QuantCompounding

@QuantCompounder

Magic Formula Investor. Happiness equals reality minus expectations. Not financial advice. Check out my #MagicFormula journey! 👇

قد يعجبك

I have decided to focus on “big bets” I learnt the hard way that low allocation + high performance = low positive impact Now at 5 holdings, my objective is twofold: high performance and high impact. #capitalallocation

It’s pretty simple In the long run Earnings Per Share growth is what matters . However this is not an invitation to not be price conscious! Source : IP Capital Partners

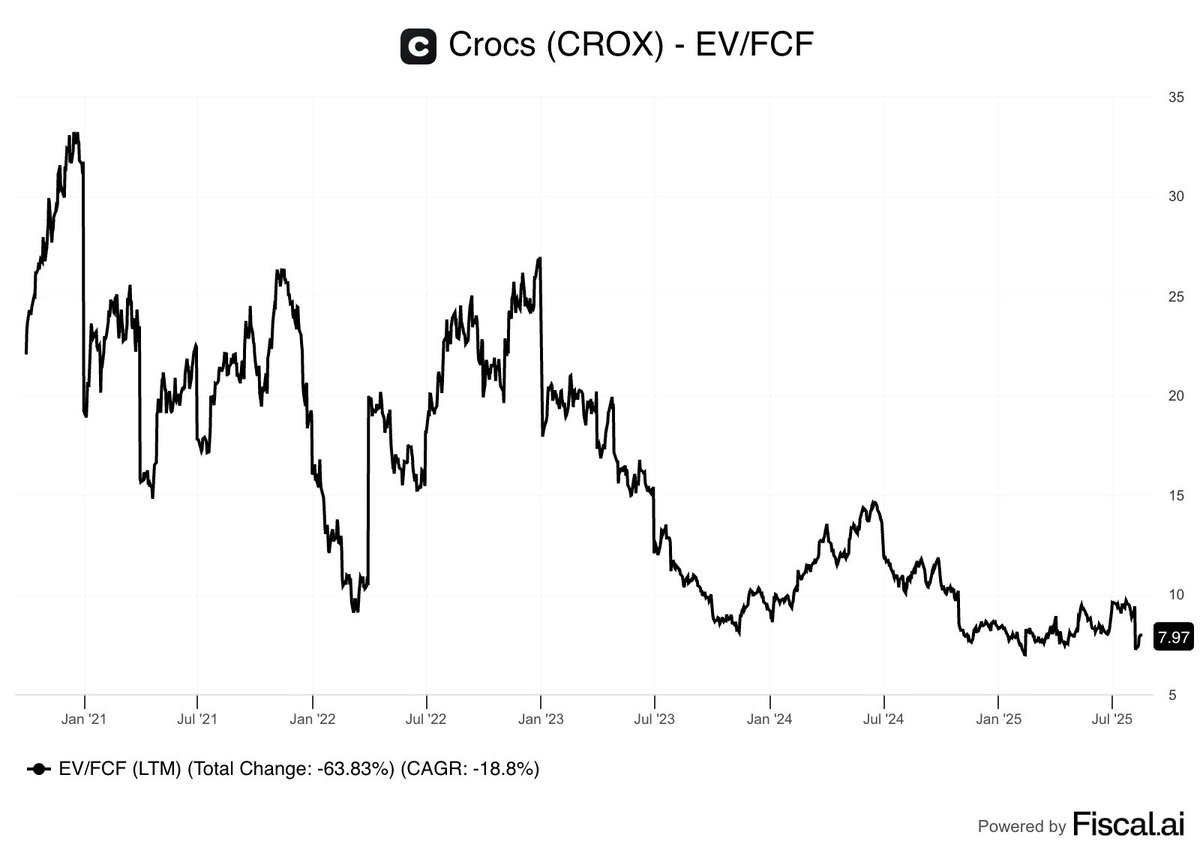

Crocs is trading at its cheapest valuation in more than 10 years. EV/EBIT: 6.1x Why wouldn't this work from here? $CROX

Why we should care about ROIC and Reinvestment Rates Source: @HaydenCapital

Li Lu’s Reflection on reaching Fifty

New letter on my stack on my thoughts about the recent $CROX selloff and why I believe there is potential to deliver outsized returns at current price

Every investor should understand this

I try to not overcomplicate valuation. When I see $CROX trading at a 20% FCF Yield, even if only half of that goes to buybacks the business doesn’t have to grow a lot for a fine outcome.

Crocs is currently trading near its lowest valuation in 10 years. EV/FCF: 7.97 $CROX

Norbert Lou is one of the most selective investors of all time. He just bought 2 new positions for the first time in years. Crocs and Paypal now account for 33% of his portfolio. $CROX $PYPL

$CROX trades at 7.1x EV/EBITDA, well below peers like $DECK at 11.7x and $SKX at 10.9x. Yet, 5Y forward EPS growth is fairly close: 📈 DECK: 4.2% CAGR 📈 CROX: 3.75% CAGR Is $CROX undervalued relative to peers? Thoughts?

$DAC Not too surprising: "when you see actually the stock appreciating really so much, to continue buyback would have shot the price up quite dramatically, which is not really to the interest of long-term shareholders... And that is why we have paused the buyback."

United States الاتجاهات

- 1. Veterans Day 83.1K posts

- 2. Mainz Biomed N/A

- 3. Good Tuesday 30.4K posts

- 4. SoftBank 8,316 posts

- 5. United States Armed Forces N/A

- 6. #tuesdayvibe 1,789 posts

- 7. Vets 13.7K posts

- 8. #Talus_Labs N/A

- 9. Armistice Day 12.1K posts

- 10. #Gratitude 1,454 posts

- 11. Bond 61.7K posts

- 12. #ARMY 1,591 posts

- 13. #RemembranceDay 11.9K posts

- 14. World War 39.7K posts

- 15. 600k Chinese 6,052 posts

- 16. $NBIS 6,923 posts

- 17. 600,000 Chinese 11K posts

- 18. Window 54.1K posts

- 19. Islamabad 42.5K posts

- 20. Korean War 1,855 posts

قد يعجبك

-

Hidden

Hidden

@hiddeninvestor -

ValueHunt

ValueHunt

@ParisParaskeva6 -

Blue Sky Management

Blue Sky Management

@BlueSkyMngmt -

Uday 👨💻📈

Uday 👨💻📈

@u_plus_k -

BK Lee

BK Lee

@FTI_BKLee -

matthew good

matthew good

@matthewjgood_ -

Buying Your Time

Buying Your Time

@BuyingYourTime -

Chris Blachut

Chris Blachut

@ChrisBlahoot -

Alef

Alef

@Alef4Epicure -

Mitch Varner CFP®

Mitch Varner CFP®

@MitchVarner1 -

The Steward of Capital

The Steward of Capital

@StewardOCapital -

Wise Old Oak

Wise Old Oak

@ValueFanatic26 -

Sachiv

Sachiv

@SachivM99 -

Huzl

Huzl

@huzlft -

Marcus Brinneman

Marcus Brinneman

@sucram_92

Something went wrong.

Something went wrong.