InterestArb

@InterestArb

Fixed Income Arbitrage Trader & Bond Market Warrior 30+yrs. Content is not advice, views are mine. "They're panicking out there right now, I can feel it" - BRV

You might like

Not sure folks agree with this from Google's AI feature: "AI is poised to create more jobs globally than it destroys, with the World Economic Forum predicting a net gain of 78 million jobs by 2030, though some sectors face disruption and displacement, particularly for entry-level…

Gold: December Gold Futures are up a stunning $70, and now Eyeballing the $4,000 mark. Don't forget the amount being mined and annually, approximately 3,644 tonnes in 2023 and 3,661 tonnes in 2024, according to the World Gold Council.

I thought I was the only one who finds this disconcerting

Gold's parabolic move toward $4,000 is sending a warning signal to the traditional financial system: developed-market nations are losing clout as being good stewards of capital.

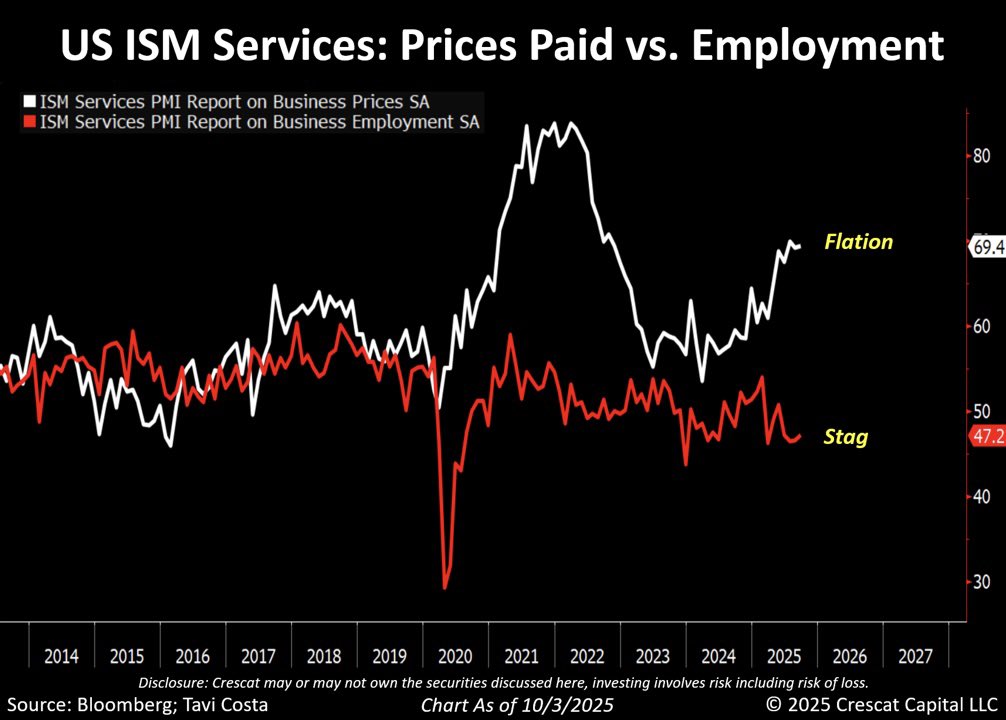

Fed will look at this within the scope of their Dual Mandate, and put significantly more weight on the employment side of the equation, hence erring on the side of lower rates / more accommodative policy.

Deeply stagflationary. The latest ISM Services report was a clear display of the Fed’s predicament. The prices paid component is now pushing toward the 70 handle, while employment has dropped well below 50. And remember, this reflects services, not goods. On the goods side —…

Concentration of Risk in Equities on going....... Fidelity's Blue Chip Growth fund has 61% of it's value in it's top 10 holdings. By Comparison, Vanguard's Total Bond Market Index Fund ETF has 4.1% of it's value in it's top ten holdings.

Not sure how this is good, unless you are long! Silver $48 Gold north of $3,900

Metals: Silver and Gold both still have a major woody and hovering at tops..........

Crude Oil Futures Eyeballing $60 This could be helpful for the Inflation outlook and the Fed!

No one is going to work and then never get paid for it, the hardship is the payment delay.....

Stop the Insanity: Federal employees who are required to work during a government shutdown who do not receive their paychecks on time, and are considered "excepted", must report for duty; their payments are delayed until after the shutdown ends and a funding deal is reached. "A…

Stop the Insanity: Federal employees who are required to work during a government shutdown who do not receive their paychecks on time, and are considered "excepted", must report for duty; their payments are delayed until after the shutdown ends and a funding deal is reached. "A…

Thanks for sharing Bill, go 9ers!

My latest Investment Outlook. Some 49ers agony and AI cannibalism, along with a few investing ideas. I still like the tax-deferred yields on MLP pipelines, as well as mortgage REITs and an imminent takeover candidate. But be cautious with AI “malinvestment”.…

Many companies are currently positioned where they do not need to add staff in order to grow. AI and other technology improvements, as well as enhanced efficiency are paving the way!!!!!

No way to describe this other than to say the economy is slowing down.

NatGas: Does not want to be left out of the mania, Futures up 17C, Eyeballing $3.50

Trump announces ‘TrumpRx’ site for discounted drugs and deal with Pfizer to lower prices cnn.com/2025/09/30/pol…

Gold: December Gold Futures up another $40 as they bust through $3,900, the freight train rolls on!!!!!

Doesn't feel like stocks are rallying on 50-75bp's of rate cuts!

United States Trends

- 1. Auburn 45.8K posts

- 2. Brewers 64.9K posts

- 3. Georgia 68.2K posts

- 4. Cubs 56.2K posts

- 5. Utah 25.3K posts

- 6. Kirby Smart 8,297 posts

- 7. Gilligan 6,042 posts

- 8. #byucpl N/A

- 9. Arizona 42K posts

- 10. #AcexRedbull 4,064 posts

- 11. #BYUFootball 1,012 posts

- 12. Michigan 63.1K posts

- 13. #SEVENTEEN_NEW_IN_TACOMA 30.1K posts

- 14. Wordle 1,576 X N/A

- 15. #Toonami 2,940 posts

- 16. Hugh Freeze 3,255 posts

- 17. Boots 50.8K posts

- 18. Amy Poehler 4,702 posts

- 19. Dissidia 6,061 posts

- 20. Holy War 2,286 posts

You might like

-

Ed Bradford

Ed Bradford

@Fullcarry -

Peter Tchir

Peter Tchir

@TFMkts -

Scott Skyrm

Scott Skyrm

@ScottSkyrm -

zeibars

zeibars

@zeibars -

Dow

Dow

@mark_dow -

Joseph Lavorgna

Joseph Lavorgna

@Lavorgnanomics -

Howard Silverblatt

@hsilverb -

LongConvexity

LongConvexity

@LONGCONVEXITY -

Yield Curve

Yield Curve

@TenYearNote -

Rishi Mishra

Rishi Mishra

@aRishisays -

@AcrossTheCurve

@AcrossTheCurve

@acrossthecurve -

UB Trader

UB Trader

@UBTrader -

John Kiff

John Kiff

@Kiffmeister -

MacroKurd

MacroKurd

@macrokurd -

Michael McDonough

Michael McDonough

@M_McDonough

Something went wrong.

Something went wrong.