Risk.Net

@RiskDotNet

The inside scoop on financial risk management, markets, investing and regulation, from http://Risk.net. Subscribe to our newsletters: http://risk.net/newsletters

قد يعجبك

View everything you need to read about this year’s Risk Awards – announced last night – in one handy place: hubs.li/Q03VXx0d0

Listen now to a conversation with Courant Institute’s Petter Kolm – joint winner of Risk’s buy-side quant award this year. hubs.li/Q03W6NNL0

FCMs reported their smallest combined capital surplus as a proportion of requirements in more than a decade in September hubs.li/Q03W5WWv0

Tomorrow’s Quants: the “ability to put things in a simple context at the level of the [non-hardcore-quant] listener is super important” – Petter Kolm, Courant Institute, NYU hubs.ly/Q03VWWSQ0

Aircraft parts supplier Safran Group has emerged as arguably the biggest corporate user of FX options hubs.li/Q03VMZMS0

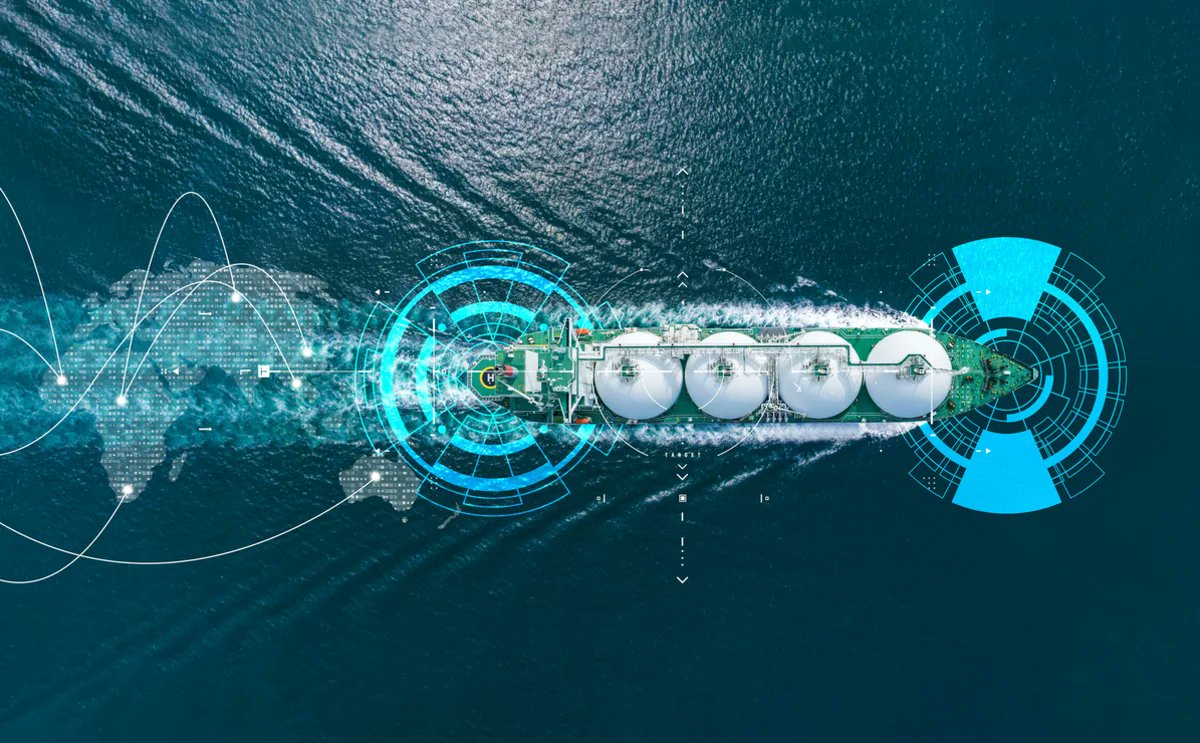

US and Qatar threats to limit LNG supply if planned new EU rules are not rolled back is creating uncertainty for energy firms hubs.li/Q03W2lnm0

Hedge funds have reduced their risk in yen interest rates trading after October’s election of Sanae Takaichi led to stop-outs and estimated losses of more than $300 million hubs.li/Q03W2jYz0

Steve Wang looks at why CVA RWAs rose so sharply & surpassed market risk RWAs as the driver for changing capital requirements during Covid hubs.li/Q03W2hnB0

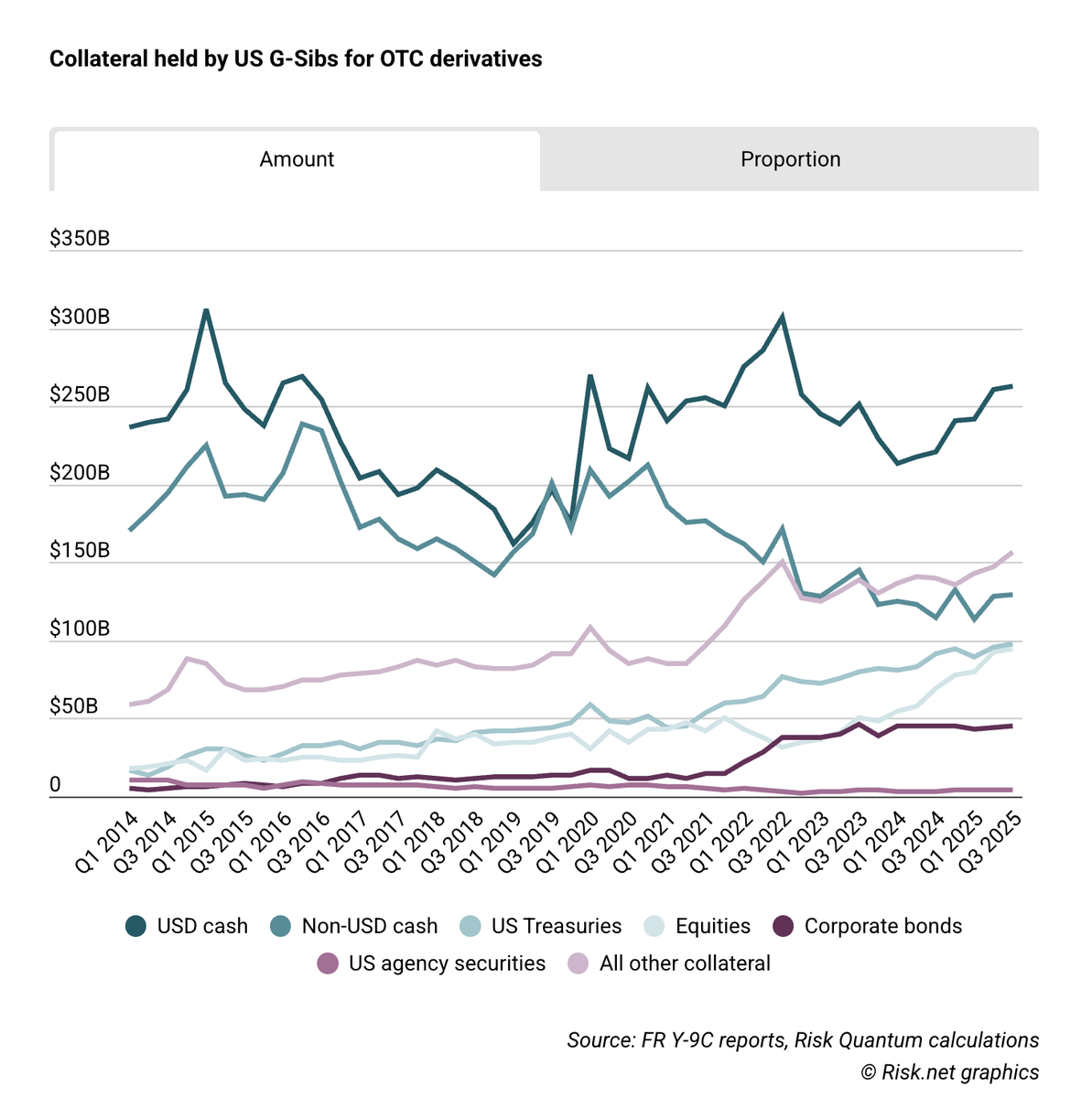

US systemic dealers held a record $95 billion of OTC derivatives collateral in the form of equities as of end-September hubs.li/Q03W1wF_0

The largest counterparties for complex FX options are typically the leading multi-strategy and macro hedge funds. But there is one corporate whose use of FX options is so extensive that it is connected to most of the top dealers on the Street hubs.li/Q03VMZxy0

Comment: IMA is at risk of becoming divorced from internal risk management, violating a fundamental principle of a sound capital model – the ‘use test’ hubs.li/Q03VXh7S0

Tomorrow’s Quants: the “ability to put things in a simple context at the level of the [non-hardcore-quant] listener is super important” – Petter Kolm, Courant Institute, NYU hubs.ly/Q03VWVfM0

Capital One’s purchase of Discover has lifted its projected retail deposit outflows in a 30-day stress scenario hubs.li/Q03VWMj90

XVA Benchmarking study: several large dealers refraining from investment in new optimisation tools due to uncertainty over the final shape of US capital requirements hubs.li/Q03VBVzf0

Have you got any training budget left? Don’t let it go to waste. Take advantage of our Black Friday 30% OFF deal on all last 2025 courses and any 2026 courses booked by 28 November. Whether it’s Model Risk Management or ALM & Balance Sheet Advanced, now’s the perfect time to:…

Dealers say multilateral compression for USD/CNH cross-currency swaps at HKEX OTCC could help relieve growing reg pressures hubs.li/Q03VN06v0

Aircraft parts supplier Safran Group has emerged as arguably the biggest corporate user of FX options hubs.li/Q03VMX-v0

The NCCBR market is much larger than regulators anticipated, finds OFR hubs.li/Q03VMZM50

Bayes Business School's Laura Ballotta explains the shift in focus of its MSc in Quantitative Finance towards machine learning, quantitative trading and algorithmic trading hubs.li/Q03VmGNq0

risk.net

Quantcast Master’s Series: Laura Ballotta, Bayes Business School - Risk.net

The business school prioritises the teaching of applicable knowledge with a keen eye on the real world

United States الاتجاهات

- 1. Black Friday 354K posts

- 2. #SkylineSweeps N/A

- 3. #FanCashDropPromotion 1,115 posts

- 4. Good Friday 58.5K posts

- 5. #releafcannabis N/A

- 6. WHO DEY 13.4K posts

- 7. mainz biomed n.v. N/A

- 8. #FridayVibes 4,052 posts

- 9. #AVenezuelaNoLaTocaNadie 2,146 posts

- 10. Clark Lea 1,071 posts

- 11. CONGRATULATIONS JIN 56.8K posts

- 12. Andriy Yermak 10.4K posts

- 13. Black Cats 3,038 posts

- 14. $SMX 8,846 posts

- 15. CONGRATULATIONS J-HOPE 48.1K posts

- 16. Victory Friday N/A

- 17. Cyber Monday 6,016 posts

- 18. Mr. President 22.2K posts

- 19. Egg Bowl 2,805 posts

- 20. ENHYPEN 854K posts

قد يعجبك

-

Risk.Net Risk Mgmt

Risk.Net Risk Mgmt

@RiskNet_RM -

Risk.Net Markets

Risk.Net Markets

@RiskNet_DER -

GARP

GARP

@GARP_Risk -

Risk Quantum

Risk Quantum

@RiskQuantum -

Risk Management

Risk Management

@RiskMgmt -

Financial News

Financial News

@FinancialNews -

Risk.Net Regulation

Risk.Net Regulation

@RiskNet_REG -

RegTech Insight

RegTech Insight

@RegTechInsight -

Risk.Net Investing

Risk.Net Investing

@RiskNet_AM -

WatersTechnology

WatersTechnology

@WatersTech -

TabbFORUM

TabbFORUM

@TabbFORUM -

Institute of Risk Management

Institute of Risk Management

@irmglobal -

RiskMinds

RiskMinds

@RiskMinds -

Leveraged Loans

Leveraged Loans

@lcdnews -

Larry Tabb

Larry Tabb

@ltabb

Something went wrong.

Something went wrong.