Tesla’s Q3 profits slid 40% as price cuts ate into margins—even as revenues beat. Add in Musk’s $1T pay pitch and robotaxi ambitions, and investors face a key question: is the focus on future vision coming at the cost of near-term discipline? #stocks #investing

Gold just saw its sharpest one-day drop in years—an echo of market unease as earnings season heats up. With Tesla's Q3 report looming and AI in focus, will Big Tech guide sentiment or deepen the uncertainty? #markets #investing

"Markets don’t rise on hope alone—they need data." Investors are cautiously optimistic ahead of this week’s inflation print and the Fed’s decision. Stay grounded—watch the signs, not just the sentiment.

TSMC’s Q3 profit up nearly 40%—AI is fast becoming semiconductors' strongest tailwind. As chipmakers ride this wave, investor appetite for tech hardware is returning. Amid U.S.-China tensions, is AI demand strong enough to offset geopolitical risk? #semiconductors #AI

“Geopolitical shadows deepen—markets flinch, but the banks stand tall.” As trade tensions flare, investors retreat to Treasuries and sell risk; yet JPMorgan and peers deliver solid Q3s. Flight to safety or selective resilience? Stay focused. #markets #earnings

TSMC’s Q3 profit jumped nearly 40%, lifting its outlook and tech market sentiment—another signal that AI demand is still running hot. But with renewed U.S.-China trade tensions, will the rally clash with a fresh macro headwind? #tech #investing

"Strong bank earnings speak to economic resilience. A 44% jump in Morgan Stanley’s investment banking fees and record-high gold suggest optimism—but hedged with caution. Are markets betting on growth or bracing for disruption? #macro #investing"

“Strong bank earnings can steady the ship—but not if geopolitical seas keep rising.” Tariff tension and trade worries are rattling risk assets despite JPMorgan and friends beating the Street. Investors may need to check their assumptions.稳中求进。

“Markets bounce on optimism, but the ground is still shaky beneath.” Rising futures and chip stocks suggest short-term relief, yet Morgan Stanley’s warning reminds us that trade tensions remain a serious risk. Stay calm, stay informed.

“Gold doesn’t rally 50% in a year without sending a message.” Investors are crowding into safety as fiscal risks rise and Fed credibility wobbles. When the oldest hedge in the book leads the pack, what are the markets preparing for? #macro #investing

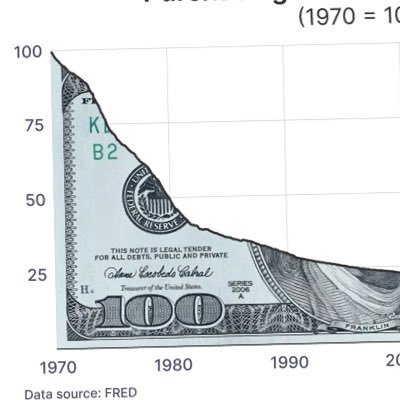

Gold breaks $4,000/oz—up 50% YTD—as fears mount over fiscal instability, Fed independence, and trade tensions. It’s the metal's best run since the '70s. Is this a new regime for #markets, where safety trumps growth—and gold regains its seat at the core of portfolios?

"AMD just stepped onto Nvidia's turf—and brought OpenAI with it." A major chip deal reshuffles the AI hierarchy as investors rotate into fresh sectors. Trim the froth, follow the flows. #AI #investing

“Nvidia isn’t the only game in town.” With OpenAI backing AMD’s Instinct GPUs, the AI hardware race just got real. Tech stocks surged, markets rallied—and the narrative is shifting. Are we entering a new phase of #AI market leadership?

OpenAI just hit a $500B valuation—another sign that AI hype is more than noise. Tech stocks rallied, lifting the S&P 500 to fresh highs. But with stretched valuations and sticky inflation, are markets pricing in perfection? #AI #markets

"Stocks climb while the lights flicker in Washington." Markets hit record highs as AI tailwinds override political gridlock and data gaps. Tech is leading—but can the rally endure without a clear read on jobs and the Fed? Stay nimble. #macro #AIinvesting

“Shutdown fears? Shrugged off. Tech and healthcare? Leading the charge.” With October underway, record highs show investors clinging to momentum—and history hints at more strength before turbulence brews. Stay focused, not fearful. #stocks #investing

“Google keeps Chrome, Apple keeps the partnership, and AI search heats up.” With bond yields nearing 5% and tech risk easing, investors face a new mix of tailwinds and tremors. Stay selective — the next search race may look very different. #tech #macro

"Markets climb while Washington wobbles." September wrapped stronger than usual, with tech and small caps leading—a sign that fundamentals are trumping fear. But with a potential shutdown looming, can momentum withstand a gap in data and added volatility? #stocks #investing

“Tariffs up, inflation steady, rate cuts possible—but not promised.” Markets are weighing policy heat against data calm. End-of-year positioning may depend on which force wins out first. #macro #investing

“Markets cheer rate cuts. Small caps rally. FedEx beats—but flags a $1B trade drag.” Global shipping may get pricier as US-China tension flares. A bullish backdrop, but policy risks aren’t done with us yet. Stay balanced. Stay tuned.

United States 趋势

- 1. Canada 328K posts

- 2. Reagan 118K posts

- 3. #FanCashDropPromotion N/A

- 4. #PoetryInMotionLeeKnow 27.8K posts

- 5. Immigration 154K posts

- 6. #FridayVibes 5,536 posts

- 7. Good Friday 68.7K posts

- 8. #FursuitFriday 12.2K posts

- 9. #askdave N/A

- 10. U-Haul 10.2K posts

- 11. Cyrene 27.7K posts

- 12. Happy Friyay 1,749 posts

- 13. Inflation 105K posts

- 14. Halle 24K posts

- 15. Tren de Aragua 19.3K posts

- 16. 3% in September 6,108 posts

- 17. MADURO LOS TIENE LOCOS 1,660 posts

- 18. Leon Thomas 6,163 posts

- 19. Lover Girl 39.9K posts

- 20. New Edition 7,280 posts

Something went wrong.

Something went wrong.