Futile DCF

@FutileDCFModel

Hospitality corporate finance by day. Long only, r/r focused investor by night. | 27 |

You might like

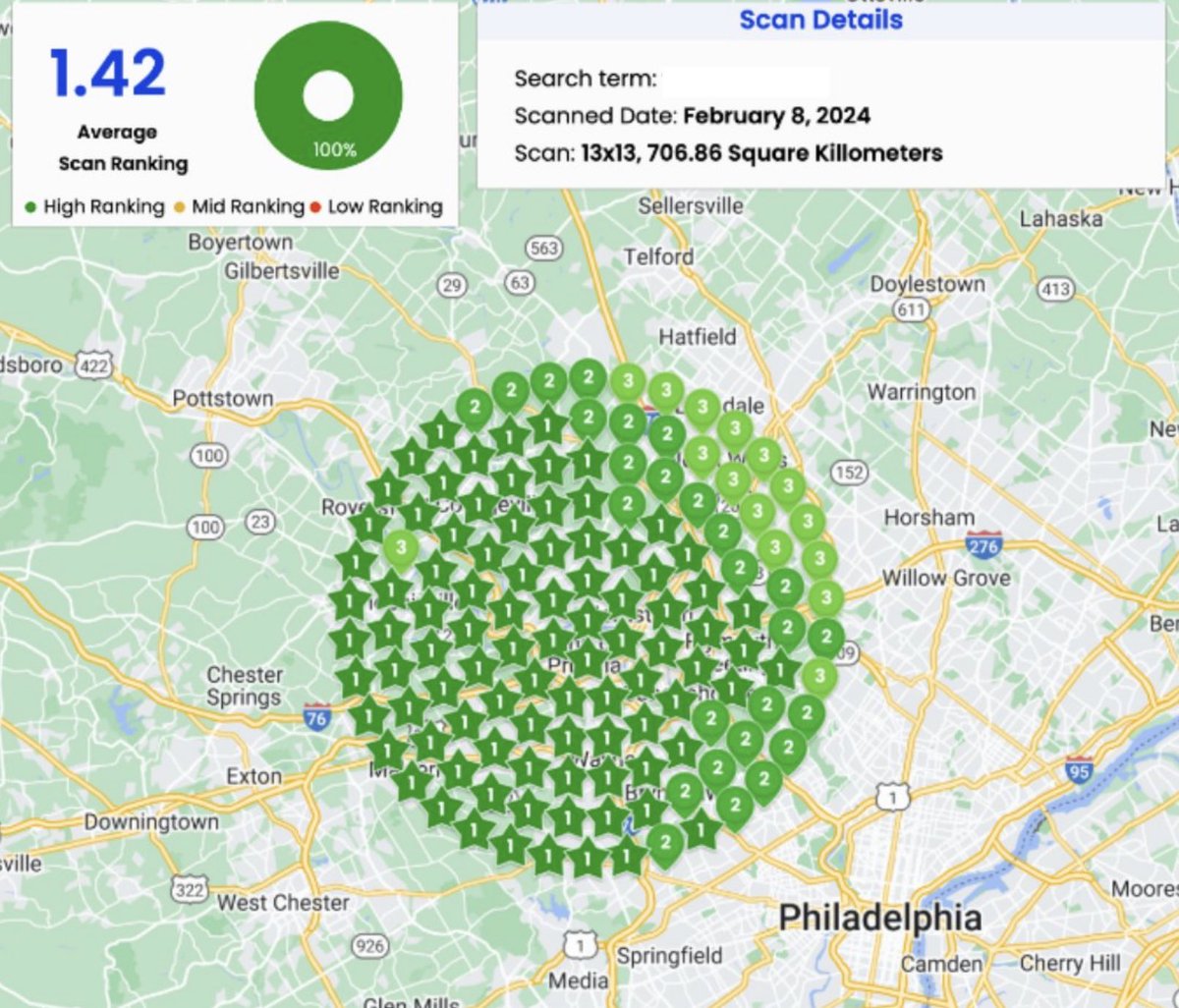

Local SEO Secrets Revealed: Over the past 24 months I’ve helped dozens of home service businesses rank #1 in their local market. I recorded a 10-minute video breaking down the exact process we use so you can do the same for your business. Like, retweet, & comment “SEO” to…

I spent 10 years learning how to use data to cut through the bs and keep your business in check. Here is the most important sheet you will ever use. FREE for 24h only. Like + ReTweet + Reply "Prime Costs". (must follow)

Contra activated. Odds we soft land now very low lmao

TL;DR Probable soft landing + Rates will be higher for longer. @theallinpod has been saying this for a while now… POWELL: Core Inflation Is Still Pretty Elevated Powell: Need to Hold Rates High for 'Some Time' Powell: Policy Has Not Been Restrictive Enough For Long Enough to…

Been not so active on here the last year. Bought a house, had a baby, promoted at work and taking on new tasks. Busy life but things are finally starting to settle down a bit. I plan to start tweeting again!

Happy to announce that my portfolio is no longer 60% china....mostly because those holdings are down 50%+ and now make up less of the portfolio😂 Still long!

Happy to announce that my portfolio is basically 60% China at this point 🙃

🤪

My portfolio allocation to $TME over the last 4+ months. What do you feel when you see this?

$LMT Had to cut this one back in April due to house buying. Happy to have the funds to add this back at a great price. CFO leaving is interesting. Abrupt for sure. Looks like either personal differences with Taclet or health issues. Very unlikely it's over financials.

$GOOG up ~1% off of stellar earnings. Market is expecting similar results from $FB. Risk/reward skewed to the downside it seems. Wouldn't be surprised if we had a leg down before moving higher. Anything less than big blowout and $FB tanks IMO.

$FB $GOOG I have to imagine after this blowout by Google that Facebook's earnings are going to be spectacular.

$MMMB +40% with the uplisting. Only a 2% position (cost basis) but still nice.

Great write up on Enthusiast. Solid work @Innovestor_ 👊

Enthusiast Gaming Deep Dive is live on my Substack! $EGLX I have spent the past 3 weeks looking into what I believe to be an interesting opportunity within the gaming/esports sector. If you enjoy, please leave a like/retweet as it helps out massively. innovestor.substack.com/p/enthusiast-g…

$SMTI Reducing exposure by half on Sanara. Getting a little expensive for my tastes. 10x EV/Sales for a company that has some execution risk. May prove to be foolish but for me it's all about setting up win-win scenarios.

My portfolio allocation to $TME over the last 4+ months. What do you feel when you see this?

$TME Increased position by 20%. Now my second largest position. Currently trading at <4x EV/Sales. Growing revenue 15-20% sustained. Gross Margin around 31-33%. Dominant position in Chinese audio market.

Watching all of the CNBC talking heads call China uninvestable has made me the most bullish on China since 2017. Excellent time to buy IMO, as long term their economy continues to outpace ours.

Sentiment very bearish in China. I would be looking at buying this week. Long term, China wants foreign investment. They will crack down down hard on certain companies that are acting against their values. Nothing has changed. $BABA $TME $TCEHY and the tech index looks 🤤

United States Trends

- 1. Veterans Day 261K posts

- 2. Veterans 415K posts

- 3. Luka 74.7K posts

- 4. Nico 126K posts

- 5. Mavs 28.9K posts

- 6. Gambit 29.3K posts

- 7. Kyrie 6,782 posts

- 8. #csm220 5,953 posts

- 9. Wike 68.4K posts

- 10. Dumont 23.3K posts

- 11. Sabonis 2,141 posts

- 12. Vets 23.3K posts

- 13. Mantis 3,944 posts

- 14. #MarvelRivals 27.4K posts

- 15. Rogue 44K posts

- 16. Venom 18K posts

- 17. #MFFL 2,290 posts

- 18. Arlington National Cemetery 12.7K posts

- 19. Shams 5,345 posts

- 20. Anthony Davis 6,364 posts

You might like

-

Cashman

Cashman

@thecashman22 -

Five Rivers Capital 🇨🇦

Five Rivers Capital 🇨🇦

@5RiversCapital -

Arham

Arham

@arhamgrowthcap -

Maxim Bogomaz

Maxim Bogomaz

@Maxim_Bogomaz -

Chips Capital

Chips Capital

@chipsndip_to -

ValueInvestor03

ValueInvestor03

@valueinvestor03 -

Falling Knife Cap

Falling Knife Cap

@mac003_c -

MyGoodLife21

MyGoodLife21

@Life21Good -

Incognito

Incognito

@IncognitusC -

MackinacCap

MackinacCap

@MackinacCap -

Avocado Capital

Avocado Capital

@Avocado_Capital -

PM

PM

@pmul1234 -

Value_Chain

Value_Chain

@OldWell17 -

VB4alpha

VB4alpha

@VB4alpha -

Amol Desai

Amol Desai

@LatticeworkInv

Something went wrong.

Something went wrong.