Pascal Trading Co

@PascalTradingCo

S&P (SPX): Analytics & Technical Analysis. unnecessary commentary

You might like

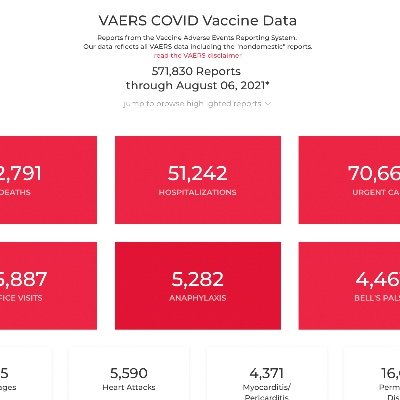

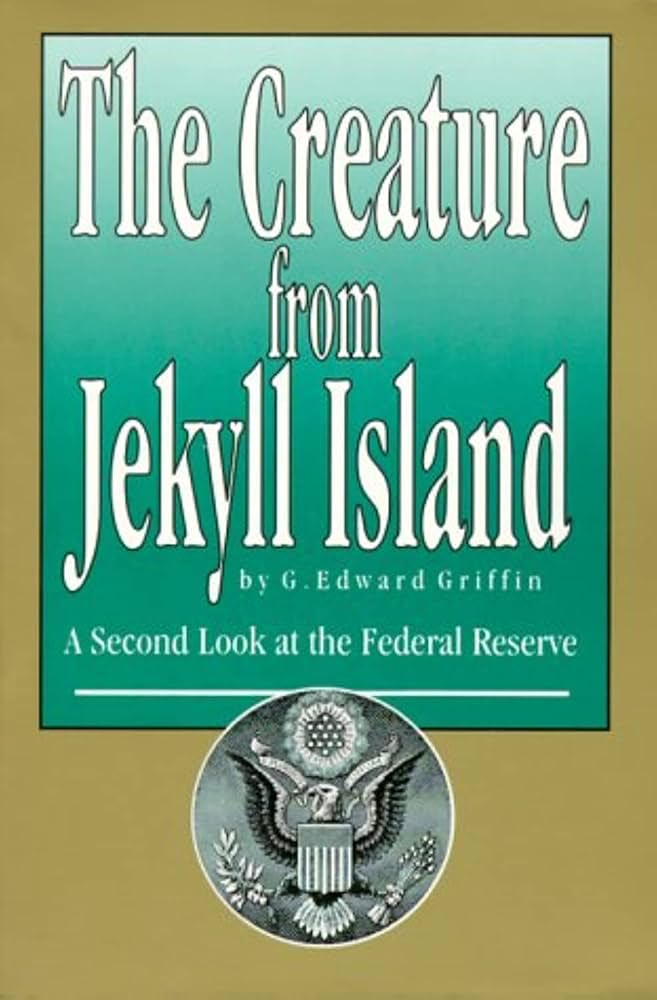

Last few weeks showed that even the wildest conspiracy theories are in fact based on unexposed realities. Dont let this ruin your perception, be optimistic about your future and your life, positive perception helps your realities in your professional and personal life but always…

You made money and felt nothing. You lost money and felt nothing. The trade closed and you moved on. That's the level most traders never reach.

Video message from Federal Reserve Chair Jerome H. Powell: federalreserve.gov/newsevents/spe…

7 small tips that make a big difference • Size down • Narrow your watchlist • Ignore headlines/news • Remove P/L from your screen • Track RS during market weakness • Do not buy if 2% past the pivot • Make Price & Volume your main indicator

The difference between pros and amateurs of any field is consistency. Life is random enough for an amateur to find success intermittently. But pros find consistency through controlling as many aspects of their process as possible.

The government has been shut down for 36 days, the longest in US history - And absolutely nothing about your life is different. What is the lesson here?

#ES structure headed into 10/17/25 RTH session. Bears have first opportunity in while here if can hold highs. #SPX #volatility #marketstructure

Debt based fiat Money that’s created out of thin air can also vanish suddenly. We are in the early phases of that cycle. See Tri Color and First Bands as examples. All credit cycles end when the ponzi credit part of the market begins to wobble.

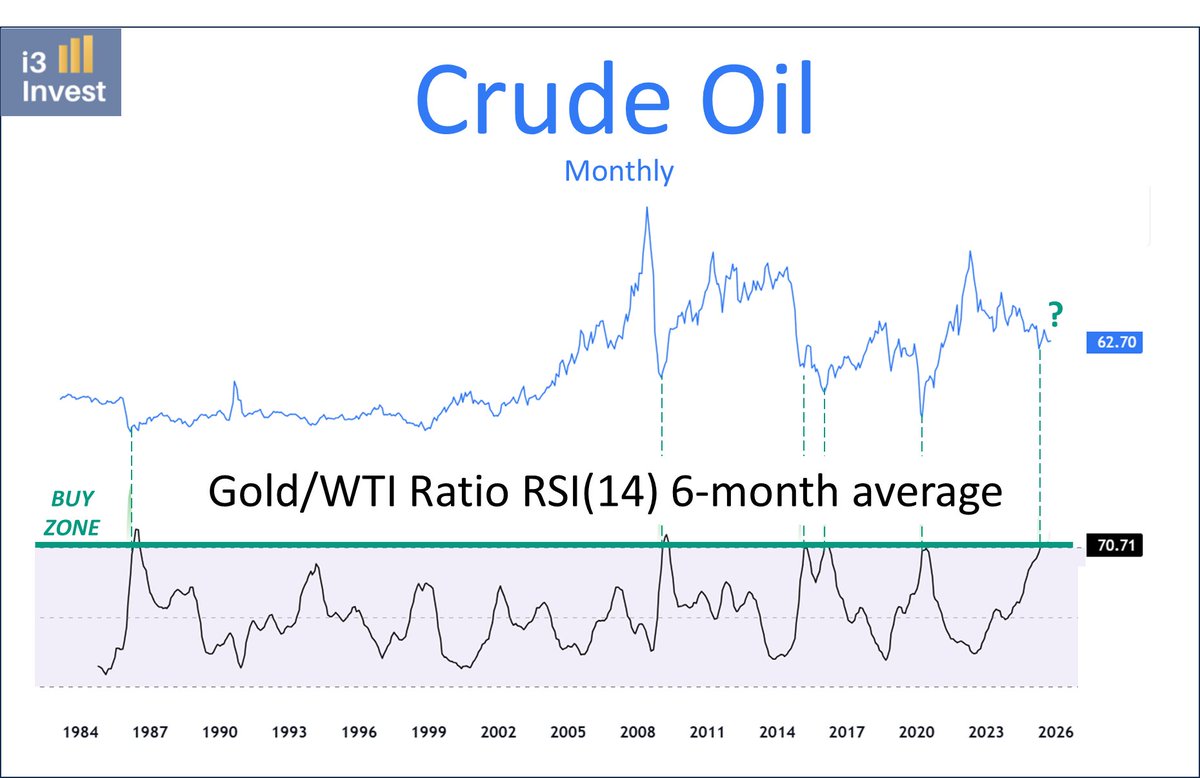

Another rare bullish signal for OIL. When measured in gold terms, the RSI(14), smoothed by a 6-month average, has reached extreme levels. Historically, when this metric rose above the 69 threshold, oil’s average 1-year performance was +57%, with gains occurring 88% of the time.…

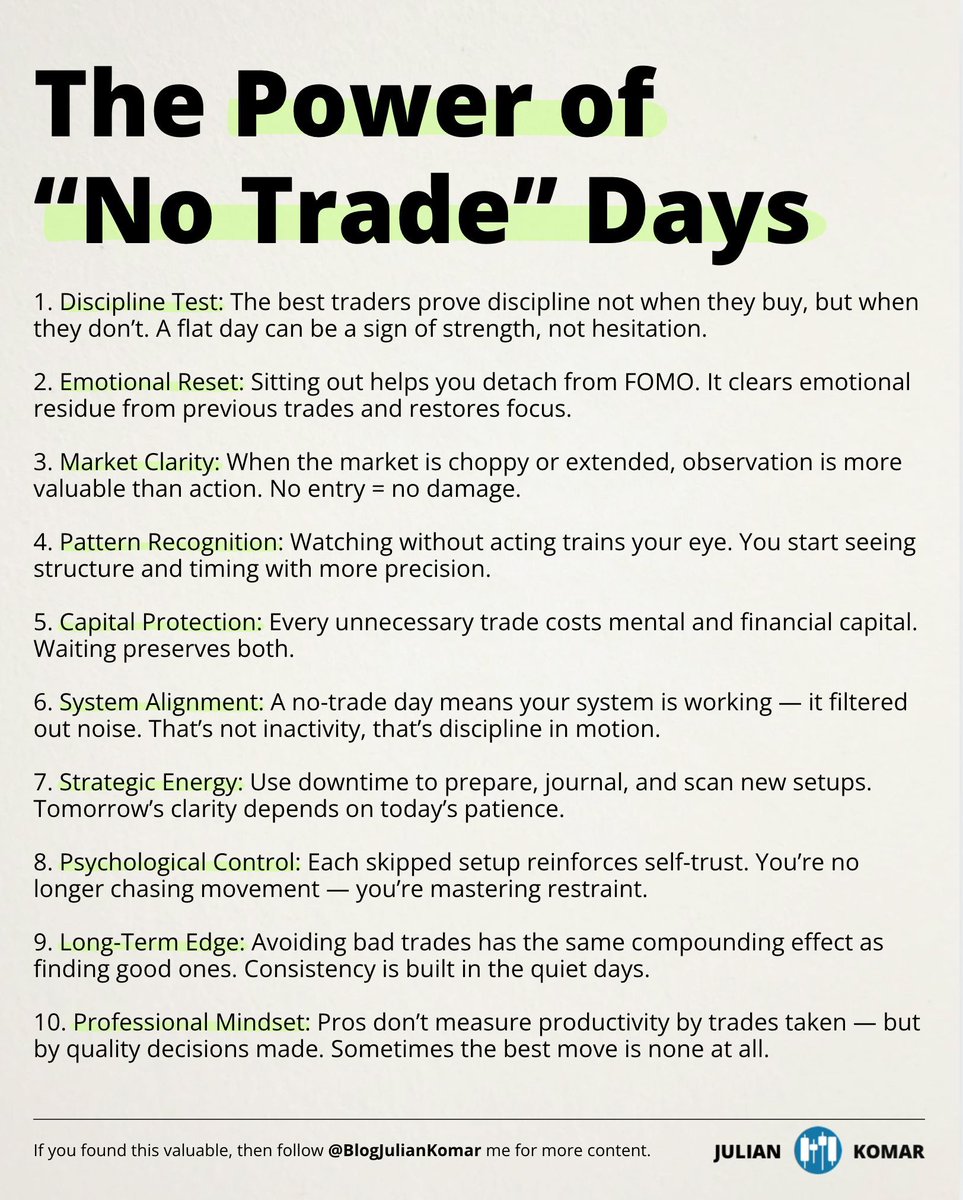

The Power of “No Trade” Days 👇

I’ve been trading since June of 92’ & I’ve never seen a market like this one. There’s no analog. Keep in mind the dot com boom started in 1995 with 30%+ returns on SPX & we still had drawdowns! This is a manipulated casino unlike anything most long time traders have ever traded.

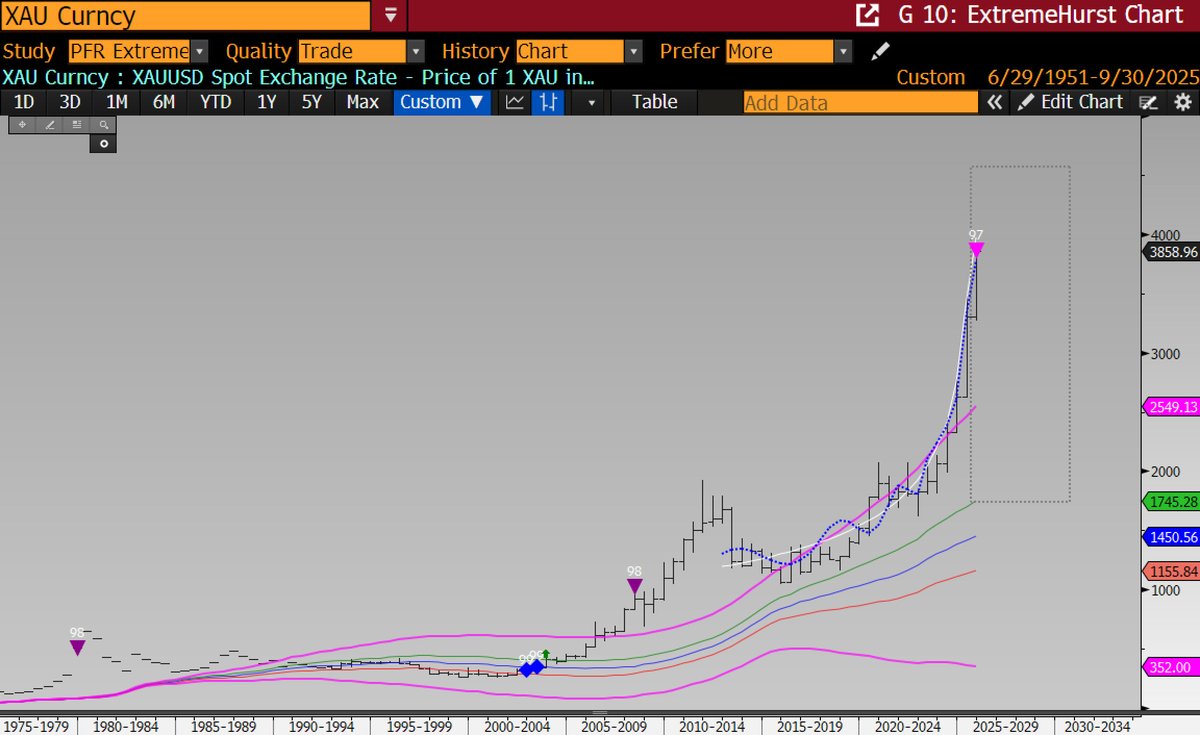

Amazing to see that gold has a semi-annual scale (6 mo. bars) top and silver just got a quarterly scale top. These are both extremely rare signals that will be active for years.

Both parties are ridiculous! Republicans passed a line-by-line continuation of Biden’s last budget, including Doge-identified waste. BUT Democrats refused to vote for Biden’s last budget, thereby shutting down the government. I voted Nay when it was for Biden and I’m Nay now.

Every major asset is at long-term extreme Highs/Lows, and Society is losing its patience and its collective mind about everything. It's my opinion this is a DANGEROUS time to be CERTAIN about anything headed into 2026. #SPX #GOLD #DXY #Bitcoin #VIX #QQQ #ES #WTI #HousingPrices

“Hate speech,” “hate crimes,” and many “conspiracy” crimes are just real world manifestations of Orwell’s dystopian thought crimes. Don’t ever expect me to vote to substantiate such things.

“Hate speech” is a meaningless term and it should never be used as a pretense to ban, censor, arrest, punish or silence anyone, ever, under any circumstance.

most amazing thing to me is people who now see the Govt was lying about data... think that skies are blue and NOW we are getting the Truth... humans really are special #BLS #SPX #Gaslighting

A foundational truth of trading is this: When wrong, you will always have too large of a position When right, you will never have enough No matter how long you trade, this will always be truth

💯 @paxtrader777 THE REAL REASON YOU OVERTRADE (It’s Not What You Think): Most traders think they overtrade because they “lack discipline.” But after 25+ years coaching top traders, I’ve found something deeper… On the surface, overtrading looks like a discipline issue.…

The less you trade, the more money you will make.

Retest of prior ATH seems probable here.. first time since April the Downside is skewed vs Upside.. 3:1 estimated.. possible 5:1. See how this goes into Oct #SPX #marketstructure #seasonality

So been super choppy and gone nowhere since this post. Even puked back to 6200. Into 6500 area here ... 6200 comes back on the radar #spx #MarketStructure #seasonality

So been super choppy and gone nowhere since this post. Even puked back to 6200. Into 6500 area here ... 6200 comes back on the radar #spx #MarketStructure #seasonality

If you're ever feeling down on yourself.. just remember there are degenerates buying the 930 edt new York open today #spx 6370 #fomo #buttonpounding

United States Trends

- 1. Valentine's Day N/A

- 2. Swayman N/A

- 3. Dame N/A

- 4. Denmark N/A

- 5. Devin Booker N/A

- 6. Jack Hughes N/A

- 7. #USAHockey N/A

- 8. Bobby Portis N/A

- 9. Kentucky N/A

- 10. Brady Tkachuk N/A

- 11. Jamal Murray N/A

- 12. Rupp N/A

- 13. Providence N/A

- 14. Rubio N/A

- 15. Eichel N/A

- 16. #NBAAllStar26 N/A

- 17. Kon Knueppel N/A

- 18. Florida N/A

- 19. Vini N/A

- 20. Otter N/A

Something went wrong.

Something went wrong.