Ralph Sueppel

@macro_synergy

Managing Director of Macrosynergy. Development of systematic macro trading strategies.

คุณอาจชื่นชอบ

Post and Jupyter notebook "Terms of trade as trading signals": "When applied systematically and across a broad set of markets, terms-of-trade dynamics can serve as a significant and independent source of true alpha in systematic macro trading." macrosynergy.com/research/terms…

Paper explores “how investors can allocate strategically across equity styles, depending on their objective: absolute return or benchmark-relative performance….The most effective approach is integration… One framework reduces timing risk, lowers turnover, and improves both…

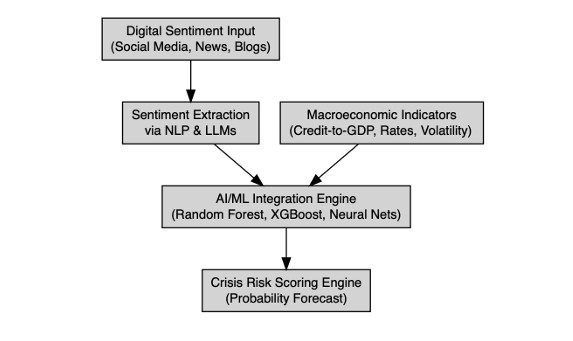

Paper "Forecasting Global Financial Crises through AI-Enhanced Sentiment and Economic Signals" suggests that "sentiment can act as a forward-looking indicator of systemic risk, especially when combined with economic fundamentals." papers.ssrn.com/sol3/papers.cf…

"The Extended Samuelson Model, a natural science–based framework that captures the dynamic, causal processes underlying market behavior... Its eight market states and six directional signals provide actionable guardrails for traders, enabling consistent profit opportunities."…

Python code: "Extracting Earnings Call Insights with LLMs: How defeatbeta-api Makes It Easy" medium.com/@bwzheng2010/e…

"Anomaly Persistence and Nonstandard Errors" presents "a framework for rigorous inference that accounts for the many methodological choices involved in testing asset pricing anomalies… Path-specific resampling greatly reduces outcome correlations and tightens the confidence…

Paper constructs "a high-frequency measure of stock-bond correlation... On days with highly negative correlations, [the U.S. Treasury] serves as the premier safe asset, with widening convenience yield and shrinking term premium. By contrast, sudden increases signal Treasury…

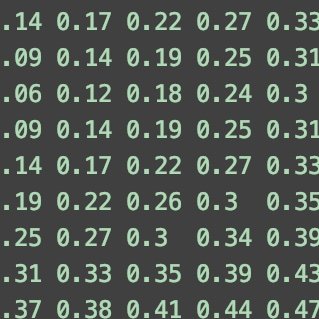

![macro_synergy's tweet image. Paper constructs "a high-frequency measure of stock-bond correlation... On days with highly negative correlations, [the U.S. Treasury] serves as the premier safe asset, with widening convenience yield and shrinking term premium. By contrast, sudden increases signal Treasury…](https://pbs.twimg.com/media/G2KBK4-WEAA8KQ1.jpg)

"Kronos is a family of decoder-only foundation models, pre-trained specifically for the "language" of financial markets... designed to handle the unique, high-noise characteristics of financial data." github.com/shiyu-coder/Kr…

A scorecard for global equity allocation: Macro-quantamental scorecards are systematic enhancements of discretionary portfolio management. An important application is capital allocation across country equity markets, which is critical for long-term wealth generation by…

New podcast "Why macro matters for systematic investors" In my conversation with J.P. Morgan’s Eloise Goulder (head of the Data Assets & Alpha Group) we explore the data sets, asset classes, and analytical techniques that yield the greatest alpha opportunities in trading…

"Language Model Guided Reinforcement Learning in Quantitative Trading": "Large language models have... demonstrated strategic reasoning and multi-modal financial signal interpretation when guided by well-designed prompts." arxiv.org/pdf/2508.02366

Paper "Forecasting Global Financial Crises through AI-Enhanced Sentiment and Economic Signals" suggests that "sentiment can act as a forward-looking indicator of systemic risk, especially when combined with economic fundamentals." papers.ssrn.com/sol3/papers.cf…

"Predicting Extreme Returns with Fundamentals: A Machine Learning Approach": "Using 45 accounting and market-based predictors, the models achieve strong predictive performance, with XGBoost consistently outperforming." papers.ssrn.com/sol3/papers.cf…

"Disaggregated Geopolitical Risks and Global Stock Returns": "We construct three factors: geopolitical risk factor (GPRF), geopolitical act factor (GPAF), and geopolitical threat factor (GPTF)." papers.ssrn.com/sol3/papers.cf…

"Conflicting News and Predictable Returns": "We analyze 96 million firm-specific news events during a 25-year period [particularly] news events where the headline and body sentiments conflict. There is a consistently negative response to conflicting news." papers.ssrn.com/sol3/papers.cf…

![macro_synergy's tweet image. "Conflicting News and Predictable Returns": "We analyze 96 million firm-specific news events during a 25-year period [particularly] news events where the headline and body sentiments conflict. There is a consistently negative response to conflicting news." papers.ssrn.com/sol3/papers.cf…](https://pbs.twimg.com/media/G08vLQaWIAAS130.jpg)

"A Rigorous Exploration of the Black-Scholes-Merton Model: Quantitative Finance Fundamentals" lnkd.in/e88BxfUZ

Macro trading factors: dimension reduction and statistical learning Dimension reduction methods, such as principal components and partial least squares, reduce bias, increase objectivity, and strengthen the reliability of backtests. macrosynergy.com/research/macro…

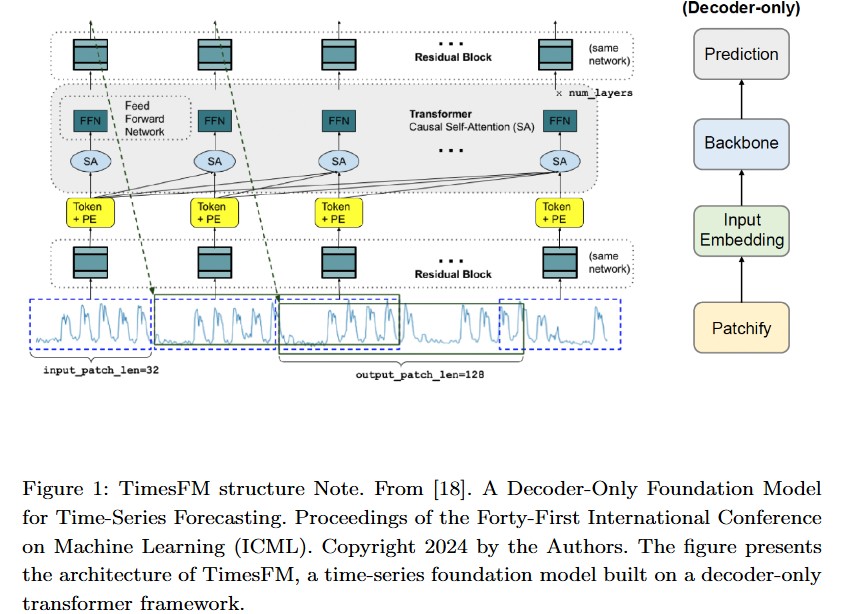

"Foundation Time-Series AI Model for Realized Volatility Forecasting": "Time series foundation models... are trained on numerous diverse datasets and claim to be effective forecasters across multiple different time series domains." arxiv.org/pdf/2505.11163

"Machine learning approach to stock price crash risk": "The minimum covariance determinant methodology... effectively captures stock price crash risk... demonstrating strong performance in terms of both statistical significance and economic relevance." arxiv.org/pdf/2505.16287

Updated Macrosynergy Python package for the development of macro-quantamental trading strategies Application examples of functions for general data exploration, processing, and signal evaluation: macrosynergy.com/academy/notebo… Application examples of machine learning functions (using…

United States เทรนด์

- 1. Good Sunday 44.9K posts

- 2. Discussing Web3 N/A

- 3. Auburn 46.8K posts

- 4. #sundayvibes 3,946 posts

- 5. MACROHARD 7,822 posts

- 6. Gilligan's Island 5,145 posts

- 7. Brewers 66.5K posts

- 8. Wordle 1,576 X N/A

- 9. #SEVENTEEN_NEW_IN_TACOMA 38.5K posts

- 10. #MakeOffer 20K posts

- 11. QUICK TRADE 2,147 posts

- 12. Kirby 24.5K posts

- 13. #SVT_TOUR_NEW_ 30.6K posts

- 14. Boots 50.7K posts

- 15. FDV 5min 2,188 posts

- 16. #HawaiiFB N/A

- 17. Utah 25.1K posts

- 18. Holy War 1,990 posts

- 19. Dissidia 7,175 posts

- 20. mingyu 108K posts

คุณอาจชื่นชอบ

-

QuantSeeker

QuantSeeker

@quantseeker -

HFT Quant

HFT Quant

@QuantRob -

HangukQuant

HangukQuant

@HangukQuant -

alvinjamur

alvinjamur

@alvinjamur -

Rob Carver

Rob Carver

@investingidiocy -

Vertox

Vertox

@Vertox_DF -

Marcos López de Prado

Marcos López de Prado

@lopezdeprado -

Stat Arb

Stat Arb

@quant_arb -

Benn Eifert 🥷🏴☠️

Benn Eifert 🥷🏴☠️

@bennpeifert -

Radovan Vojtko - CEO of Quantpedia.com

Radovan Vojtko - CEO of Quantpedia.com

@quantpedia -

Kris Sidial🇺🇸

Kris Sidial🇺🇸

@Ksidiii -

Pim van Vliet

Pim van Vliet

@paradoxinvestor -

Formula δ1

Formula δ1

@FormulaDeltaOne -

Carl Carrie (@🏠)

Carl Carrie (@🏠)

@carlcarrie -

elPythonQuantador

elPythonQuantador

@ThePythonQuant

Something went wrong.

Something went wrong.