FDIC Exposed

@FDIC_Exposed

Exposing the Federal Deposit Insurance Corporation (@FDICgov). We report on FDIC’s violations of laws, rules, regulations, mismanagement and abuse of authority.

.@FDICgov Office of Communications Director Amy Thompson is on blast by her former supervisor, Deputy to the Chairman for External Affairs Nikita Pearson. For quite some time, we've been discussing Ms Thompson's insider trading of bank stocks, misuse of the contracting process,…

In the interest of transparency, we reached out to the FDIC for comment. The agency declined to provide one. We were directed to contact Mr. Sullivan at +1 (202) 412-1436 for any further inquiries.

Brian Sullivan of @FDICgov has just threatened to expose any "Jewish" journalist. Text messages forthcoming. We're not sure what this means but, wow, the fact that a media relations "specialist" would even say that is abhorrant.

*sip* @FDICgov @FDIC_Exposed got any commentary?

The Santa Anna National Bank in Santa Anna, Texas, failed today. No press release from the FDIC yet, but based on the bank's former website looks like another bank in the same county is the buyer. mysanb.com

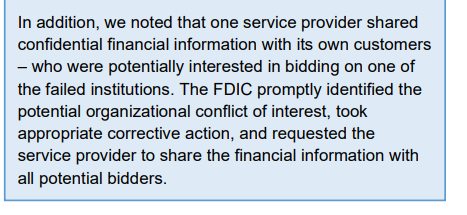

In the same box, the FDIC IG goes on to relate a separate anecdote about client service that was maybe a little too good

Another sort of funny anecdote from the report. The FDIC hired a contractor to provide "global advisory services." The contractor would get, among other fees, a fee based on the "sales price" for First Republic Bank. But "sales price" wasn't clearly defined, so naturally...

Not really a bombshell report - it was a crisis, the FDIC skipped a few steps in its contracting processes, and will try to do better next time. I think the below screenshot is fairly representative.

OIG reports on certain FDIC resolution and receivership contracts during the largest bank failures in Spring 2023 – we identified seven best practices to enhance the FDIC’s control environment and emergency acquisition preparedness. fdicoig.gov/sites/default/…

OIG reports on certain FDIC resolution and receivership contracts during the largest bank failures in Spring 2023 – we identified seven best practices to enhance the FDIC’s control environment and emergency acquisition preparedness. fdicoig.gov/sites/default/…

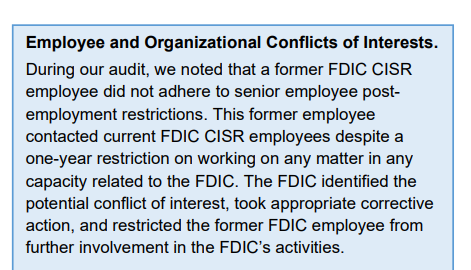

Maybe slightly more seriously from today's FDIC IG report, there is this box on "Employee and Organizational Conflicts of Interests"

Multiple reports coming in that @FDICgov Daniel H. Bendler, Deputy to the Chairman and Chief Operating Officer was escorted out of the FDIC yesterday. More details to come.

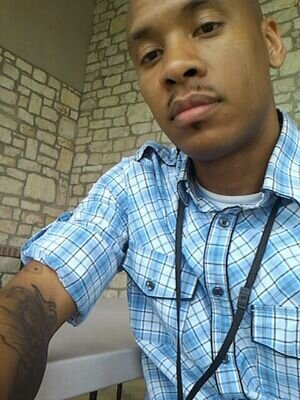

Another @FDICgov employee is an alleged sex pedo… Jonathan Travis Mackey, 46, of Loveland, allegedly exploited child victims both online and in person while employed by the Federal Deposit Insurance Corporation (FDIC). Just last year another FDIC employee Mark Black (who was…

Local men arraigned in federal court in separate cases alleging child exploitation via online chat, social media sites & in-person abuse. More: fdicoig.gov/news/investiga…

🚨SCOOP: @PatrickMcHenry reveals that former SEC chief Gary Gensler was not as anti-crypto in private as he was in public. “I think it had more to do with Senate politics, and confirmation politics.” Full episode with the former Chair of @FinancialCmte out tomorrow AM!

FDIC 2025 risk review, which focuses on market risk and credit risk (incl net interest margin, liquidity, funding/deposits, consumer lending) makes *ZERO* mention of: fintech, crypto/blockchain, stablecoins, or AI.

The Random Man asks why the FDIC Chairman can’t be @JelenaMcW. The best FDIC Chairman in my lifetime Jelena McWilliams was railroaded out of the job in a politically engineered back-stabbing coup. She’s tanned, rested, and ready.

Rep Scott asks why there isn't an FDIC chairman selected. Bessent says there was an acting chair under previous administration. No specifics on timeline for selection

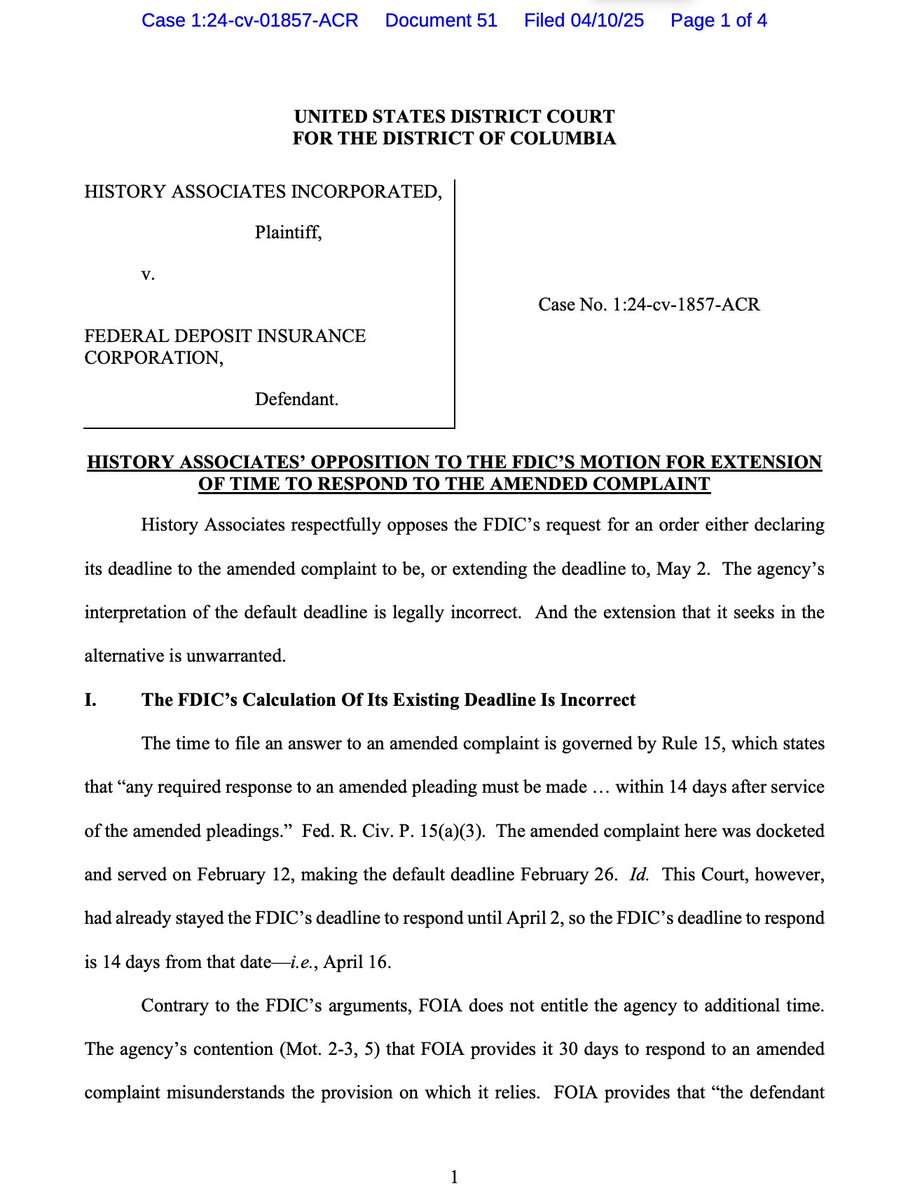

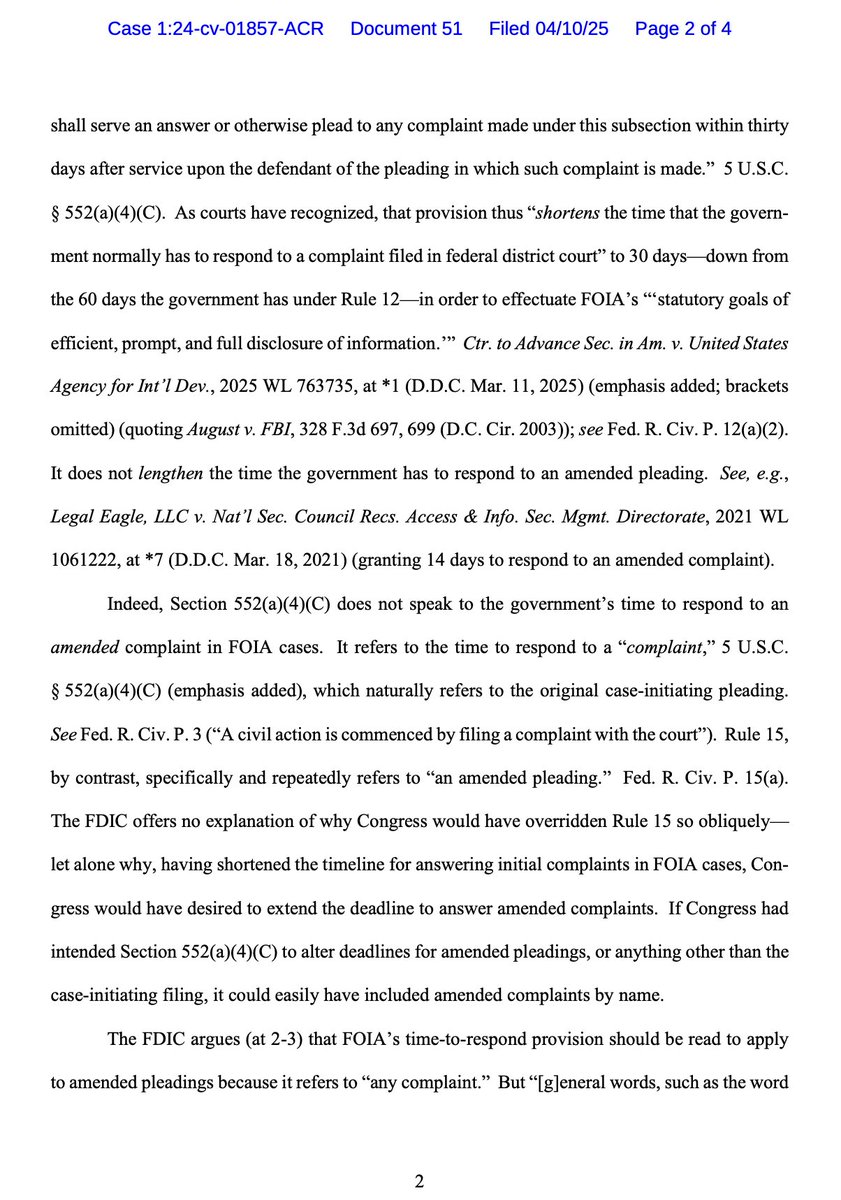

Parties in litigation regularly ask for reasonable extensions to deadlines--fine. But @FDICgov just filed 13 pages in our FOIA suit asking the Court for another 16 days to decide whether to ask us for ... even more delay. As laid out in our response, this is absurd.

Banks can now engage in crypto-related [and digital asset] activities without receiving prior FDIC approval, so long as they "adequately manage risks" and "conduct activities in a safe and sound manner"; in accordance with new guidance--FIL-7-2025. FIL-7-2025 rescinds FIL-16-2022…

![McSqueezyTheCow's tweet image. Banks can now engage in crypto-related [and digital asset] activities without receiving prior FDIC approval, so long as they "adequately manage risks" and "conduct activities in a safe and sound manner"; in accordance with new guidance--FIL-7-2025.

FIL-7-2025 rescinds FIL-16-2022…](https://pbs.twimg.com/media/GonH8VCWkAAzXHY.jpg)

![McSqueezyTheCow's tweet image. Banks can now engage in crypto-related [and digital asset] activities without receiving prior FDIC approval, so long as they "adequately manage risks" and "conduct activities in a safe and sound manner"; in accordance with new guidance--FIL-7-2025.

FIL-7-2025 rescinds FIL-16-2022…](https://pbs.twimg.com/media/GonKXubXYAACsNw.png)

![McSqueezyTheCow's tweet image. Banks can now engage in crypto-related [and digital asset] activities without receiving prior FDIC approval, so long as they "adequately manage risks" and "conduct activities in a safe and sound manner"; in accordance with new guidance--FIL-7-2025.

FIL-7-2025 rescinds FIL-16-2022…](https://pbs.twimg.com/media/GonLNSaW4AEcc3y.png)

Per usual, top tier work here by @nic__carter Of course, this alone didn't sink the modern democrat party; there are myriad other reasons - but it also didn't not Giving excess power to captured shape shifters like @ewarren is a one way ticket to ballot box hell

United States Trendy

- 1. Peggy 27.1K posts

- 2. Zeraora 8,502 posts

- 3. Berseria 2,480 posts

- 4. #FaithFreedomNigeria 1,402 posts

- 5. Good Wednesday 33.8K posts

- 6. Dearborn 331K posts

- 7. Luxray 1,405 posts

- 8. #wednesdaymotivation 7,115 posts

- 9. #Wednesdayvibe 2,411 posts

- 10. Cory Mills 19.2K posts

- 11. Hump Day 16.8K posts

- 12. #LosVolvieronAEngañar 1,913 posts

- 13. #MissUniverse 25K posts

- 14. $NVDA 41.6K posts

- 15. Tom Steyer N/A

- 16. Happy Hump 10.9K posts

- 17. International Men's Day 63.2K posts

- 18. Jessica Tisch N/A

- 19. Semrush N/A

- 20. Sonic 06 1,214 posts

Something went wrong.

Something went wrong.