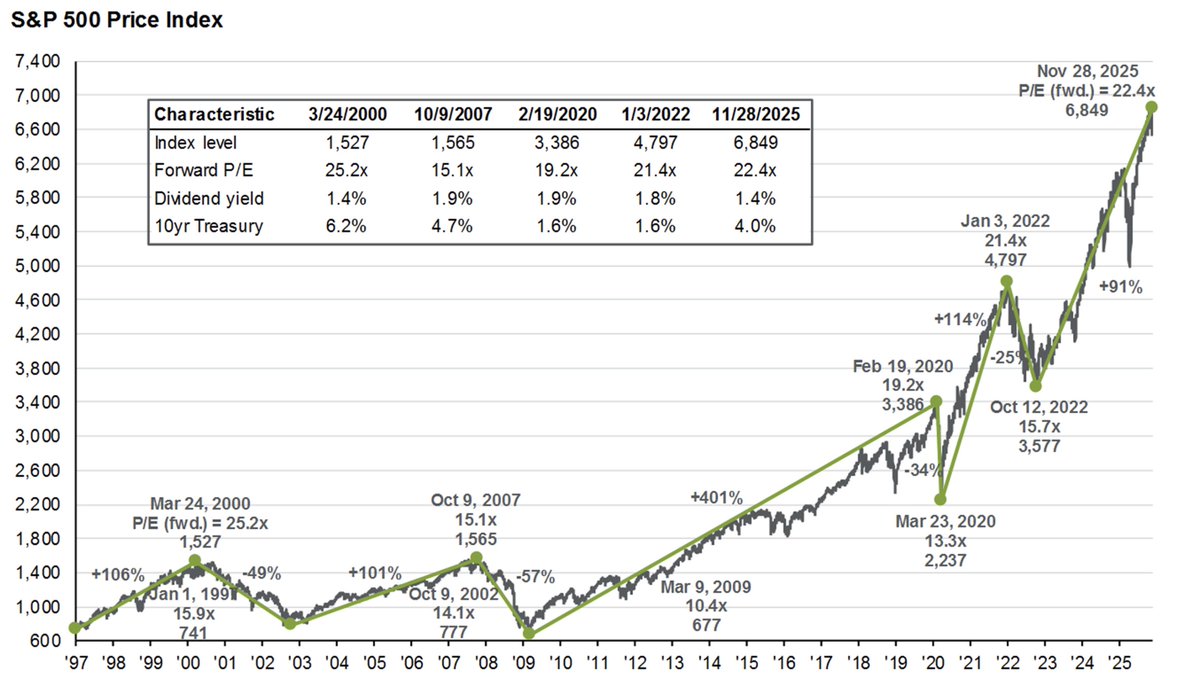

Nordic Compounding

@NorCompounding

I asked for great private equity, M&A, and dealmaking books. What else would you suggest?

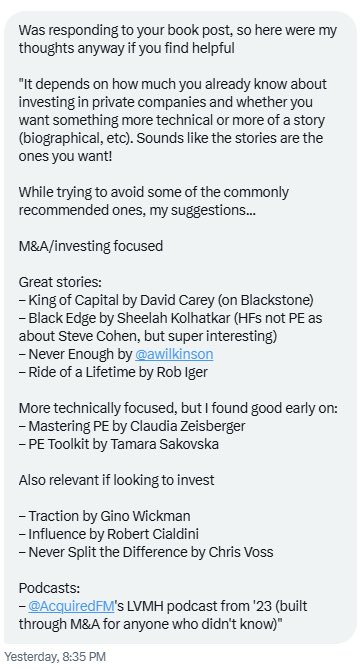

This is funny. What if you invested in the S&P 500 every time CNBC had a "Markets in Turmoil" special? Well... your average return after one year would be 40%, with a 100% success rate.

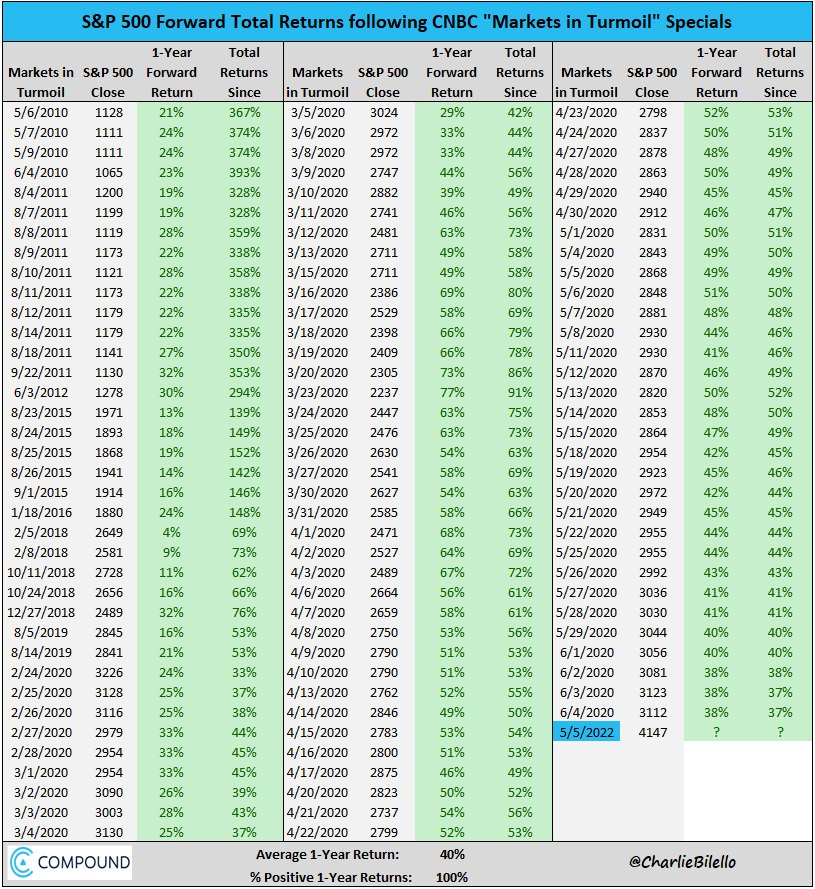

The best slide deck ever? J.P. Morgan's 'Guide to the Markets' Here are the top 10 charts every investor should see right now.

$DEDI - Price per share: SEK 47 - Expected earnings 25E-26E per share: SEK 7.8-9.0 - Cash adjusted P/E 2025-2026E: 4x-3.6x - Is the market overreacting to political risk in Dedicare? Has fear outpaced fundamentals? Structural demand should outlast political noise in the long run

POTENTIAL WARNING 🚨: S&P 500 CAPE Ratio hits 3rd highest level in history

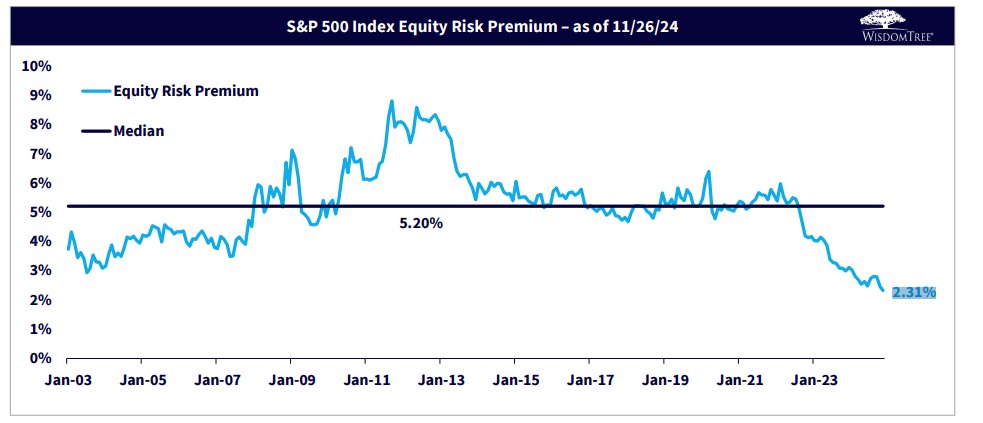

Another fresh 24-year low in the S&P 500 equity risk premium (SPX earnings yield minus the 10yr TIPS yield)

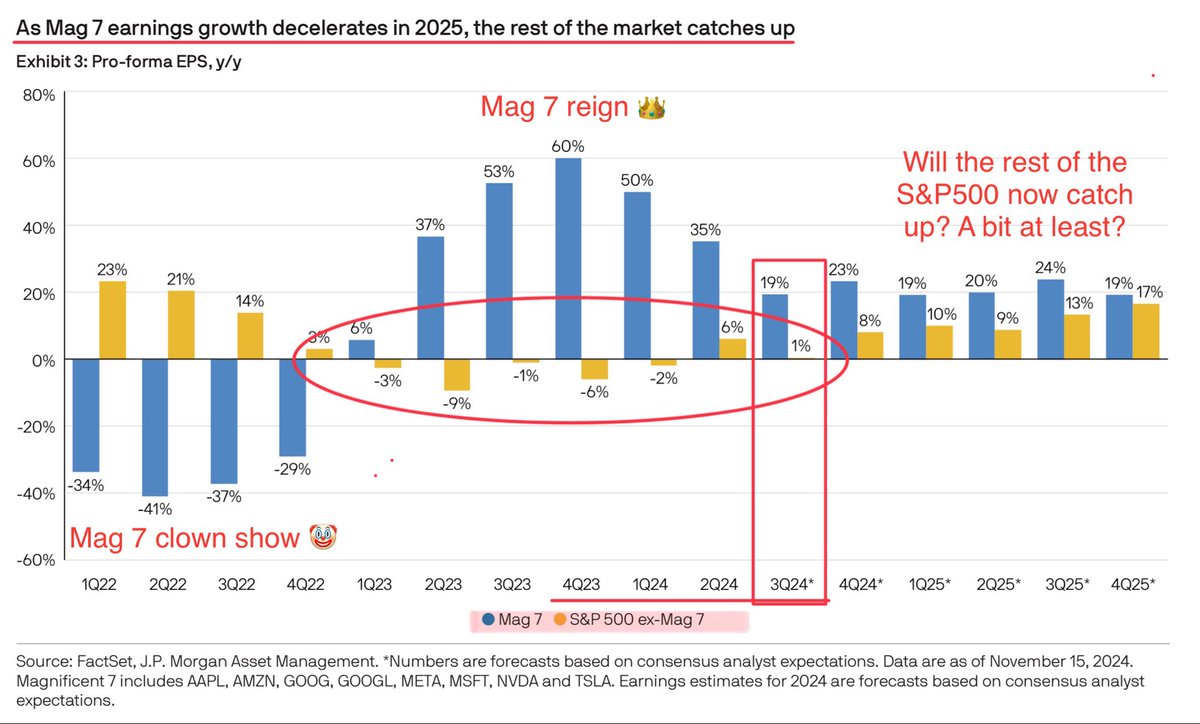

In case you weren’t aware, S&P500 EPS growth outside the Mag 7 has been AWFUL for many quarters now. Last 6 quarters was all about the Mag 7, and that’s why they have outperformed (after the ‘22 Mag 7 clown-show). Into ‘25, an ex-Mag 7 EPS catch-up may be a key market driver.

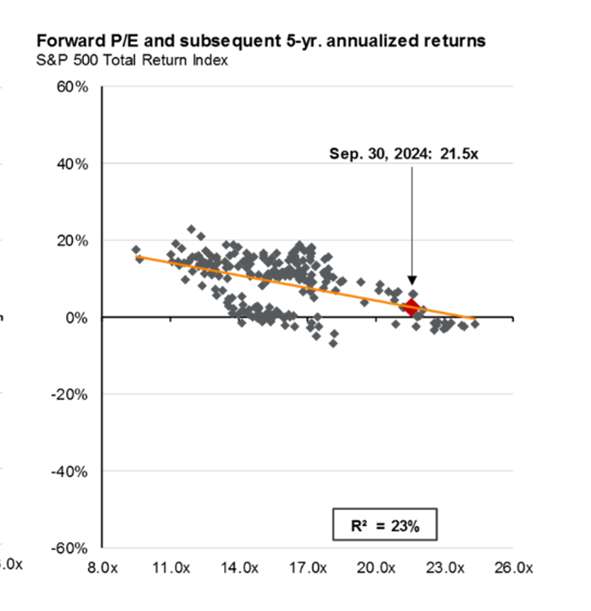

Goldman strategists calculate a 72% probability that 10 year treasuries outperform the S&P 500 over the next decade

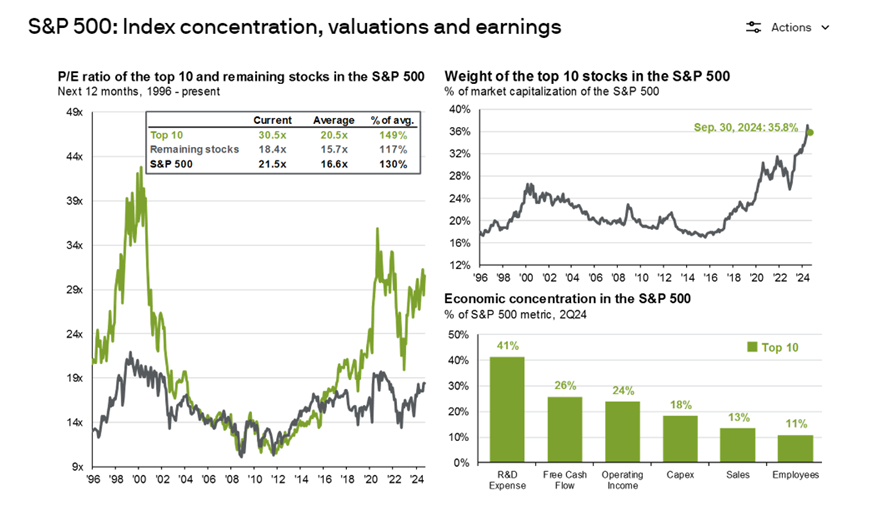

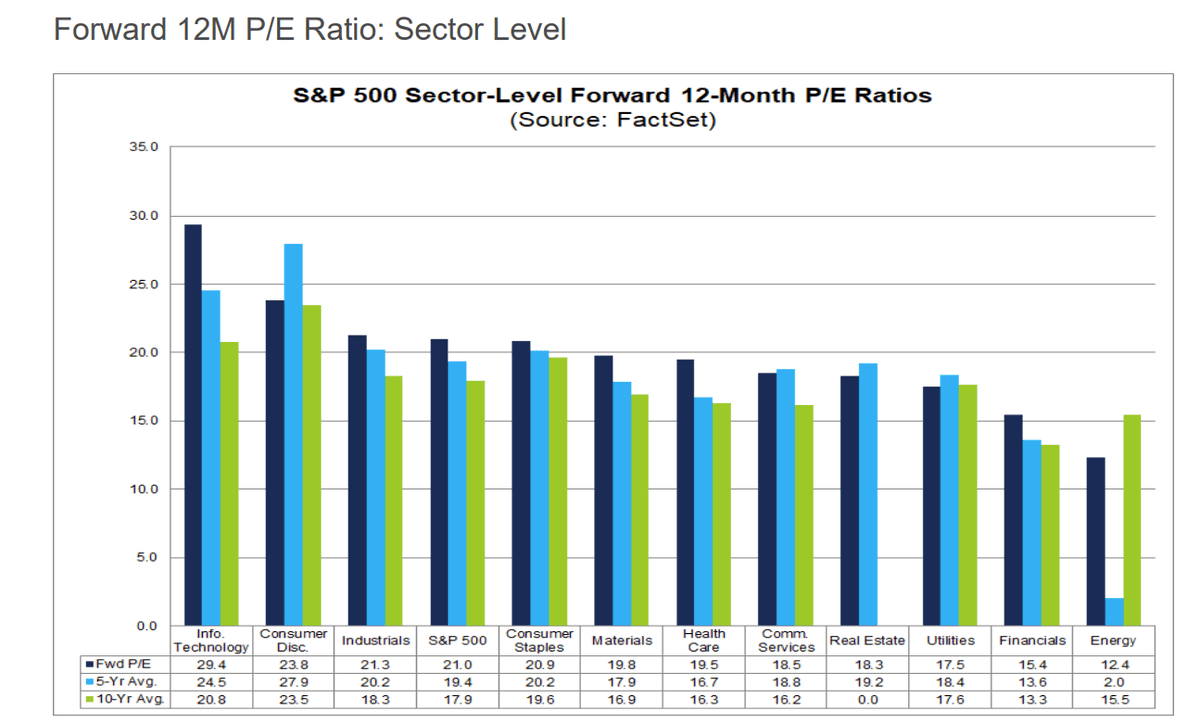

1/4 The 5 most important valuation graphs from JP Morgan Q3 Guide to the markets: S&P 500: - expensive, even without MAG7 - Weight of top10 highest since 1995 - 5Y Forward returns historically very low with the current starting valuation

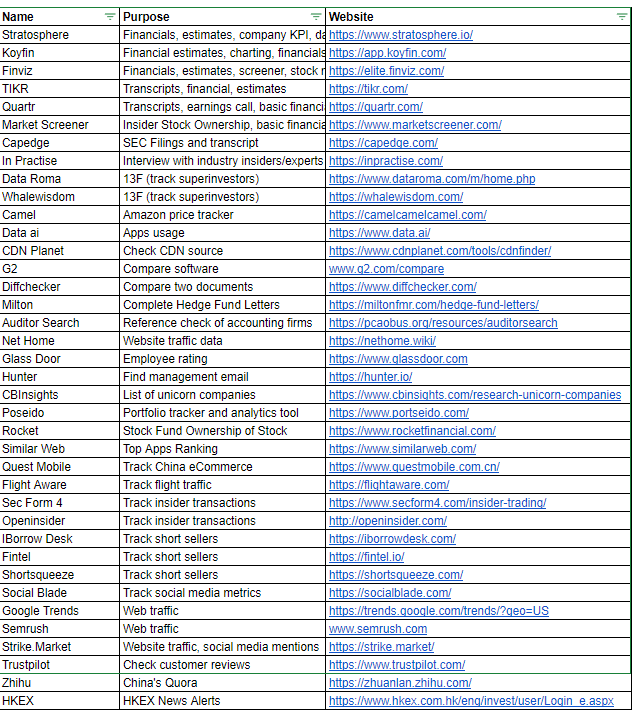

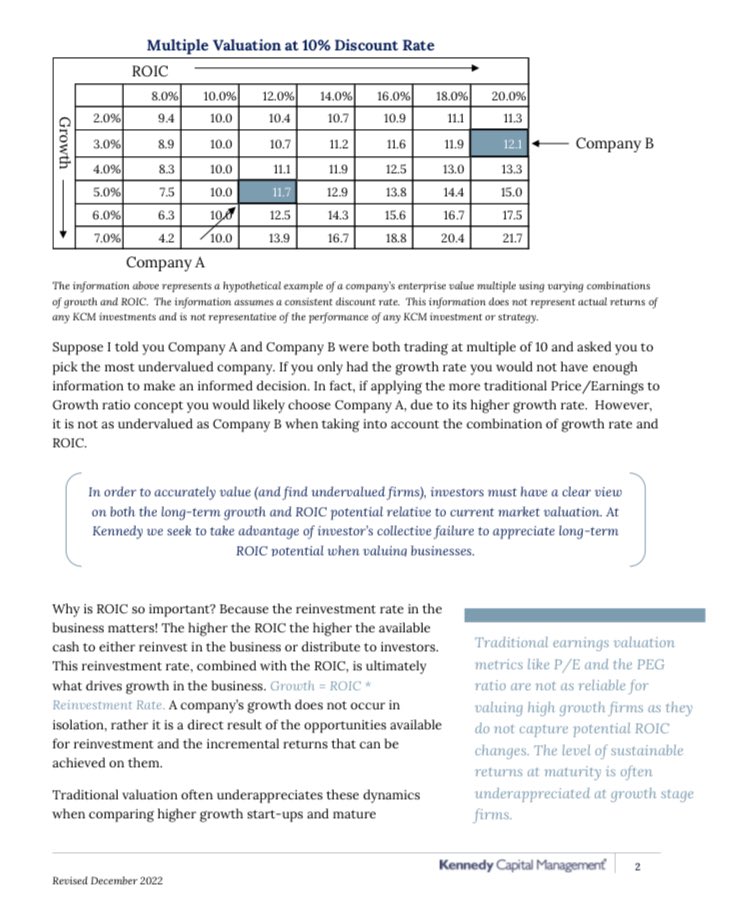

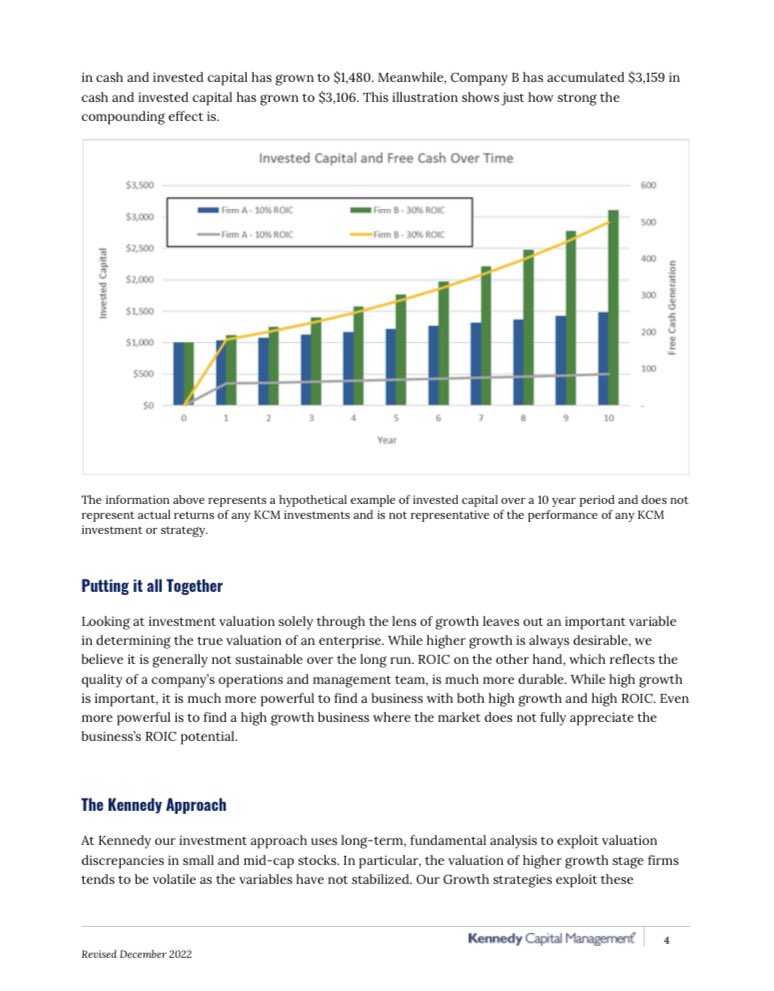

ROIC - The underappreciated variable in valuation:

Dear investor, If 30%+ IRR is your dream…stop everything and listen to this. Here's the secret to success from Uni of Wharton: „If I could come back (after death) I probably come back as a roll up specialist. Because some of the wealthiest people in the world did roll ups.“

Warren Buffett parameters:

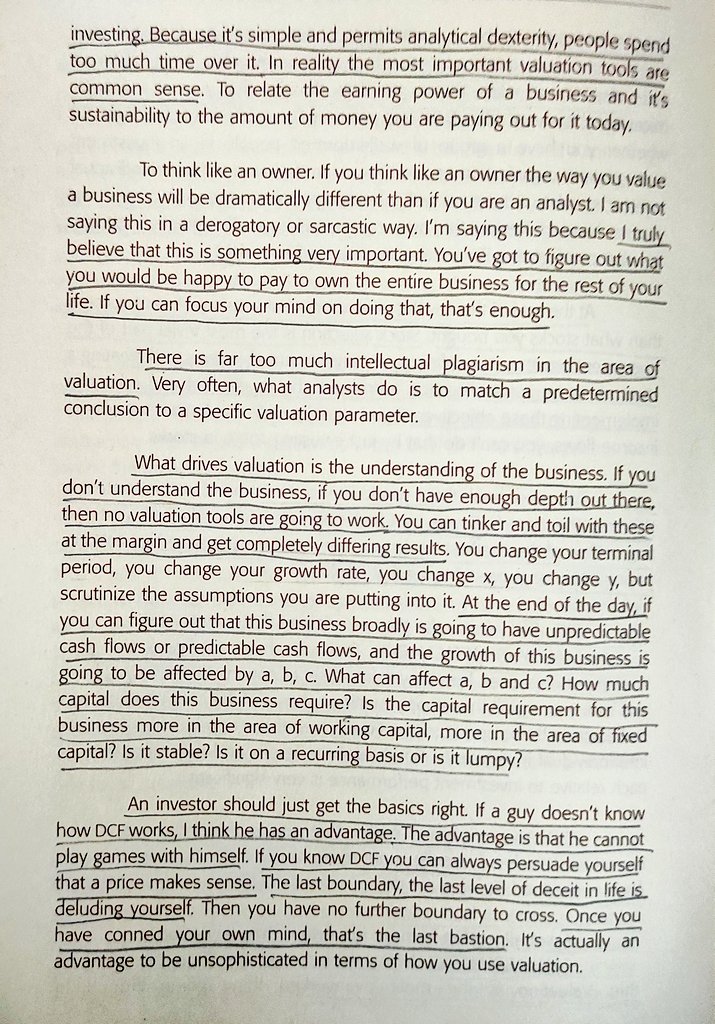

The Best Page I read on Business Valuation

Peter Lynch achieved 29.5% annual return for 13 years. I was obsessed with his stragey and I spent 100+ hours reading all his books to solve it. Here, I will explain to you his framework in 10 simple steps: 🧵

15 Visual Investing Lessons: 1. Bear markets are painful, but the stock market provide solid returns over time:

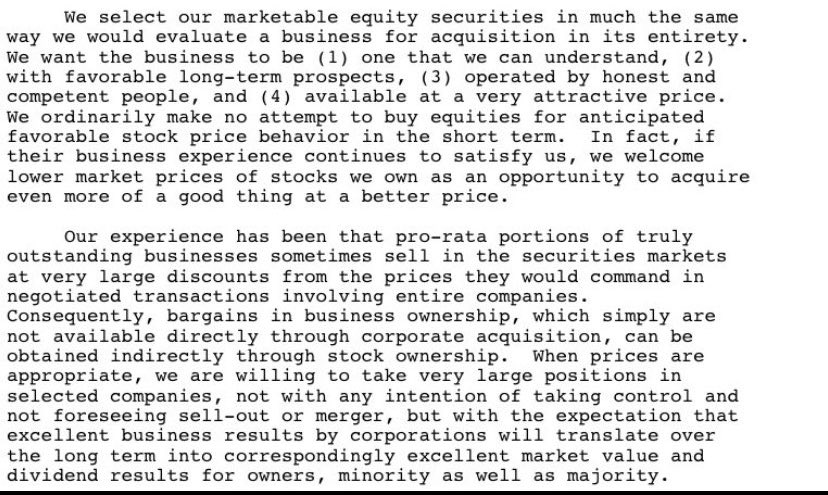

Warren Buffett on how he selects equities for Berkshire. A timeless approach.

Microsoft $MSFT and Altria $MO grew Free Cash Flow/share at roughly comparable rates between 2013 and 2024 Each company has delivered different total returns since the end of 2013 however Microsoft delivered a total return of 1305% Altria delivered a total return of 155% It's

Stocks appear to be fully priced to expensive

United States الاتجاهات

- 1. #SmackDown N/A

- 2. #DragRace N/A

- 3. manon N/A

- 4. Kiana N/A

- 5. Xbox N/A

- 6. Tucker N/A

- 7. Huckabee N/A

- 8. Supreme Court N/A

- 9. #iubb N/A

- 10. #savePunch N/A

- 11. SCOTUS N/A

- 12. #loveduringlockup N/A

- 13. FanDuel N/A

- 14. Snooki N/A

- 15. Ilja N/A

- 16. Naz Reid N/A

- 17. Phil N/A

- 18. McConnell N/A

- 19. Jade Cargill N/A

- 20. Microsoft N/A

Something went wrong.

Something went wrong.