Option Optimo™

@OptionOptimo

We give traders a sneak peek into the most lucrative hedge fund & institutional size trades as they happen. NOT considered trade recommendations. Option Optimo™

Potrebbero piacerti

$MRO Apr 17 calls active on 2/24 $0.39-$0.45. Underlying up nearly 3% today and those calls are now trading $0.68.

$NMBL Mar 10 calls active yesterday trading $0.35-$0.38. Underlying up nearly 3.5% today and those calls are trading $0.60.

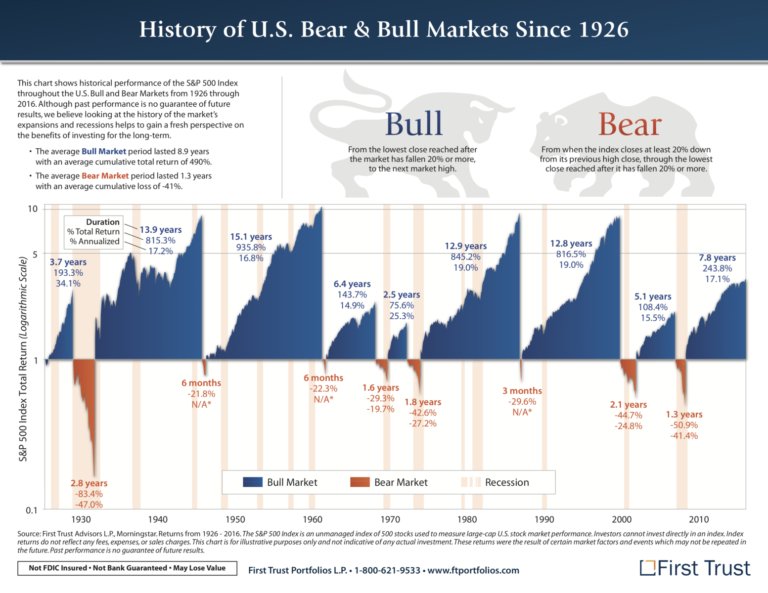

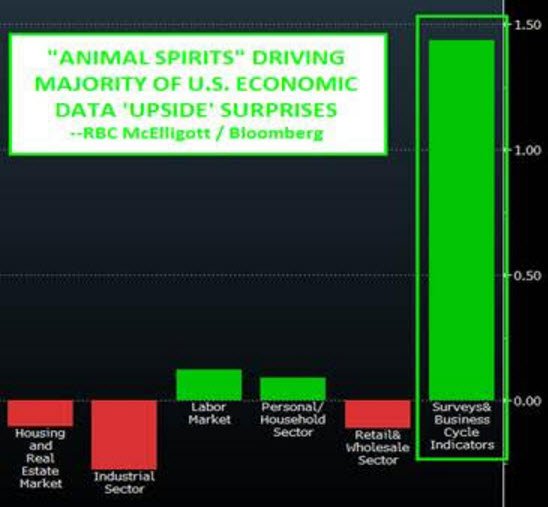

Long-in-the-tooth and overbought bull market? Really? Does not look that way based on this graph. $DJIA, $ES_F $QQQ

Check out $TTWO. Unusual #options activity on 1/4 in the Feb 55 calls for $0.90. These are now trading $2.80-2.85. bit.ly/2lokENA

Check out $FL. Big call buyers on 2/1 in the Mar 70 calls for $1.74. These calls are now trading around $4.00. bit.ly/2lokENA

These $WFT calls are now trading $0.79! Impressive move in $WFT!

Observed unusual #options activity in the $WFT 10 Feb 5.5 calls on 1/30 for $0.19. Underlying up over 13% and the 10 Feb 5.5's are now $0.48

Observed unusual #options activity in the $WFT 10 Feb 5.5 calls on 1/30 for $0.19. Underlying up over 13% and the 10 Feb 5.5's are now $0.48

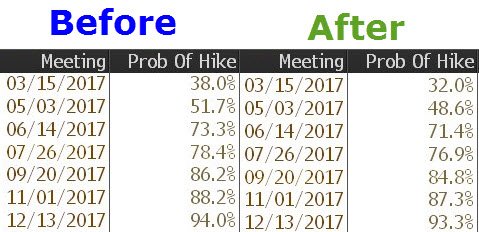

March rate hike odds slide from 38% to 32%

$DIS has been seeing interesting activity in the July 115 call strike all day. Institutional sized trades.

What has driven the bulk of the economic data "upside" surprises?

Markets hammered today, but still some interesting order flow. $CRM, $WFT, $COH

Interesting options activity ahead of earnings for $MRK today.

Those $RCL Feb 90 calls are now trading $6.50!

On 1/10 we observed institutional order flow in the $RCL Feb 90 calls for $2.10. Earnings are out and these are trading $5.30 currently!

What a move in $TMUS. On 1/18 we observed institutional call buying in the $TMUS May 70 calls for $0.84. Was trading $2.20 earlier today.

On 1/10 we observed institutional order flow in the $RCL Feb 90 calls for $2.10. Earnings are out and these are trading $5.30 currently!

The $dow has surged about 2150 since the election!

Massive move in $AA. We observed institutional call buyers in the Feb 32 calls on 12/28 for $1.20. These are now trading $6.10!

United States Tendenze

- 1. #OlandriaxRahulMishra N/A

- 2. Tom Homan N/A

- 3. Good Monday N/A

- 4. #MondayMotivation N/A

- 5. Ran Gvili N/A

- 6. Roval N/A

- 7. #PMSSuperBowlSZN N/A

- 8. #MaduroCiliaHeroes N/A

- 9. #VenezuelaEsAmorYPaz N/A

- 10. $CRWV N/A

- 11. Scheelhaase N/A

- 12. Udinski N/A

- 13. AirTag N/A

- 14. CoreWeave N/A

- 15. Cramer N/A

- 16. Signal N/A

- 17. Browns HC N/A

- 18. Tomodachi Life N/A

- 19. $IONQ N/A

- 20. Reform N/A

Something went wrong.

Something went wrong.