Market Reaper

@IdeateJS

Not trading / financial advice. Professor of economics, international trade, and hypocrite roasting.

You might like

To all the fools in the comments that think the same routine of high prices and real estate appreciation to continue only need to look at the huge loan loss provisions of big banks to show the everything bubble is already bursting. Stock market going to get the ax by Jan or Feb

BREAKING: 🚨 Michael Burry EXPOSING GLOBAL TECH SECTOR SCAM 🚩🚩 He accuses giants of cooking the books 📚 like META, Google, Amazon, Microsoft, and Oracle of inflating earnings via accounting tricks. They're extending AI server lifespans from 2–3 years to 5–6, understating…

🚩🚩 Watching "The Big Short" in 2025 is dejavu... The 2008 housing bubble feels eerily relevant with today's sky-high stock & housing valuations 🤌 In 08, the crisis stemmed from a massively overvalued housing market fueled by risky subprime loans, lax regulation, and greed…

The economy is booming.

BREAKING: Amazon to start layoff of over 30,000 employees starting from tomorrow

The WSJ describes how Tech megalomaniac Sam Altman conned today's largest Tech company CEOs into signing $650 billion in compute "deals" against a miniscule $13 billion of revenue. OpenAI Too Big To Fail (Too Small To Succeed): wsj.com/tech/ai/sam-al… Making this AI bubble the…

Another DeepSeek moment hits the tape. China continues showing how to win at AI by working smarter instead of simply piling on more brute force computing power Investors will soon wake up to reality US tech co’s spending half a trillion each year is not bullish… it’s the…

Mr. Saylor… I don’t feel so good. $MSTR

This software engineer was nearly hacked by a coding interview. I've never seen this attack channel before. Be careful out there, especially vibe coders.

X's new feed algorithm is total garbage. It's way worse than it was. I get nothing but click bait posts of people I am not even following.

Distress in the loan markets US auto loan just had their biggest monthly loss since March 2020

This is alarming. Over 60% of VC money is now going to AI companies. For reference, only 40% of the VC money went to internet companies in 1999. If those AI companies don’t start generating real revenue soon enough, investors will start stepping back. When this happens, all…

Mind boggling The car bubble is the literally collapsing Buyers with 720 credit scores are now being quoted 12% interest rates on new car loans. One year ago they could have gotten 2.9% Lenders are so afraid of the rapid deterioration of car prices they must quote these…

The $NVDA CoreWeave fraud just hit a new milestone. On September 9, $CRWV signed a $6.3 billion deal with Nvidia. Per the deal terms, Nvidia is obligated to purchase any spare capacity that CW is unable to sell to end customers. This seems to be a clever way to skirt…

Nvidia-backed CoreWeave $CRWV loses 24 cents on every dollar in sales. The company has a working capital deficit of $3.6 billion plus long-term debt of $10.6 billion. Its only asset is $NVDA GPUs which depreciate rapidly. The company survives on raising debt to fuel its losses.…

Super dangerous for a financial trading company to use that much AI generated code.

~40% of daily code written at Coinbase is AI-generated. I want to get it to >50% by October. Obviously it needs to be reviewed and understood, and not all areas of the business can use AI-generated code. But we should be using it responsibly as much as we possibly can.

Too cool of a chart not to share: $QQQ weekly trend channel. Save for the post Covid printing absurdity the lower trend line and the middle trend line have been a pivot ping pong game of precision & relevance ever since the GFC. Very impressive.

Ontario just recorded the largest outflow of non-permanent residents in Canadian history. At first glance, that headline might sound like a random stat, but it’s actually a huge deal and it has major implications for real estate, for investors, and honestly, for Canada’s…

Market Crash Indicator 30y:2y (August Final Print): This indicator, which measures the spread between the 30y & 2yr treasuries, has called the biggest crashes of the last 30 years every time it fired off...And it just fired off this afternoon...The final August monthly print for…

BREAKING NEWS: Out of the top 200 insider trades over the last week (by value). 0/200 were buy orders. I have never seen anything like this in my life.

The Japanese bond market is flashing a code red: ca.finance.yahoo.com/news/japan-bon… "In 2008, Japan was the quiet stabilizer in an unravelling world...Fast forward to 2025, and Japan is the epicentre of a potential sovereign debt crisis" Here we see U.S.-Japan bond spreads have collapsed…

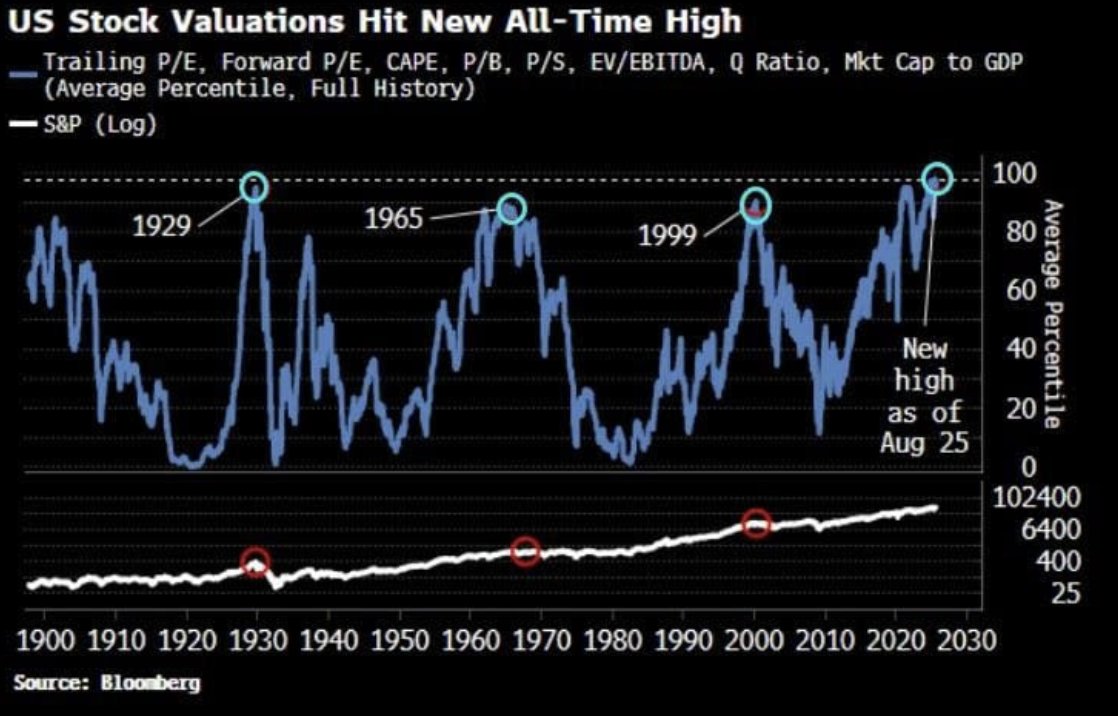

JUST IN 🚨: U.S. Stock Market hits its most expensive valuation in history, surpassing the Dot Com Bubble and the run-up to the Great Depression 🤯

This is NVDA adjusted for volatility ahead of earnings. The high price with low volatility is extremely distant from its long-term exponential growth trendline. At the current level, it seems there is more risk than reward in the short/medium term. 600% above is significant.

$SPX I call this the simulation chart. Because it's near too damn perfect dating back to 2018! Everyone in Wall Street sees it. Every Fintwitter sees it. My blind dog who died 3 years ago still sees it. We are at a critical juncture here now testing the upper line of the…

United States Trends

- 1. Good Thursday 23.3K posts

- 2. #GrabFoodMegaSalexหลิงออม 83.7K posts

- 3. GRABFOOD LOVES LINGORM 86.4K posts

- 4. SUSDT N/A

- 5. PancakeSwap BNB Chain N/A

- 6. Rejoice in the Lord 1,721 posts

- 7. Happy Friday Eve N/A

- 8. #River 5,644 posts

- 9. #WorldKindnessDay 7,403 posts

- 10. #thursdayvibes 2,104 posts

- 11. Namjoon 88.7K posts

- 12. Jokic 29.6K posts

- 13. New Zealand 14.5K posts

- 14. FELIX VOGUE COVER STAR 13.4K posts

- 15. #FELIXxVOGUEKOREA 14K posts

- 16. Mikey 57.4K posts

- 17. Rory 8,640 posts

- 18. Clippers 15.8K posts

- 19. Shai 16.3K posts

- 20. Horizon 27.9K posts

You might like

-

Zenith Bank

Zenith Bank

@ZenithBank -

Amber Kanwar

Amber Kanwar

@baystreetamber -

Gulf Business

Gulf Business

@GulfBusiness -

Merritt Black

Merritt Black

@merrittblack -

Zalmy

Zalmy

@greatstockpicks -

Yeni Şafak English

Yeni Şafak English

@yenisafakEN -

UVXYTrader

UVXYTrader

@michaellistman -

Trade_the_Matrix

Trade_the_Matrix

@TradetheMatrix1 -

M3 🦍🟨◼️⛏️🥒🏠✋️

M3 🦍🟨◼️⛏️🥒🏠✋️

@MindMakesMatter -

TabbFORUM

TabbFORUM

@TabbFORUM -

finanzmarktwelt.de

finanzmarktwelt.de

@finanzmarktwelt -

Amp Trades

Amp Trades

@Amp_Trades -

Duck and cover is not a good strategy

Duck and cover is not a good strategy

@Tshort63 -

SPX Trader

SPX Trader

@SPXTrades -

David Aron Levine

David Aron Levine

@davealevine

Something went wrong.

Something went wrong.