Chris

@Lexow

Citizen of Earth in the early part of the 21st Century. Ex-Brewer turned Investor. Guitar is life. My opinions are my own.

You might like

Last night, we heard @KamalaHarris and @Oprah talk with folks who were inspired to organize in their communities, and fight for the hopeful, forward-looking America we believe in. Join them: go.KamalaHarris.com

There is so much at stake in this election, and, ultimately, the question before us is: What kind of country do we want to live in? The beauty of a democracy, as long as we can hold on to it, is that each of us has the power to answer that question. go.kamalaharris.com

Months ago, we were told that the regional bank crisis is over. Now, the Regional Bank Index is down 13% YTD with New York Community Bank, $NYCB, down 63% in 1 month. Here's where it get's interesting, directly from Fed Chair Powell's interview on 60 Minutes this week: "There

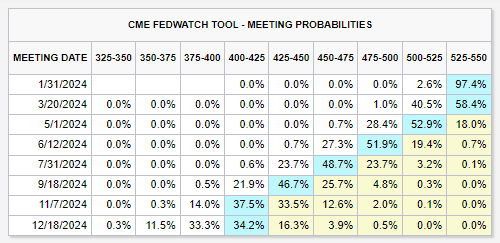

As he was pressed further, #FederalReserve Chair #Powell went back to repeating the mantra of "data dependency" and pushed back more explicitly against a March rate cut. This is fueling more questions about the risks of the #Fed being late again, albeit in a different direction.

.#FederalReserve Chair #Powell responding to the first question in the press conference -- on the #economy's path to durable 2% #inflation: "We do have confidence but we need greater confidence." He was pressed further by the next question on what this specifically means. I

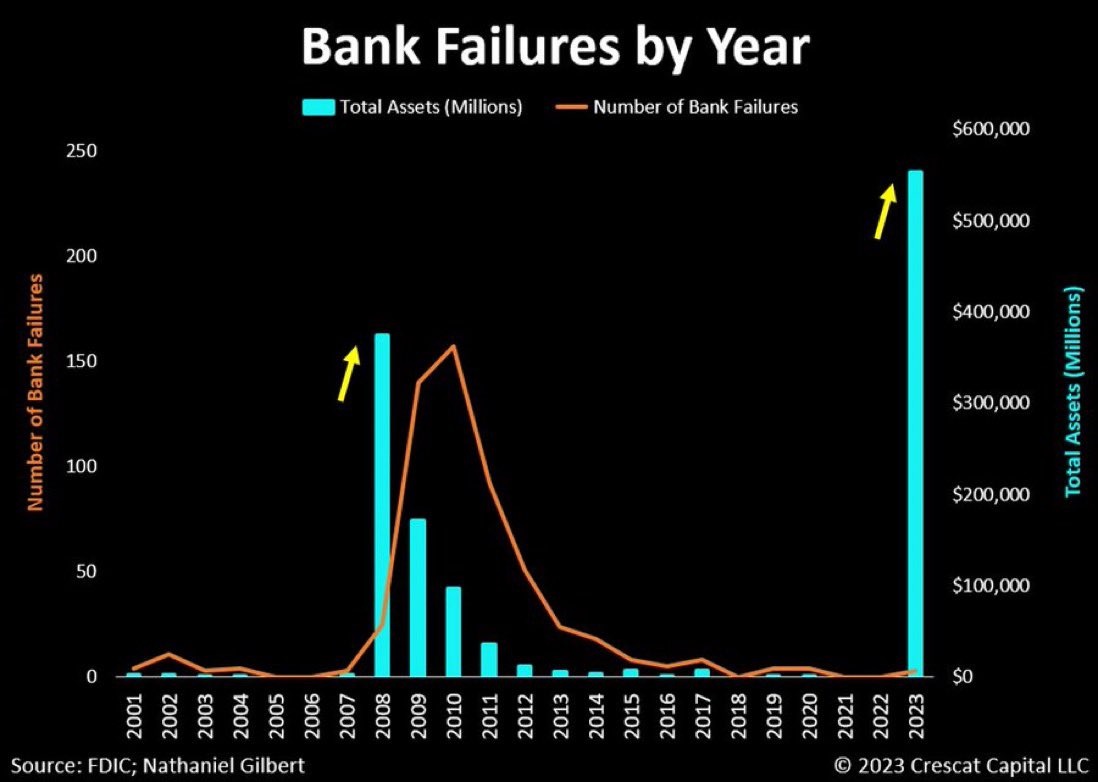

The re-emergence of issues in the banking industry is the most significant development unfolding right now. This almost perfectly follows the script we saw in 2008. In the usual sequence of events, one issue triggers another, leading to a cascading effect that evolves into a

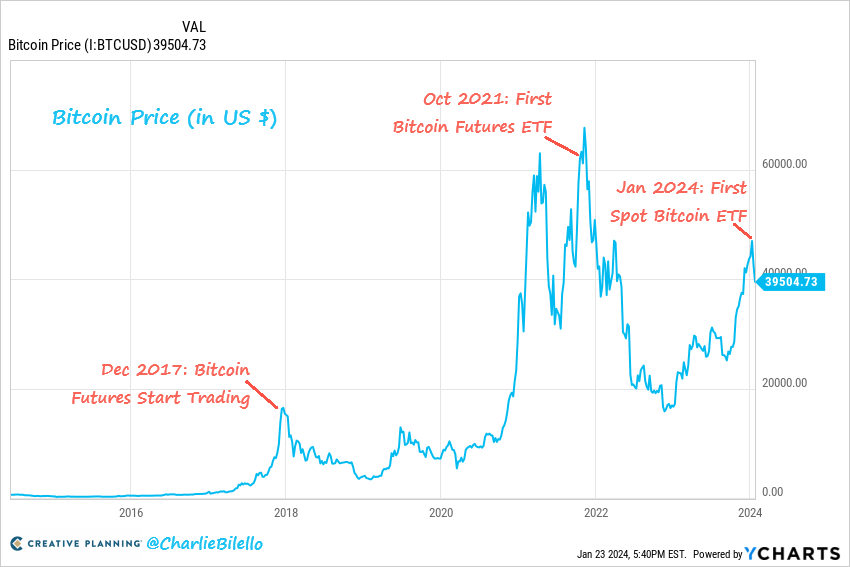

History doesn't repeat itself, but it often rhymes: -Dec 2017: Bitcoin runs up ahead of the start of Bitcoin futures trading. 84% correction follows. -Oct 2021: Bitcoin runs up ahead of the approval of the Bitcoin futures ETF. 78% correction follows. -Jan 2024: Bitcoin runs up

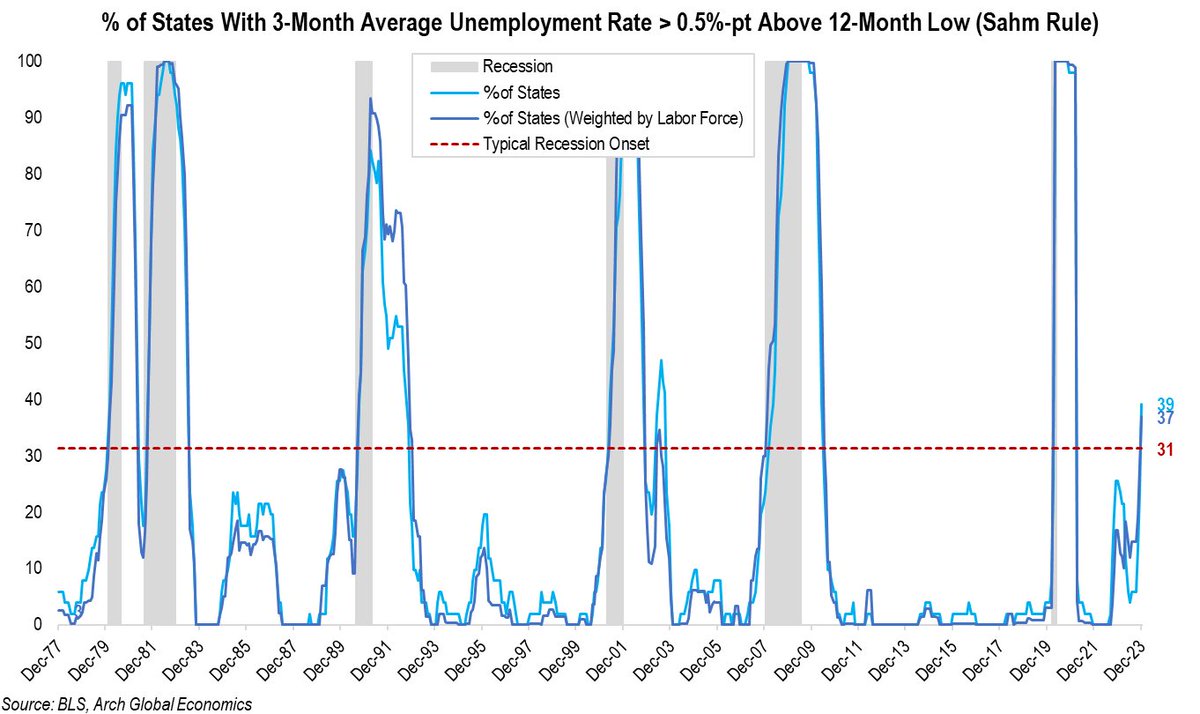

State-level unemployment rates were just released and they continue the string of bad news from the household survey. It's been a while since I've refreshed this dataset and now my updated state-level Sahm-Rule indicator is really heating back up - in fact, it's now above the

It's official: markets are no longer expecting a rate cut in March 2024. There's still a ~42% chance of rate cuts beginning in March, but this is a major shift in expectations. Just two weeks ago, markets saw a 90% chance of rate cuts beginning in March. Odds of rate cuts

US versus Chinese equities — two diverging narratives.

3 buckets in 14 seconds! A wild sequence in LA as the Nets and Clippers trade buckets in the 3Q 👀 Nets-Clippers | Live on the NBA App 📲 link.nba.com/BKNvLAC

Check out my review of BriskFire BBQ on Google Maps. Best Brisket in the greater #Atlanta area #bbq #brisket #ribs @DiscoverAtlanta @googlemaps maps.app.goo.gl/bQxuLaraoyGhZT…

Conservatives Are Having a Meltdown Over Trump and the Epstein List | The New Republic newrepublic.com/post/177828/co…

Switch 2 ‘likely to be iteration rather than revolution’, predicts analyst | VGC videogameschronicle.com/news/switch-2-…

This was one of most liked tweets: Ro Khanna introduced a reform plan that: - bans stock trading for Congress + spouses - bans Congress from lobbying - 12 year limits for Congress - ban lobbyists + PACs donations He directly mentions Unusual Whales work in fighting corruption.

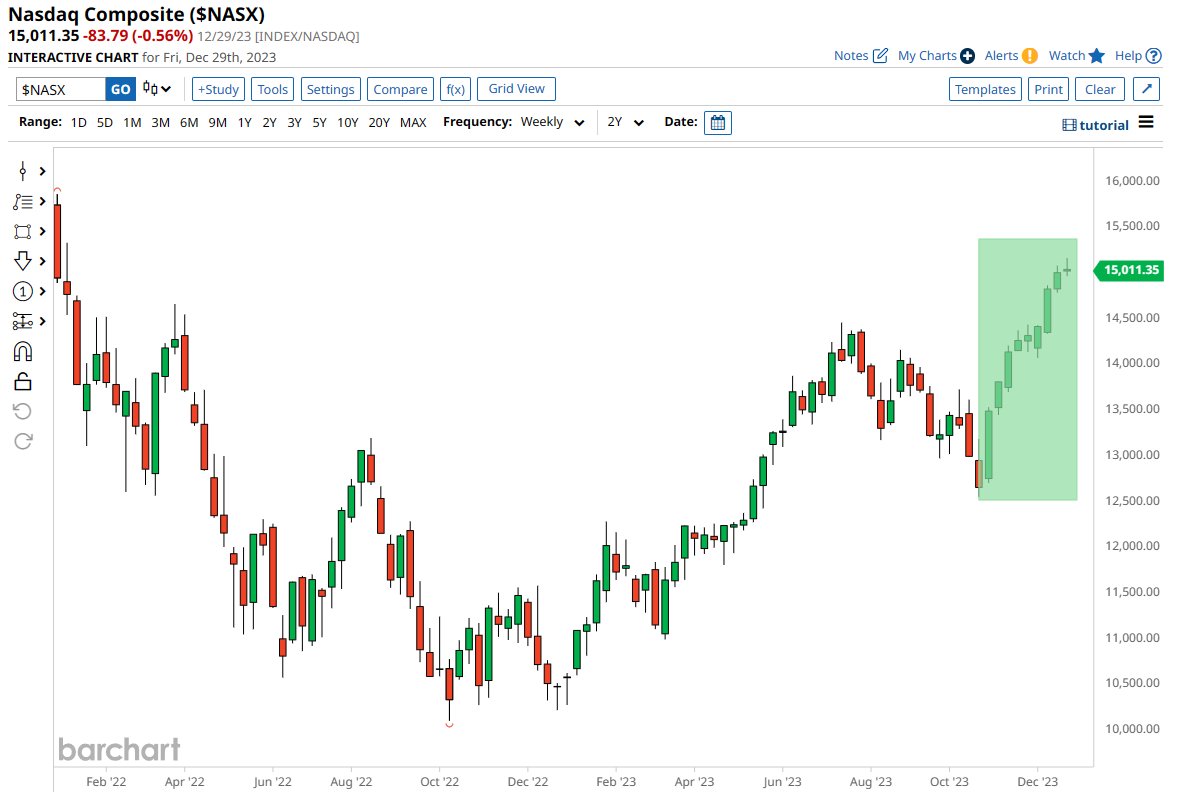

Nasdaq had its 9th consecutive green week, its longest winning streak since February 2019

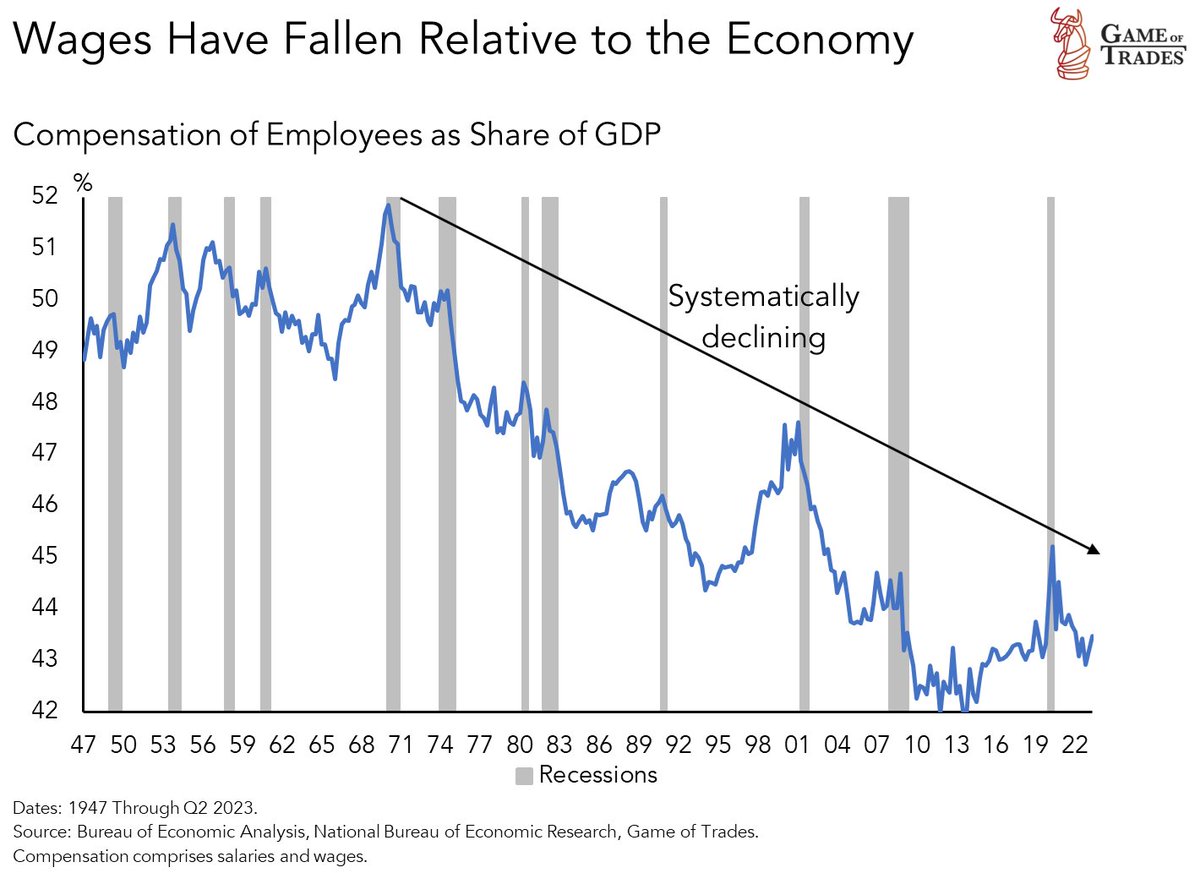

This is a very concerning trend Wages have systematically fallen relative to the economy in the last 50+ years From 1970 to 2023, employee compensation as a share of GDP decreased from 52% to 43%

Anticipation builds for restaurants, hot spots opening in 2024 griffindailynews.com/business/antic…

United States Trends

- 1. Eric Dane N/A

- 2. Baby Keem N/A

- 3. McSteamy N/A

- 4. Jamal Murray N/A

- 5. #TheTraitorsUS N/A

- 6. WE LOVE YOU TAEHYUNG N/A

- 7. Aliens N/A

- 8. Cade N/A

- 9. Pistons N/A

- 10. FRLG N/A

- 11. WITH TAEHYUNG TILL THE END N/A

- 12. Knicks N/A

- 13. #thepitt N/A

- 14. House Money N/A

- 15. Grey's Anatomy N/A

- 16. UFOs N/A

- 17. Tara N/A

- 18. FireRed N/A

- 19. Good Flirts N/A

- 20. #Casino N/A

You might like

Something went wrong.

Something went wrong.