SVMF_SyncView

@SVMF_SyncView

➡️ NISM Certified AMFi Registered MFD ➡️ Passionate about investing ➡️ Helping Investors Build wealth with Mutual Funds ➡️ Want to know more? connect 👇

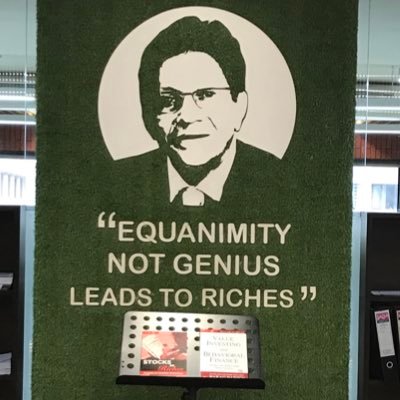

Stock Market માં investing શરુ કરતા પેહલા વાંચવા જેવી 3 Books youtu.be/SYCITOE-gYk?si… #Books For Stock Markets # finance in Gujarati @gulam_soni

youtube.com

YouTube

Book for Stock Markets

Every day Many ASK for Checking out some high flying fund Comparing it's last 3 Yrs Returns Politely we try to explain 12-14 % in Longer Term > Then taking unnecessary risk based on Recent results Over the longer Term Mean Reversion of Returns is inevitable #MutualFunds #Sip

#lenskartipo FOMO play Step-1 Investors will apply hoping to flip for IPO gain Step-2 Those who get Ipo allotment will try to sell at earliest Step 3 Those who didn't will be happy to buy lower than IPO price because they didn't get allocation Dumping Chronology #IPOs

Lenskart ipo has clearly sparked a debate Let's answer Tough Questions Whether valuations are justified? "No' Whether willing buyers are there to buy at this price?" Probably Yes" Are Mutual Funds Buying justified? At which price they are Buying?

I'd keep a close eye on Mutual funds that would subscribe to Lenskart IPO. To put them in my blacklist.

A page and graphs everyone needs to read.

EPFO meeting yesterday has announced some alarming provisions: 1) Full withdrawal in case of unemployment will happen after 12 months vs 2 months currently 2) Full withdrawal of pension after 36 months rather than 2 months currently 3) 25% of your EPF, kept in EPF always!

United States Trends

- 1. CarPlay 3,445 posts

- 2. Megyn Kelly 18K posts

- 3. Osimhen 76.2K posts

- 4. Cynthia 101K posts

- 5. Senator Fetterman 10.5K posts

- 6. Padres 28.3K posts

- 7. Black Mirror 4,322 posts

- 8. Katie Couric 7,439 posts

- 9. Vine 17.3K posts

- 10. #WorldKindnessDay 15.3K posts

- 11. Gabon 111K posts

- 12. Woody Johnson N/A

- 13. Sheel N/A

- 14. #LoveDesignEP7 210K posts

- 15. #NGAGAB 15.1K posts

- 16. RIN AOKBAB BEGIN AGAIN 210K posts

- 17. Massie 99.5K posts

- 18. Ariana 86.3K posts

- 19. Bonhoeffer 3,963 posts

- 20. V-fib N/A

Something went wrong.

Something went wrong.