Infosys India Business

@InfosysIndiaBiz

Official handle of Infosys India Business Unit. Follow us to join conversations on how to #NavigateYourNext!

Dit vind je misschien leuk

Hi all, I am happy to announce my latest project with @Infosys called "Rafa Forever". Using Infosys.RafaForever.com you can create generative AI artwork of me. Let’s see your creativity with all possibilities and share it on social media using #RafaForever. #InfosysxRafa…

India Inc ranks the new #incometax portal as one of the most effective digital tax administration tools, the #Deloitte survey says.

India Inc ranks the new #incometax portal as one of the most effective digital tax administration tools, the #Deloitte survey says. Read @_janani_jana's report. bqprime.com/economy-financ…

Kind Attention Taxpayers! Last date to file Updated ITR for AY 2020-21 is 31.03.23. Don't miss this last chance! Updated ITRs for AY 2021-22 & 2022-23 can also be filed by 31.03.23 to avoid paying higher tax later. Pl refer to S. 139(8A) of IT Act, 1961. Don’t delay, file today!

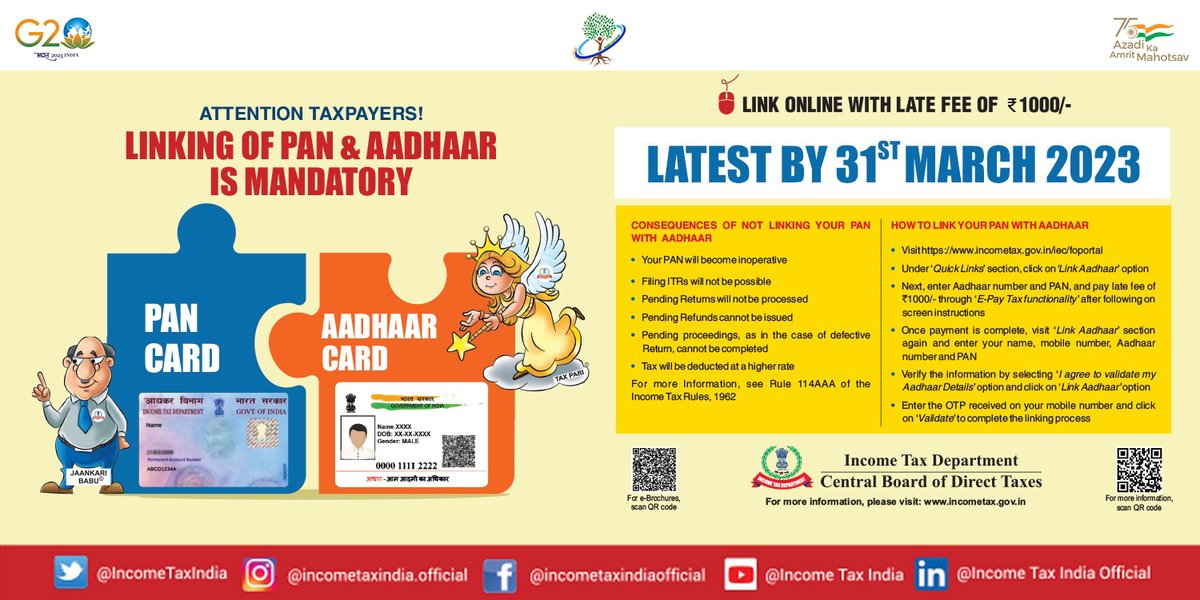

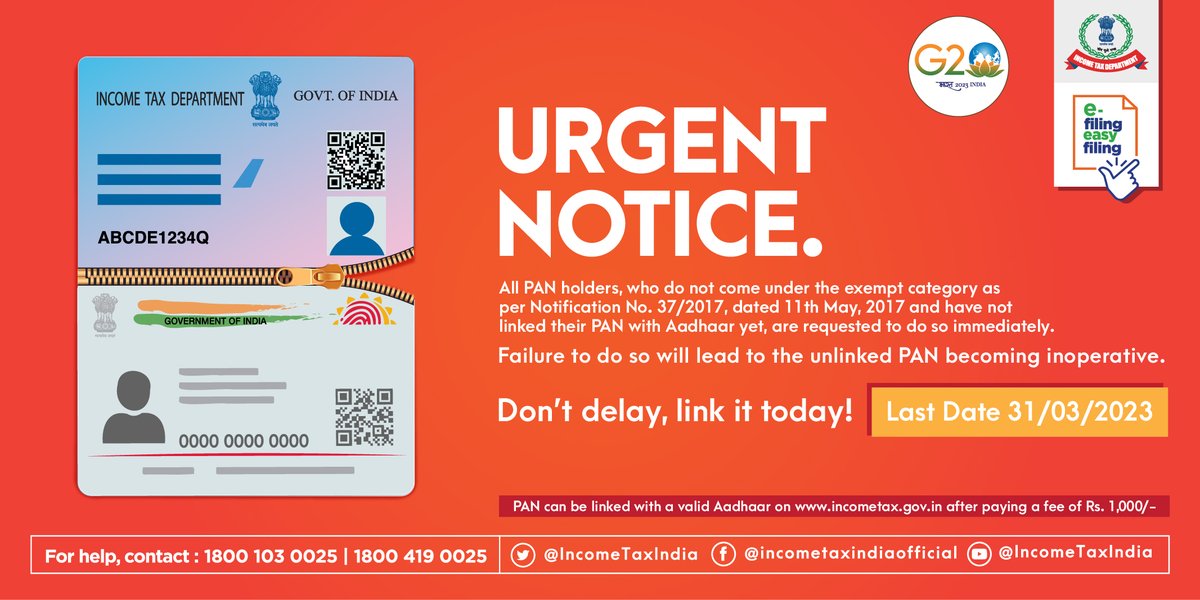

Attention Taxpayers! PAN-Aadhaar linking deadline is approaching! Please do link PAN & Aadhaar before 31.03.2023 to avoid consequences. Refer to FAQ regarding procedure to link PAN with Aadhaar: incometax.gov.in/iec/foportal/h…

पहले टैक्स रिफंड के लिए लंबा इंतज़ार करना पड़ता था। आज ITR भरने के कुछ ही दिनों के भीतर रिफंड मिल जाता है। आज GST से पारदर्शिता के साथ-साथ करदाताओं की गरिमा भी सुनिश्चित हो रही है।

As per Income-tax Act, 1961, it is mandatory for all PAN holders, who do not fall under the exempt category, to link their PAN with Aadhaar before 31.3.2023. From 1.04.2023, the unlinked PAN shall become inoperative. Urgent Notice. Don’t delay, link it today!

Gross Direct Tax collections for FY 2022-23 upto 10th January,2023 are at Rs.14.71 lakh crore, higher by 24.58% over gross collections for corresponding period of preceding yr. Net collections at Rs.12.31 lakh crore are 19.55% higher than net collections for same period last yr.

Made a presentation at #G20 on India’s digital public infrastructure & how an open,inclusive,interoperable model is accessible to all. It has ensured billions of Indians benefit through digital inclusion. Delighted that India’s tech pole vaulting was highly praised & appreciated

#ETNOWExclusive | Watch Revenue Secretary, Tarun Bajaj on GST, income tax & new initiatives by the Govt @SecyDEA @FinMinIndia @Meghnamittal23 #GST #tax @IncomeTaxIndia

Over 5 crore ITRs filed upto 8:36 pm today. Please file your ITR now, if not filed as yet. The due date to file ITR for AY 2022-23 is 31st July, 2022. #FileNow to avoid late fee. Pl visit: incometax.gov.in #ITR

The due date to file ITR is approaching! Don’t forget to file ITR for AY 2022-23 before 31st July 2022. File today and avoid the stress of filing last minute! Pl visit: incometax.gov.in #ITD #FileNow

Have you filed your ITR yet? Due date to file ITR (AY 2022-23) for salaried taxpayers & non-auditable cases is 31st July, 2022. Please don’t wait till the last date. File today. Do visit: incometax.gov.in #ITD #FileNow

The clock is ticking as the due date to file your Form 10-IC for AY 2020-21 is close! The extended due date to file Form 10-IC is 30th June, 2022. Don't wait for the last day. #FileNow Pl visit: incometax.gov.in #ITR

Did you know filing your ITR makes expanding your business easier? The Income Tax Return is an important document to avail bank loans. File your ITR and enjoy the benefits. Pl visit: incometax.gov.in #ITR #FileNow

ITR filing for AY 2022-23 is available on e-filing portal. Check your Form 26AS, AIS & other relevant documents before submission. Be an early filer. #FileNow Pl visit incometax.gov.in #ITR

The clock is ticking, the due date to file your ITR for auditable cases for AY 2021-22 is very close! The extended due date to file ITR for AY 2021-22 is 15th March, 2022. Hurry! Pl visit: incometax.gov.in #ITR #FileNow

As part of our efforts to inform & educate all stakeholders on important aspects of CPC, e-filing, processing & refunds, we are airing a 3-part series on “Returns & Refunds”. Watch the 1st episode of discussion with Dr Sibichen Mathew, DIT(CPC-ITR), at 11:30 AM today. (1/2)

Dear taxpayers, Don't miss the last chance to e-verify/verify your ITR. The last date for verification for AY 2020-21 is 28th February, 2022. Hurry! Pl visit: incometax.gov.in #ITR #VerifyNow

Have you verified your ITR after filing? Don't miss out on the last opportunity to verify your ITR for AY 2020-21. The last date for verification for AY 2020-21 is 28th February, 2022. Pl visit: incometax.gov.in #VerifyNow #ITR

The extended due date for filing Form 29C is 15th February, 2022 for furnishing the report under section 115JC of Income-tax Act, 1961. Let’s not wait till the last day. File Now! Pl visit incometax.gov.in #FileNow #eFiling

United States Trends

- 1. Comet 26.4K posts

- 2. Amorim 42.5K posts

- 3. Ugarte 11K posts

- 4. West Ham 43.7K posts

- 5. Sun Belt Billy N/A

- 6. Manchester United 44.2K posts

- 7. #MUNWHU 7,281 posts

- 8. #MUFC 19.6K posts

- 9. Sac State N/A

- 10. Cunha 16K posts

- 11. Brennan Marion 1,145 posts

- 12. Dorgu 5,385 posts

- 13. Eurovision 155K posts

- 14. Brian Cole 50.5K posts

- 15. Mainoo 11.1K posts

- 16. Dalot 11.5K posts

- 17. #TrumpAffordabilityCrisis 8,479 posts

- 18. #EndRevivalInParis 22.3K posts

- 19. Mbuemo 2,079 posts

- 20. Buster Faulkner N/A

Dit vind je misschien leuk

-

Income Tax Parody

Income Tax Parody

@IncomeTaxParody -

Top Indian Economy News

Top Indian Economy News

@IndianEcoNews -

Chartered Accountants Association, Surat

Chartered Accountants Association, Surat

@caas_org -

Faceless Compliance®

Faceless Compliance®

@FacelessCompli1 -

Bombay Chartered Accountants' Society(BCAS)

Bombay Chartered Accountants' Society(BCAS)

@bcasglobal -

PracticeGuru - Grow Tax Practice

PracticeGuru - Grow Tax Practice

@practice_guru -

All India Transporters Welfare Association 🇮🇳

All India Transporters Welfare Association 🇮🇳

@aitwa -

GSTsite

GSTsite

@GSTsite -

CA Harshil sheth

CA Harshil sheth

@CA_HarshilSHETH -

Counselvise

Counselvise

@counselvise -

Tilotama Vikram

Tilotama Vikram

@TilotamaG -

DGTS AHMEDABAD CBIC

DGTS AHMEDABAD CBIC

@AhmedabadDgts -

Lakewater Advisors

Lakewater Advisors

@LakewaterPMS -

Sudhir Parmar

Sudhir Parmar

@sudhirgparmar -

Mihir Modi

Mihir Modi

@I_AM_Mihir_Modi

Something went wrong.

Something went wrong.