MarketWatts

@RootSwego

20+ Years on the Buy side, Energy, Materials , EM & Commodities

Potrebbero piacerti

Based on the IEA Net Zero forecast from 2020, oil demand should be 79MM/d right now.

Stockpiles of #oil and relevant derivatives are at the lowest levels in recent years. The market is now looking for an “explanation” - room for a narrative shift and a reversal in the extremely pessimistic positioning. At the same time, #OPEC announced it would pause production…

US companies announced the most job cuts for any October in more than two decades. "This comes as AI adoption, softening consumer and corporate spending, and rising costs drive belt-tightening and hiring freezes:” Challenger, Gray & Christmas bloomberg.com/news/articles/…

If it wasn’t for the AI CapEx investment (or should we say malinvestment that won’t generate adequate return on capital), the economy would probably be in a recession. Worst year in layoffs since the 2020 COVID and the GFC of 2008.

Don't look now but global refined product demand is soaring. Opec = 1 IEA = 0 (or minus a million for being stupid) The oversupply is real, but not 3mmbpd real.

20% of "50+ year old students" are defaulting.

Here's the reason for the collapse in consumption

Been saying this......but here it is AGAIN

Thanks to the @datacenterhawk team for sending me these updated charts on who has the GW and who is building out the GWs. Owning the compute infrastructure is the new oil.

AI OVERPRODUCTION China seeks to commoditize their complements. So, over the following months, I expect a complete blitz of Chinese open-source AI models for everything from computer vision to robotics to image generation. Why? I’m just inferring this from public statements,…

What's the best explanation you've heard for why China is leaning so hard into open source? It's now an official position from the foreign ministry apparently.

Incredible: Amazon's AWS revenue over the last 12 months ($122 billion) was higher than the revenue of 465 companies in the S&P 500. $AMZN bilello.blog/newsletter

Retweeting since Jassy just said every bit of capacity they bring online they are monetizing. $AMZN the most aggressive in building out capacity in GW.

We’ve lost “it’s all being funded out of free cash flow” as a talking point.

BofA: Borrowing to fund AI datacenter spending exploded in September and so far in October $LQD

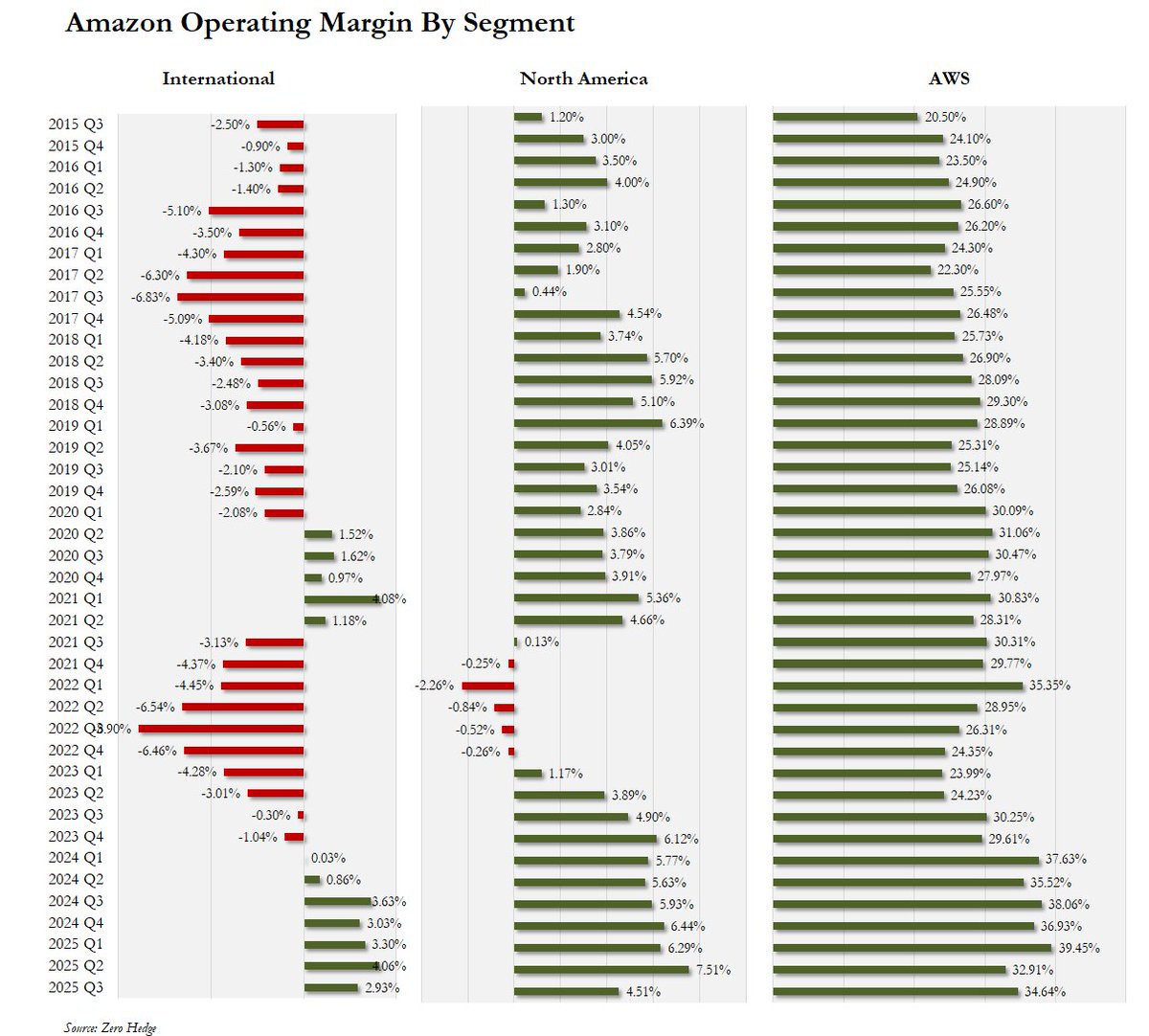

AMZN operating margin by segment

Cisco peaked at 4% of U.S. GDP. Nvidia is currently 16% of U.S. GDP.

Perhaps unsurprisingly, I haven’t seen many media outlets report accurately on the “deal” reached between Trump and Xi today, most forgetting to mention crucial aspects of it and almost all failing to contextualize the “47%” tariff figure quoted by Trump. Let me try to detail…

Good slide regarding US Shale peak from Kpler. The utilization of DUCs is a key factor that has distorted the capital requirements to maintain these levels despite low rig count. IOW = it's going to get more expenses & more rigs will be required. #OOTT

United States Tendenze

- 1. Penn State 22.1K posts

- 2. Mendoza 18.9K posts

- 3. Gus Johnson 6,226 posts

- 4. #iufb 3,998 posts

- 5. $SSHIB 1,287 posts

- 6. Omar Cooper 8,985 posts

- 7. Sayin 65.5K posts

- 8. Estevao 29.4K posts

- 9. Sunderland 151K posts

- 10. #UFCVegas111 3,768 posts

- 11. Iowa 18.7K posts

- 12. Texas Tech 13.2K posts

- 13. Jim Knowles N/A

- 14. James Franklin 8,100 posts

- 15. Happy Valley 1,818 posts

- 16. Oregon 32.8K posts

- 17. Arsenal 252K posts

- 18. Neto 25.5K posts

- 19. Garnacho 22.4K posts

- 20. WHAT A CATCH 11K posts

Something went wrong.

Something went wrong.