Are Your Ready? youtu.be/DU0nwsY-8WY?fe… Latest Bitcoin 4 Year Cycle Video. Appreciate a retweet and share on other platforms. All the best.

youtube.com

YouTube

Are Your Ready?

hey new 𝕏 algo, let people know about: → DOT 2.1B capped supply → Polkadot App → Hub: deploy smart contracts on Polkadot → Elastic Scaling & Polkadot 2.0 completion → DeFi Builders Program → Polkadot Cloud Build Party → sub0 in Buenos Aires, November 14-16 → JAM

The short-term $ETH playbook pre-post Fed rate decision (bookmark this): GM, We don't need 5 indicators, 10 pages of on-chain analysis, we need to keep things simple. Scenario 1: ETHUSDT finds itself in a very good place for a swing long in terms of Risk/Reward. This might be…

Here is what makes sense ,,

It's really really simple... In an ideal world, the Fed needs to see consistent disinflation to cut rates. In a nonideal world, the Fed needs to see terrible labor market data to cut. Right now, we have neither of those things. So the Fed isn't going to cut. Do you get it?

So true and it’s happening everyday

The playbook. 1. Get your face on TV. 2. Be right eventually after years being wrong. 3. Start a scammy company, SPAC or ETF. 4. Sell high and keep pumping it. 5. Rug all your investors. 6. Retire a multi millionaire.

🔥THE RISKS OF RATE CUTS Trump wants lower rates to boost the economy, jobs, and cut debt costs — even if inflation hits later. In 1972, Nixon tried the same. It led to a short boom… then 15% inflation and a brutal recession.📉 🇺🇸Powell’s resisting — for good reason.

I don't mention this enough, but I write books. And they are priced pathetically low. If you desire to buy a $40 book for sub-$20, or a high-quality e-book for less than a cup of coffee, look no further. They are available on Amazon or at any other book outlet. Thank you for…

The Perfect Storm Bitcoin 4-Year Cycle Journey video. Appreciate you sharing it on other media, and a retweet. Cheers. youtu.be/lFyXznUq30A?fe…

youtube.com

YouTube

The Perfect Storm

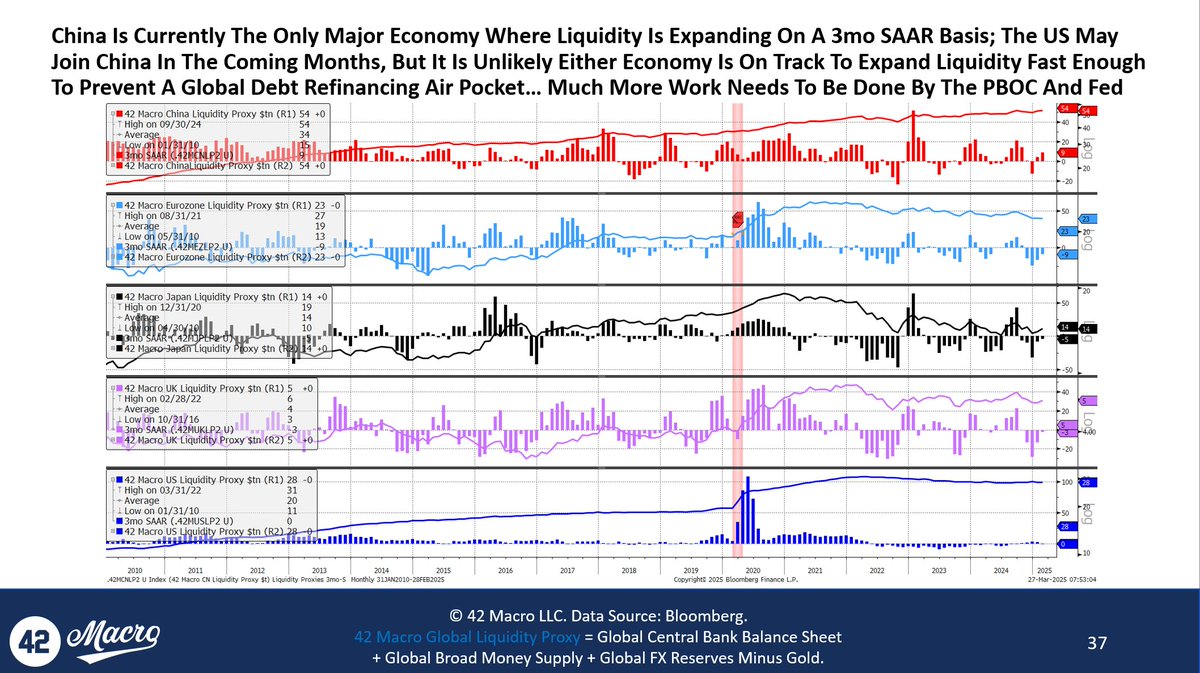

Good morning, and God bless, #Team42! Today’s Key Macro Question: Is it time to buy bonds? The S&P 500 rebounded post the Memorial Day holiday as markets priced in @POTUS' abrupt U-turn on EU tariff threats. Trump walked back his June 1, 50% EU tariff threat to July 9 after a…

Good morning, and God bless, #Team42! Today’s Key Macro Question: Will “SALTY Republicans” knock over @SecScottBessent's three-legged stool? Rally fatigue has set in after a sharp rebound erased YTD losses for the S&P 500. Goldman Sachs’ $GS Prime Desk flagged the…

Good morning, and God bless, #Team42! Today’s Key Macro Question(s): Will risk assets retest the lows? Tech stocks dropped after the US cracked down on Nvidia $NVDA chip exports to China and ASML $ASML NA posted weak results, reigniting trade-war fears. NVDA and ASML are down…

On CNBC, @SullyCNBC just asked "if tariffs are so bad, why do so many nations have them?" The answer is politics. Tariffs deliver large benefits to a small group, while exacting a small cost from each individual in a larger group. The benefits to the small group are clear, and…

Good morning, and God bless, #Team42! Today’s Key Macro Question(s): Has the “Trump put” strike price been revised higher? Regarding next Wednesday’s reciprocal #tariff announcements, President #Trump promised leniency compared to existing trade barriers, stating, “We’re going…

Good morning, and God bless, #Team42! Today’s Key Macro Question(s): Is “US exceptionalism” dead? Risk assets are increasingly feeling the strain amid increasing fears of stagflation in the US economy. This dynamic is playing out across global markets, with the S&P 500 and…

Nothing We Have Not Seen Before youtu.be/KxeZCCoOLB8?fe… 4 Year Bitcoin Cycle Video Appreciate a retweet and share on other platforms. $BTC

youtube.com

YouTube

Nothing We Have Not Seen Before

For everyone who thinks that they’re going to make it big getting into the next memecoin watch this. The deck is stacked against you. If you don’t know who the sucker is at the poker table, then you are the sucker. Don’t be a loser. Buy Bitcoin and STFD.

🚨BREAKING: Snippet from a Coffezilla interview of Hayden Davis (involved in LIBRA launch) on sniping. Make of the answer what you will👇👇

Good morning, and God bless, #Team42! Today’s Key Macro Question(s): Will US #dollar strength die at a potential Mar-a-Lago Accord? Perhaps. It more than likely depends on which risk assets. European risk assets are likely to continue outperforming. “Continue outperforming”…

Good morning, and God bless, #Team42! Today’s Key Macro Question(s): Is the disinflation process still intact? Yes, for now—with emphasis on “for now”—because we have a highly non-consensus view that Core PCE #inflation will bottom in Q1 and begin a multi-quarter uptrend in Q2.…

Good morning, and God bless, #Team42! Today’s Key Macro Question(s): Should investors take some chips off the table because of #tariffs? No. We do not believe investors should ever adjust their positions because of fundamental research views. That is not because fundamental…

DOT inflation is on the decline. The Polkadot community decided to lower inflation in OpenGov Ref# 1139 → Old inflation = constant 10% → New inflation = currently 7.78% and declining every day

United States الاتجاهات

- 1. Auburn 23.4K posts

- 2. #UFCRio 48.4K posts

- 3. Penn State 25.8K posts

- 4. Indiana 47.1K posts

- 5. James Franklin 13.5K posts

- 6. Hugh Freeze 1,098 posts

- 7. Michigan 53.8K posts

- 8. Chad Patrick N/A

- 9. Diane Keaton 213K posts

- 10. Oregon 68.1K posts

- 11. Billy Napier 1,348 posts

- 12. Charles 103K posts

- 13. King Miller N/A

- 14. Sherrone Moore N/A

- 15. Andrew Vaughn 1,305 posts

- 16. Fickell 1,654 posts

- 17. Nuss 4,372 posts

- 18. Do Bronx 8,210 posts

- 19. #AEWCollision 8,861 posts

- 20. Gilligan's Island 2,657 posts

Something went wrong.

Something went wrong.