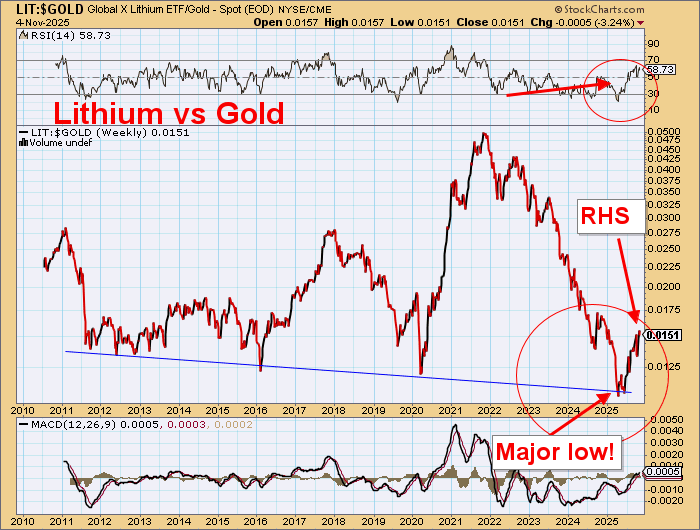

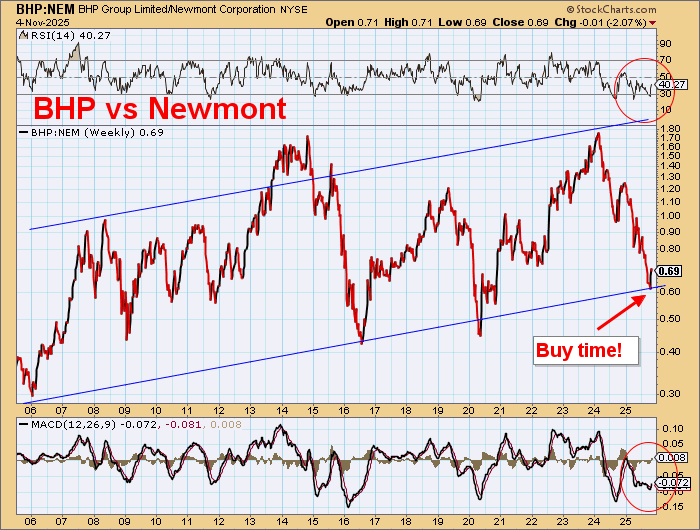

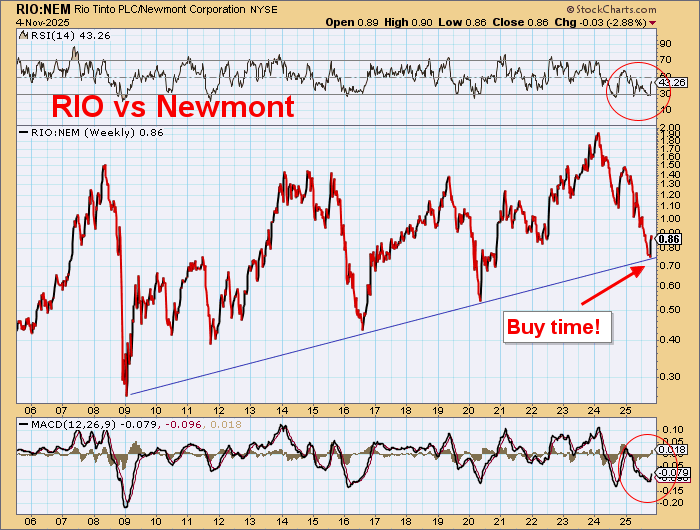

All these industrial commodities are about to break up strongly against gold. Silver is LT v cheap and ready to break higher Copper is now at extreme low so ready to snapback Platinum will have a big boost soon Palladium ready to go All say #gold is way overpriced

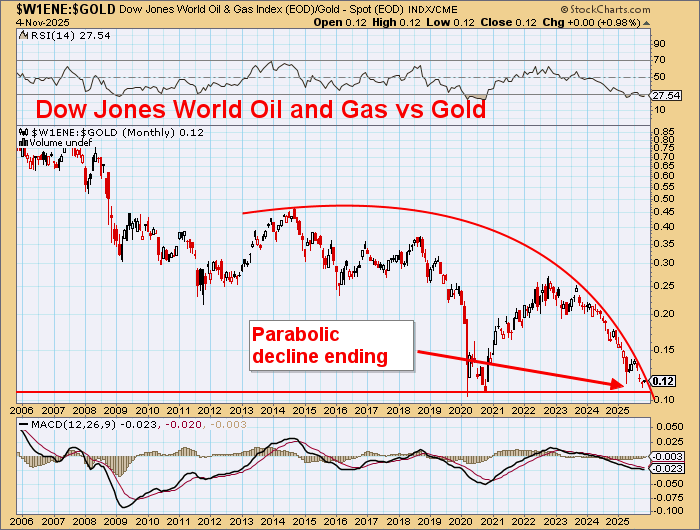

Many industrial commodities are overextended vs gold -now are ready to snap back. Oil has declined parabolically to an important technical low. The oil sector is following - ready to turn. Uranium is ready for a big move. Even lithium is changing. #gold heading MUCH lower.

The performance of big resources stock vs big gold stocks tells a big story. The peak in gold has been achieved & basic resources are heading higher. Gold has reached a peak against almost all asset classes and now will fall away. Reality. #gold $BHP $RIO $NEM $AEM $GC $B

US$ strength continues & the major currencies are now in freefall. As they fall it will become increasingly difficult for these countries to find funding to buy bonds to finance woke NET ZERO type deficits. Falling yields in the US make the US$ even more attractive. #gold

Are we allowed to say CB buying YTD is the lowest in 4 years and only smaller players & CCP bought in 2025. Probably like gold can rise with a strong US$ and falling US Tbond yields mean falling real yields (even though inflation is falling). Do I have that right? #gold

The biggest gains are made buying low to sell high. Nickel is hated as much as T Bonds so here's low risk play. Look at Ni vs Au! WMG.AX has 5.3mt cont Nickel @ 0.27%Ni that can only get bigger & with 🔼🔼higher grades. Just US$20m mkt cap. Inground value…

A big question. The US$ is clearly in a major bull market. The major currencies look very weak long term. US T yields are falling across the maturities. So is #gold worth $27tn mkt val? Can the $9tn 2025 gain hold (biggest yearly gain ever, in anything), let alone rise?…

Fascinating that the 6.9bnoz of global #gold at $4400 was worth $30.4tn and up ~$12tn in 2025. Was this the biggest market value gain ever? Today its $27.6tn at $4000. Big overhang to profit from the short side? How much buying is needed to push it to $5000 and $34.5tn?

United States Trends

- 1. $MAYHEM 2,547 posts

- 2. The WET 102K posts

- 3. FINALLY DID IT 301K posts

- 4. Warner Bros 157K posts

- 5. HBO Max 67.5K posts

- 6. #FanCashDropPromotion 2,208 posts

- 7. #NXXT_CleanEra N/A

- 8. #NXXT_AI_Energy N/A

- 9. NextNRG Inc 2,549 posts

- 10. Paramount 30.4K posts

- 11. #FridayVibes 5,545 posts

- 12. Cyclist 2,930 posts

- 13. World Cup 82.1K posts

- 14. Good Friday 64.8K posts

- 15. Jake Tapper 65.4K posts

- 16. Ted Sarandos 5,503 posts

- 17. #สิงสาลาตายEP6 86.4K posts

- 18. The EU 156K posts

- 19. SINGSA LATAI EP6 87K posts

- 20. Hep B 8,205 posts

Dit vind je misschien leuk

-

The Assay - Mining Magazine

The Assay - Mining Magazine

@TheAssay -

ResourcesRisingStars

ResourcesRisingStars

@RR_Stars -

Edward Gofsky

Edward Gofsky

@EdwardGofsky -

American Rare Earths Limited (ASX: ARR)

American Rare Earths Limited (ASX: ARR)

@ARRLimited -

Gavin Wendt

Gavin Wendt

@MineLifeReport -

Making Money Matter and Gold Events

Making Money Matter and Gold Events

@GoldEventsAU -

Nicholas Read

Nicholas Read

@nicholas_read -

Ken Watson

Ken Watson

@ken_kfwatson -

NWR Communications

NWR Communications

@NWRcomms -

The Mining Bartender

The Mining Bartender

@jtourzan -

TheHedgelessHorseman 🏇

TheHedgelessHorseman 🏇

@Comm_Invest -

Julia Maguire

Julia Maguire

@MsJuliaMaguire -

MakCorp

MakCorp

@makcorppl -

Simon

Simon

@sich8 -

High Grade 🚜⚒🌎🇺🇸🇨🇦

High Grade 🚜⚒🌎🇺🇸🇨🇦

@EconomicAlpha

Something went wrong.

Something went wrong.