Notes on Money

@NotesByWesley

Dividend Growth Investor | Bombastic Business Owner | Making Finance Visual through Weekly Graphics | Here to share my thoughts | Not tell what to do

I’ll jump back in at 84k (if we get there) for a swing to 100k 😬

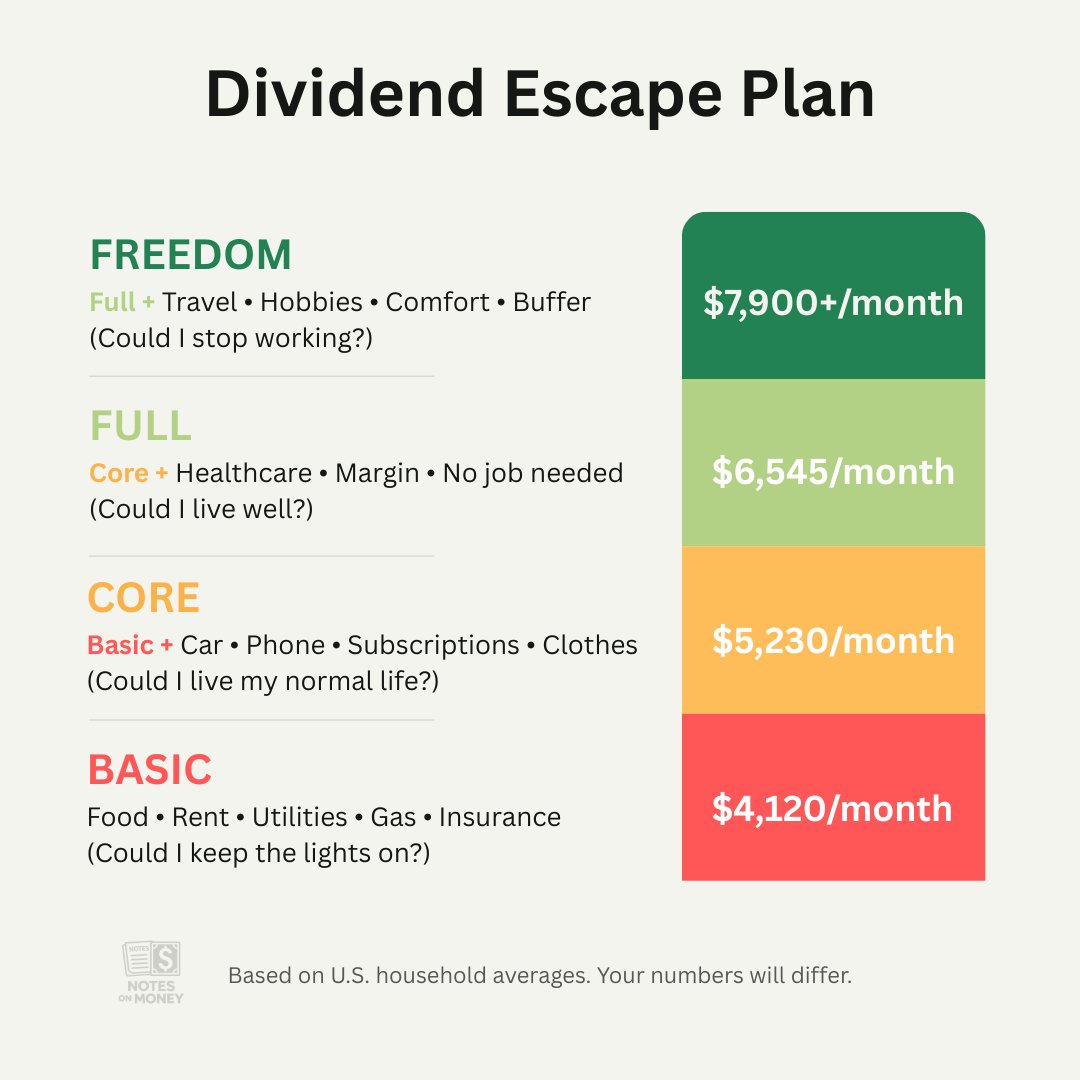

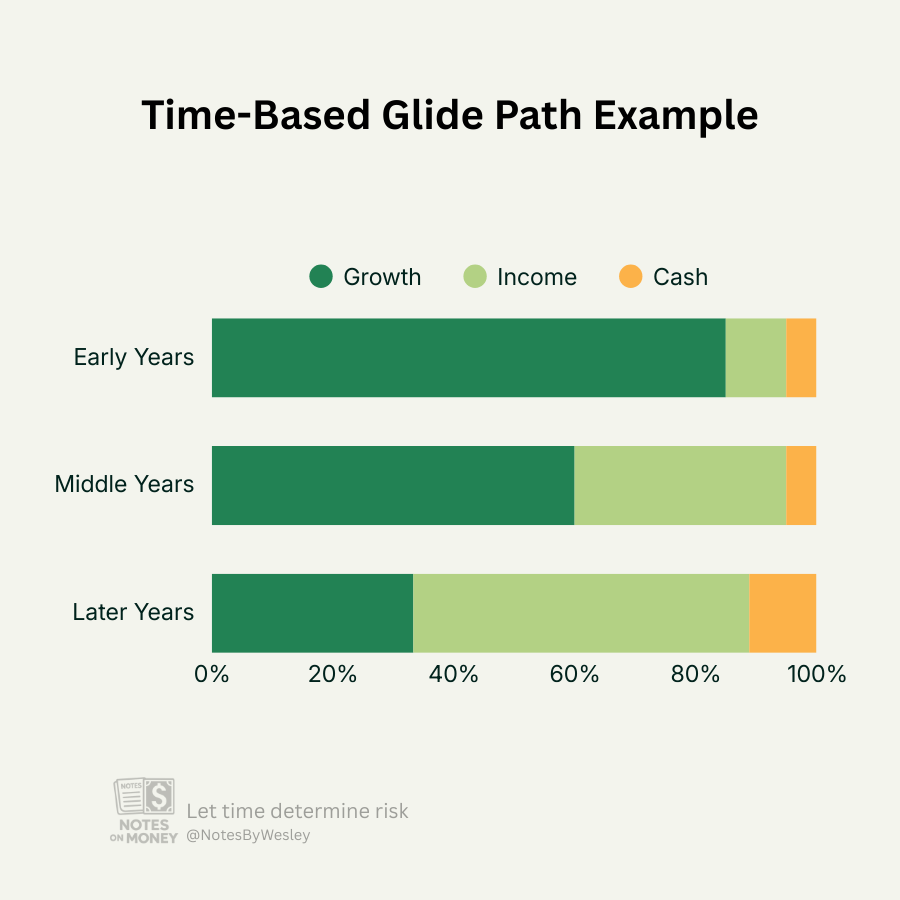

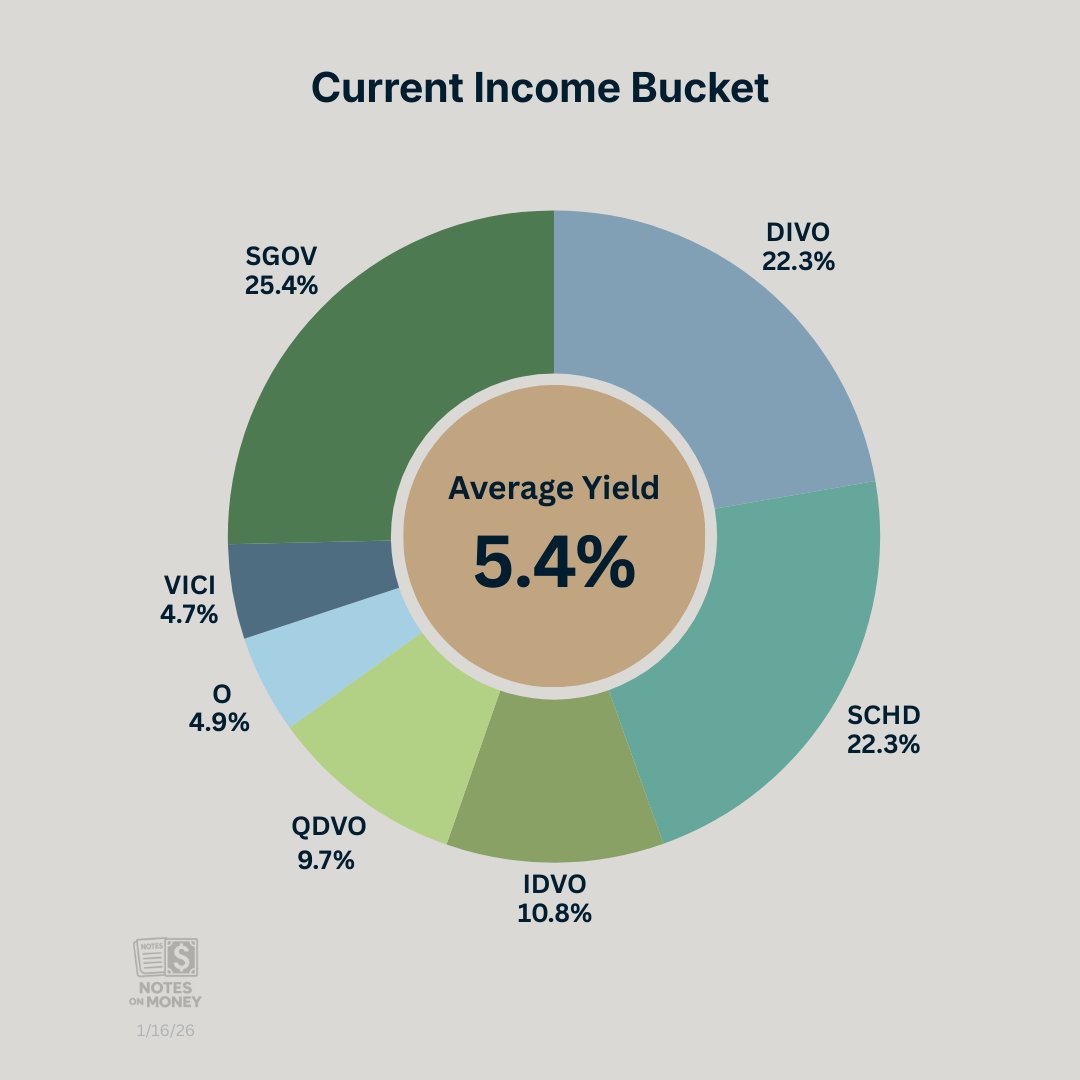

How do you guys determine what money goes where? I have 3 buckets. Growth. Income. Cash. I let time determine risk and shift from growth to income as I get closer to financial independence. Kind of a cheat sheet I use to rebalance yearly. You agree with this? Too…

$VICI looking good down here. Still in the discount zone. Think concerns are overblown and a nice starting yield if you’re looking for a position. Do some research on this if you’re looking into REITs.

REIT beast. Super stable div. Gonna pick up more on Tuesday. Not a ton but rebalancing and need to up my REIT exposure basket. 2026 tailwinds?! $O $VICI

I bought a “mutual funds for dummies” book when I was in high school. 🤣 What a nerd. I had no one to teach me anything. Sometimes I wonder why people like us are the way we are. Is it a personality trait we’re born with?

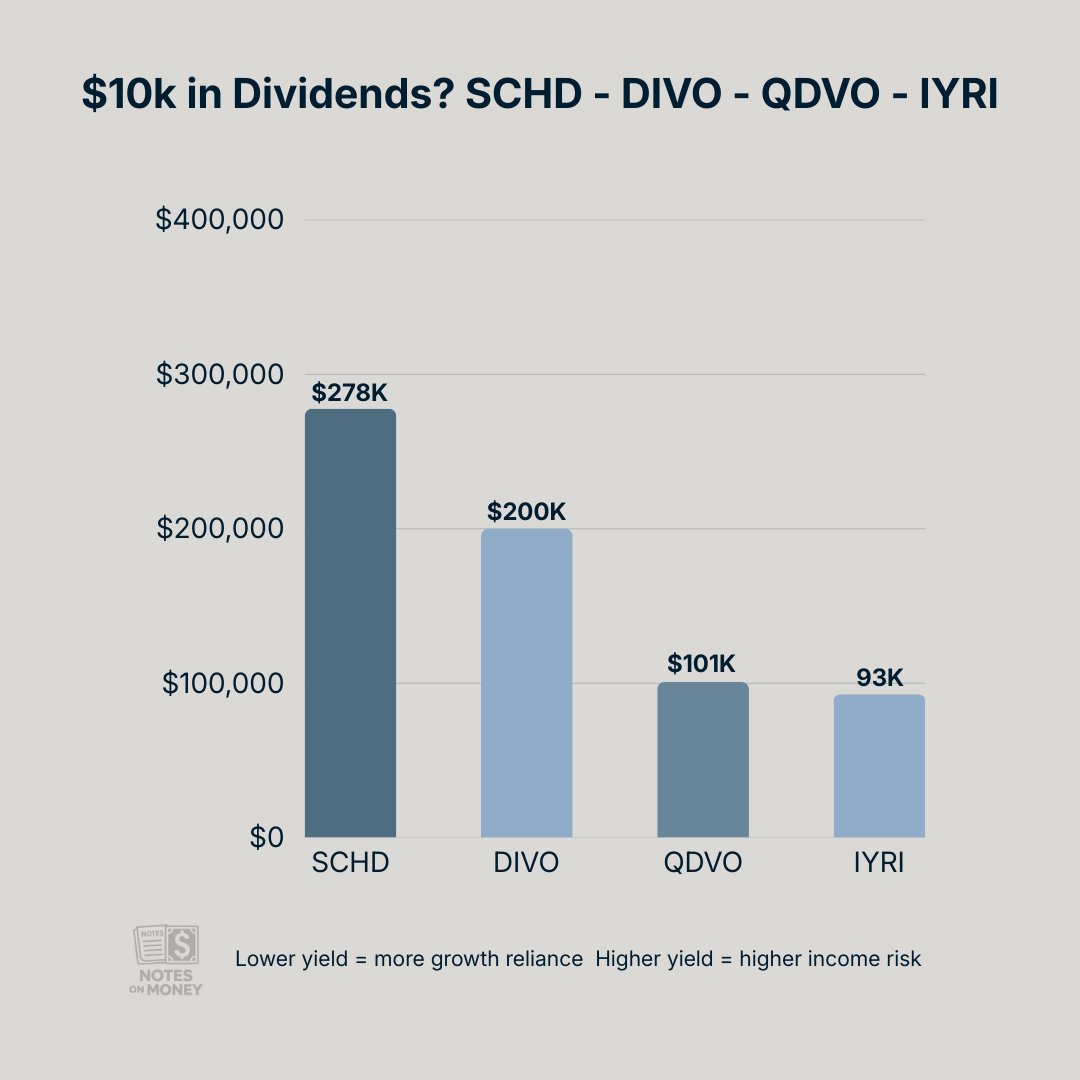

The Holy Trio 💡 Unlike 100% covered call portfolios that forfeit all upside potential, DIVO, IDVO, and QDVO use partial coverage writing calls on only a portion of the portfolio.

Roast my income bucket Friday! Exited successful investment. Moving cash slowly. How would you allocate? Pro tip. Holding Cash? SGOV is exempt from state and local taxes. SGOV SCHD DIVO IDVO QDVO O VICI

As a business owner I can identify with income investing. I use my profits to buy assets that generates more cash (forever!). It just makes sense to me. Growth is important as well but I get more enjoyment out of dividends. An army you don’t have to manage. Too much fun.

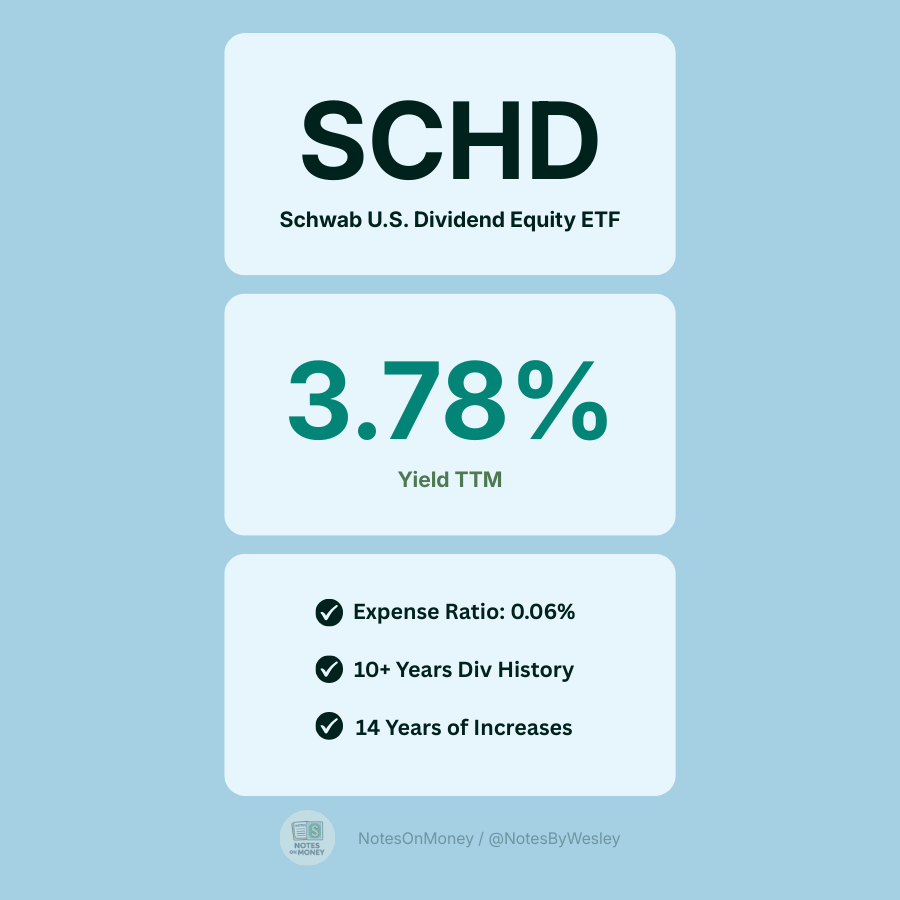

An example of a core income fund. I have this bad boy in my port. SCHD helps smooth out risk. 👇

In the future you won’t be checking your account every day. You’ll be living your life having fun while your portfolio spits off cash.

United States Trends

- 1. $GHOST N/A

- 2. Peralta N/A

- 3. Brewers N/A

- 4. Hathaway N/A

- 5. Cyraxx N/A

- 6. Mets N/A

- 7. #TusksUp N/A

- 8. Fredo N/A

- 9. #AEWDynamite N/A

- 10. Sproat N/A

- 11. Jett N/A

- 12. Alijah Arenas N/A

- 13. Myers N/A

- 14. #ArknightsEndfield N/A

- 15. SDSU N/A

- 16. David Stearns N/A

- 17. Aztecs N/A

- 18. Ajay Mitchell N/A

- 19. Tennis N/A

- 20. Clayton Keller N/A

Something went wrong.

Something went wrong.