PSX Pulse

@PSXJournal

Retweeting the sharpest takes on PSX — fundamentals, technicals, and market trends.

It is also mentioned on the back of the PBO that everyone who booked the car would have signed. It’s only a safety clause if the company runs out of a specific color. 😅

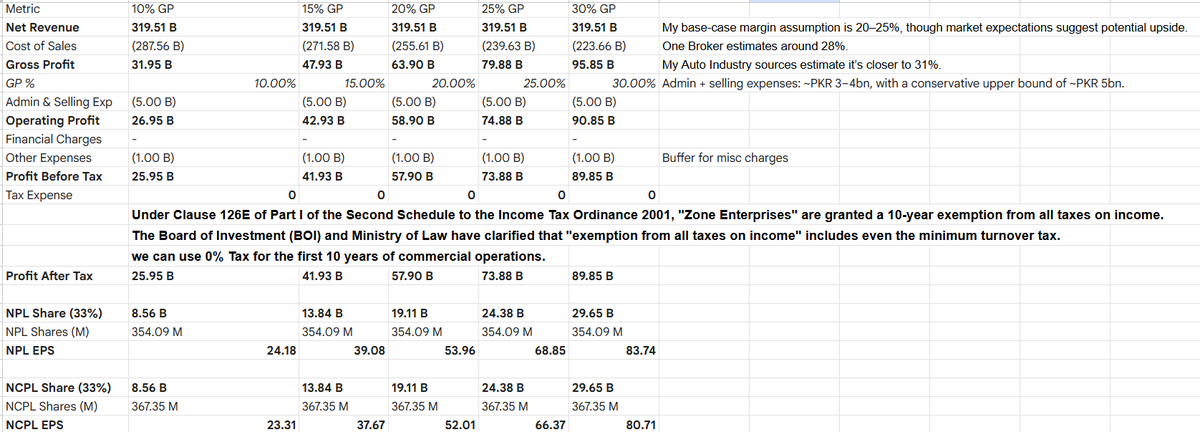

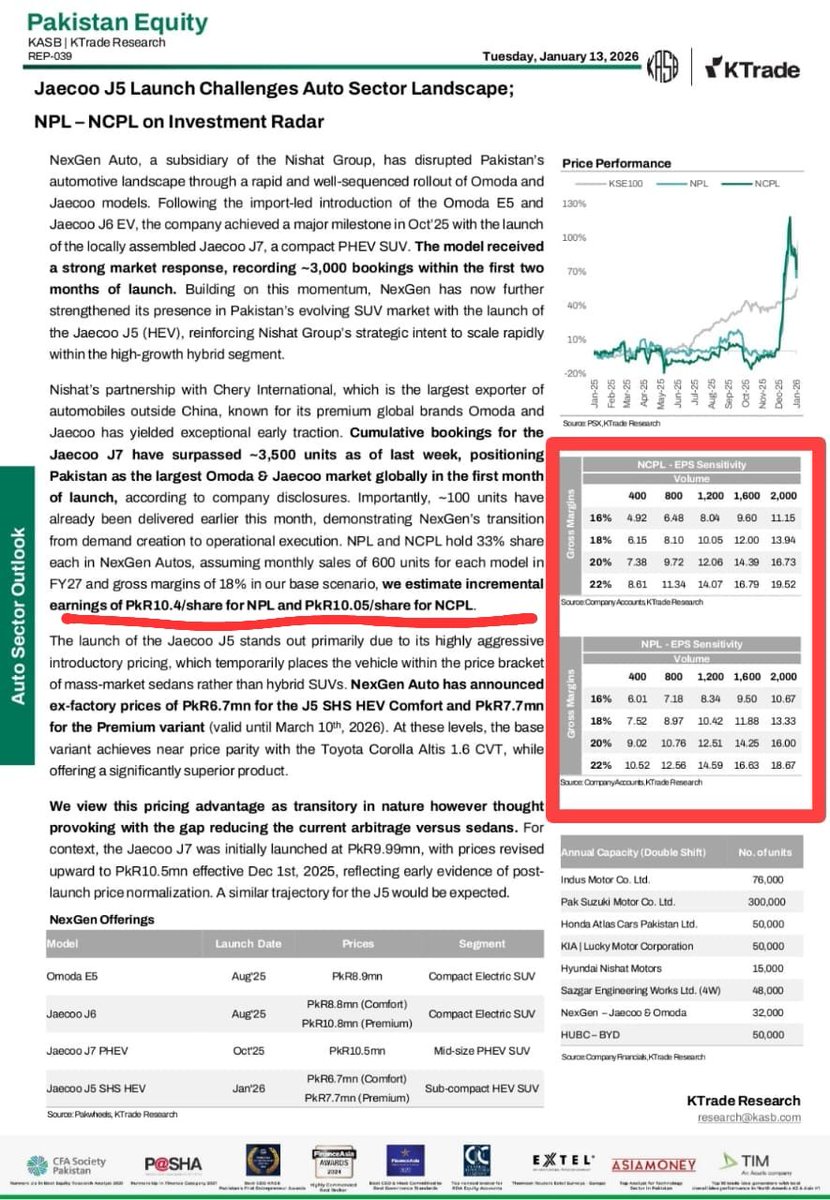

To @afkhwaja & the @KASBSecurities Research Team: I am publicly flagging a case of gross negligence in your Jan 13th report on #NPL & #NCPL Indisputable fact: Both companies have equal profit share. • NPL: 354M shares • NCPL: 367M shares Basic math: fewer shares = higher EPS

Tracked it quietly for a month. Numbers don’t lie. Skyrocket incoming 🚀💎

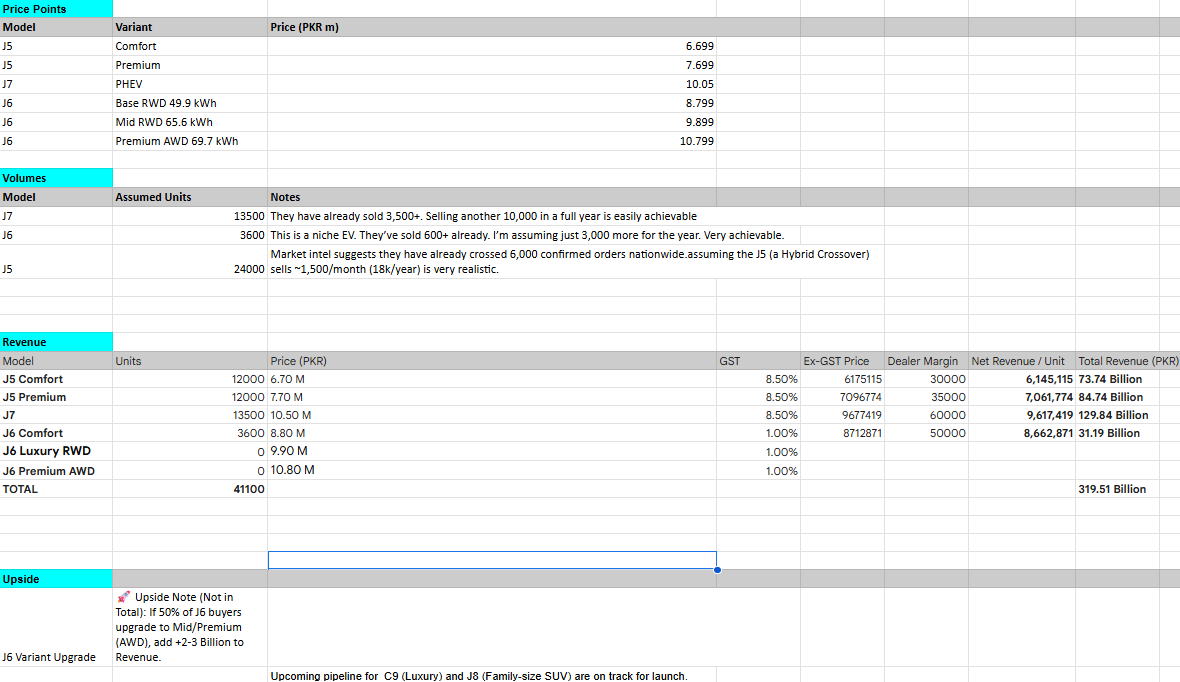

These same global markets host multiple competitors, yet none have come close to this level of award-sweeping dominance. The distinction is clear. In Pakistan, that global momentum gets a powerful multiplier: Nishat Group 🇵🇰 Global validation + Nishat execution = a new standard

From Best Value to Car of the Year 🌍🏆 Dominating the UK, Europe, LATAM, Middle East & Asia. OMODA & JAECOO aren’t entering markets they’re owning them. 2025 is just the beginning. 🚀⚡ #OMODA #jaecoo #AutoAwards2025 #GlobalDomination #NPL #NCPL #NISHAT

🧵Tracking the sentiment on Jaecoo J7 post-Tiggo 8 launch.Honestly? The panic is overstated. I just had a detailed chat with a friend deep in the auto market to verify the ground reality. Here is why the J7 remains the safer,stronger play despite the new competition👇 #NPL #NCPL

Just cross-referenced the CR financing data with booking trends... calling it now: Jaecoo J5 orders are set to DOUBLE. 🚀 MCB just poured gasoline on the fire 🔥. The data is screaming volume growth. Secure the ride before the backlog hits july. ➡️📈 #NPL #NCPL #DYOR #JAECOO

Why does #NPL generate higher EPS? It comes down to share count. With 12 Million fewer shares than #NCPL, #NPL is more efficient at turning profit into shareholder value. #NPL holders get a EPS bonus simply because the pie is sliced into fewer pieces. 🍰 #MULTIBAGGER

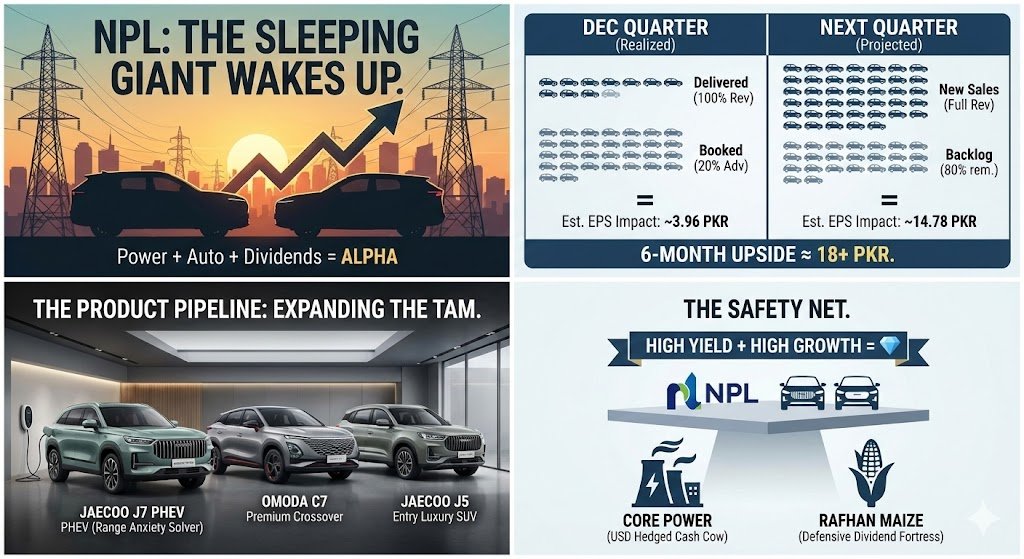

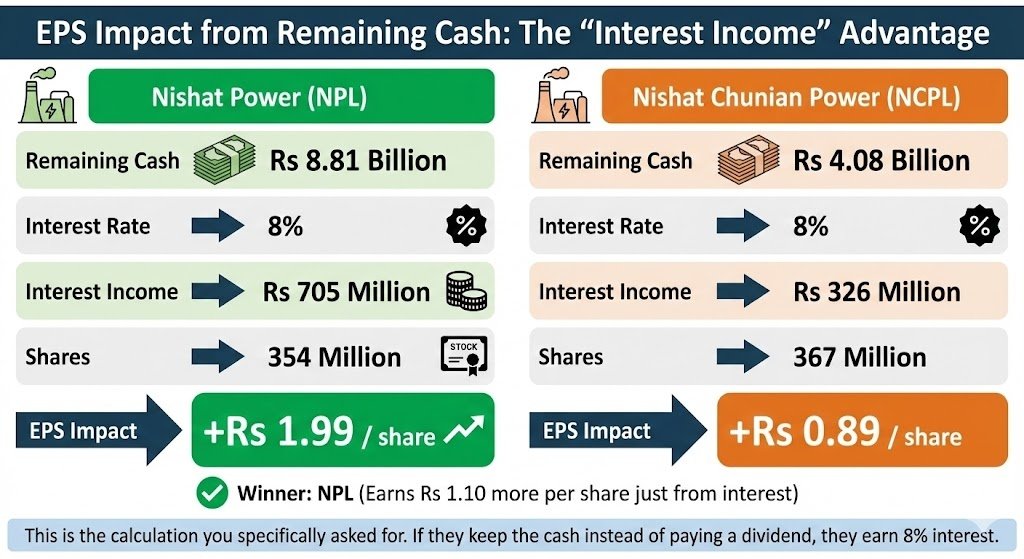

Cash is King, but Interest Income is the Kingdom. 👑 #NPL generates +Rs 1.99/share just from bank interest (8%). #NCPL generates only +Rs 0.89/share. That is a 120% advantage for #NPL shareholders before the core business even starts. Safe. Liquid. Profitable.🛡️🚀 #MULTIBAGGER

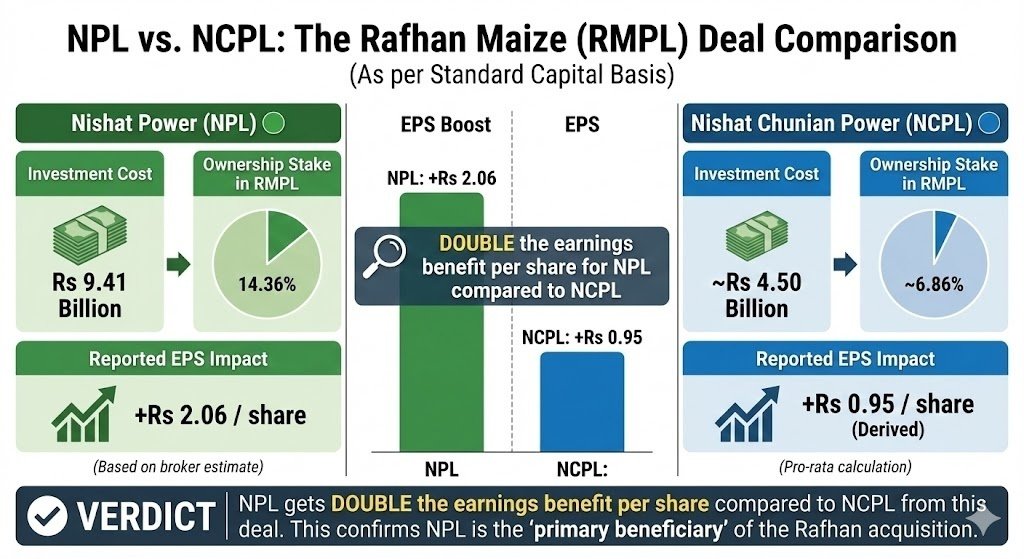

🚨Deal Confirmed: NPL vs NCPL Impact Analysis Nishat Power (NPL):Investment: Rs 9.41 BillionEPS Boost:+Rs 2.06/share🚀 Nishat Chunian (NCPL):Investment: Rs 4.5 BillionEPS Boost:+Rs 0.95/share NPL gets 2x the benefit while keeping 2x the cash safety. The choice is obvious.📉🚫

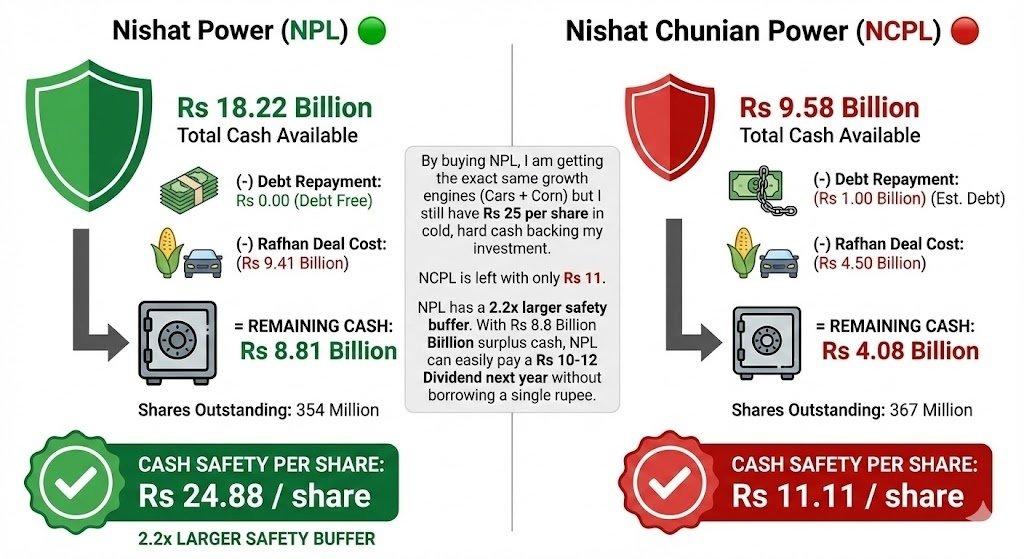

#NPL vs #NCPL:The "Post-Deal" Cash Reality Even after buying the Rafhan Maize stake (Rs 9.4B), NPL still holds Rs 25/share in liquid cash. What does this mean? 🟢Possibility of Bumper Dividend: 8.8 Billion cash, a massive payout (Rs 10+) is on the table without borrowing a dime

Spot on!💯The Seth never enters a game unless the rules are rigged in his favor. In this case, the rig is the Policy Arbitrage: 1️⃣Zero Tax (SEZ Status) 2️⃣1% Duty Mansha doesn't play for %. He plays for the 2 ka 4, 4 ka 8, 8 ka 16 multiplier. We are just riding the coattails💸#NPL

Power ✅ Food ✅ EV Revolution ⚡🚗 🐂 #NPL — Your next multi-bagger! 💎

FY26 Sum of Parts 🏆 1️⃣ Core Power: ~4–5 PKR EPS (Bond Proxy) 2️⃣ Rafhan Maize: ~2+ PKR EPS (Defensive Carry) 3️⃣ NexGen Auto: ~30+ PKR EPS (Growth Engine) 🚀 Total FY26 EPS Potential ≈ 40 PKR 💰 Target Cash Dividend: 6–7 PKR (Yield Floor) 📉 Current PE is broken (<2)

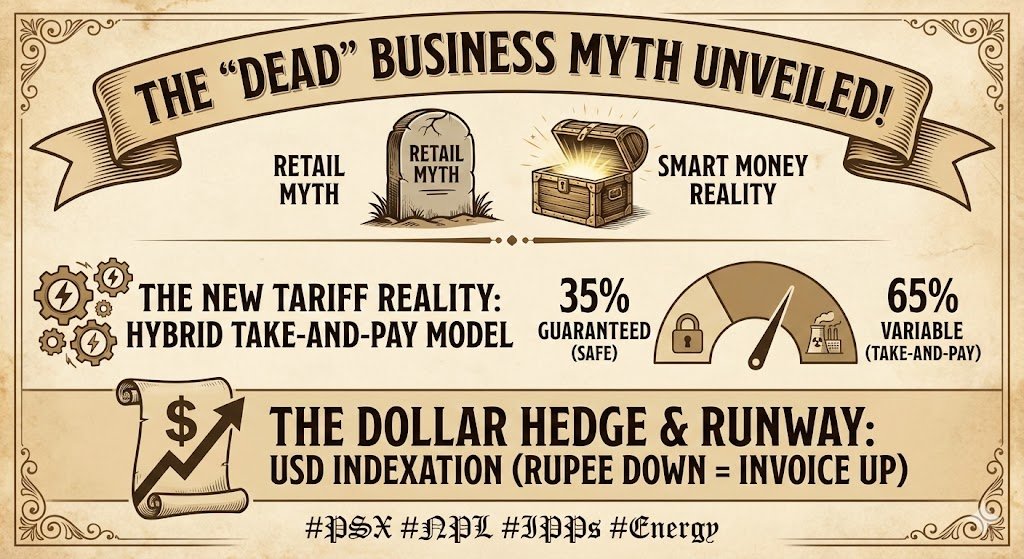

✅ USD Indexation: Part of CPP linked to USD/PKR → Rupee down 📉 = Invoice up 📈 (Inflation Hedge) ✅ PPA Expiry: June 2035 → ~9.5 years of guaranteed/hybrid cash flows ✅ Strategic Location: Plant in Kasur → Close to urban demand + nearby industrial hubs → Less line-loss .

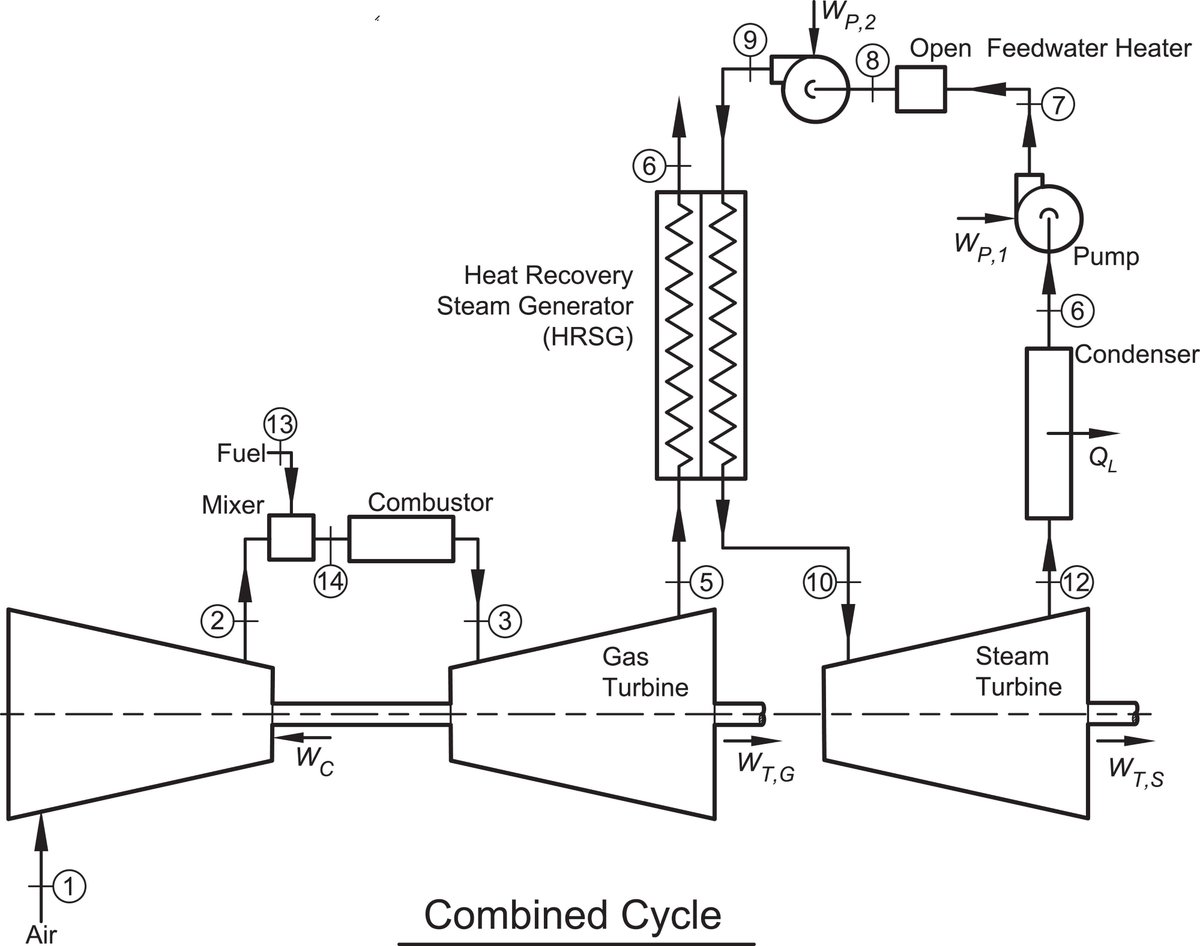

Gone are the days of 100% Take-or-Pay. The New Deal: 🔹35% Guaranteed → Covers fixed costs & baseline profit 🔹65% Variable → Linked to dispatch (Take-and-Pay) The Edge: 🏭 NPL runs on Wartsila 18V46 engines (Ultra-efficient) ⚡ Grid Operator prefers running NPL during demand

The "Dead" Business Myth 🧟♂️ Retail thinks IPPs are dead. Smart Money knows #NPL has morphed into a High-Yield Bond Proxy. It’s no longer a "Growth" asset. It’s a cash machine with a 9-year expiration date. Let's decode the "Hybrid Take-and-Pay"

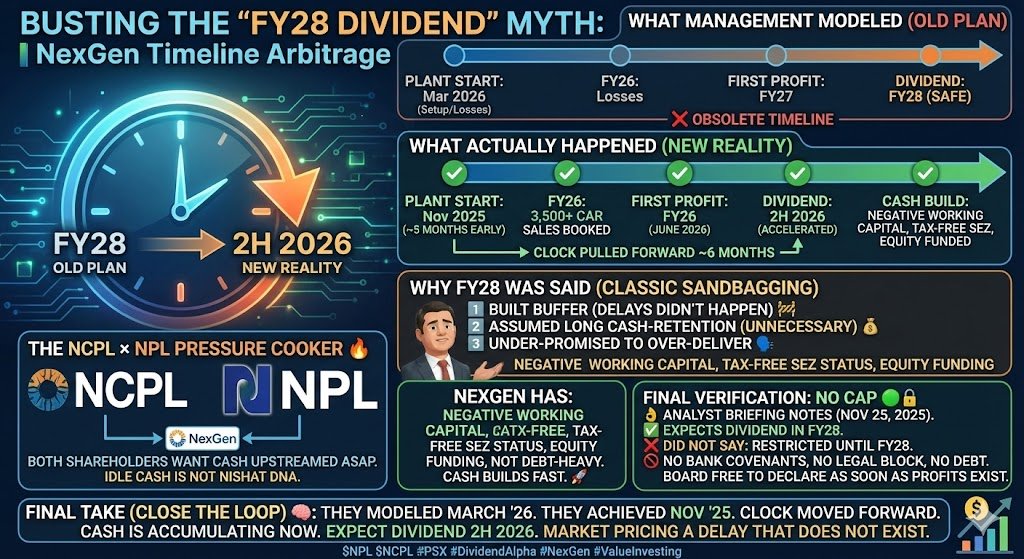

NexGen⚡ • Negative working capital (advances) 💰 • Tax-free SEZ cash 🏭 Management said: “expects dividend FY28”📅 They did NOT say: “restricted until FY28” ❌ 📌First payout likely FY27 (2H 2026)🚀 The market is pricing a delay that doesn’t exist

What Management Modeled (Old): • Plant start: Mar 2026 • FY26: Setup / losses • First profit: FY27 • “Safe” dividend: FY28 What Actually Happened: • Plant start: Nov 2025 • FY26: 3,500+ car sales already booked • First profit: FY26 You can’t keep the old dividend date...

The Twin Benefits: 1️⃣ SEZ Act: Potential 10-Year Income Tax Holiday (0% Corp Tax). 2️⃣ NEV Policy: 1% Custom Duty on parts (vs 30% standard). The Math:High Margins (Low Duty) + Zero Tax = Pure Cash Flow for Dividends. 💸 #NPL shareholders get the full pie, not the leftovers.

United States Trendler

- 1. #AEWDynamite N/A

- 2. #TheMaskedSinger N/A

- 3. Ciampa N/A

- 4. Andrade N/A

- 5. Cavs N/A

- 6. Thekla N/A

- 7. Jaylon Tyson N/A

- 8. #ChicagoFire N/A

- 9. #SistasOnBET N/A

- 10. Allie N/A

- 11. Doyle N/A

- 12. Nicki N/A

- 13. Bronny N/A

- 14. El Clon N/A

- 15. Giannis N/A

- 16. Cleveland N/A

- 17. Fulton County N/A

- 18. Optimus N/A

- 19. #AbbottElementary N/A

- 20. Mikey N/A

Something went wrong.

Something went wrong.