Invest Decoder

@Invest_Decoder

Decoding markets for people who think before they invest. Weekly insights for smart investors. 📥 Get the newsletter → http://investdecoder.com

“Sure, we cut—but don’t count on another.” That’s Powell’s message, and markets heard it loud and clear. With the Fed signaling caution, optimistic tech bets and soft landing hopes may already be priced in. Stay nimble, the real driver now is central bank tone. #macro

“Nvidia just flirted with $5T in market cap—and it’s not just hype driving it. AI momentum, product strength, and tech dominance are reshaping the investment landscape.” Big tech’s grip tightens. Stay focused. #investing #tech

"Securing rare earths outside China's grip? The US-Japan pact signals a strategic shift in critical mineral supply—and a hedge against future tech and energy shocks. As #FOMC and Amazon layoffs loom, are markets pricing in too smooth a landing?" #macro #investing

“Markets are rallying like peace is breaking out.” A thaw in U.S.-China relations, record highs on Wall Street, and AI-fueled earnings optimism ahead. All this with the Fed poised to cut rates—with one eye closed, thanks to the data blackout. Stay focused, not euphoric.

Tesla beat on revenue—but profits dropped 25% as margins thinned, sending shares lower pre-market. At the same time, new U.S. sanctions on Russian oil giants jolted crude prices higher. In a market craving clarity, are we bracing for more volatility ahead? #investing #macro

Tesla’s Q3 profits slid 40% as price cuts ate into margins—even as revenues beat. Add in Musk’s $1T pay pitch and robotaxi ambitions, and investors face a key question: is the focus on future vision coming at the cost of near-term discipline? #stocks #investing

Gold just saw its sharpest one-day drop in years—an echo of market unease as earnings season heats up. With Tesla's Q3 report looming and AI in focus, will Big Tech guide sentiment or deepen the uncertainty? #markets #investing

"Markets don’t rise on hope alone—they need data." Investors are cautiously optimistic ahead of this week’s inflation print and the Fed’s decision. Stay grounded—watch the signs, not just the sentiment.

TSMC’s Q3 profit up nearly 40%—AI is fast becoming semiconductors' strongest tailwind. As chipmakers ride this wave, investor appetite for tech hardware is returning. Amid U.S.-China tensions, is AI demand strong enough to offset geopolitical risk? #semiconductors #AI

“Geopolitical shadows deepen—markets flinch, but the banks stand tall.” As trade tensions flare, investors retreat to Treasuries and sell risk; yet JPMorgan and peers deliver solid Q3s. Flight to safety or selective resilience? Stay focused. #markets #earnings

TSMC’s Q3 profit jumped nearly 40%, lifting its outlook and tech market sentiment—another signal that AI demand is still running hot. But with renewed U.S.-China trade tensions, will the rally clash with a fresh macro headwind? #tech #investing

"Strong bank earnings speak to economic resilience. A 44% jump in Morgan Stanley’s investment banking fees and record-high gold suggest optimism—but hedged with caution. Are markets betting on growth or bracing for disruption? #macro #investing"

“Strong bank earnings can steady the ship—but not if geopolitical seas keep rising.” Tariff tension and trade worries are rattling risk assets despite JPMorgan and friends beating the Street. Investors may need to check their assumptions.稳中求进。

“Markets bounce on optimism, but the ground is still shaky beneath.” Rising futures and chip stocks suggest short-term relief, yet Morgan Stanley’s warning reminds us that trade tensions remain a serious risk. Stay calm, stay informed.

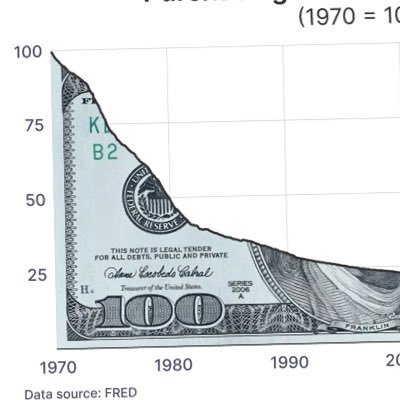

“Gold doesn’t rally 50% in a year without sending a message.” Investors are crowding into safety as fiscal risks rise and Fed credibility wobbles. When the oldest hedge in the book leads the pack, what are the markets preparing for? #macro #investing

Gold breaks $4,000/oz—up 50% YTD—as fears mount over fiscal instability, Fed independence, and trade tensions. It’s the metal's best run since the '70s. Is this a new regime for #markets, where safety trumps growth—and gold regains its seat at the core of portfolios?

"AMD just stepped onto Nvidia's turf—and brought OpenAI with it." A major chip deal reshuffles the AI hierarchy as investors rotate into fresh sectors. Trim the froth, follow the flows. #AI #investing

“Nvidia isn’t the only game in town.” With OpenAI backing AMD’s Instinct GPUs, the AI hardware race just got real. Tech stocks surged, markets rallied—and the narrative is shifting. Are we entering a new phase of #AI market leadership?

OpenAI just hit a $500B valuation—another sign that AI hype is more than noise. Tech stocks rallied, lifting the S&P 500 to fresh highs. But with stretched valuations and sticky inflation, are markets pricing in perfection? #AI #markets

"Stocks climb while the lights flicker in Washington." Markets hit record highs as AI tailwinds override political gridlock and data gaps. Tech is leading—but can the rally endure without a clear read on jobs and the Fed? Stay nimble. #macro #AIinvesting

United States Trendy

- 1. Halloween 3.14M posts

- 2. #DoorDashTradeorTreat 1,754 posts

- 3. #sweepstakes 2,856 posts

- 4. #smackoff 2,264 posts

- 5. #SwapSilently 8,619 posts

- 6. ESPN 82.4K posts

- 7. Disney 99.4K posts

- 8. Jessica Lange 39.6K posts

- 9. YouTube TV 47.5K posts

- 10. Hulu 23.5K posts

- 11. Trick or Treat 449K posts

- 12. Candy 254K posts

- 13. Monangai 1,451 posts

- 14. Coven 12.6K posts

- 15. YTTV 2,600 posts

- 16. Judges 88.1K posts

- 17. Billy Bob 5,520 posts

- 18. Julia Fox 2,331 posts

- 19. Sicario 3,978 posts

- 20. Christians in Nigeria 50.6K posts

Something went wrong.

Something went wrong.