FEDS Notes

@FEDS_Notes

FEDS Notes are research articles by Federal Reserve Board economists, their own views / analysis in economics & finance & international Unofficial account.

คุณอาจชื่นชอบ

#FEDSNote shows that monetary policy may be constrained in a recession. (1/2) go.usa.gov/xpSe6 #EconTwitter

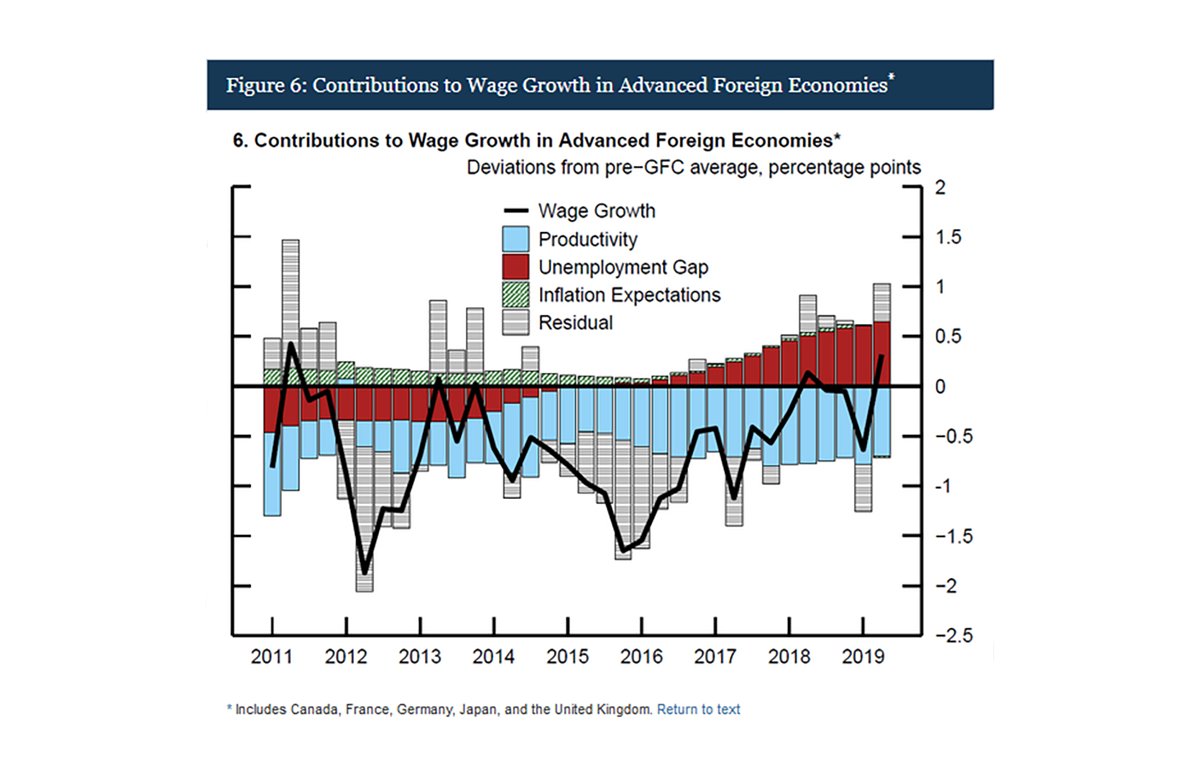

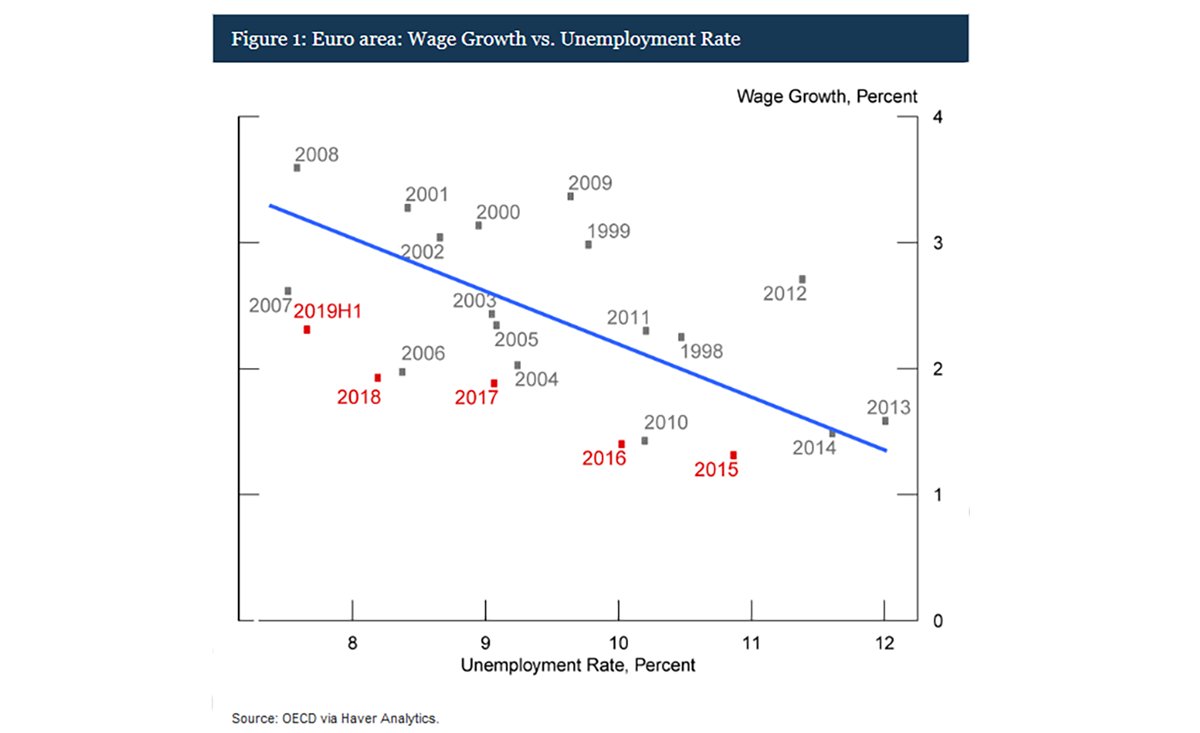

Slower productivity growth and lower natural rates of unemployment explain much of the recent weakness in wage growth. Controlling for these factors, we find that tighter labor markets have put upward pressure on wages (2/2): go.usa.gov/xdxnz #FedResearch

Why has wage growth remained relatively subdued in numerous advanced economies, even as unemployment rates have fallen to/near historical lows? A new #FEDSNote analyzes wage growth in Canada, France, Germany, Japan, and UK (1/2): go.usa.gov/xdxnz #EconTwitter

New #FEDSNote: Goods-Market Frictions and International Trade: go.usa.gov/xda4h #FedResearch

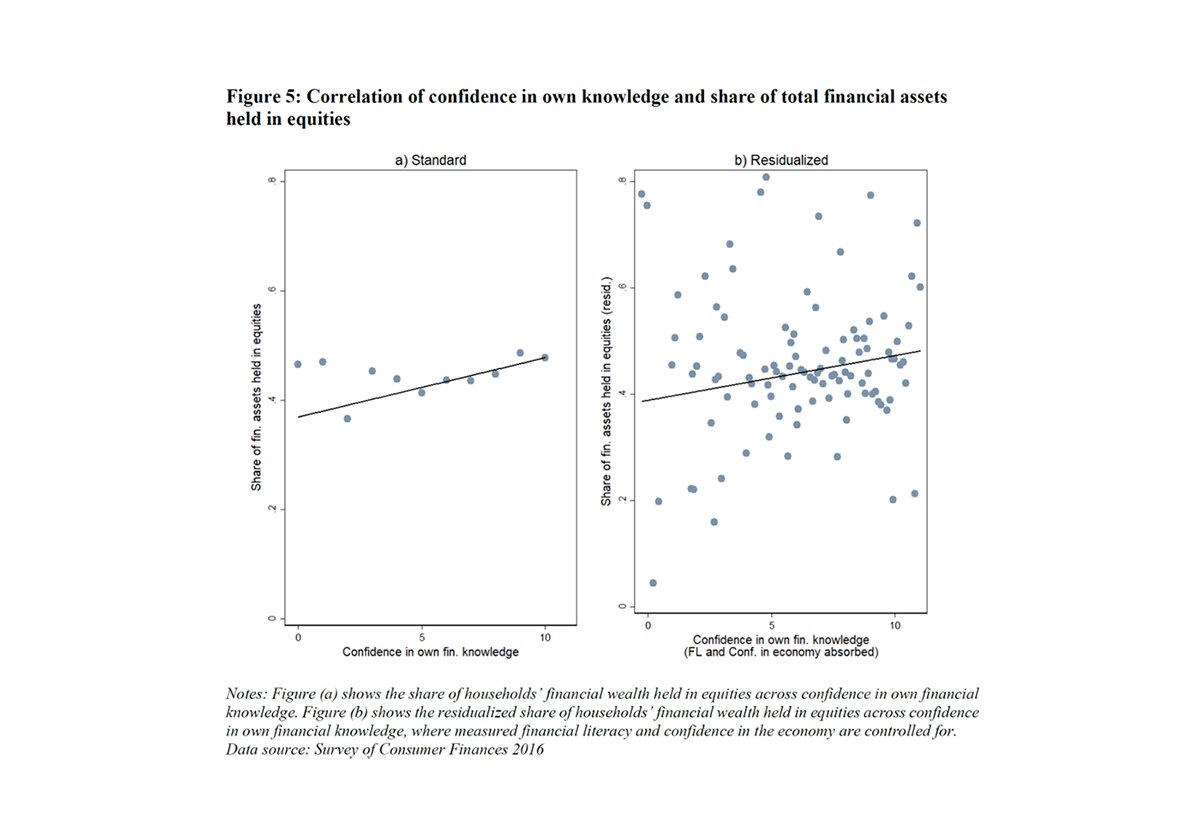

Though households aren't professional traders, confidence in future economic development also shapes household investment decisions: go.usa.gov/xdarE (2/2)

Financial literacy and confidence in own financial knowledge increase participation in risky assets, but not the share of wealth held in those assets (1/2): go.usa.gov/xdarE #FEDSPaper #EconTwitter

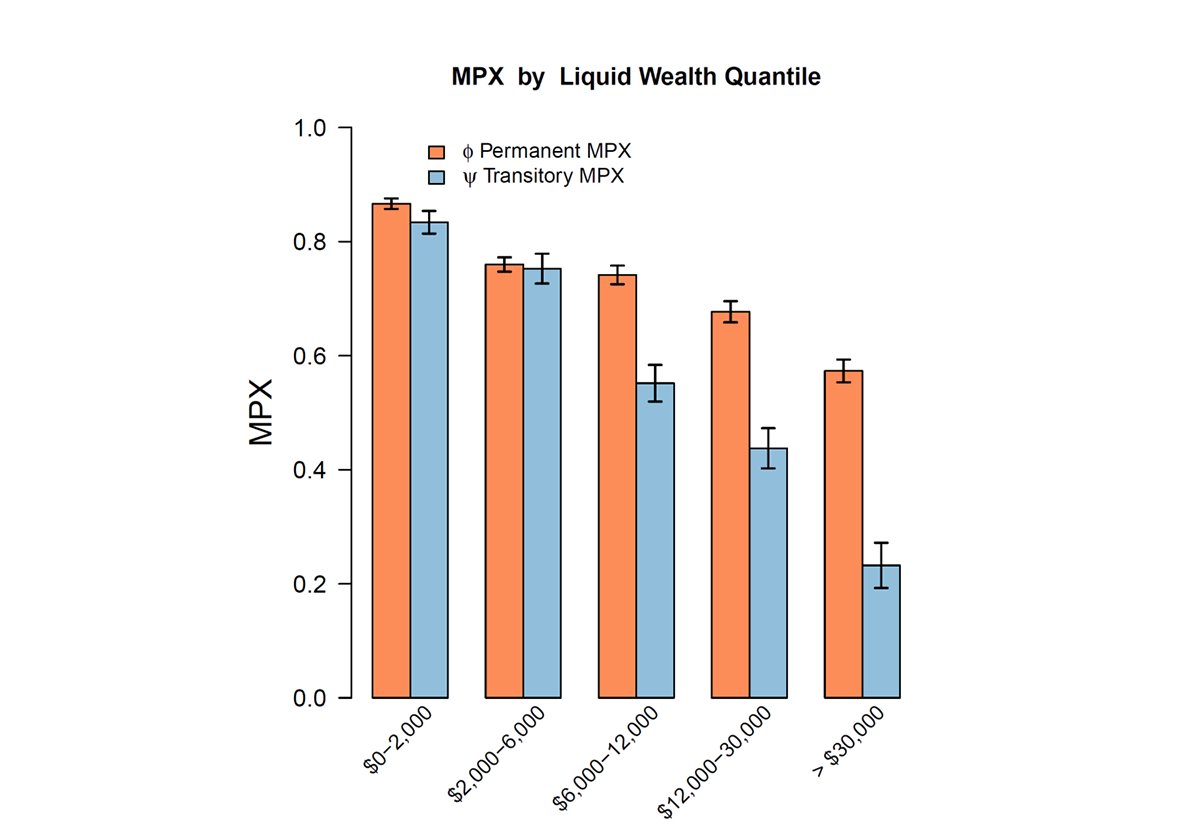

Households' marginal propensity to consume varies systematically and in ways that are important for macro. We develop a new method to measure MPCs and uncover clear heterogeneity in administrative data: go.usa.gov/xdxSU #FEDSPapers #EconTwitter

ETFs have become a popular tool for investors and made it easier to hold emerging market assets. New #IFDPpaper shows that flows to EM ETFs are more than twice as sensitive to global financial conditions than flows to EM mutual funds: go.usa.gov/xda2T #EconTwitter

thank you 🙏 everyone who followed this unofficial account ... we’ve now got an official @FedResearch ... that’s your new source for excellent research from the Board 🎉🎉🎉

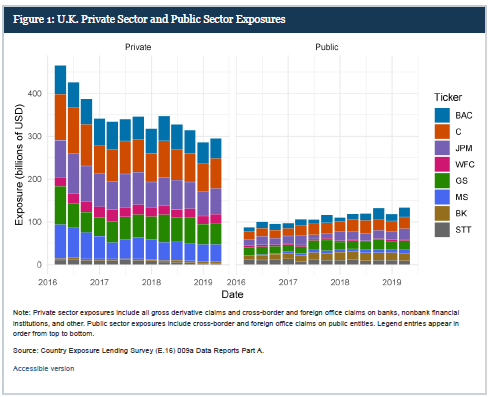

"Assessing Major Country Exposures of U.S. Banks Using 009a Data Reports: A Brexit Case Study" Alexander H. von Hafften "U.K. and E.U. exposures of U.S. global systemically important banks (G-SIBs) have changed since the Brexit referendum" doi.org/10.17016/2380-…

“Interest on Excess Reserves and U.S. Commercial Bank Lending” by Marcelo Rezende, Judit Temesvary, and Rebecca Zarutskie federalreserve.gov/econres/notes/…

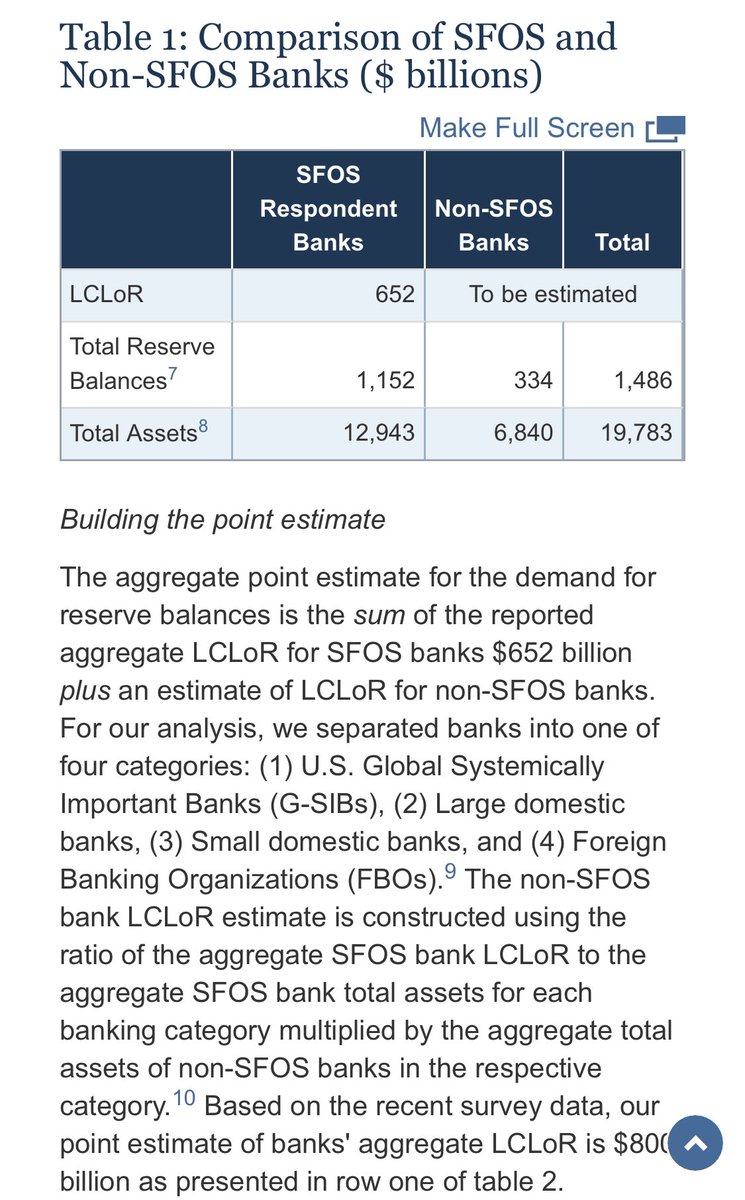

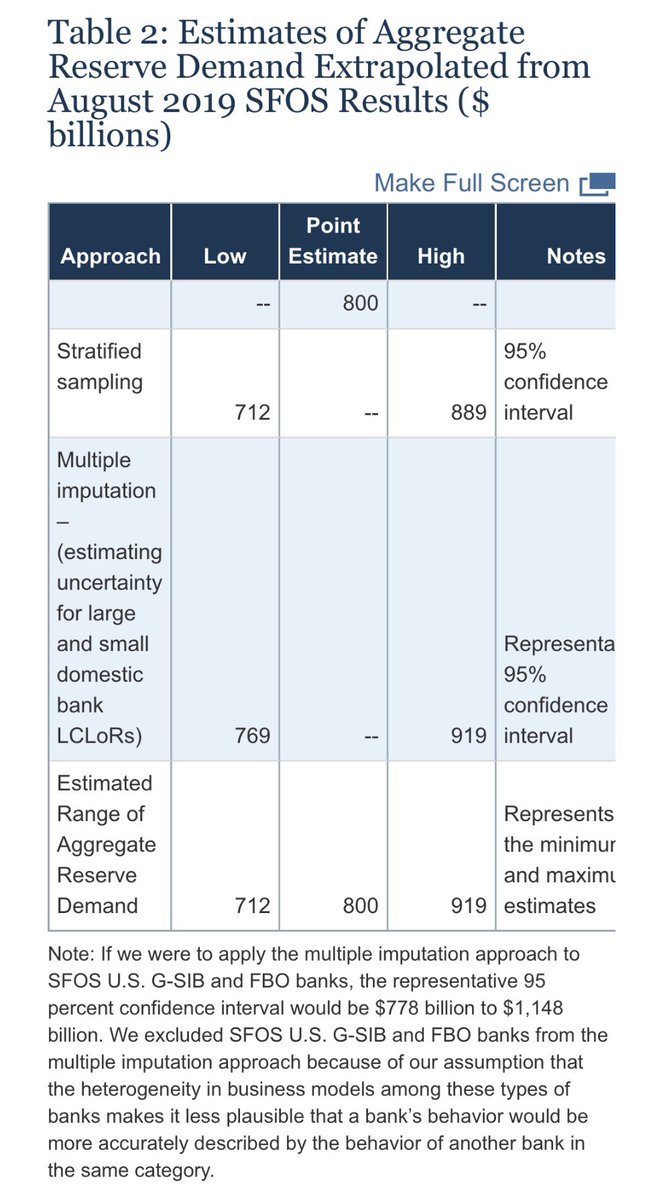

“Approaches to Estimating Aggregate Demand for Reserve Balances” by Joseph Andros (Federal Reserve Bank of New York), Michael Beall, Francis Martinez, Tony Rodrigues (Federal Reserve Bank of New York), Mary-Frances Styczynski, Alex Thorp (Federal Reserve Bank of New York)

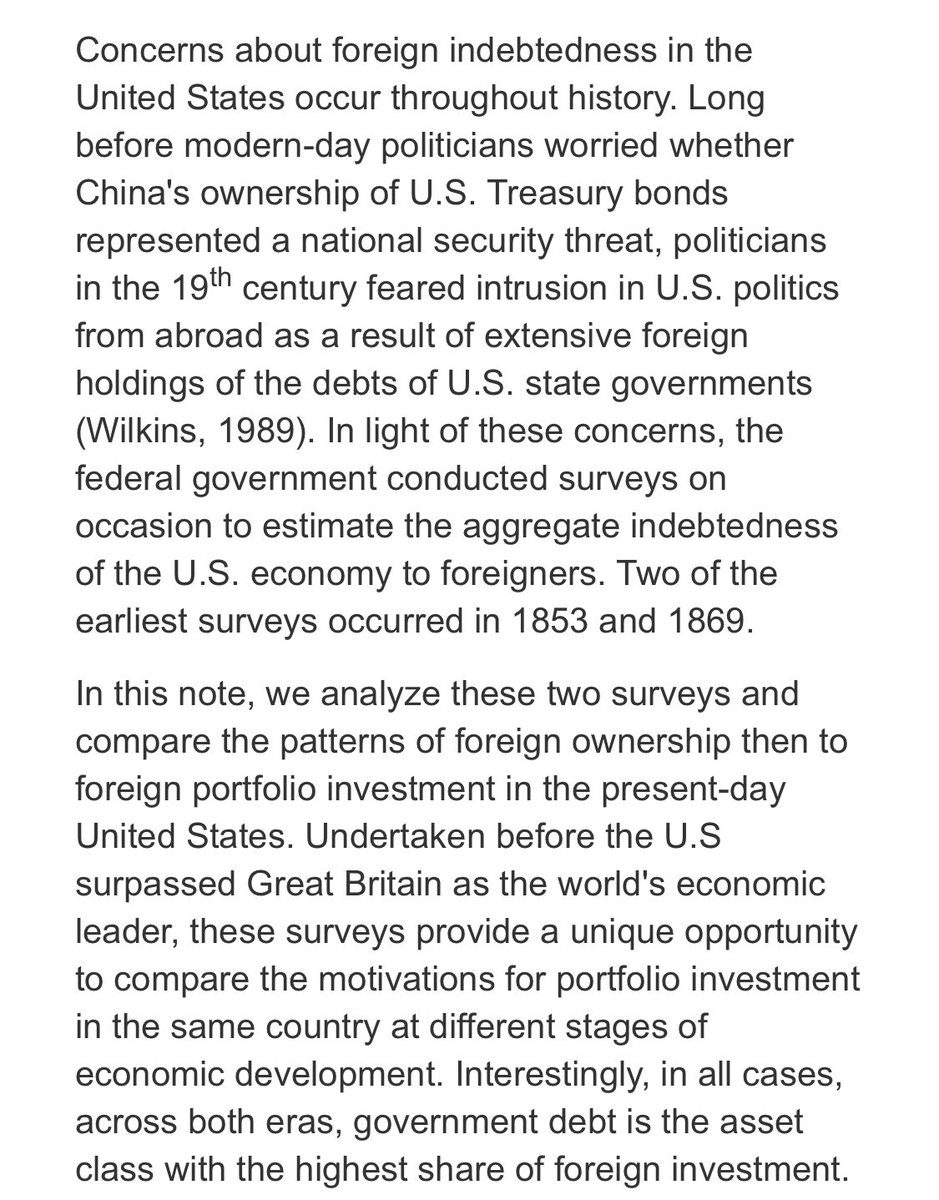

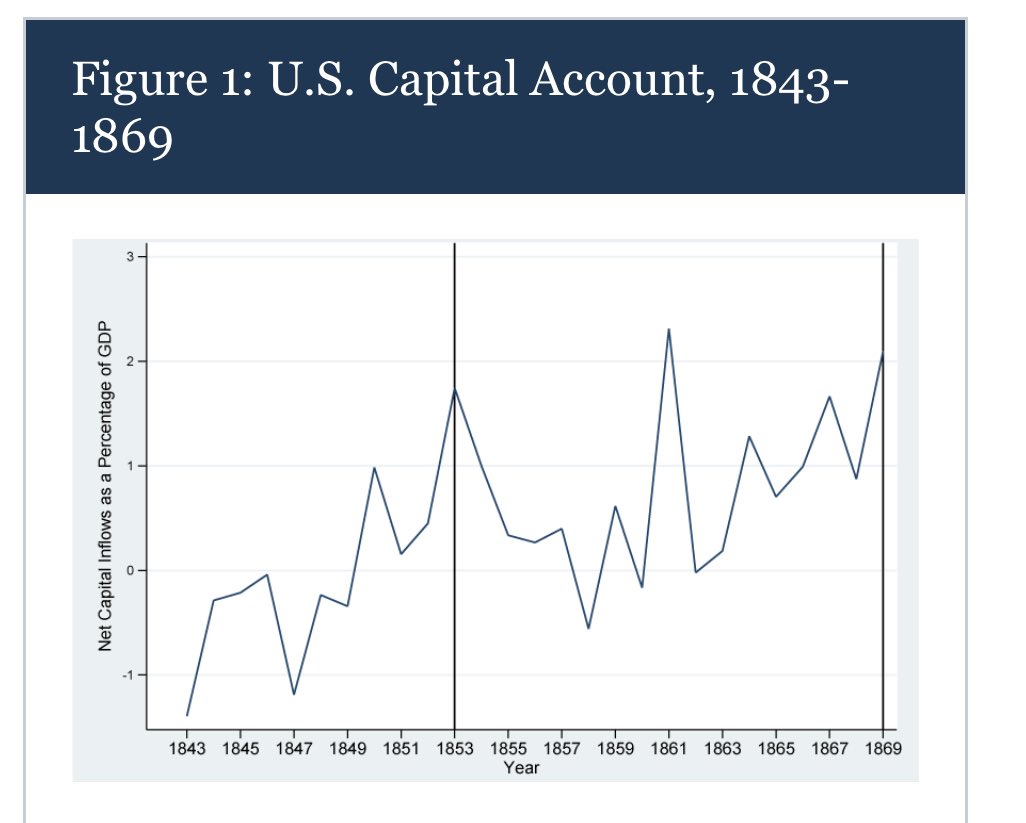

Foreign Portfolio Investment When the United States was an Emerging Market Julio Monge and Colin Weiss federalreserve.gov/econres/notes/…

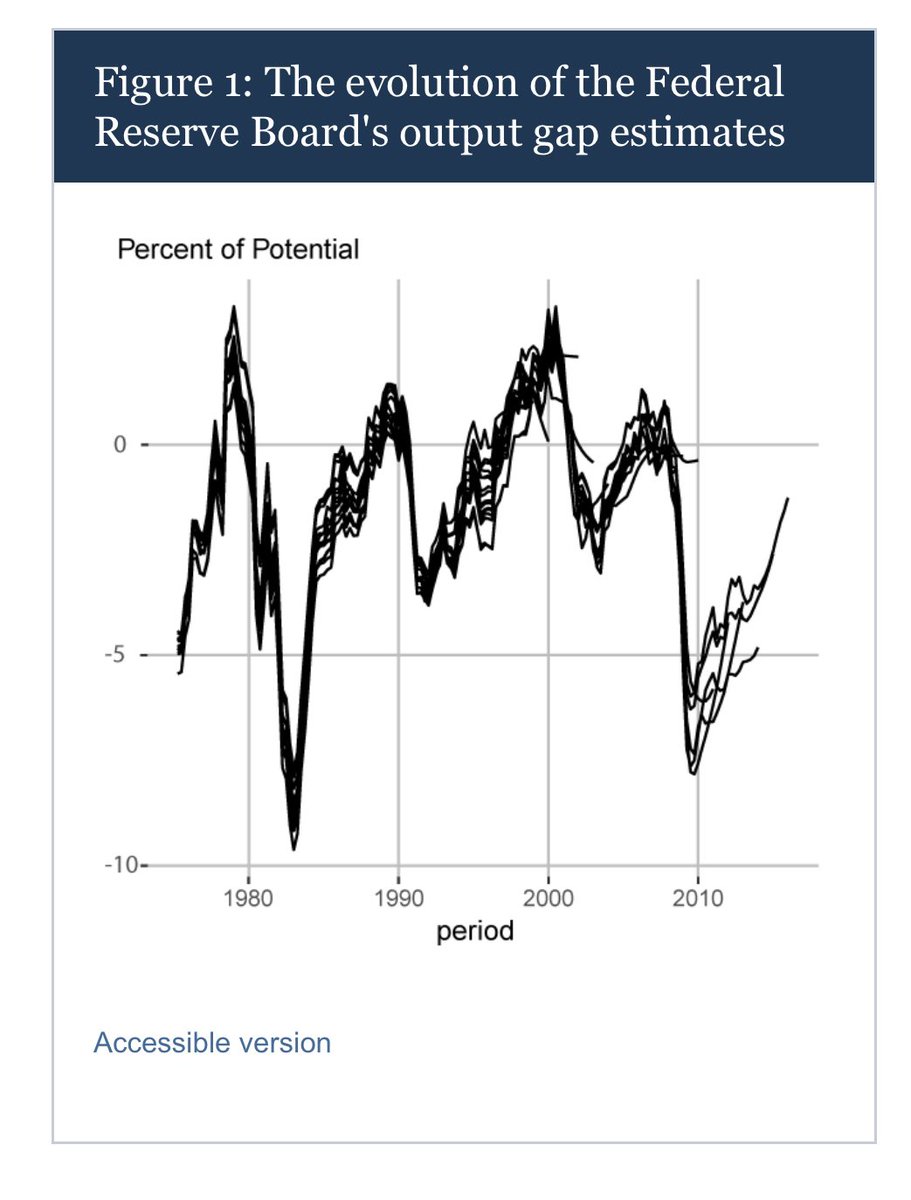

“Real-time Historical Estimates of the Output Gap” Luke Van Cleve, Jean-Philippe Laforte, and Andrea Stella federalreserve.gov/econres/notes/…

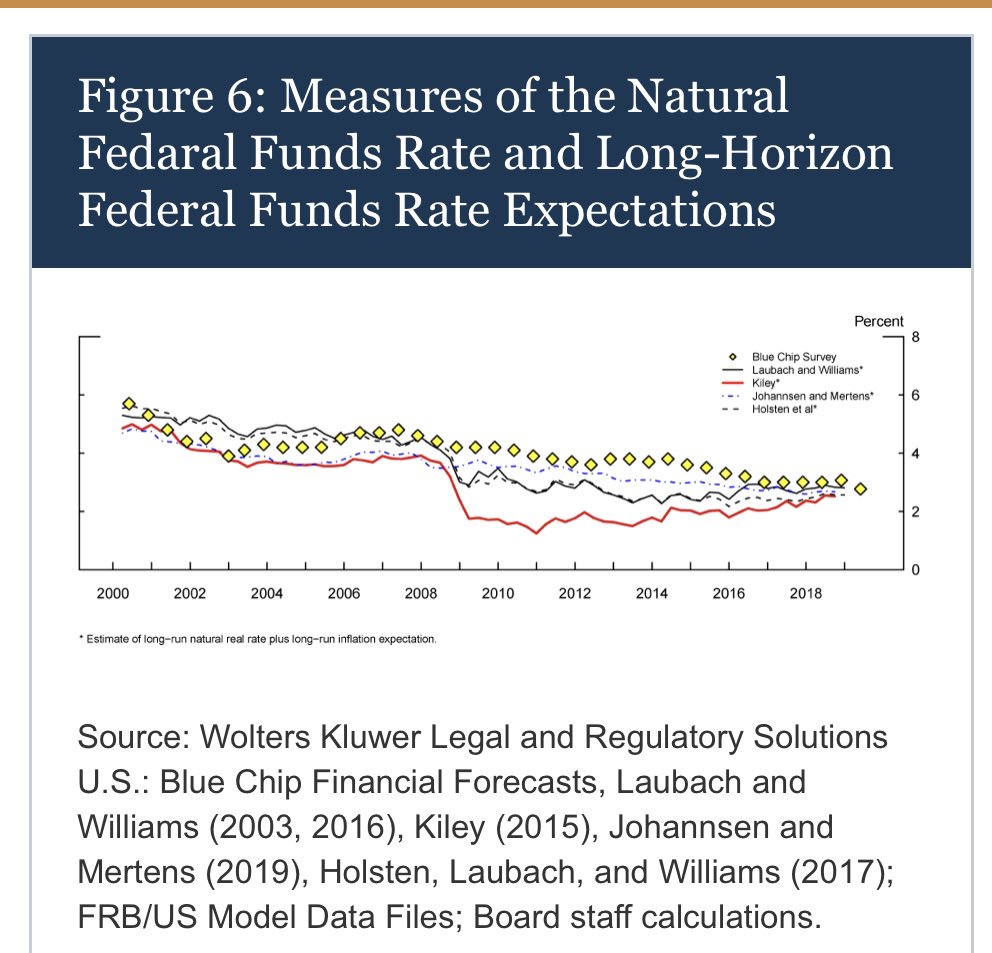

“Expectations about the Federal Funds Rate in the Long Run” by Kasper Joergensen and Andrew Meldrum federalreserve.gov/econres/notes/…

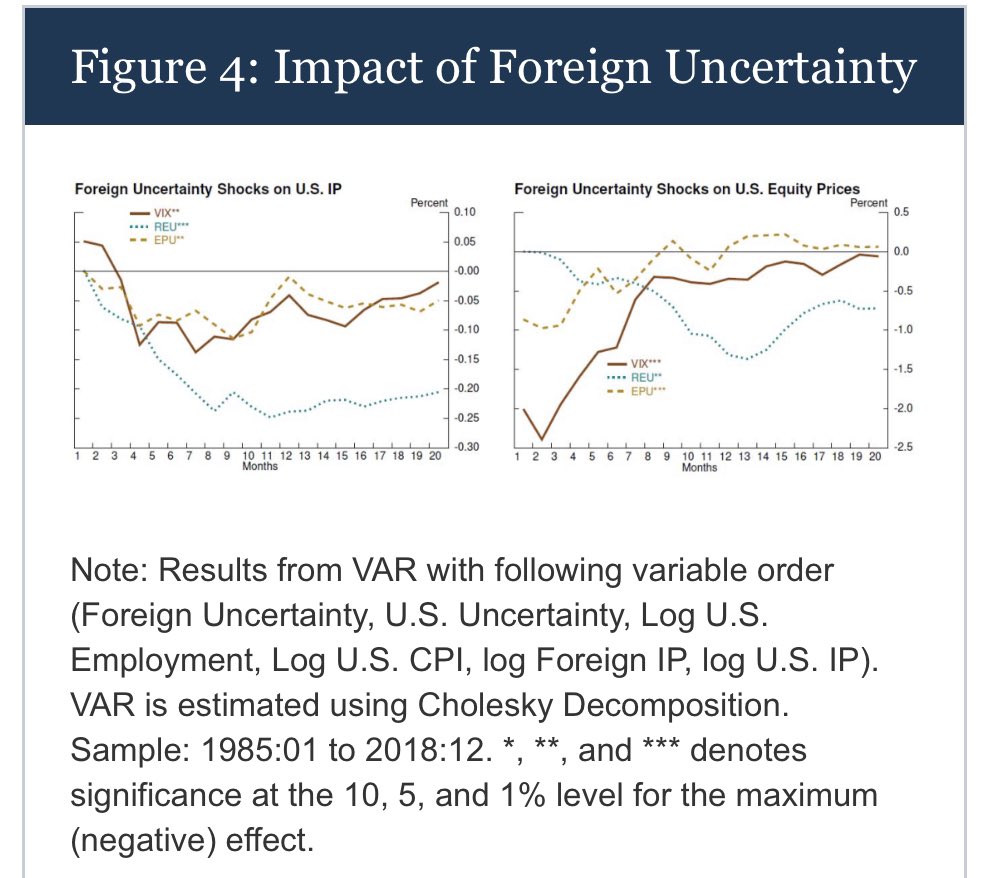

“Quantifying the Impact of Foreign Economic Uncertainty on the U.S. Economy” by Juan M. Londono, Sai Ma, and Beth Anne Wilson federalreserve.gov/econres/notes/…

United States เทรนด์

- 1. Thanksgiving 1.24M posts

- 2. Thankful 229K posts

- 3. Turkey Day 30K posts

- 4. Busta Rhymes N/A

- 5. Lil Jon N/A

- 6. Toys R Us N/A

- 7. Turn Down for What N/A

- 8. Afghanistan 234K posts

- 9. Mr. Fantasy N/A

- 10. #ProBowlVote 10.2K posts

- 11. Shaggy 3,229 posts

- 12. #Gratitude 6,812 posts

- 13. Gobble Gobble 20.1K posts

- 14. #Grateful 4,046 posts

- 15. Sarah Beckstrom 9,898 posts

- 16. Debbie Gibson N/A

- 17. Andrew Wolfe 25.9K posts

- 18. Feliz Día de Acción de Gracias 2,255 posts

- 19. Taylor Momsen N/A

- 20. Darlene Love N/A

คุณอาจชื่นชอบ

-

FedResearch

FedResearch

@FedResearch -

Cristina Arellano

Cristina Arellano

@cristinarellano -

Joseph Gagnon

Joseph Gagnon

@GagnonMacro -

Jon Steinsson

Jon Steinsson

@JonSteinsson -

ClevelandFedResearch

ClevelandFedResearch

@ClevFedResearch -

Kansas City Fed

Kansas City Fed

@KansasCityFed -

Martin S Eichenbaum

Martin S Eichenbaum

@EichMartin -

Mariacristina De Nardi

Mariacristina De Nardi

@M_De_Nardi -

Federal Reserve Bank of San Francisco

Federal Reserve Bank of San Francisco

@sffed -

David Beckworth

David Beckworth

@DavidBeckworth -

Mariano Max Croce

Mariano Max Croce

@MCroce_MacroFin -

Laura Castillo-Martinez

Laura Castillo-Martinez

@lcastillomart -

Phila Fed Research

Phila Fed Research

@PhilFedResearch -

Marco Del Negro (he, him)

Marco Del Negro (he, him)

@marcodelnegro -

Minneapolis Fed

Minneapolis Fed

@MinneapolisFed

Something went wrong.

Something went wrong.