You might like

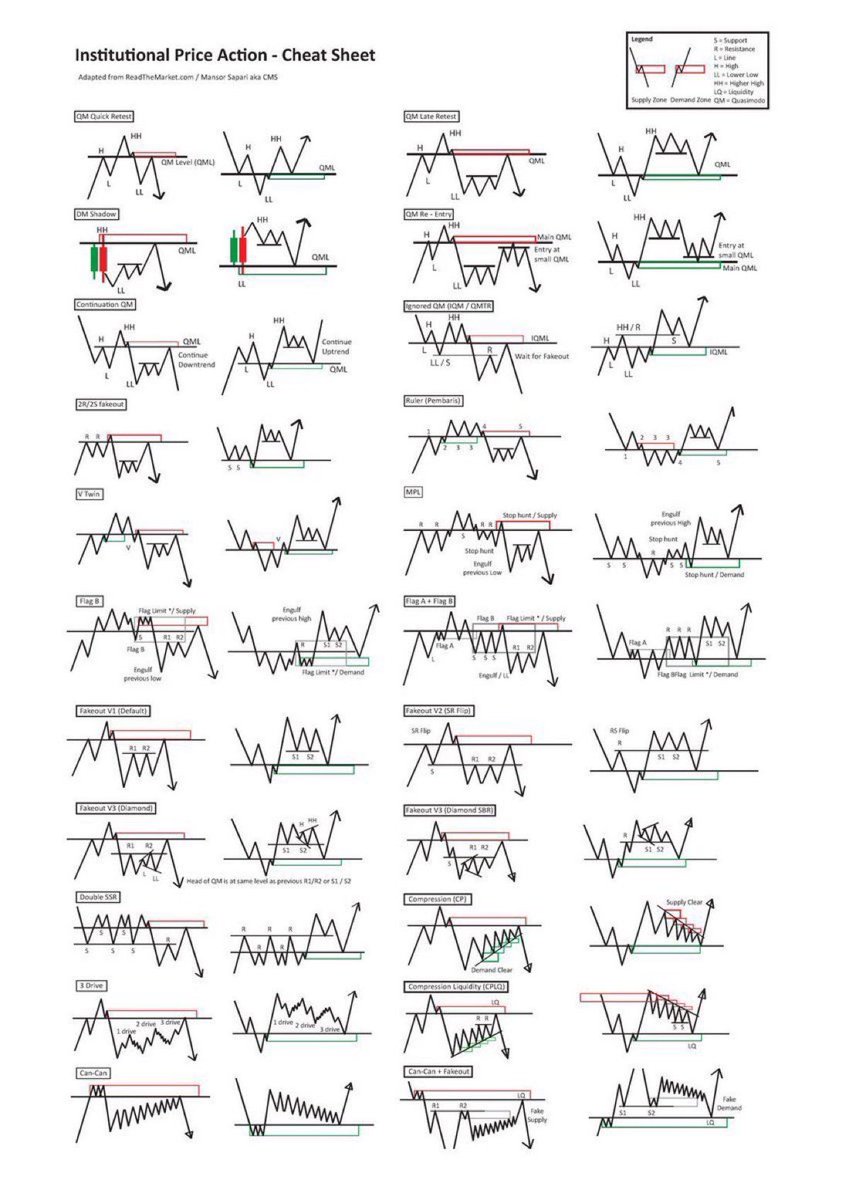

🚨 THEY’RE KEEPING THIS SECRET, BUT I’M MAKING IT PUBLIC. What you’re looking at in this image is how the game is actually played. Big money doesn’t care about RSI, MACD, or whatever indicator is trending this week. They care about where liquidity sits, who’s trapped, and how…

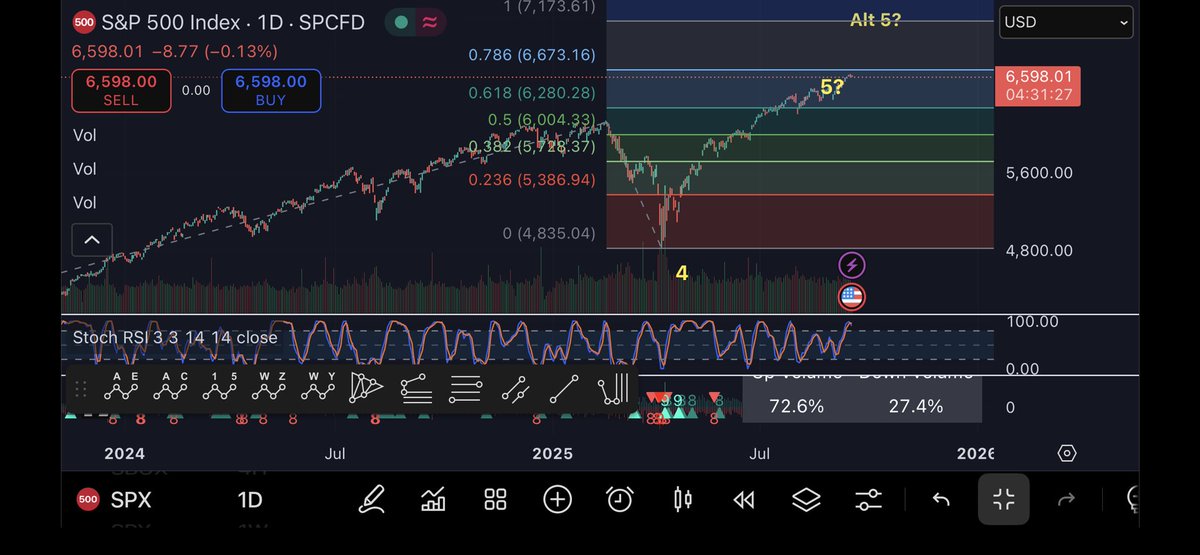

Here I'm just spitballing an idea If we go up to 7,000 by opex which seems very likely and top there. I'm guessing we would drop to P and the green vWAP at 6830 by end of January. The green vWAP has held many times since April with the exception of November That would…

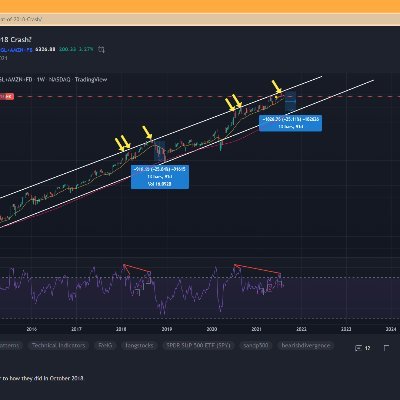

Time to remind everyone what I’ve been tracking for $SPX all last year. We are getting close to my extended 🎯. Now we must be patient to see how the market reacts. Long positions are high risk but shorting too soon will be painful. Wait for candle/volume formation & breakdowns.

Since April I have been preaching this final wave up for $SPX. Wave 5 is 0.618 (6280.23) minimum 🎯 with an extended 🎯 at 1.000 (7173.61). Now in the middle of this move we need to be cautious ⛔️ ⚠️. Looking for a topping pattern over the coming months. Trade safe & God Bless🙏🏻

First stock on the "Left to Die" list $TGT 🎯 Currently sitting right above the 200 Month SMA Main competitors are $WMT $AMZN $COST which are all trading at a massive premium compared to the market average and especially TGT. Take: Tariff fears and inventory issues have…

I'm going to start a watch list or series of watchlist that are made up of companies that have been forgotten or left out to die but yet have great business models. Coming soon NFA Happy Trading!

$SPX needs to stay above 5700 this week! If that happens I am targeting 5850.09-5862.16 which is the magnet area. If we lose 5700 then the odds increase to fall to 5623.22.

It may be a little early but if this megaphone pattern plays out for $SPX we could hit 6397.11 over the coming months. IMO any new high that is made is dangerous! ⚠️ ‼️ ⛔️ Very risky for the long term investor if we stretch back above 6100. Trade safe and God Bless!

Really watching this zone between 5707.54 and 5679.61. After that the extension for $SPX is 5623.22. Be patient and wait for buyers to step in before going long.

$SPY could do something like this. This isn't to be taken as a trading template but rather just to understand how things can unravel quickly leading up to March OPEX. This could also be entirely wrong and make me look dumb. Willing to make a bold prediction as I'm seeing broad…

Chop-shop to the drop. Highly plausible. Flows are very weak as well. Indexes are very tenuous at the moment.

$SPY could do something like this. This isn't to be taken as a trading template but rather just to understand how things can unravel quickly leading up to March OPEX. This could also be entirely wrong and make me look dumb. Willing to make a bold prediction as I'm seeing broad…

Again not a coincidence that $SPX closed on the 0.618 (5862.16) to the downside from the top that was recently called. Within $1 again!

Long term #SPX market analysis showing a dangerous overthrow. I hope that I am wrong here but in the near future we could see a bear market that enters near #COVID 2020 prices again or lower. This will take years to play out. I pray that we don't drop that far. 🙏

$SPX making new highs today but unable to clear the 0.618 mark of 6143.24. We need to clear and hold that mark to gain momentum up to the 1.000 mark of 6278.80. 🎯

FILTRAN VIDEO DEL ULTIMO VUELO DEL MALAYSIA AIRLINES✈️, PRESUNTAMENTE RAPTADO POR “OVNIS”.🛸 DE SER CIERTAS ESTAS IMÁGENES, ESTARÍAMOS ANTE LA CONFIRMACIÓN ABSOLUTA, DE UNA MANIPULACIÓN EXTRATERRESTRE QUE PUEDE SECUESTRAR A PLACER. #MH370 #MalaysiaAirlines #OVNI #UFO #ÚLTIMAHORA

United States Trends

- 1. #SmackDown N/A

- 2. #DragRace N/A

- 3. Sinner N/A

- 4. Pacers N/A

- 5. #OPLive N/A

- 6. Dabo N/A

- 7. Giulia N/A

- 8. Amari Williams N/A

- 9. #Dateline N/A

- 10. Sami N/A

- 11. Pistons N/A

- 12. Hugo N/A

- 13. #ZuffaBoxing01 N/A

- 14. Kiana N/A

- 15. Spizzirri N/A

- 16. Attitude Era N/A

- 17. Jen Z N/A

- 18. Antarctica N/A

- 19. Briar N/A

- 20. Trick Williams N/A

Something went wrong.

Something went wrong.