SEPIAM

@SEPIAM4

The difference between delusion and analysis is reality.

قد يعجبك

#BTC about to break 25,000 due to sliding copper and gold prices with a massive bear steepener 10 yr out to 30yr. Do not get sucked in here!!!!

📷SEPIAM@SEPIAM4is right Stimpyz wouldn't know a bank run if it blew up in front of him. Rate hikes killed regionals that in turn withdrew deposits from Fed Liabilities that they had (NO CHOICE) to replace with BTFD.

Great call. Move on to another one. The easy money has been made here. Don't make it personal, life is too short and the system is way too fucked up.

Stimpyz, you remember the last time you thought you had Assets/Liabilities all figured out? #SI really? Simple bs question vs Fed... though the #Fed gets to ripoff a hell of a lot more people. @RobertFantozzi6 you are dead right on Fed. & you never mention QE.

It's just simple arithmetic. If Lane wants to he can sell UST from the portfolio and buyback his shares, or dividend out the capital. The stock is worth 30$+ on paper. And yes, I know there are lawsuits. JPM is party to 1000's and still does buybacks. The squeeze would be ugly.

The only guy who gets what just happened... read the entire thread!!!! Called the 10YR and the Treasury paradox ahead of time. Brilliant not enough followers... Equity markets and HYG are very vulnerable now... Bloomberg talking heads should read this.

The #Feds Stirling Engine. The #FederalReserve prior to 2008 had as its main monetary tool a blunt instrument. A dual action piston of either raising or cutting #FedFunds. After the 2008 crisis the Fed adopted new tools mainly QE/Balance Sheet/ liquidity mechanism.

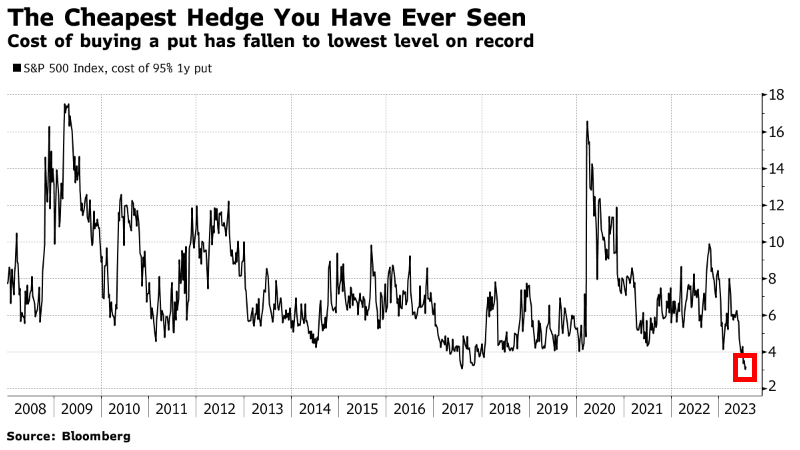

#BTC about to drop to 25,000 as #Gold crowds out #BTC and credit hedgers like me crack the cheapest CDS in history!

Nailed it! Displacement coming home...

The #Fed's Balance Sheet in action and they have no idea of how to reign it in.

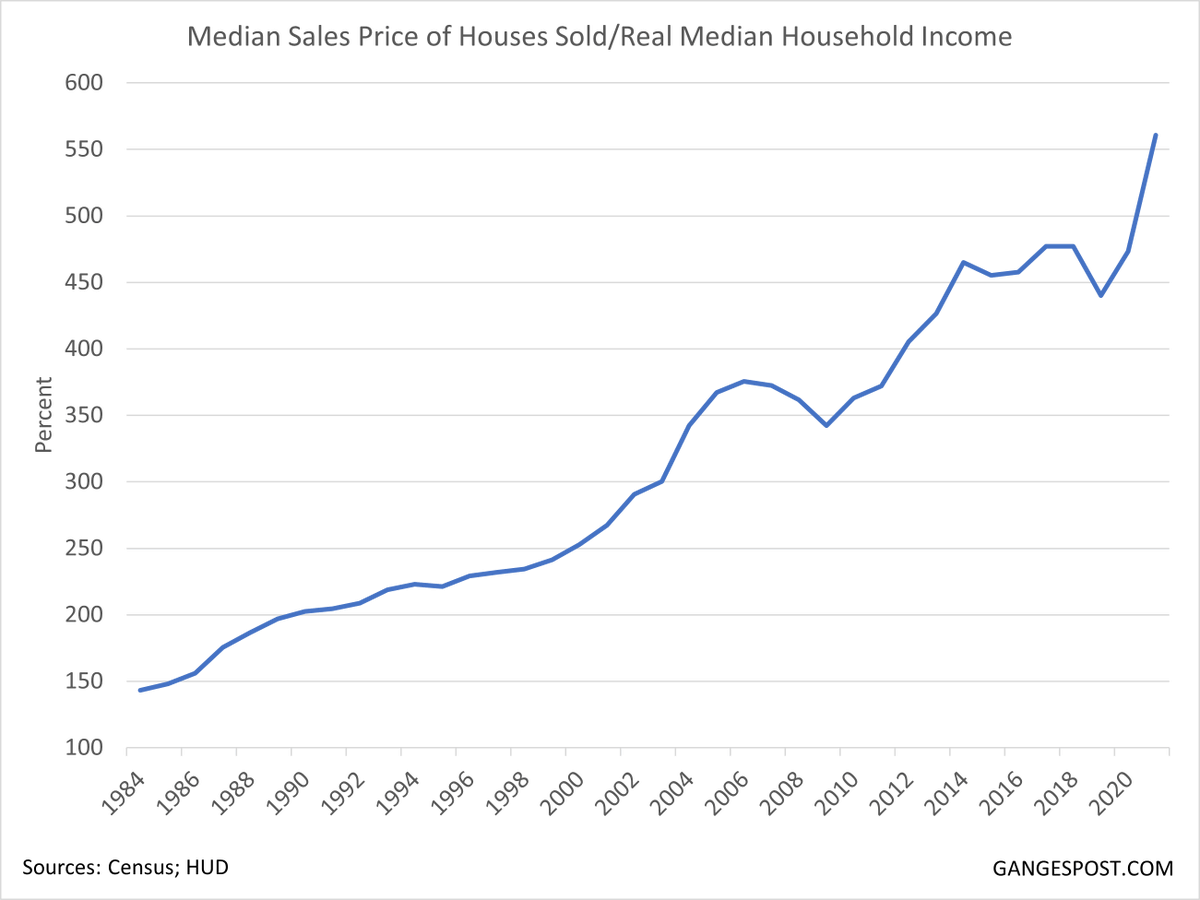

The median sales price of a home in the US is now 560% of the median household income. In 2008, it was 360% of the median household income. This is the least affordable housing market in history.

I'm sure it's nothing.

COST OF BUYING A PUT HAS FALLEN TO THE LOWEST LEVEL ON RECORD $SPX

The #Fed balance sheet rally has obliterated diversification. CAPM is dead.

U.S. Stock Market is facing its steepest concentration in 60 years. And as the market continues to rely on just a handful of stocks, the risks continue to climb higher.

The #Fed is pinned above 3.1T on H.4.1 and #Treasury is pinned below 4,06% on the 10Year. The idea there is a choice here is laughable.

Great point. As the #Fed pursues its policy how many more areas of the economy get wrecked. Creating stained glass, just to throw a rock through it.

Fantastic point.

The #Feds Stirling Engine. The #FederalReserve prior to 2008 had as its main monetary tool a blunt instrument. A dual action piston of either raising or cutting #FedFunds. After the 2008 crisis the Fed adopted new tools mainly QE/Balance Sheet/ liquidity mechanism.

T-Bills out to June trading at a premium with July to one year trading at a discount. Looks like the debt ceiling is going to be a problem after all. Credit spreads are way to tight. #Vix term structure is a disaster; AAA credit skew massive overnight to 3month SPY puts cheap.

$GS getting hit on consumer banking risk while $COIN with a Wells notice is up premarket. Efficient market theory is toast under this #Fed.

Not even an acknowledgment on the tech rip? Wow.

You need to tear into all the folks who claimed the 10yr was going to 2%. The false narrative created by commercial banks stroking their clients should have been called out in April. The tech rip into Jan 2 will be immense.

You need to tear into all the folks who claimed the 10yr was going to 2%. The false narrative created by commercial banks stroking their clients should have been called out in April. The tech rip into Jan 2 will be immense.

Great synopsis... anyone gone to jail?

What's going on with $Coin 10b5-1 plan? Any truth to the rumor it's part of the Wells notice? A beard for insider trading?

$Coin still over $60.00? Option single name traders better buy tail risk before April 2.

United States الاتجاهات

- 1. #StrangerThings5 57.4K posts

- 2. Thanksgiving 561K posts

- 3. Afghan 152K posts

- 4. #AEWDynamite 15.6K posts

- 5. National Guard 487K posts

- 6. #Survivor49 2,133 posts

- 7. Kevin Knight 1,671 posts

- 8. Rahmanullah Lakanwal 61.7K posts

- 9. holly 23.1K posts

- 10. dustin 83.5K posts

- 11. Cease 27K posts

- 12. Celtics 13.8K posts

- 13. Rizo 2,022 posts

- 14. Doris Burke N/A

- 15. Blood 250K posts

- 16. Savannah 5,066 posts

- 17. #TheChallenge41 N/A

- 18. Operation Allies Welcome 20.1K posts

- 19. robin 46.3K posts

- 20. Blue Jays 11.6K posts

قد يعجبك

-

Eoghan Corry

Eoghan Corry

@eoghancorry -

💎 ISODOPE

💎 ISODOPE

@isodope -

DCP

DCP

@Dcpcooks -

Jeremy Schwartz

Jeremy Schwartz

@JeremyDSchwartz -

Daniel Perczek

Daniel Perczek

@exposurerisk -

One Bubble to Rule Them All

One Bubble to Rule Them All

@shortl2021 -

Alpha_Ex_LLC

Alpha_Ex_LLC

@Alpha_Ex_LLC -

Daren Firestone, Levy Firestone Muse LLP

Daren Firestone, Levy Firestone Muse LLP

@cryptowhistlebl -

Angie Dunlap

Angie Dunlap

@StreetWatchdog -

DMT Capital

DMT Capital

@DMTCapital -

Jeff Malec

Jeff Malec

@AttainCap2 -

Gary Gordon, MS, CFP

Gary Gordon, MS, CFP

@TheStockBubble -

Prime

Prime

@primeRTB -

Vukasin Pekovic

Vukasin Pekovic

@VukasinPekovic -

Alex Manzara

Alex Manzara

@AlexManzara

Something went wrong.

Something went wrong.