SectorVue - David Schultz

@SectorVue

Risk analysis, Sector rotation, Weatlthbuilder, and total return stocks. Tweets are not recommendations. Request sample Sector Alert to [email protected]

You might like

Expected turbulence with a tariff deadline coming April 2nd. Ukraine and Gaza war is still ongoing. A resolution to any or all of these would be very positive for markets. Be stingy but take advantage of the volatility to by winning stocks are lower prices. #buylowsellhigh For a…

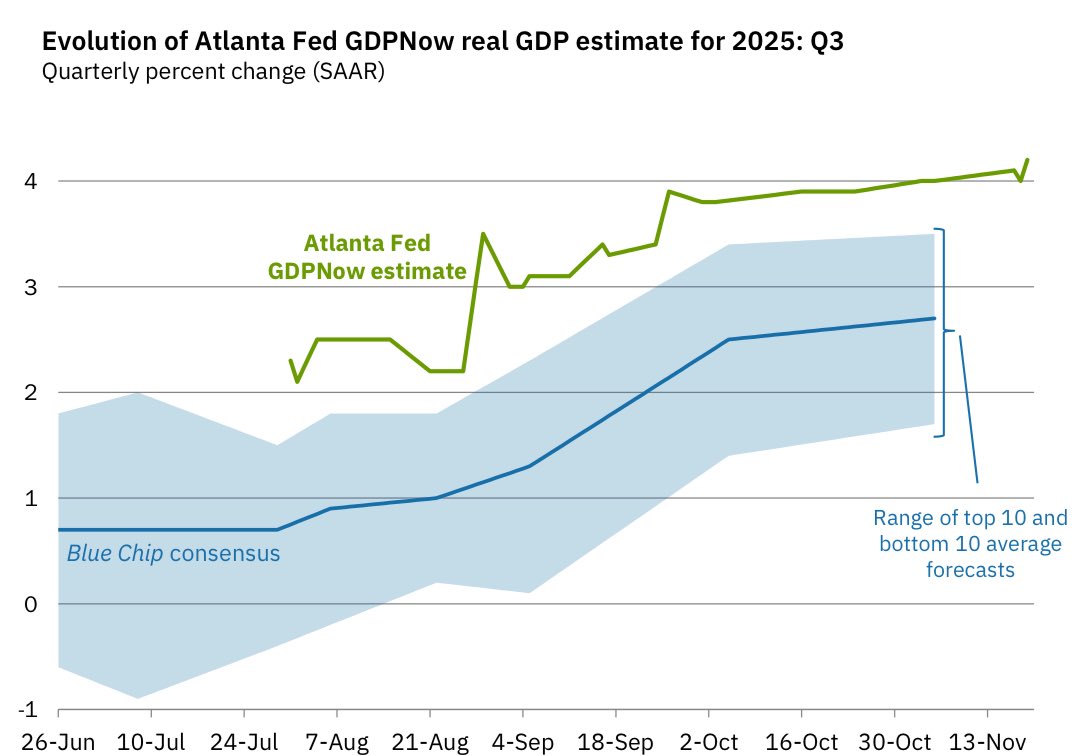

Holy. Shit. Atlanta Fed is now projecting that Q3 GDP will be +4.2%… a massive expansion. We’re running it hot. Get on board.

President Trump has driven $20 trillion in new investments so far — the largest in American history. By comparison, the Biden administration brought in only $1 trillion over a four-year period. President Trump is laying the foundation for a Golden Age economy, with investment…

Elon Musk and Jenson Huang were being interviewed at the US-Saudi Investment forum this morning. And the Saudi Prince was at the White House yesterday. I mentioned earlier this year that this commercial relationship is the Marshall Plan for this century. This is where the money…

NVDA earnings due out after the bell. The reaction to the news is always more important than the news itself. At $185, the stock is at the same price it has been for the last 3 months and is in the middle of our Implied Risk ranking, and it is a short-term trading buy. Wall…

Wowzers!!

Atlanta Fed 3Q tracker now at 4.1% GDP growth.

This is a normal rest stop after the huge rally this summer. The FOMC has held interest rates too high for too long. Interest rates should and will come down. Hopefully before more damage is done to the economy. Dividend paying stocks are at some good prices here. For more…

Steel production is up from a year ago but down slightly over the last week. From Iron and Steel Institute -- The current week's production represents an 8.3 percent increase from the same period in the previous year. Production for the week ending November 15, 2025 is down 0.7…

Steel production was up last week! The current week production represents a 9.1 percent increase from the same period in the previous year. Production for the week ending November 8, 2025 is up 1.0 percent from the previous week ending November 1, 2025

Full steam ahead for the Mag 7!

Breakout confirmed, but internals lag. The chart remains bullish — for now, it’s still the $SPX leading the way. 🔗open.substack.com/pub/optionstra…

Wow - Steel production up nearly 10% from a year ago! In the week ending on October 25, 2025, domestic raw steel production was up 9.9 percent from the same period in the previous year. Production for the week ending October 25, 2025 is up 0.2 percent from the previous week…

All systems Go! A V bottom last week looking for more upside this week and beyond.

$SPX broke out to new all-time highs after positive China trade news — a strong gap move that usually signals follow-through. Breadth and volume breadth confirm the move, $VIX buy signals remain in place, and support sits near 6750. youtu.be/MVzbBUZjgNE?si…

youtube.com

YouTube

Larry McMillan Stock Market Update Video 10/27/2025

Up and Up! A market that won't go down tends to breakout to the upside, and we are seeing that now. The Technology XLK Sector regained its top rank last week. For samples of our institutional research email [email protected]

We Bulls wobble, but we don't fall down. Despite numerous headlines and potholes which could sink the market or give it a flat tire, this market does not want to go down, and between Thursday and today, the Bulls are back in town.

I don't know how families can do it, and perhaps F1 doesn't consider families to be a target audience. The multi-day tickets costing thousands of dollars is a hard spend for interested parties (double entendre) then alone a family of four. The media is also tricky. The F1 media…

Apple buying US F1 rights for $140 million. If you pay for the F1 app (as I do) it will apparently be free with an Apple TV subscription. F1 had - basically - almost no media value a few years ago. TV deal was something like $4m a year. In the past few years: F1 has way…

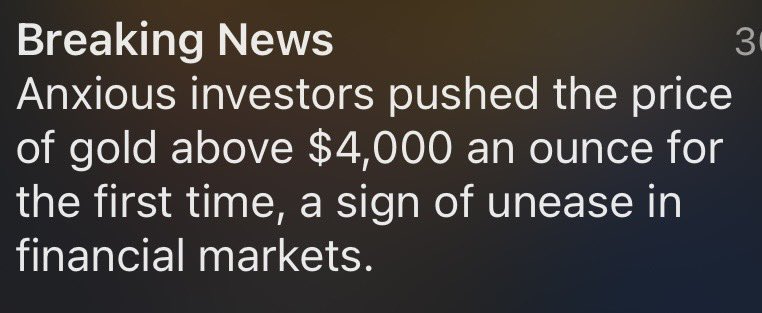

Are Chinese investors piling into gold with a shaky economy and political situation in China?

This is the type of headline you’d expect when gold prices hit a milestone record high, as they did this morning. Yet, as noted in yesterday’s posts and several earlier ones, this surge is occurring alongside “risk-on” indicators — such as the S&P, NASDAQ, Russell, and others —…

There is definitely some selling into the Semiconductor SMH surge this week, and the stocks are generally down today. I would describe this as trimming positions which became too large rather than a Sell on the Sector. Manage the risk and the profits will take care of themseles.…

Look out for the treeeee!

The 20ATR for the SP500 is officially "pretty far down there".

Treat Capital as a resource for stability and investing in the future. Not pieces of paper to print and throw around like confetti.

I wanted to point out something that I think folks miss - because they deeply disagree: I DO NOT see oil spike as reason for next inflation wave - like SO MANY fear. I see METALS: Gold, silver, copper, palladium, platinum… And THIS isn’t a “commodity super cycle” with oil.…

Is it a breakout if your own buy signal causes the volume and price increase?

All Bitcoin needs now is jokes from the late-night hosts monologues!

United States Trends

- 1. #AAA2025 79.5K posts

- 2. Cocona 114K posts

- 3. Gunther 25.2K posts

- 4. YUNHO 22.1K posts

- 5. #MCWonyoungAAAte 14.8K posts

- 6. 5 YEARS WITH MC WONYOUNG 13.9K posts

- 7. Tulane 14.2K posts

- 8. fnaf 2 65.6K posts

- 9. #SmackDown 36.9K posts

- 10. Trouba 1,271 posts

- 11. #GCWSay N/A

- 12. #ROHFinalBattle 19.2K posts

- 13. Boise 6,594 posts

- 14. Meek 8,818 posts

- 15. Flag Day 3,271 posts

- 16. UNLV 4,461 posts

- 17. The EU 339K posts

- 18. Dizzy 6,572 posts

- 19. North Texas 7,541 posts

- 20. Rivals Rewind 11.4K posts

You might like

-

Chai_Promayarn

Chai_Promayarn

@RUCKCHAT -

Muriz H.

Muriz H.

@MH17063830 -

BnR2024

BnR2024

@BreakNRetest -

J.Besson

J.Besson

@OctoTraders -

TRBS

TRBS

@TheRealBigSun -

zi

zi

@zi_press -

Franklin Jefferson 🐒

Franklin Jefferson 🐒

@franklintoday -

Coffee

Coffee

@coffees02291713 -

Kenji_GetMotherfuckinPaper: CFA CMT CAIA FMR

Kenji_GetMotherfuckinPaper: CFA CMT CAIA FMR

@0xKenjii -

Mario Danese

Mario Danese

@md220565 -

tradingworldmarkets

tradingworldmarkets

@tradeworldmark -

SubbNatural

SubbNatural

@DanZalew -

Julian

Julian

@thunderbythesea

Something went wrong.

Something went wrong.