Polarizer Trading

@PolarizerTrader

Welcome to the Labyrinth! Polarizing stock market professional for 35+ years | True Opinion | Enlightenment instead of harmony | No investment advice! |

The concentration in $spx and $ndx on the #AI theme is insane and will ultimately pop. It is as simple as that. Switch your $mag7 #stocks to value stocks now. As $pltr shows a brutal correction started in #techs. $jpy $usd $eur

Trump on a possible AI bubble: So everyone wants it. Yeah. I mean, the only problem is if you don’t get it. -- So, the real AI bubble is pessimism about AI leading to not owning enough of it? AI stocks are already at a record concentration for one theme, 48% of the S&P 500.

Today with a low already @~$1107.2 in $nflx now @~$1114 down -$40 just ignore short-term attempts in #Netflix #stocks for a recovery. $spx $ndx $ETFs $jpy $usd $eur

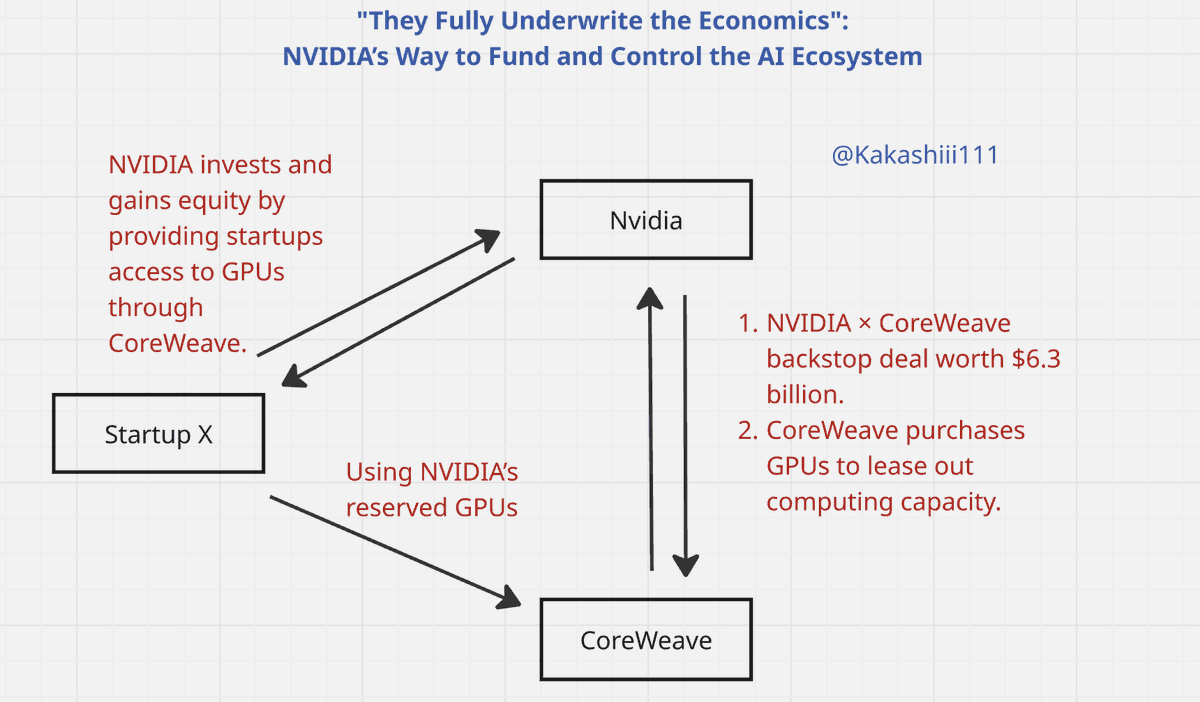

A clearer description: A simple sale and lease back by #Nvidia of their own #AI #chip capacity. If CoreWeave did not have the $nvda |@~$184 -$10| backstop at the start, they would have bought less #chips from Nvidia. Chip sales #inflation. Who else? $crwv $ndx $spx $jpy $usd

So this is pretty amazing: As you all know, NVIDIA has a backstop deal with CoreWeave worth $6.3 billion, which basically means NVIDIA will play “savior of unsold capacity” for CoreWeave all the way through 2032. During the earnings call, Intrator, CoreWeave’s CEO, proudly…

The $vix @20 is shortly before a breakout towards the ~26 area and if things develop badly towards the ~40 area later. $vvix @~109 is always welcome around the ~135 area. The $mags Roundhill #mag7 ETF now @~$64,6 could see the $55 levels relatively quick. $ndx #Nasdaq100 to fall!

#pltr @~173 down -$11 with an insane PE >600 at the top is a pure lunatic stock for people that ignore fundamentals. $Palantir's CEO can perhaps impress some of the young MEME-#stocks traders with this nonsense, but cannot heal the overvaluation. $spx $ndx $jpy $usd $eur $vix

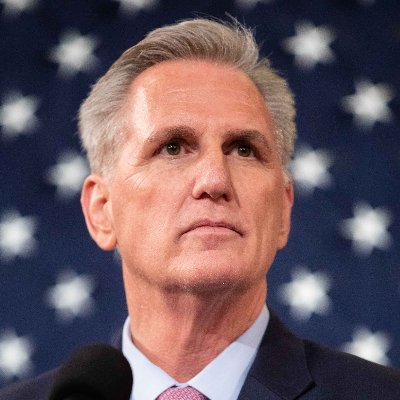

$PLTR Coolest CEO ever or cringe? What say you?

In the April correction of the $spx and $ndx #Palantir briefly touched the 38-week moving-average. Today with $pltr @~$181.6 down~5% the 38w-MVA stands @~$141. Besides the fact that anytime a peace-agreement with Russia could happen, this is already a target in the #chart. $usd

#Brent and #WTI #Crudeoil @~60.4 $|b for the Dec25 #futures are much undervalued vs. overvalued #gold @~4150 $|oz for the Dec25 futs. $gold $gld $silv #crude

Precious metals are having the best day in some time. That's because markets think the US gov't shutdown will end. This is worth taking note of. As markets downgrade their odds for US recession, precious metals start rising again because people start worrying about inflation...

In #Palantir there is now this wonderful opportunity to sell $pltr on levels @~$190 plus|minus $3. Only pure fantasy brought the #stocks back up +$11 today and that will most likely not hold. $ndx + $spx are expensive on a #PE valuation basis and $pltr is insane overvalued. $usd

Go short now @ mkt in $spx #Futures Dec25 @<~6820. Dubious movement premarket down from the 6830 level. Over-#optimism in #US #tech #stocks with nonsensical valuations like $pltr #Palantir|'s PE above 600! Nice #charts from the 1989 $nky #bubble are matching $ndx now. #ETFs $dji

#Palantir #stocks will only recover to the $196 level. Thereafter even after a nice #Wella hairspray stile and childish gesticulation of the CEO the $pltr stocks will go down. Main reason is simpel: After 4 yrs of unsuccessful invasion of Russia in Ukraine a peace is possible.

Palantir, $PLTR, CEO on Michael Burry shorting: It’s crazy motivating. Every time they short us, we are tripling down on getting better numbers. In part, honestly, to make them poorer... He’s putting a short on AI. Us and Nvidia. What is going on here, is market manipulation."

Trump on a possible AI bubble: So everyone wants it. Yeah. I mean, the only problem is if you don’t get it. -- So, the real AI bubble is pessimism about AI leading to not owning enough of it? AI stocks are already at a record concentration for one theme, 48% of the S&P 500.

Reporter: Could I ask you — some experts warn about an AI bubble. Are you concerned? Trump: What’s the AI problem? Reporter: Some experts say that some investors are overreacting. Trump: Everybody wants AI because it’s the new internet. It’s the new everything. It’s one of the…

Stick to your #Swatch group #stocks @~164 $chf after high ~175 and further increase your exposure @~157. This #Swiss #luxury brand owner of names like #Omega, #Longines, #Tissot, #Breguet, #Hamilton, #Balmain, #Glashuette and #CalvinKlein #watches is in a turn-around. $uhr $jpy

#Palantir @~$192 pre-mkt is the ultimate illusionists #stock - a kind of #bubble within a historic $ndx and $spx #StockMarket volcano - loosing its fire now! Much has been written and been ignored about PE of 600 and price|sales of ~100. $pltr to see <$100 within 1 yr. $vix $jpy

$nflx yd @~$1075 was close to the first target. Now a few days of zig-zagging might follow AND thereafter the train moves #Netflix towards the $890-910 target. Stay short and increase your exposure, as soon as passive #ETFs might prop up the stock to $1120. $spx $ndx $vix $jpy

In #Kering #luxury #stocks @~€313 you should be out now from this owner of #Gucci and other great #brands. $jpy is too weak and the new #Japanese PM is on a lunatic mission with the idea that higher #debt and too low #yields could reduce #inflation. Like a #BOJ pipe dream. $usd

#HugoBoss #stocks are still trading @~€41.30 and totally missed the up-move in #European #luxury stocks, as predicted. Still stay out. The fundamentals are missing in that #German #style and #fashion company. Since also $lvmh stocks are correcting. Just stay out. $mdax #stoxx

Stick to your #Puma longs w| #stocks now @~€22.45. A re-valuation in $pum - that great #sneakers maker - is underway and ultimately one might see prices > €30 again soon. $ads #adidasFootball $mdax $dax $eur $usd $jpy #optimism #SmallCaps $ker #kering #luxury

Get out of your remaining #luxury #stocks in #Kering with $ker trading @~€316.80 now. A cheaper re-entry seems possible and higher #oil prices might be in the cards from a still sleepy base of $62|b for WTI #crude. That could put some strain on #consumers. #cac40 $cac $eur $jpy

Kering today @~€195 up ~5.4% and $LVMH @~€470 +~6%. Buy idea in #European #luxury #stocks was right on the spot and the move is only starting. #Inflation will cool down due to lower #crude #oil and higher $eur #currency. That will free money for #consumers. #Gucci $ker #EV

United States Trends

- 1. Luka 49.3K posts

- 2. #DWTS 90.7K posts

- 3. Lakers 36.2K posts

- 4. Clippers 14.2K posts

- 5. Robert 128K posts

- 6. #LakeShow 3,000 posts

- 7. Kris Dunn 1,881 posts

- 8. Jaxson Hayes 1,640 posts

- 9. Kawhi 4,949 posts

- 10. Reaves 6,988 posts

- 11. Alix 14.7K posts

- 12. Ty Lue 1,252 posts

- 13. Elaine 45.2K posts

- 14. Jordan 117K posts

- 15. Zubac 2,094 posts

- 16. Collar 37.7K posts

- 17. Dylan 34.7K posts

- 18. NORMANI 5,826 posts

- 19. Colorado State 2,241 posts

- 20. Godzilla 35.6K posts

Something went wrong.

Something went wrong.