MarketWatts

@RootSwego

20+ Years on the Buy side, Energy, Materials , EM & Commodities

Bạn có thể thích

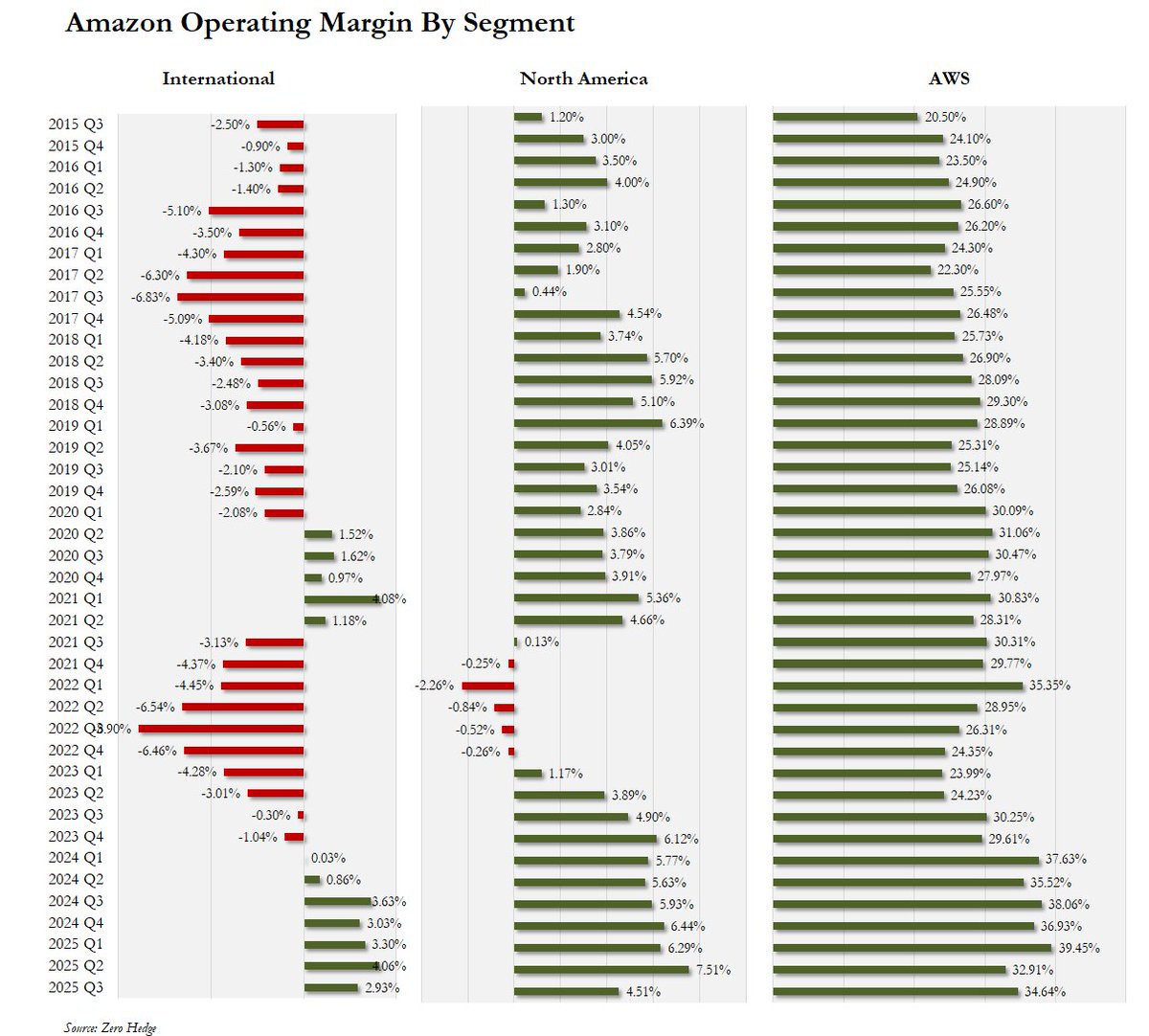

AMZN operating margin by segment

Cisco peaked at 4% of U.S. GDP. Nvidia is currently 16% of U.S. GDP.

Perhaps unsurprisingly, I haven’t seen many media outlets report accurately on the “deal” reached between Trump and Xi today, most forgetting to mention crucial aspects of it and almost all failing to contextualize the “47%” tariff figure quoted by Trump. Let me try to detail…

Good slide regarding US Shale peak from Kpler. The utilization of DUCs is a key factor that has distorted the capital requirements to maintain these levels despite low rig count. IOW = it's going to get more expenses & more rigs will be required. #OOTT

AWS CEO on CNBC just said they are bringing on ~5GW in 15 months. Excuse me what?! On 67GW global data center capacity at the end of 2024, that's brining on +6% of global supply! -Overall AWS Capacity: Added 3.8 gigawatts in the last 12 months with another gigawatt planned for…

$META call just wrapped up. I think I figured out why $META stock is down 9%. Expenses are growing faster than revenue, driven by third party cloud. The last two years it’s been the flip story. March revenue up 16% vs. expenses up 9%, June revenue up 22% vs. expenses up 12%.…

5/5 The top 41 stocks in the S&P 500 will always account for around 50% (or more) of the S&P 500's market capitalization. Nothing new here. What is different now, however, is that 47% of the Index's capitalization is based on a single theme: AI. This is unique and represents…

Today was the S&P's worst breadth day ever for an "up" day. Since 1990, the S&P has never had weaker breadth on a day that it closed positive. The index closed up 0.23% with a net advance/decline line of -294. There were 104 stocks up and 398 down. 🤮

Actually, obligatory: Two economists are walking in a forest when they come across a pile of shit. The first economist says to the other “I’ll pay you $100 to eat that pile of shit.” The second economist takes the $100 and eats the pile of shit. They continue walking until…

Every dollar spent on food stamps creates $1.50 in economic activity. Only the economically illiterate want to cut food stamps.

60% of all grades given at Harvard are A’s. They’ve turned America’s most “elite” academic institution into a participation trophy.

The Dean of Undergraduate Education at Harvard just exposed how bad it’s gotten… She wrote that so many "unprepared" students have been admitted in recent years, professors have simply become more lenient. Today, 60% of all grades given are A’s. 20 years ago, it was 25%.

That's incorrect, ma'am. Fossil fuels do not receive more subsidies than solar or wind power in the U.S. Between 2010 and 2023, solar received an average of $65.71 / megawatt-hour (MWh) of generation and wind received $18.58 / MWh. Comparatively, coal received $0.92 / MWh…

You realize that fossil fuels get way more subsidies...right? And they have eminent domain powers...wind and solar do not. Fossils take forever easements...wind and solar do not...

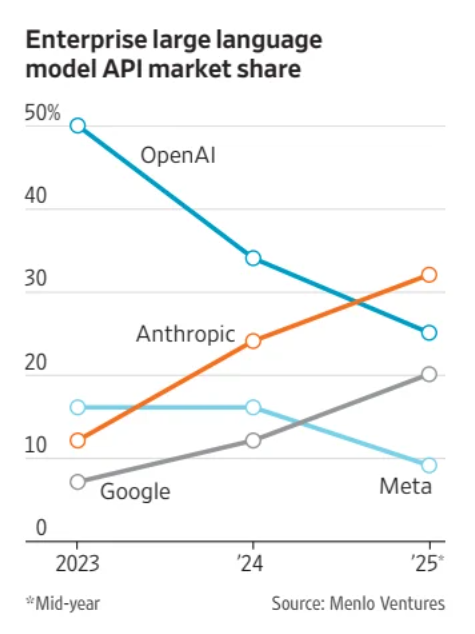

Anthropic has overtaken OpenAI in enterprise large language model API market share

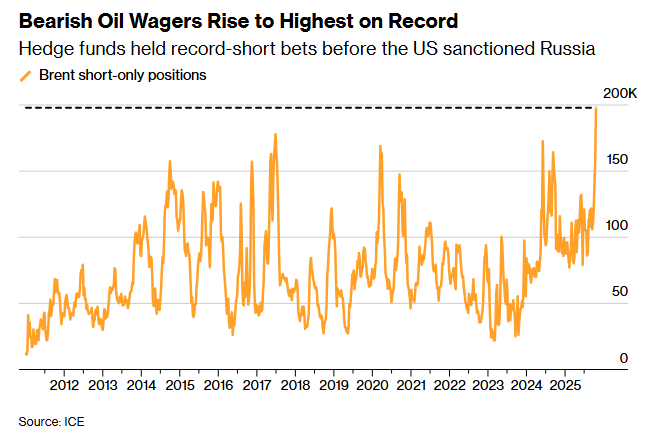

Largest Oil Short in History... Wonder how this ends every time.

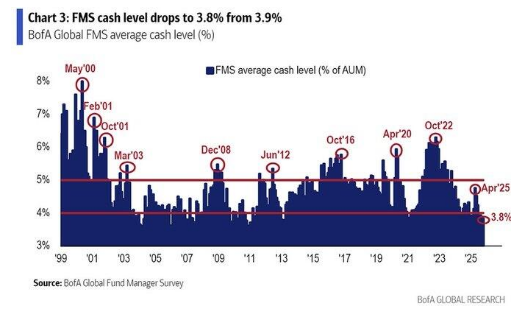

Fund Managers now have the lowest allocation to cash in more than a decade

I'm once again asking you to stop comparing today's PE multiples against the dot com bubble Why? Earnings quality is absolute shit because of trillions of dollars in rountripping fuggazi AI revenue Look at the free cash flow, which cuts through the noise of non-cash vendor…

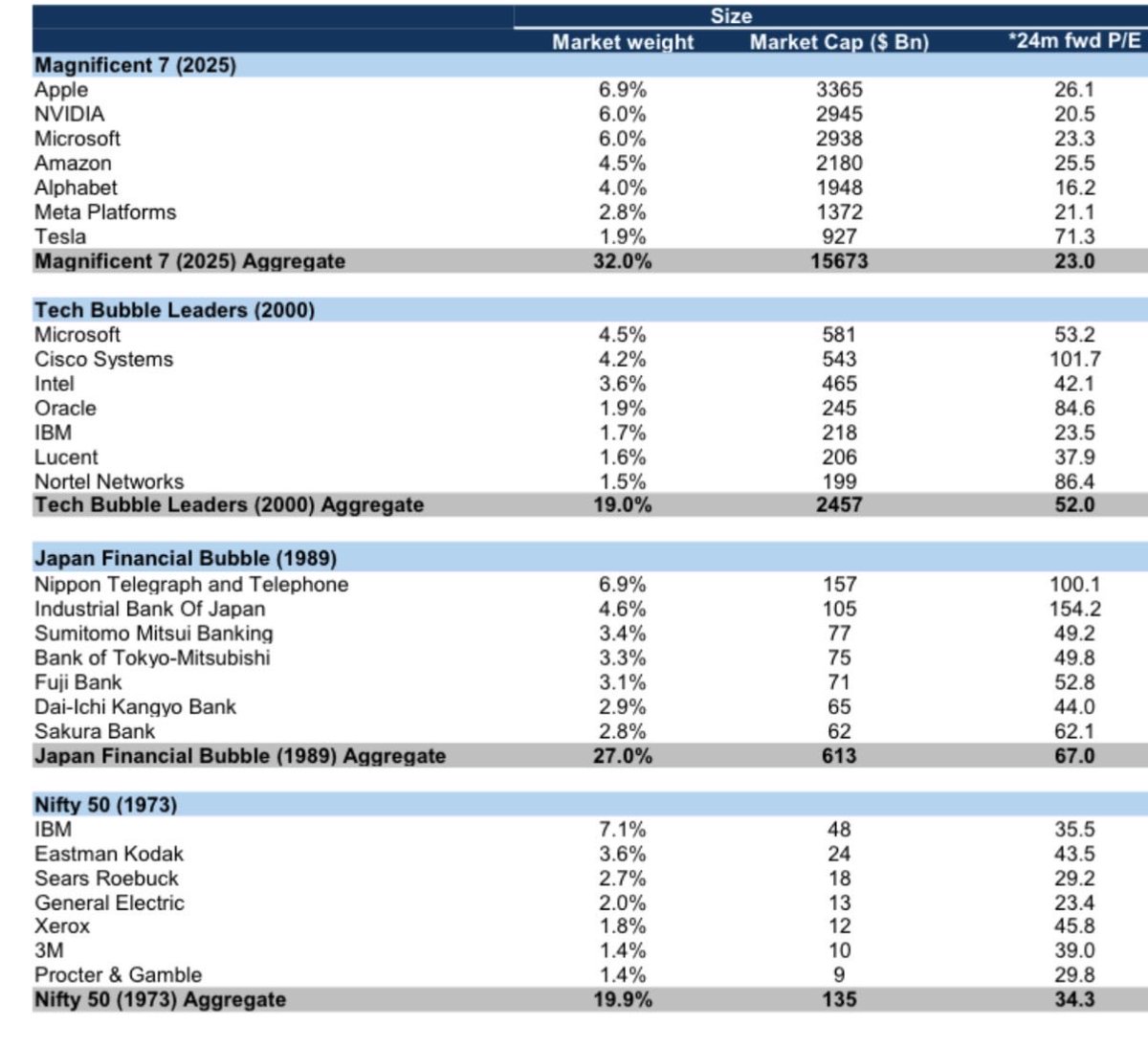

Great comparison of valuation of the largest companies today vs. previous bubbles

The reason govt shutdowns in the past were resolved fast, is because they coincided with debt ceilings which threatened a technical default/market crash. Since there is no negative pressure point the US govt may be shut until 2027 when the $41.1 trillion debt ceiling will be hit

ALL-TIME HIGH BRENT SPEC SHORT Managed Money short positions in Brent crude reached a fresh record high immediately before the shock of the latest US sanctions on Russia hit the market.

United States Xu hướng

- 1. Happy Halloween 751K posts

- 2. Dolphins 40.4K posts

- 3. YouTube TV 47.3K posts

- 4. Ryan Rollins 12.1K posts

- 5. #SinisterMinds 6,219 posts

- 6. Ravens 55.6K posts

- 7. Mike McDaniel 5,073 posts

- 8. Lamar 52.1K posts

- 9. Talbot 1,022 posts

- 10. Mary Ann N/A

- 11. YTTV N/A

- 12. Fiala 1,700 posts

- 13. Hulu 18.7K posts

- 14. #DBX4 1,793 posts

- 15. #RHOC 3,394 posts

- 16. #RUNSEOKJIN_epTOUR_ENCORE 79.4K posts

- 17. Achane 4,788 posts

- 18. Henry 56.8K posts

- 19. UTSA 3,684 posts

- 20. #TNFonPrime 3,018 posts

Something went wrong.

Something went wrong.