Dylan

@NextWaveCap

Equity Research | Investing in Hyper-Growth Disruptive Stocks | US Equities | Not Financial Advice, Only Opinions

End of July portfolio update Current holdings: $ABCL, $ASPN, $CPNG, $DDOG, $DOCN, $FOUR, $GLBE, $HIMS, $JMIA, $KVYO, $LMND, $MDB, $MNDY, $NU, $PLTR, $ROOT, $S, $SE, $TMDX, $TSLA Since inception (19/01/2024): Portfolio returns: 20.85% | S&P 500 returns: 14.72%

A great writeup I'm long $GRAB

I have just published a 4,500-word deep dive into $GRAB. I believe it'll become the next big ecosystem business with at least a decade of fast growth ahead. The price is also fair now. You can read it below, it's free 👇 capitalist-letters.com/p/grab-excepti…

capitalist-letters.com

Grab: Exceptional Business At Fair Price

Grab is creating the next big ecosystem of interconnected businesses. The potential is undeniable, the price is fair.

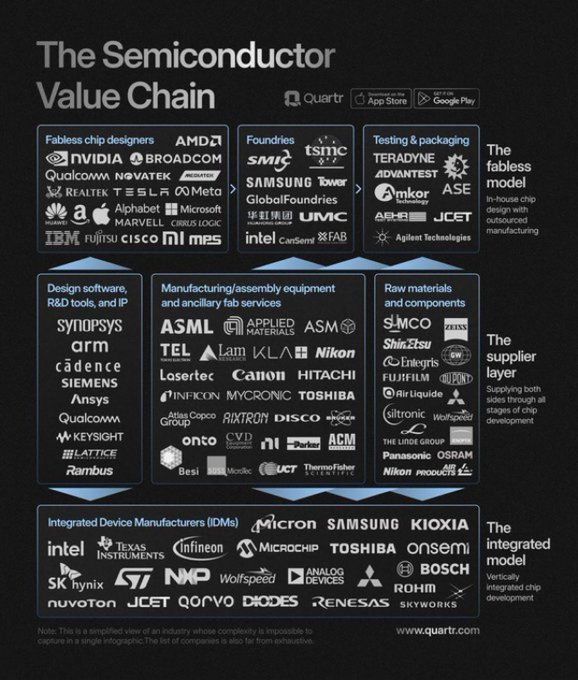

25 COMPANIES POWERING THE SEMICONDUCTOR VALUE CHAIN 1. $NVDA -- Designer of AI GPUs & CUDA platform for model training 2. $TSM -- Manufacturer of advanced 3nm & 5nm chips for AI workloads 3. $AVGO -- Supplier of networking ASICs & high-speed connectivity components 4.…

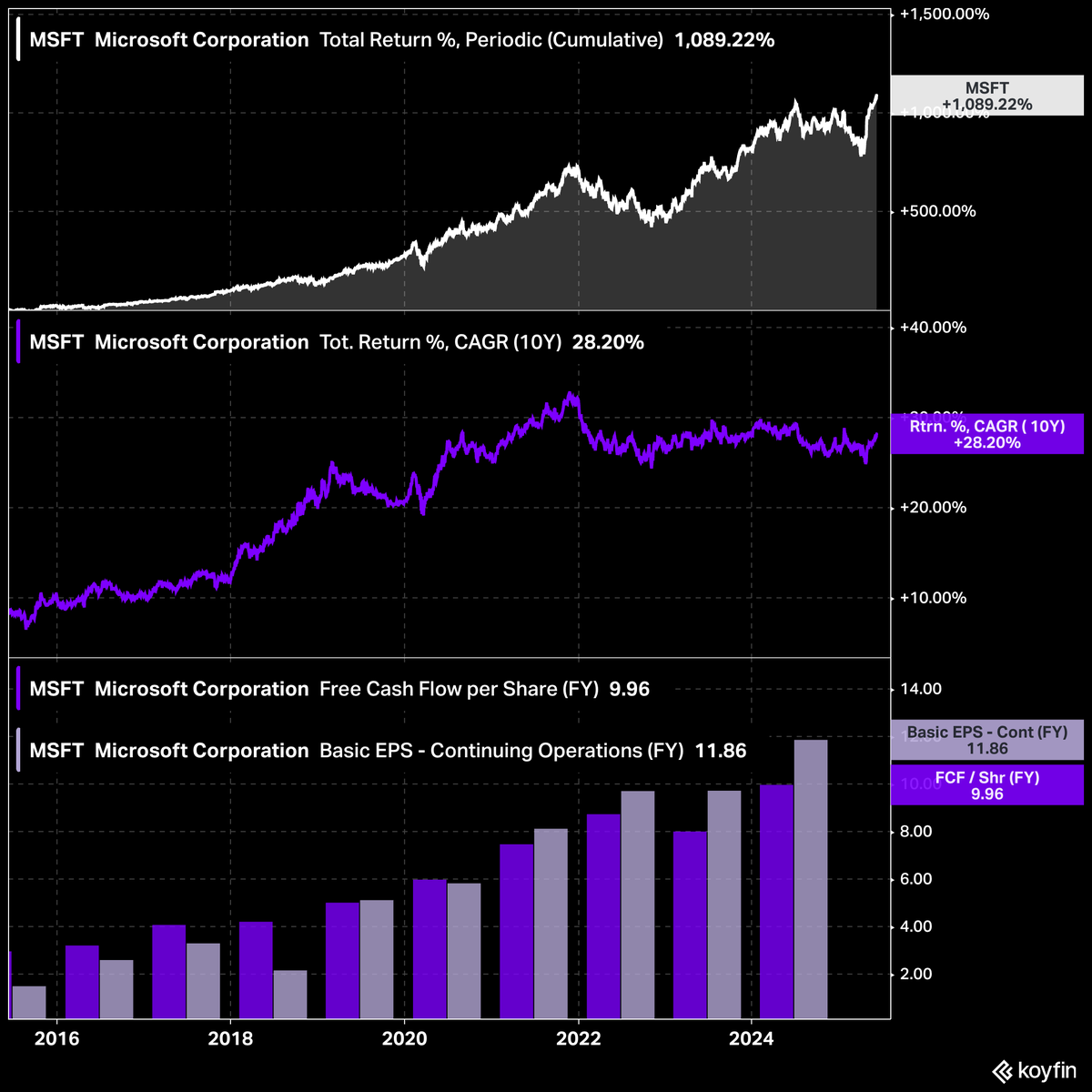

These 8 companies have been 10-Baggers in the last decade: 1) $MSFT Microsoft • Market cap: $3.6 trillion • 10Y Total Return: 1,089% • PE: 33.2x • PS: 11.6x

I've been long $CRWD since $93, but I wouldn't buy it now. The comeback from the devastating outage has been incredible - all-time highs in just 11 months. But I won't be adding to my position... Here's why: 🧵

10 COMPELLING STOCK IDEAS WITH MARKET CAPS UNDER $15B 1. $OKLO | Oklo 2. $ACHR | Archer Aviation 3. $NVTS | Navitas 4. $RKLB | Rocket Lab 5. $IONQ | IonQ 6. $TEM | Tempus AI 7. $ASTS | AST SpaceMobile 8. $ENVX | Enovix 9. $EOSE | Eos Energy 10. $TMDX | TransMedics

There's no $NVDA, $AMD, $AMZN, $GOOGL, or $META without $OKLO, $VST, $CEG, $SMR, $EOSE. Exposing yourself to the nuclear stocks will play out very well long term. I'm personally in $CEG.

$AMD MI355X compared to $NVDA B200: - 30% more throughput. - 40% more tokens per dollar. - 60% larger memory capacity. And it'll be cheaper than B200. It will take a significant market share from Nvidia. Why aren't you buying $AMD yet?

$ASTS is building a network that's increasingly positioned to print billions of FCF practically overnight, if the excellent execution continues. This is my $ASTS thesis🧵

$TSLA now trades at a forward P/E of 180x. In the history of the stock market, we can’t find a single $1T market cap company that traded at a forward P/E of 180x (we even asked Grok with no success). Why not? The long-term growth rate needed to justify a 180x P/E would cause…

$LMND Deep dive 🧵 I recently decided to invest in Lemonade Here is what I have learned about the business and why I think this could be a potential multi bagger over the next 3-5 years

1/ $NBIS is a 10x potential AI infrastructure stock everybody ignores. Revenue is growing triple digits, they are building new data centers and the institutions still own less than 60% of the company. Here is why $NBIS is an asymmetric bet now: 🧵

Jim Simons was the greatest investor of all time. He turned $1000 in 1988 into $4B in 30 years. His hedge fund achieved 66% returns annually by hiring mathematicians and physicists instead of Wall Street experts. Here's how a mathematician became the world's best investor: 🧵

LEGO was 4 weeks away from bankruptcy in 2003: • Losing $1 Million per day • $800 Million in debt • Negative profit margin (-30%) But then something happened, and by 2010, they started growing faster than Apple. How? 🧵

Warren Buffett just handed over the CEO reins. At 94, he steps aside for Greg Abel, and left a treasure trove of wisdom in his final shareholder letter. Here are my 11 biggest takeaways in under 5 mins:🧵

Bill Ackman is one of the best investors alive. His fund crushed S&P 500 by more than 80% in the last 5 years. Yesterday, I re-watched his 3-hour interview with Lex Fridman. Here are the 7 things you can't miss: 🧵

10 companies which every investor should consider owning: 1) $HIMS | Hims&Hers Description: $HIMS is a telehealth company offering personalized treatments for hair loss, mental health, skincare, and more via a digital platform. Why is $HIMS attractive? • Sector is…

$SOFI has moved 26% in 5 years. Yet it has: - Increased members by 447% - Increased revenue by 367% - Increased products by 484% $SOFI is easily a $25 stock no matter what happens today

If I were to start a hyper growth portfolio today, these are the stocks I would buy: - $NU - $AMD - $SOFI - $NBIS - $HIMS - $SEZL - $OSCR - $LMND - $TMDX - $ROOT All 10x opportunities from these levels.

United States Tendenze

- 1. #WWERaw N/A

- 2. Don Lemon N/A

- 3. #HardRockBet N/A

- 4. Finn Balor N/A

- 5. Jeff Hafley N/A

- 6. McDermott N/A

- 7. Nattie N/A

- 8. Chet N/A

- 9. #MLKDay N/A

- 10. Punk N/A

- 11. #NationalChampionship N/A

- 12. Azzi N/A

- 13. Drew Petzing N/A

- 14. Nicki Minaj N/A

- 15. Gunther N/A

- 16. Brooklyn Beckham N/A

- 17. #RawonNetflix N/A

- 18. Dr. King N/A

- 19. Bussi N/A

- 20. AJ Styles N/A

Something went wrong.

Something went wrong.