LowIQSloth

@LowSloth

new trader of crypto currency coins (plan to 100x, currently down 98%) likes: larping, shit-talking dislikes: lactose

You might like

I prefer to think that two weeks of price action means the great decoupling has happened and also that people who cannot stomach the exceedingly small risk of losing their bank deposits now prefer putting their savings into internet coins but that’s just me

My latest: a deep dive on why no, Bitcoin isn't pumping because it's a "safe haven" from banks. Please for the love of god stop printing nonsense. newsletter.mollywhite.net/p/no-bitcoin-i…

but the existence of decentralized crypto assets with better understood supply dynamics can still be a helpful counterbalance (and check) on fiat currency imo rooting for nation-state fiat systems to fail often misses the point tbh crypto can’t replace them. not even close

more of this please!

City of Newark, New Jersey admits it got scammed into becoming “sister cities” with a fake nation. @CBSNewYork cbsnews.com/newyork/news/n…

NAILED IT: “In five years a number of banks will not be around because of blockchain technology.” -Joseph DiPaolo, Signature Bank CEO, 2018 bloomberg.com/news/articles/…

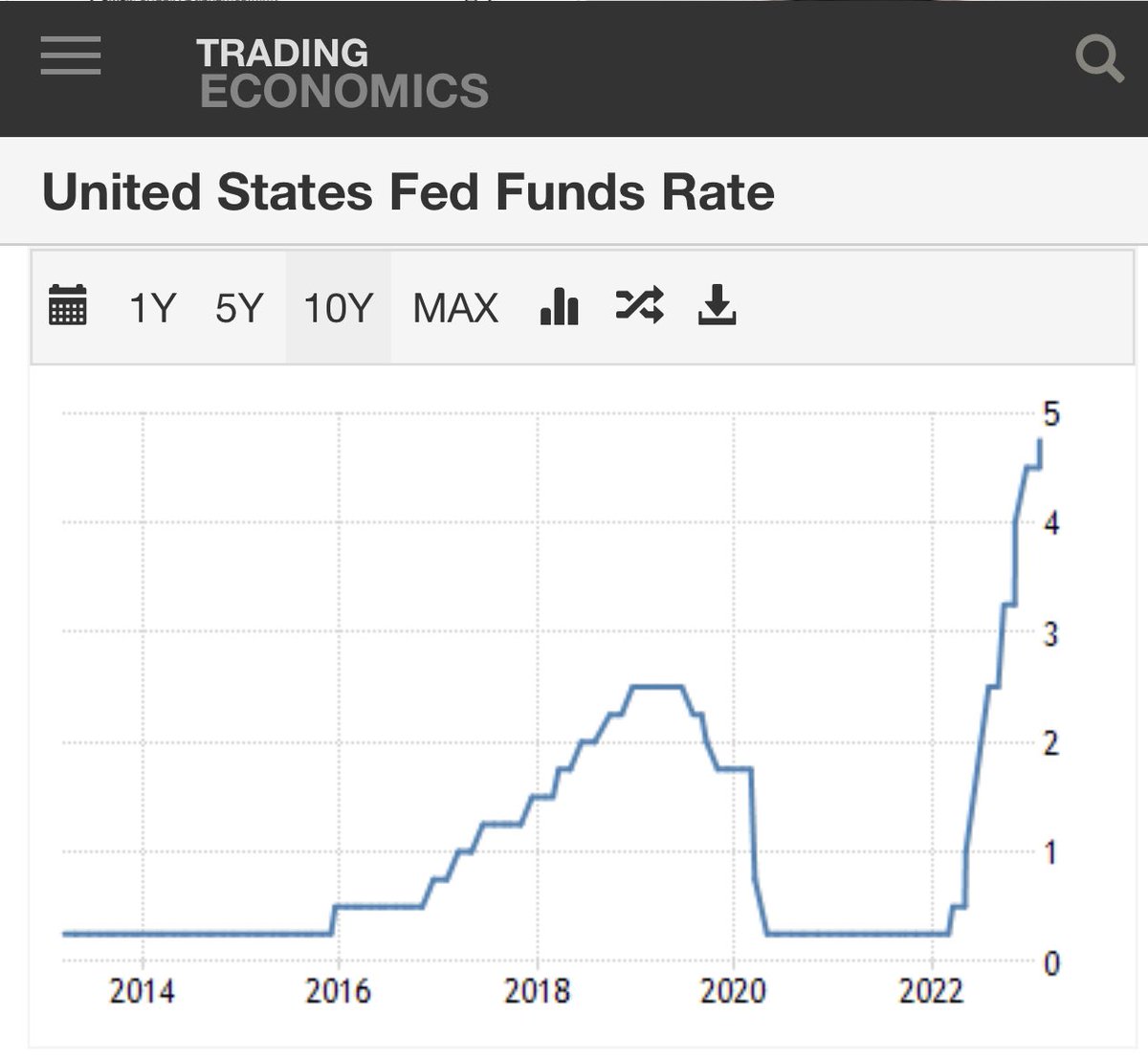

Calling US treasuries “the riskiest asset in the world” is objectively asinine. Balaji radicalizing himself in real time. Hate to see it.

Banks are failing because they bought Treasuries. Full stop. The "safest asset in the world" is the riskiest asset in the world.

evergreen tweet

big week ahead for venture capitalists finding ways to take credit for things they had nothing to do with

If managing inevitably uncertain interest rate risk seems impossibly difficult, I'd strongly advise against owning or running a very large bank.

This arguably boils down to their prediction of what the interest rate curve would look like. Would it go up, down, sideways? If you think this is easy, then a good exercise is to sketch out your predicted curve for the next few years. If you nail it you can make billions 🙂

There is no group of people making the full recovery of SVB deposits less likely than the All In podcast vc crew screaming from a rooftop for a bailout and blaming…Ukraine???

If you don’t declare my bank “too big to fail” too, then the only banks left standing will be too big to fail totes

The US banking system is on the cusp of being concentrated in a handful of politically connected “too big to fail” banks. One wonders if that’s the point.

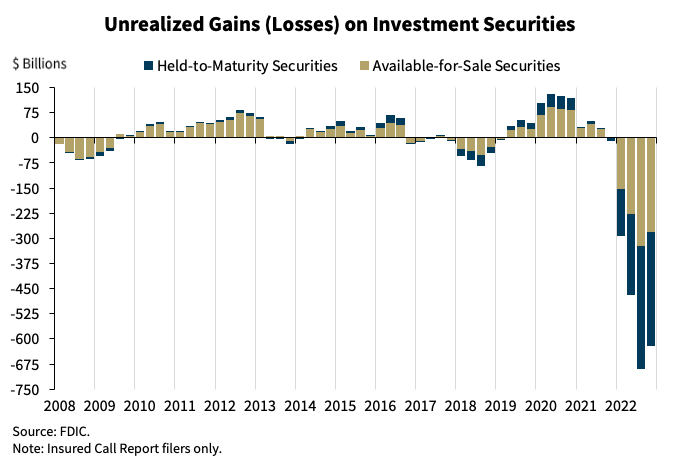

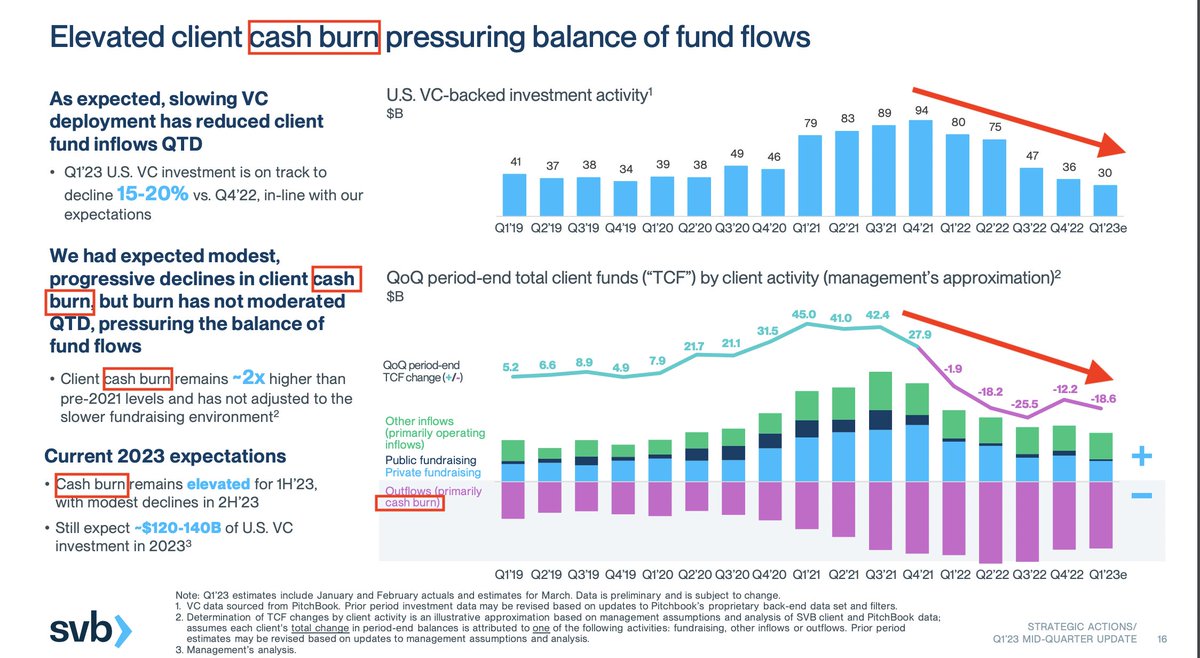

Forget about the losses on securities, the true cause of Silicon Valley Bank's collapse is "cash burn": Money-losing companies who banked at SVB were taking money out to fund operations. They required constant inflows of venture capital funding which stopped, and... (1/4)

SVB was just a badly run bank that went bust. Happens all the time. What's special about SVB is that many influential people banked with them, and are now lobbying for special treatment. Let's hope our system is fair.

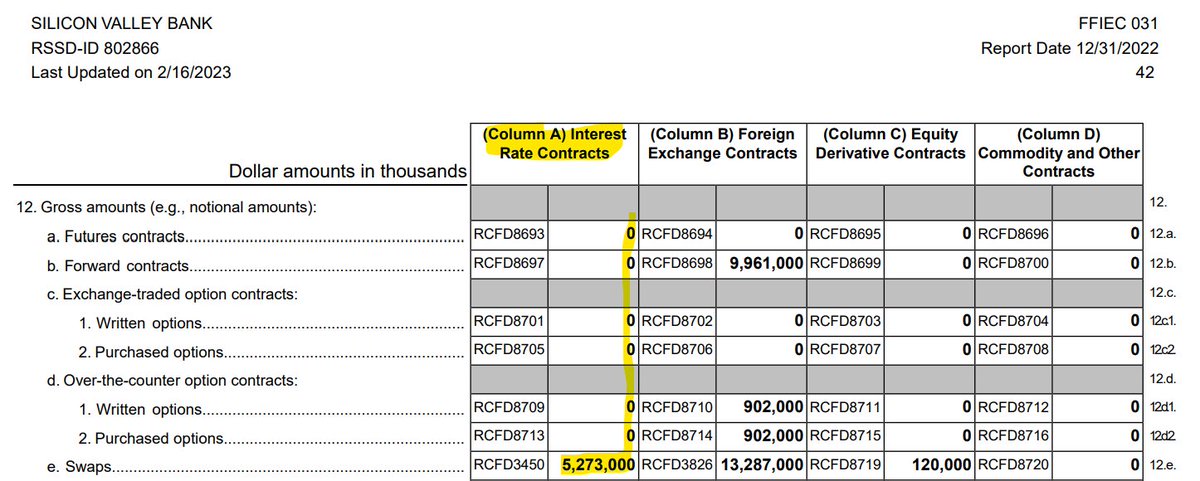

Looks like SVB held $120b in securities but basically didn't hedge their interest rate exposure. That's totally crazy. No wonder they failed.

tough one for the dickriders who had jumped to Elon’s defense because they just knew he was right and Halli was a lazy free-riding deep state liberal nazi or whatever

I would like to apologize to Halli for my misunderstanding of his situation. It was based on things I was told that were untrue or, in some cases, true, but not meaningful. He is considering remaining at Twitter.

🇫🇷Gen: Yakovleff, riffing off R. Aron: "If one has to be under an Empire, frankly I prefer to be under the American Empire, and I believe that's the case for most of the people who wear blue jeans, drink Coke, and love yelling at their deputies."

Dépendance “Quitte à être sous un Empire, très franchement je préfère être sous l’Empire Américain et je crois que c’est le cas de la plupart des gens qui portent des Blue Jeans, qui boivent du Coca-Cola et qui aiment engueuler leurs Députés si vous voulez” 👊🏻

The cost of US military aid to Ukraine is 25¢ per day per American For this investment Ukraine is dismantling the military of a top US adversary & China’s top partner There is no “forever war” because we aren’t fighting This isn’t a proxy war because Russia attacked Ukraine

This filing in the Dominion lawsuit against Fox News is one of the most remarkable documents I've ever seen. Filled with private texts between Fox stars like Hannity and Carlson, plus Murdoch, all admitting they knew Fox's stolen election claims were lies. int.nyt.com/data/documentt…

NEW: Elon Musk directed Twitter engineers to design a secret system to boost his tweets over everyone else's after his post about the Super Bowl did poorly compared to President Biden's: platformer.news/p/yes-elon-mus…

WOMEN👏DO👏NOT👏WANT👏FLOWERS👏THEY👏WANT👏FISHING LICENSES👏JUST👏TRUST👏ME👏ON👏THIS👏BRUH👏

So sudden cardiac deaths surged in 2020 (during COVID pre-vaccine), then dropped off as vaccine uptake increased, then surged again in Oct ‘21 (during the delta wave which was devastating for unvaxxed people). What does this prove exactly?

United States Trends

- 1. #StrangerThings5 59.9K posts

- 2. Lakers 32K posts

- 3. Lions 90.8K posts

- 4. Goff 21.4K posts

- 5. Dustin 82.4K posts

- 6. Luka 36.2K posts

- 7. jancy 14.2K posts

- 8. Vikings 45.6K posts

- 9. Dan Campbell 5,638 posts

- 10. Nigeria 304K posts

- 11. #AEWCollision 5,385 posts

- 12. Sutton 3,637 posts

- 13. Ben Johnson 6,250 posts

- 14. holly 39.2K posts

- 15. KAREN WHEELER 2,156 posts

- 16. Vando 2,050 posts

- 17. #BroncosCountry 2,736 posts

- 18. Lucas 55K posts

- 19. Max Brosmer 8,566 posts

- 20. FaZe 17.7K posts

Something went wrong.

Something went wrong.