MarsCapitalPartners

@MCP_Premium

MarsCapitalPartners

You might like

Due to popular request we have unlocked last week's MCP Market Update for the public. - Importantly our bearish equities, US$ and rates outlook has played out nicely. - If you like what you see, please subscribe. marscapitalpartners.com/2025/03/31/mcp…

A new Macro Outlook note is live. ✅Last week: a funding lapse delayed #USPayrolls, softer labor metrics so far for Jan, & CB's: #RBA hike, #BoE narrow hold, & #ECB on hold. 🚀This week: the big three for the Fed #NFP #retailsales #CPI. Download (free)👇 marscapitalpartners.com/2026/02/09/lab…

marscapitalpartners.com

The Macro Outlook: US Labour Market, Retail Sales, & Inflation — Mars Capital Partners

Important US macro data is in focus this week: non-farm payrolls & employment, retail sales, and CPI. This will provide a critical update for the Fed's balance of risks and for the timing of rate cut...

The latest Mars Market Update is now posted - Churning Higher - #SPX and #NASDAQ100 corrective declines held key trend support - #DJIA new ATH's from 50 day sma - #DXY attempting to hammer out a low - #Bitcoin counter-trend rally on deck? marscapitalpartners.com

#NDX #QQQ #Nasdaq - Bulls need to hold the line here or risk a break lower and test of 24000 support... marscapitalpartners.com

#BTC #Bitcoin initial downside targets met for wave 1 / A down into layered support. Looking for signs of life to help set up a counter-trend rally before the downtrend resumes... marscapitalpartners.com

Our latest Macro Outlook note is posted! We review #FOMC & #BoC decisions last week> Plus, we preview upcoming #US Labour Market report for Jan & central bank decisions this week: #RBA #BoE #ECB. Download (free) 👇 marscapitalpartners.com/2026/02/02/cen…

marscapitalpartners.com

The Macro Outlook: Central Bank Meetings and the US Labor Market — Mars Capital Partners

Weekly macro outlook: US labor market data for Jan, annual benchmarking, & rates decisions from the RBA, BoE, and ECB. Plus, Jan S&P Global PMIs.

The latest Mars Market Update is now posted - Reversal Risk - #SPX new ATH's unconfirmed by #Nasdaq but no confirmation of a bearish change in trend (yet) - Liquidation risk after blow-off reversals in #Gold and #Silver - #DXY / #Euro / #CHF inflection - #BTC at support

Our latest Macro Outlook note is posted. We review catch-up of #PCE inflation & growth activity ahead of the #FOMC this week. Also; we preview the #BoC decision and Aus #CPI for Q4 ahead of the #RBA next week. Download 👇 marscapitalpartners.com/2026/01/26/fom…

marscapitalpartners.com

The Macro Outlook: FOMC Preview – Resilient Growth, Stalled Hiring, and a Cautious Inflation...

As the FOMC prepares to meet this week, resilient U.S. growth has not led to a rebound in hiring yet. Meanwhile, emerging underlying disinflation could provide a more constructive, if cautious,...

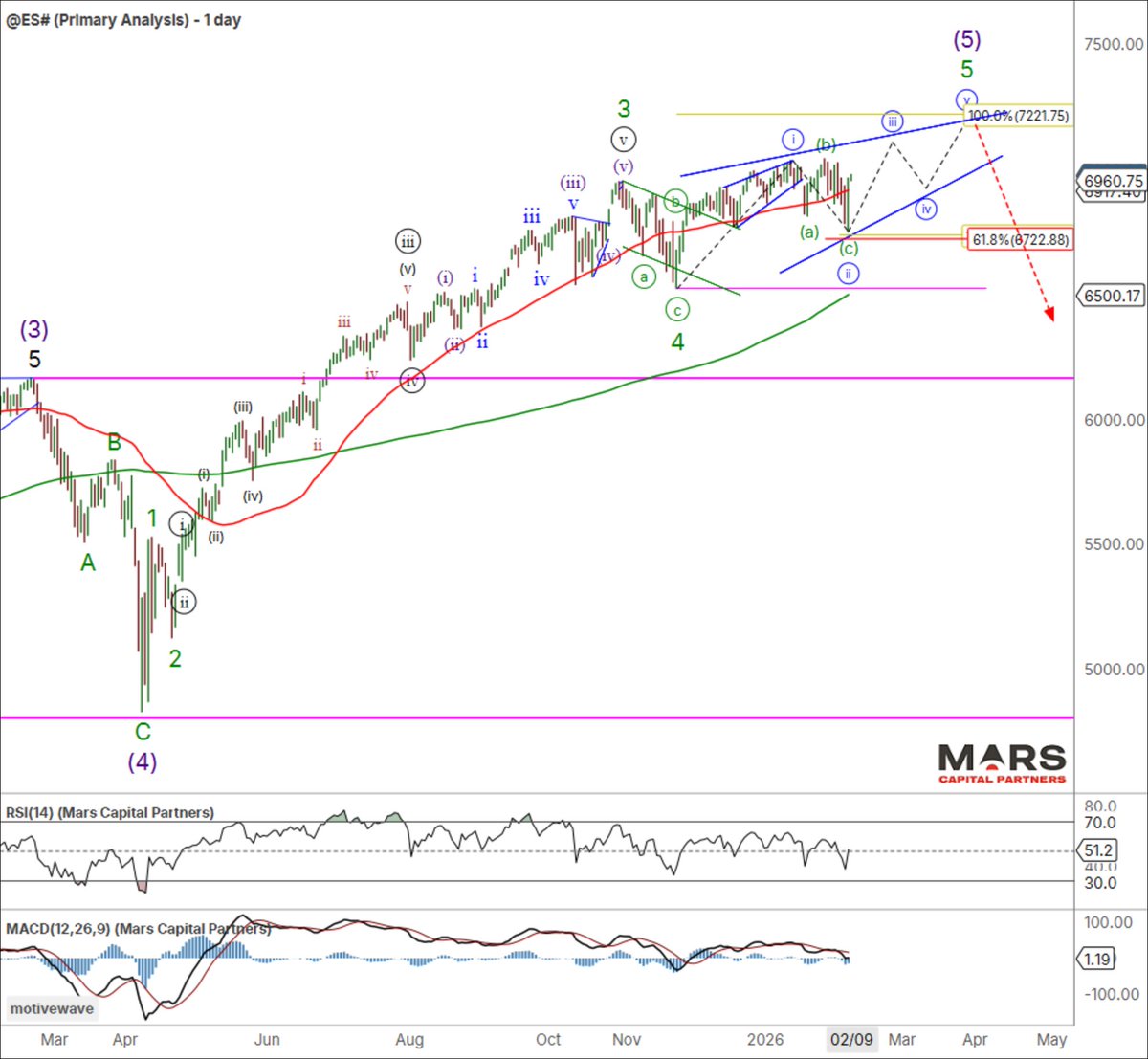

The latest Mars Market Update is now posted - Corrective decline - #SPX #ES_F corrective decline opens the door to new ATH's - #Nasdaq #QQQ bullish triangle intact - #USDJPY reversal - #Gold #Silver parabolic blow-off? marscapitalpartners.com

Our latest Macro Outlook note is posted. We review last weeks #CPI, #growth, #labormarket data ahead of the #FOMC next week, & amid sentiment risks. This week: #PCEinflation, #BoJ, #Davos, global #CPI reports. Download (free)👇 marscapitalpartners.com/2026/01/19/eco…

marscapitalpartners.com

The Macro Outlook: Economic Steadying Amid Sentiment Risks — Mars Capital Partners

As data flows normalise, the picture reveals a U.S. economy that is largely steadying, though not yet out of the woods, following the end of the government shutdown, significant trade upheaval, and...

Our latest Macro Outlook note is posted. We review last weeks broad US labor market update for Dec, amid resilient activity data. This week we preview; US #CPI, #PPI, #retailsales, #Fedspeeches. Download 👇 marscapitalpartners.com/2026/01/12/lab…

marscapitalpartners.com

The Macro Outlook: Labor Market Risks vs. Resilient Activity — Mars Capital Partners

Despite the fall in the unemployment rate in Dec, data still suggests a labor market stuck in a low-hiring/low-firing gear and, for now, keeping labor market risks elevated.

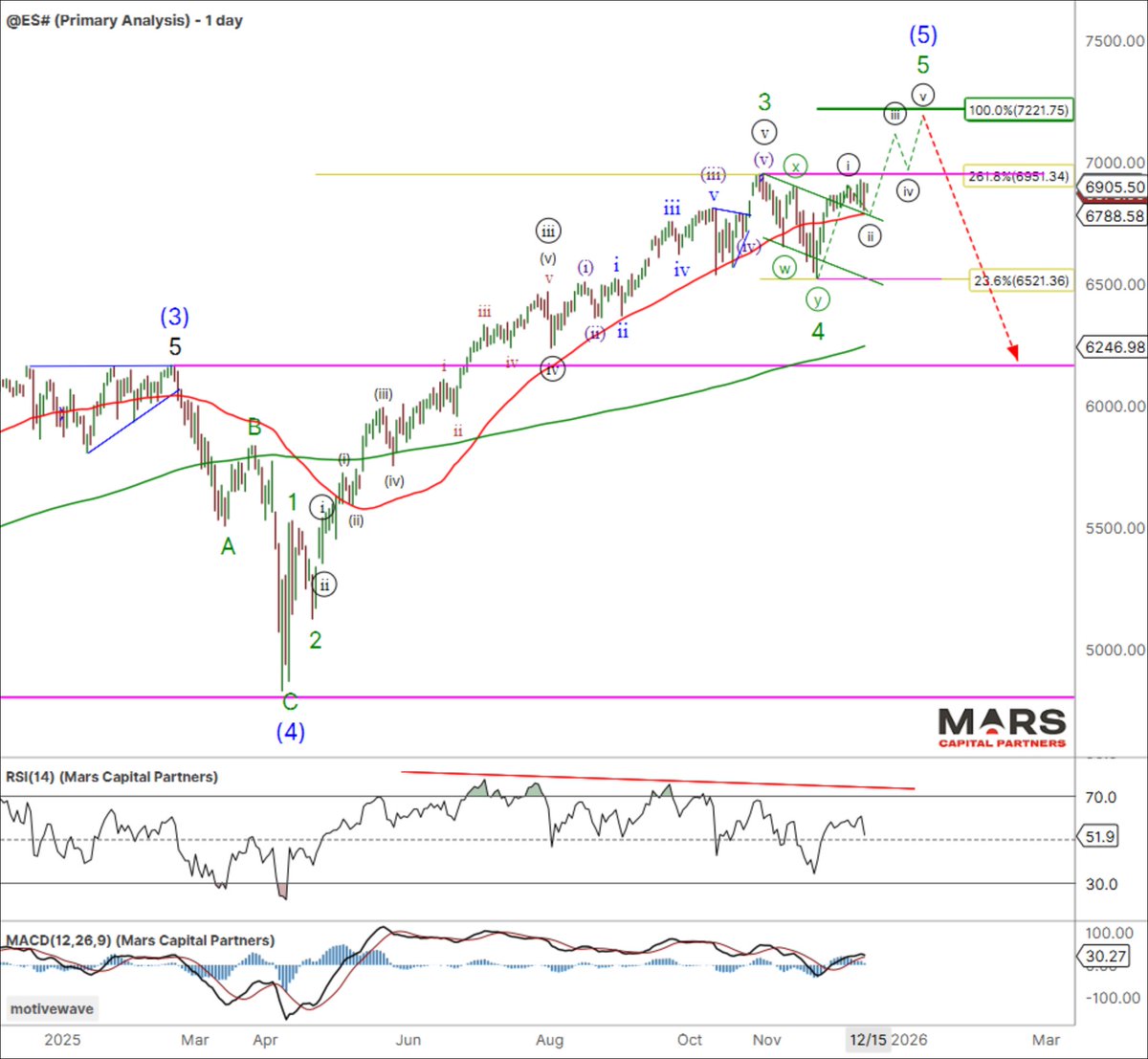

The latest Mars Market Update is now posted - Wedging into the Highs - #SPX / #ES_F enough waves to complete 5 up. No confirmation (yet) of a top. 50 day sma key trend support - #Nasdaq / #QQQ triangle compression continues - #Gold new ATH's marscapitalpartners.com

Out latest Macro Outlook is posted. 2026 starts with a data-heavy catch-up, while geopolitical developments unfold. This week; US #Nonfarmpayrolls for Dec, assessing US #growth into year end, #AusCPI for Nov, and Dec #PMIs. Download (unlocked) 👇 marscapitalpartners.com/2026/01/05/us-…

marscapitalpartners.com

The Macro Outlook: Setting the Tone for 2026 — Mars Capital Partners

As we orient ourselves for the start of 2026, the focus this week is on final data for 2025, including US non-farm payrolls for Dec.

The latest Mars Market Update is now posted - Happy New Year! - #SPX #ES_F Bull trend incomplete but watch 50 day sma trend support - #Nasdaq #QQQ Triangle consolidation - #BTC has not yet confirmed a bearish change in trend marscapitalpartners.com

Our Weekly Macro Outlook is posted. We review #ECB #BoE & #BoJ decisions, as well as US payroll, unemployment, inflation, & activity data. This short week: US Q3 GDP & #RBA Minutes. Download 👇 Have a great holiday break & see you in 2026! marscapitalpartners.com/2025/12/22/fin…

marscapitalpartners.com

The Macro Outlook: Final Central Bank Decisions of 2025 — Mars Capital Partners

The final major central bank decisions of the year reinforced the theme of policy divergence - the ECB stayed on hold, the BoE cut rates, and the BoJ hiked rates.

Our latest weekly Macro Outlook note is posted! We recap key CB meetings: #FOMC pauses after a cut, #RBA warns on inflation, #BoC holds. Plus; the outlook for the #ECB #BoE #BoJ, US #payrolls, retail sales, & #CPI. Download our free weekly note 👇 marscapitalpartners.com/2025/12/15/cen…

marscapitalpartners.com

The Macro Outlook: Central Bank Decisions – Part 2 — Mars Capital Partners

Central bank divergence: The Fed pauses after a cut, the RBA warns on inflation, & the BoC holds. Plus, the full outlook for this week’s ECB, BoE, & BoJ and US payrolls, retails sales, and CPI.

United States Trends

- 1. Valentines Day N/A

- 2. #SmackDown N/A

- 3. Range Rover N/A

- 4. SWAT N/A

- 5. Culver N/A

- 6. #RISERCONCERTD2 N/A

- 7. #OPLive N/A

- 8. #FromMintoWithLove N/A

- 9. Hampton N/A

- 10. UNLV N/A

- 11. #DragRace N/A

- 12. Tubi N/A

- 13. Sami N/A

- 14. Baird Greene N/A

- 15. Rising Stars N/A

- 16. North Carolina A&T N/A

- 17. Bitboy N/A

- 18. Nimi N/A

- 19. Paige N/A

- 20. Tory N/A

You might like

-

Dario Mofardin

Dario Mofardin

@Trader_Mars -

Sahara

Sahara

@SaharasCharts -

GeoInvesting, LLC.

GeoInvesting, LLC.

@GeoInvesting -

Stan Raksin

Stan Raksin

@stanraksin -

Jeff York, PPT

Jeff York, PPT

@Pivotal_Pivots -

Xenia Taoubina

Xenia Taoubina

@XTaoubina -

WestPacific Market Analytics

WestPacific Market Analytics

@wstpacglenn -

TheBehavioralTrader📈

TheBehavioralTrader📈

@StockReversals -

Zachary Mannes

Zachary Mannes

@ZacMannes -

Marcelo Busquets

Marcelo Busquets

@busquetsmarcelo -

Lifter

Lifter

@RoSaxEM -

Deepak K Tiwari

Deepak K Tiwari

@dtarian04 -

Fernando Pertini

Fernando Pertini

@DecodeMarkets -

Mike Valletutti 🎯

Mike Valletutti 🎯

@marketmodel -

Wild.Gandalf

Wild.Gandalf

@WildGandalf1

Something went wrong.

Something went wrong.