M2 Stewardship Group - Mark Mac

@M2_Financial

Stewardship: Prudent mgt. of assets entrusted to one's care. Investment Advisory & Retirement Plan Consulting: @mark__mac. Research: @EASI_invest Luke 16:10

You might like

A big investing mistake (fear/greed bias): assuming a stock that has gone up quickly, will soon go down. A stock that has gone down quickly, will soon go up. Macro conditions matter, but over longer periods, the opposite actually occurs.

In my 32 years in business, I’ve watched dozens of people get rich. I can’t think of a single case where it made someone a better person. But I can think of many where it sent them off the rails. The reason is simple: Money can only solve money problems. And it turns out that…

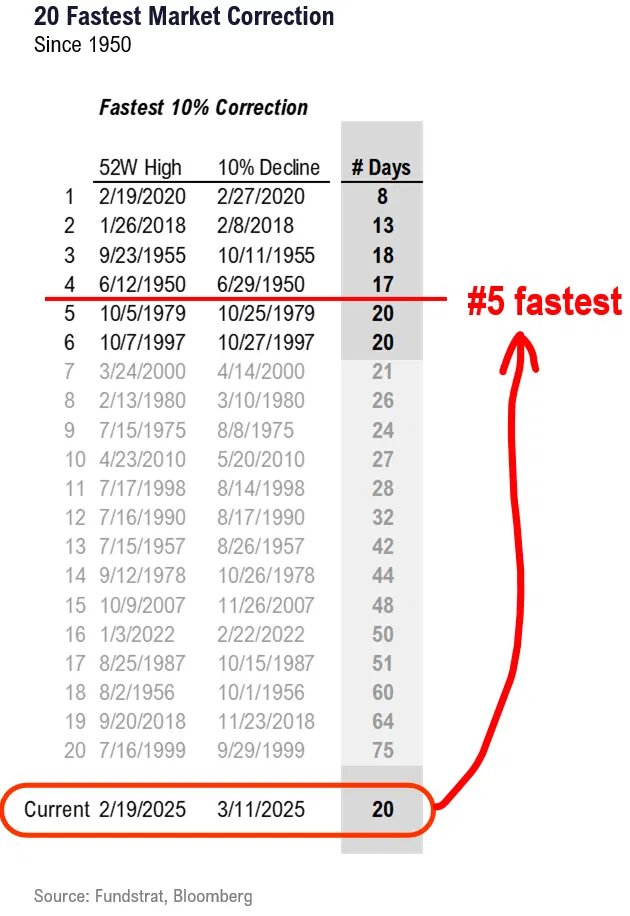

Tom Lee: A 10% SPX correction in 20 days is the 5th fastest in the past 75 years. 6 prior similar-speed/magnitude declines saw SPX gains 3m, 6m, 12m later @fundstrat @fs_insight fsinsight.com/our-services/

Yes. It already exists. It’s called open-market capitalism and merit-based pay.

Slashing rates is a move out of necessity/triage, not a strategic one. Lower rates can be a good thing. When the reasons are as such, the bigger issue is the why not the what of reducing interest rates.

China just surprised markets by slashing interest rates to revive its property sector and economy. But here is why it's NOT going to work. 1/

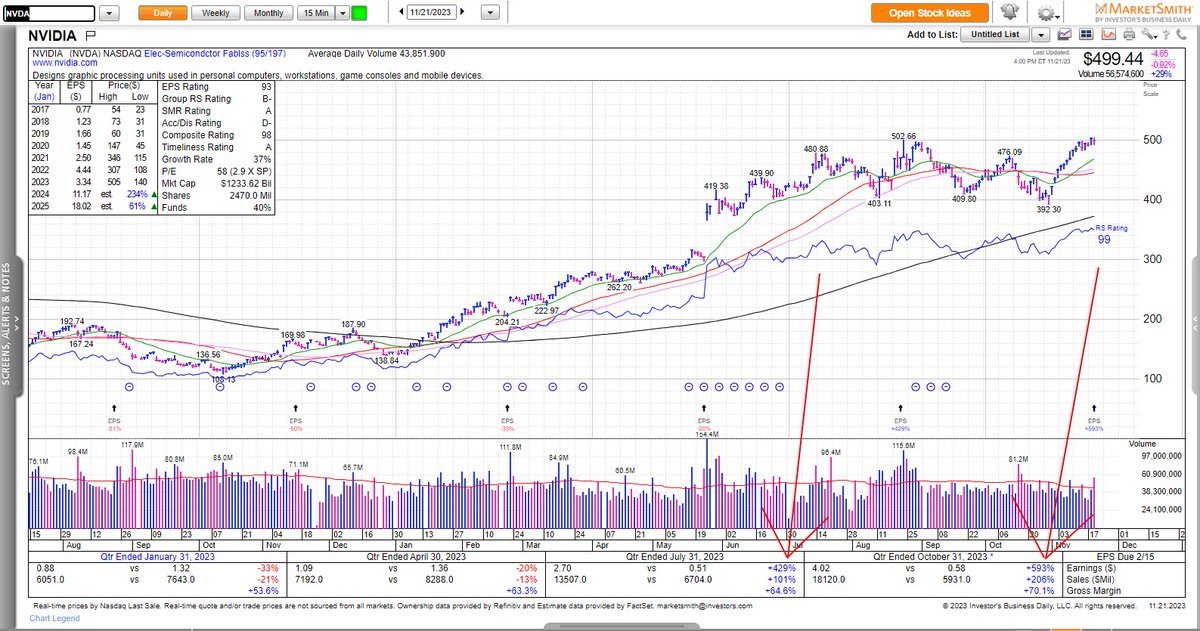

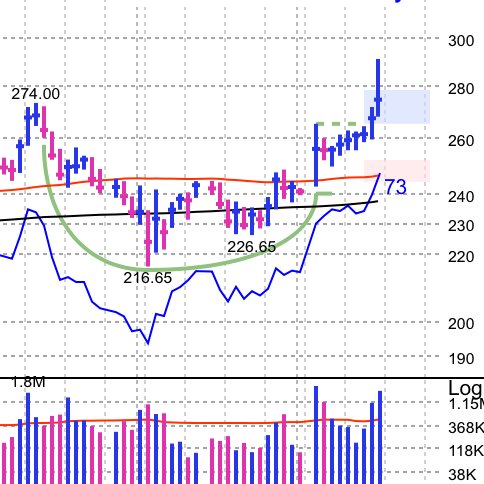

$SMCI gave back two days price, quickly. There's cases when its harbinger and there's cases when not. $UPST wasn't close to profitable in 2021. Still isn't. $SMCI already earned $12.75 p/s. $NVDA gave back 2-3 days price many times while profitably increasing market cap 20x.

'20-'24, $NVDA had six > (-20%) shakeouts going from ~$60 →~$750. $SMCI isn't even $50B market cap. Not defense of blindly holding @SMCI. But neither is selling all simply b/c it went up fast. Risk management is critical, as is prepared conviction. (See pinned tweet)

Good mental framework for public market investing.

$META Market Cap is now 1.22Trillion Today, approximately $35Billion traded hands, while increasing market cap by ~$250B. That's a massive move. Only 33 publicly traded stocks have total market cap greater than $250B. One day's move in $META.

The primary reason to own stocks (equities) is to benefit (profit) from great companies with terrific ideas, compounding (not just growing) their revenues, usually with unique products/services. #RiskReward

Market lubricity. Relative to previous decades, the friction costs to investing have been largely eliminated (info, access, commission, etc), which likely creates a more viscous (not necessarily liquid) market. Price discovery moves quicker, more volatile, but similar LT return.

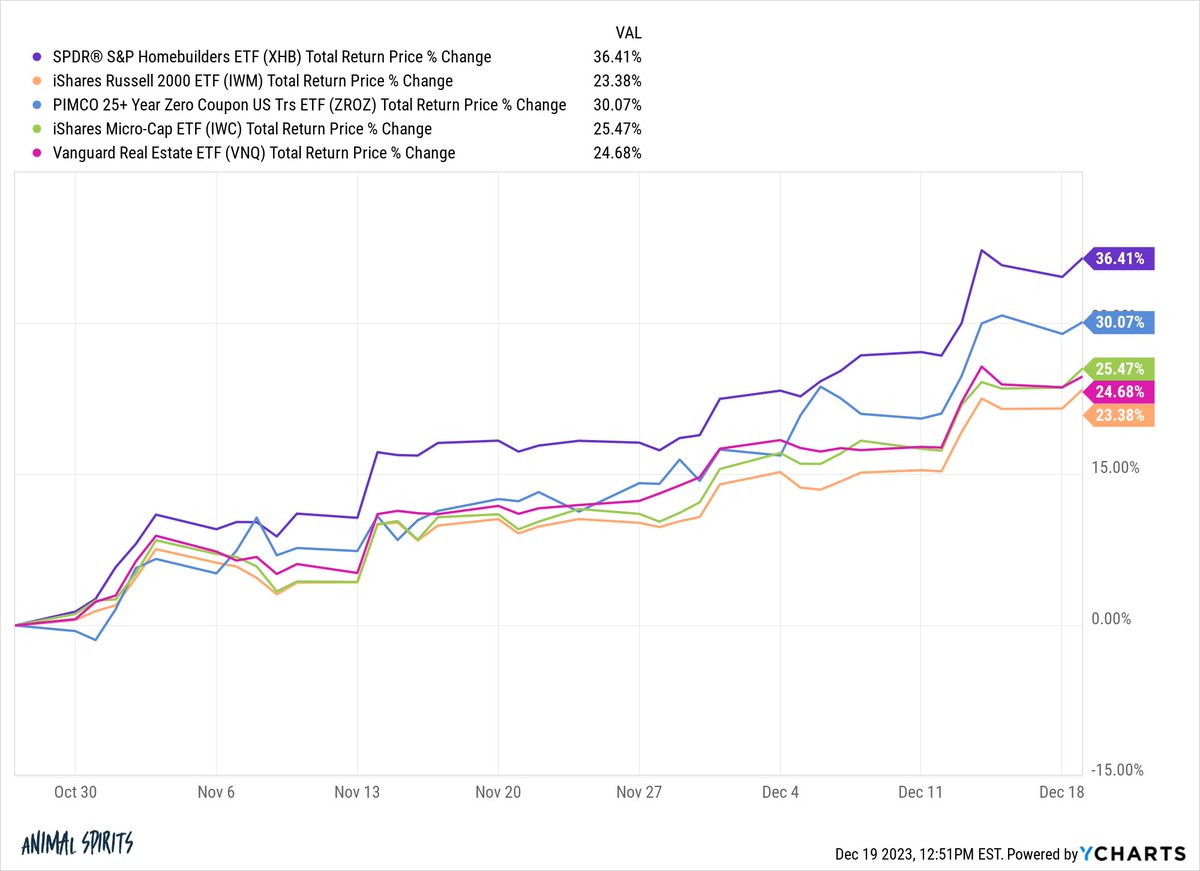

Returns from the last Friday in October: Homebuilders +36.4% Zero coupon bonds +30.1% Micro caps +25.5% REITs +24.7% Small caps +23.4% There are decades where nothing happens and there are weeks where bull markets happen

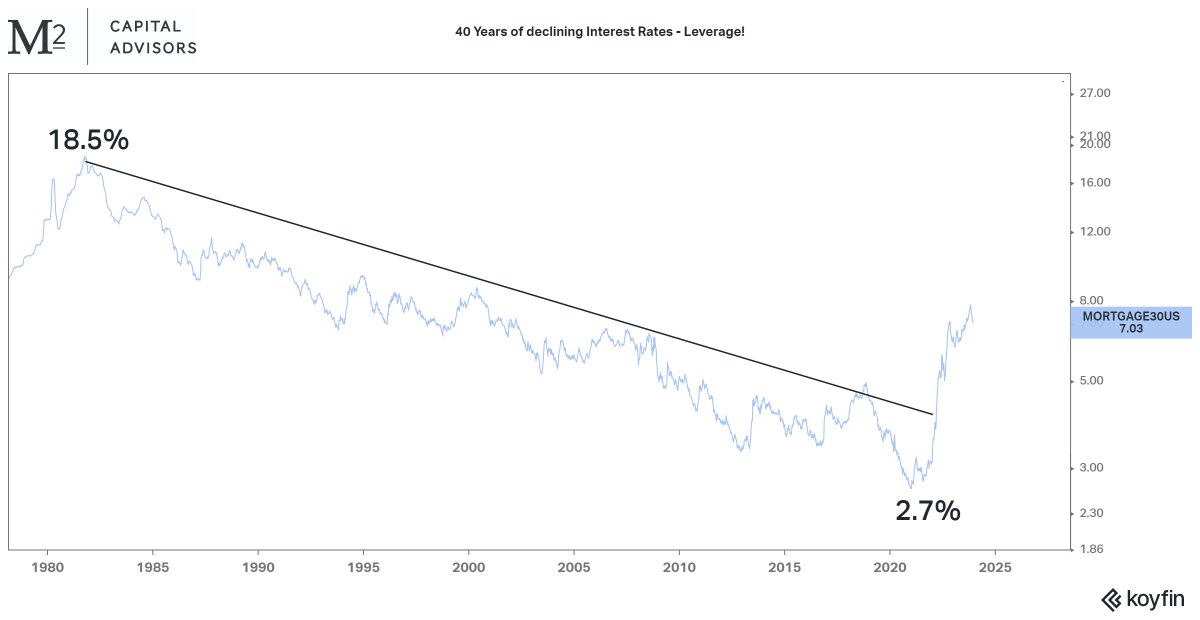

Agreed. These and other dynamics aided, but the most significant contributor to "superior" performance for last 40 years is ever-lower cost of borrowing. #leverageworksbothways

Long-term investing was super easy from 2009-2021 due to perpetual QE and ZIRP It wasn't so easy from 1929-1954 , 1968-1982 and 2000-2013 when $SPX had horrendous declines and went nowhere for 25 years, 14 years and 13 years. The next 7-8yrs unlikely to be as easy as 2009-2021.

Bond market

The Fed doesn’t cut rates out of goodness. Powell’s nascent remarks re: unemployment/lower rates is likely b/c they see economic weakness impending. Key: the Fed lowers rates to stave off more economic problems, not to reward fiscal responsibility. #recession24 @saxena_puru

The massive volume of actual dollars (cash flow)necessary to accomplish this is startling. Considering all the economic transactions occurring globally, one company/product to be garnering this amount of $$ share is unprecedented. Hard to continue this % take.

In my 27 year career, I've never seen a company grow earnings and sales like this on such large numbers. In recent memory, Zoom was the closest insane growth story I've seen, but that was "only" on annual revenue growth from $500M to $4B, not $25B to $60B! $NVDA

United States Trends

- 1. Happy Thanksgiving Eve 1,639 posts

- 2. Good Wednesday 22.1K posts

- 3. Luka 66K posts

- 4. #DWTS 97.7K posts

- 5. Lakers 51.6K posts

- 6. Clippers 19.1K posts

- 7. Robert 142K posts

- 8. Kris Dunn 2,933 posts

- 9. Collar 46.7K posts

- 10. Jim Mora 1,070 posts

- 11. #LakeShow 3,606 posts

- 12. Kawhi 6,581 posts

- 13. Karoline Leavitt 25.1K posts

- 14. Colorado State 2,702 posts

- 15. Alix 15.3K posts

- 16. Jaxson Hayes 2,657 posts

- 17. Reaves 13.8K posts

- 18. TOP CALL 14.8K posts

- 19. Elaine 46.6K posts

- 20. Ty Lue 1,682 posts

You might like

-

Eve Boboch

Eve Boboch

@EBoboch -

Justin Nielsen

Justin Nielsen

@IBD_JNielsen -

Topstep

Topstep

@Topstep -

EASI Investments LLC

EASI Investments LLC

@EASI_invest -

David Saito-Chung

David Saito-Chung

@SaitoChung -

HFT Quant

HFT Quant

@QuantRob -

Scott St. Clair

Scott St. Clair

@Zeninthemarkets -

Kevin C. Smith, CFA

Kevin C. Smith, CFA

@crescatkevin -

Anish Sikri

Anish Sikri

@anishsikri -

Kuppy's Korner

Kuppy's Korner

@kuppyskorner -

Ross Haber

Ross Haber

@RossHaber -

Stack Hodler

Stack Hodler

@stackhodler -

White Coat Investor

White Coat Investor

@WCInvestor -

Wolfpack Research

Wolfpack Research

@WolfpackReports -

Daniel Oliver Jr.

Daniel Oliver Jr.

@Myrmikan

Something went wrong.

Something went wrong.