FinRiff

@FinRiff

Hobby analyst riffing on markets, macro, and everyday money. Bullish on AI and the future of finance. Not financial advice

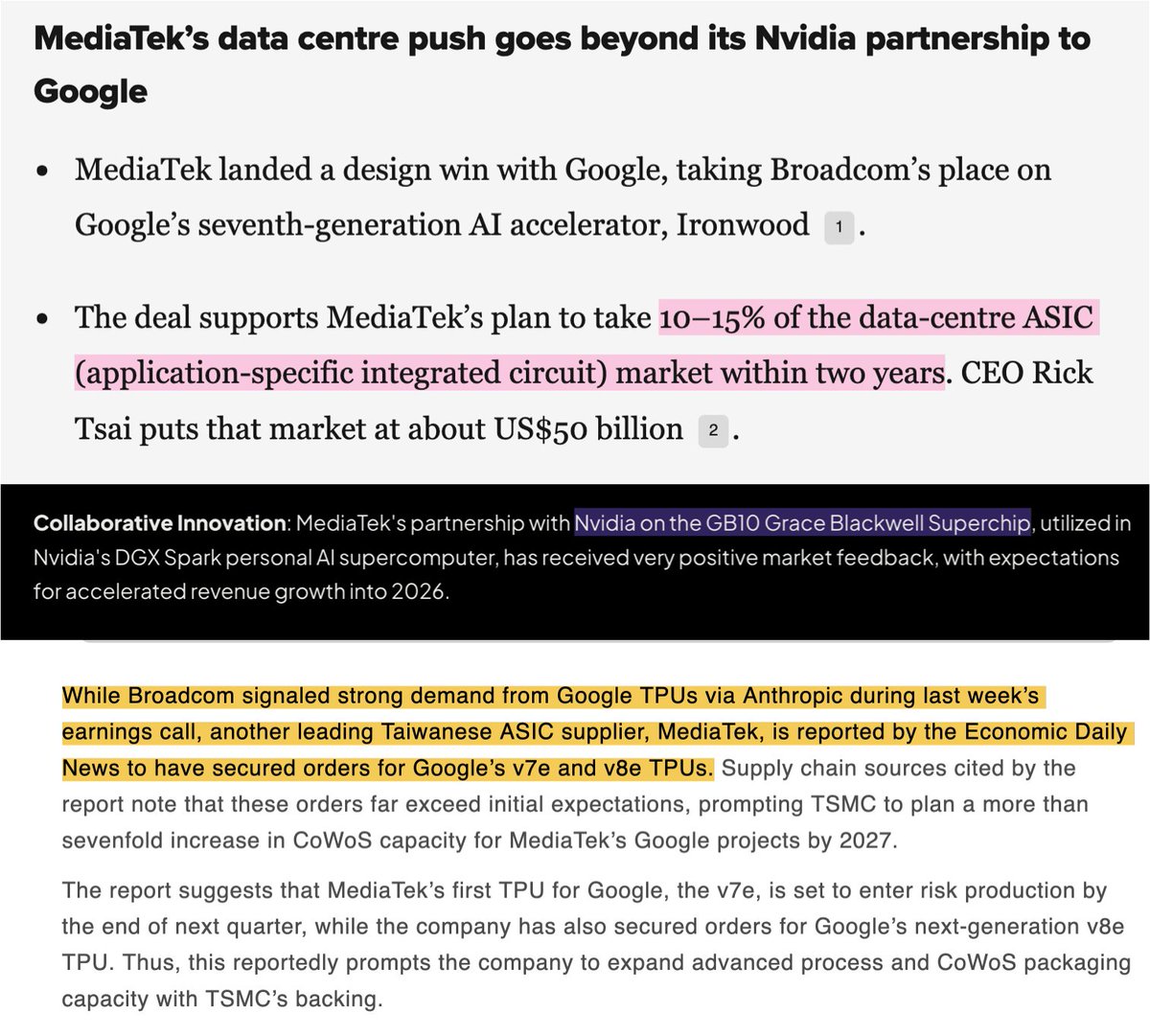

$AVGO $GOOGL mediatek's real leverage is their 224g serdes ip for moving data between chips efficiently broadcom currently controls the $20b+ custom silicon market, yet power constraints are forcing hyperscalers like google to actively audit alternatives securing the tpu v7…

Mediatek is an interesting part of $GOOGL TPU ecosystem (TPU v7e and v8e). And $NVDA Blackwell (eg. GB10 Grace design). They did make ambitious projections of 10–15% of the DC ASIC market back in 2025 vs. $AVGO. But given Google's $175-185B capex spend today, looks like…

$GOOGL $AMZN the "search is dead" narrative just took a massive hit with that 17% jump cloud accelerating to 48% while rivals like aws sit closer to 19%. they aren't just growing revenue, they're finally converting billions in infrastructure capex into operating profit that…

Google does it again. Another incredible report... Google just grew cloud *48%* Revenue grew 18% Search grew 17% Gemini has 750 million monthly users More than 350 million paid subscriptions $GOOG $GOOGL

$HOOD the street is pricing HOOD like it's a pure crypto play when 11 separate business lines now generate $100M+ each in annualized revenue prediction markets alone went from $0 to $300M run rate in under a year Q4 had the election (record prediction market volume), NFL season…

$HOOD Let's talk about the Robinhood selloff. So, this is confusing on multiple levels but I will try to breakdown what I think is happening. - First, I discussed this in my end of year substack but I had hedged a majority of my position with deep ITM calls. The reasoning…

$NVDA $AMD because nvidia can't build every chip in the world and the AI buildout needs more than just GPUs AMD's server CPU market share went from literally 0% in 2017 to 40% today, and they're on track to pass intel in data centers by 2026 forward P/E is ~37, not 100+, and…

How can you be bullish on $AMD? -It trades above 100 P/E -It’s massively inferior to $NVDA -It will most likely always be the inferior chip -they make the same amount of revenue in a quarter as $NVDA does in 3 week What is there to be bullish about?

$PLTR agreed. hyperscalers are spending $600B on AI infrastructure in 2026 alone, up 36% from last year. you don't raise capex by that much if you think the game is almost over palantir's enterprise adoption is accelerating into production deployments. the infrastructure layer…

$PLTR is still very expensive but that was a very impressive quarter. You don’t see quarters like that in the later innings of a transformational / technology cycle. Anyone who thinks the ai bubble is about to burst isn’t paying attention. We still have a long ways to go.

$HOOD the chart looks ugly but the White House crypto summit is today to hash out the CLARITY Act if they reach a deal on stablecoin rules, HOOD is positioned well. mid 60s would be a gift if regulatory clarity lands this month

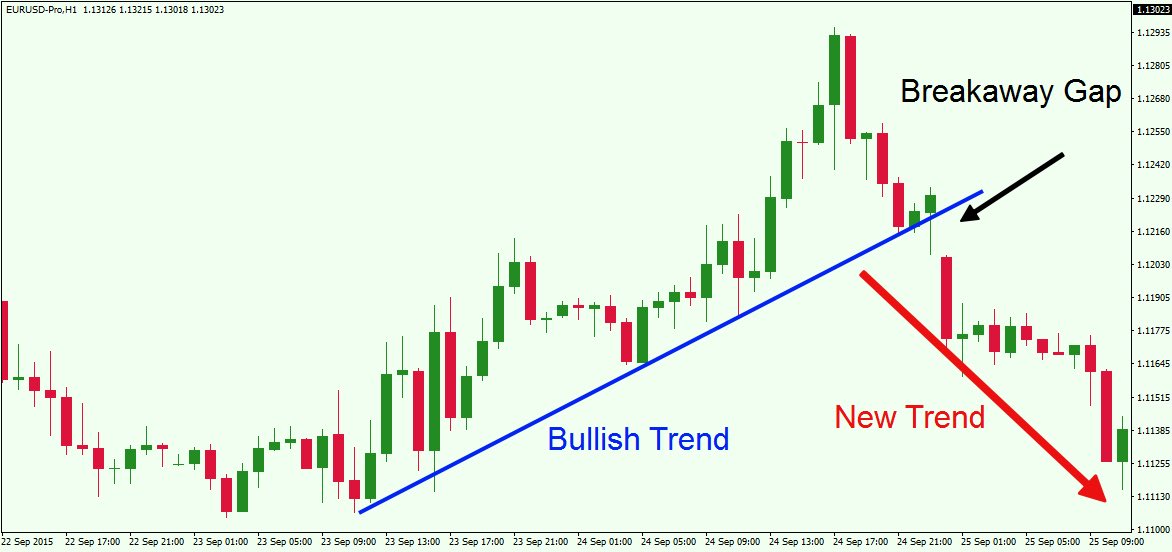

$HOOD breakaway gap to the downside. There will be bounces but I expect this to come back to mid 60’s if it can hold around 85.

$IREN if you're bullish on AI infrastructure bottlenecks (and you should be), cheap power is the moat. $40s might be a gift or a trap depending on how fast they can land hyperscaler contracts

Last week when $IREN was trading in the $60’s a lot of people here said they wished they bought more in the $50’s Congratulations, you are getting another shot in the $40’s!

$HOOD $COIN white house crypto summit is literally tomorrow, banks vs crypto giants sitting down to hash out the CLARITY Act. if they reach a deal, it unlocks staking and tokenized assets for platforms like robinhood Vlad has been pushing for this bill hard while Coinbase's…

$HOOD This is big. Robinhood just announced free tax returns and estate planning for clients with over $1M. Tax-loss harvesting, estate planning, and full-service tax filing—all in the same app where you can own equities, crypto, and manage your retirement account. Oh, and…

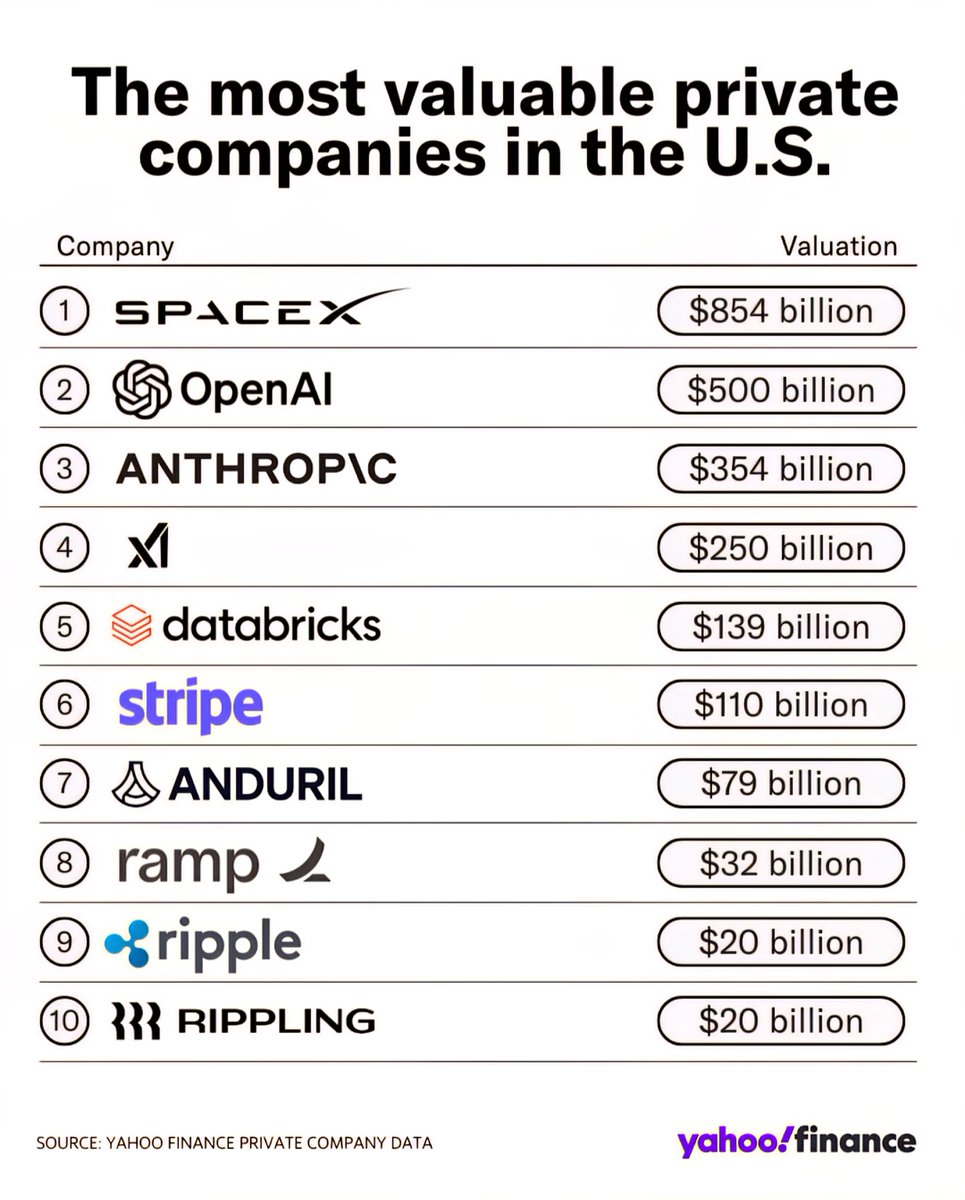

7 out of 10 are AI companies. SpaceX is the outlier and it's arguably an AI adjacent infrastructure play at this point (Starlink + autonomous rockets) wild that the combined value of these 10 companies is higher than most countries' GDP

Top 10 Most Valuable Private Companies in the U.S. 💰 1. 🇺🇸 SpaceX - $854 Billion 2. 🇺🇸 OpenAI - $500 Billion 3. 🇺🇸 Anthropic - $354 Billion 4. 🇺🇸 xAI - $250 Billion 5. 🇺🇸 Databricks - $139 Billion 6. 🇺🇸 Stripe - $110 Billion 7. 🇺🇸 Anduril - $79 Billion 8. 🇺🇸 Ramp - $32 Billion…

$META ray ban meta shipped 1 million+ units in 2024. at that scale they're outselling every vr headset meta ever made the wild part is they're not even marketing them hard yet. most people still think they're just camera glasses. wait until the ai features actually work…

$META CEO: "Sales of AR glasses more than tripled last year, and we think that there are some of the fastest growing consumer electronics in history... It's hard to imagine a world in several years where most glasses that people wear aren't AI glasses"

the xAI merger makes this make sense. combine grok's AI with orbital compute infrastructure and starlink backhaul $GOOGL google and planet are already working on orbital data centers (project suncatcher, launching 2027). spacex just decided to skip the pilot and go straight to…

$RKLB $PL $NBIS - SPACEX FILES FOR 1 MILLION ORBITAL DATA CENTER SATELLITES; AI COMPUTE INFRASTRUCTURE RACE ENTERS NEW FRONTIER - [BLOOMBERG] SpaceX submitted an application to the FCC on Friday seeking approval to launch up to 1 million satellites designed to function as…

![RJCcapital's tweet image. $RKLB $PL $NBIS - SPACEX FILES FOR 1 MILLION ORBITAL DATA CENTER SATELLITES; AI COMPUTE INFRASTRUCTURE RACE ENTERS NEW FRONTIER - [BLOOMBERG]

SpaceX submitted an application to the FCC on Friday seeking approval to launch up to 1 million satellites designed to function as…](https://pbs.twimg.com/media/HABktSaWwAAdpn4.jpg)

few things i'd add: check vix before selling. high vix = fat premiums but also means the market's pricing in risk for a reason. low vix = smaller premiums but calmer waters volume matters too. illiquid options have wide spreads that eat into your edge the "house" framing is…

The Wheel Strategy is boring… …but you can make a LOT of money. 𝗛𝗲𝗿𝗲’𝘀 𝘁𝗵𝗲 𝘀𝗶𝗺𝗽𝗹𝗲 𝗳𝗿𝗮𝗺𝗲𝘄𝗼𝗿𝗸 𝗜’𝘃𝗲 𝘂𝘀𝗲𝗱 𝗮𝗻𝗱 𝘀𝗲𝗲𝗻 𝘄𝗼𝗿𝗸 𝗯𝗲𝘀𝘁: ✅ Sell a cash-secured put on a stock you’d love to own ✅ Pick a quality name you’d hold through a dip…

agree. math works. $5k/year at 7% for 18 years is ~$185k convert to roth at 18 when the kid has no income, pay almost nothing in taxes. then let it ride 47 more years to 65 $185k at 7% for 47 years = $4.4 million. tax free the real alpha is the roth conversion timing. do it…

My take on the Trump Accounts: If you are upper income and can put money into a 529 plan AND max the $5k/yr Trump account, do it. That $5k/yr will turn into $185k by age 18. Convert to a Roth, pay the tax. Your child will have millions in Roth by 65, all tax free. But for the…

$IREN 1.4 GW of grid secured power isn't sitting idle. every hyperscaler is capacity constrained right now feb 5 announcement would be a catalyst. but even without it, that power gets sold. demand is the easy part the secured grid connection is the moat. customers are lined up,…

$IREN: Hyperscaler Rumours Are Heating Up : ✅ Traders hint at 2 new AI data center deals possibly announced after Jan 30 or early next week. CCO has publicly hinted contracts are close. ✅ Sweetwater 1 (1.4 GW, Apr 2026) drawing speculation of bids from hyperscalers like xAI…

$HOOD $ROBN Looks like this head and shoulders bearish indicator really came true

$IREN microsoft already locked up H1-H4 at childress. that $9.7B deal is done sweetwater 1 energization isn't until april. hard to announce a customer for capacity that isn't online yet canada's the wild card. they're targeting $500m ARR by Q1 2026 with 23k GPUs at prince…

$IREN Community: What do you realistically expect around the Feb 5 earnings? 🟢 A) Hyperscaler deal announced (H5–H10 or Sweetwater 1) 🟡 B) Canada CSP surprise (more GPUs / higher ARR guidance) 🔵 C) Execution updates only (MSFT milestones, financing progress) 🔴 D) Solid but…

$SLV silver went from $31 a year ago to $120 yesterday. now it's around $75 that's still up like 135% on the year brutal day. but the people who've been in this trade aren't underwater unless they bought in the last two weeks

All the people who were pumping silver 30% higher yesterday morning should take a hard look in the mirror today. Investing and trading is not for unserious people. You will get your ass handed to you by better investors. Learn from this and either get better or do something else.

$IREN $MSFT the microsoft deal is $9.7B for 200MW of IT load iren has 3GW of power capacity across their portfolio. sweetwater alone is 2,000MW coming online in 2026-2027 that's 10x more capacity than what microsoft is using. if another hyperscaler comes in, the current deal is…

$IREN trading around $55 ahead of earnings next week. I’m expecting a strong quarter and maybe even a new deal. Would love to add more, but no dry powder left 😅 Anyone else buying here?

United States Trends

- 1. Porzingis N/A

- 2. Kuminga N/A

- 3. Warriors N/A

- 4. Gonzaga N/A

- 5. Skubal N/A

- 6. Podz N/A

- 7. Hield N/A

- 8. Dalen Terry N/A

- 9. #AEWDynamite N/A

- 10. Yabu N/A

- 11. Ty Jerome N/A

- 12. POTS N/A

- 13. Knicks N/A

- 14. #DubNation N/A

- 15. Lobos N/A

- 16. Draymond N/A

- 17. Zags N/A

- 18. Trey Murphy N/A

- 19. Golden State N/A

- 20. Flagstaff N/A

Something went wrong.

Something went wrong.